Financial Technologies and Economic Resilience from COVID-19

Financial technology, or Fintech, describes the delivery of financial services using technology. Over the past decade, Fintech has been attracting attention from businesses, consumers, investors, and regulators. Specialised software and algorithms allow Fintech users to manage their financial operations, processes, and lives through computers and smartphones easier, quicker, and cheaper. Fintech appears to be on an endless upward trend, with analysts projecting a CAGR (compound annual growth rate) of 26.2% until 2030.

The COVID-19 pandemic hit during this period and the economy plummeted into the worst recession since the Great Depression. Businesses closed and jobs were lost, plunging millions into poverty. Just as rapidly as the world retreated into a global financial crisis, some countries were able to rebound. But why is it that not all countries recovered equally?

To find out more about this disparity, Professors Xin Chang and Cindy Deng and their team at the Centre for Sustainable Finance Innovation at Nanyang Technological University, Singapore, have developed a measure of economic resilience that captures the speed and strength of economic resistance and recovery of countries responding to the pandemic shock. As well as discovering how quickly an economy recovered, they investigate to what extent Fintech has contributed.

Quantifying growth

The research team explored technological, social, political, economic, and healthcare factors across 86 countries. The researchers investigated whether the various factors had a positive or negative effect on economic recovery to find out if Fintech played an important role in the economic recovery of a country. They used GDP growth and unemployment rates to examine the effect of Fintech on shaping a country’s economic resilience.

The increase in demand for Fintech was not surprising since the use of contactless payment methods helped reduce the spread of COVID-19. To determine the growth in Fintech use, the research team analysed the Google search volumes of Fintech-related terms to ascertain global trends.

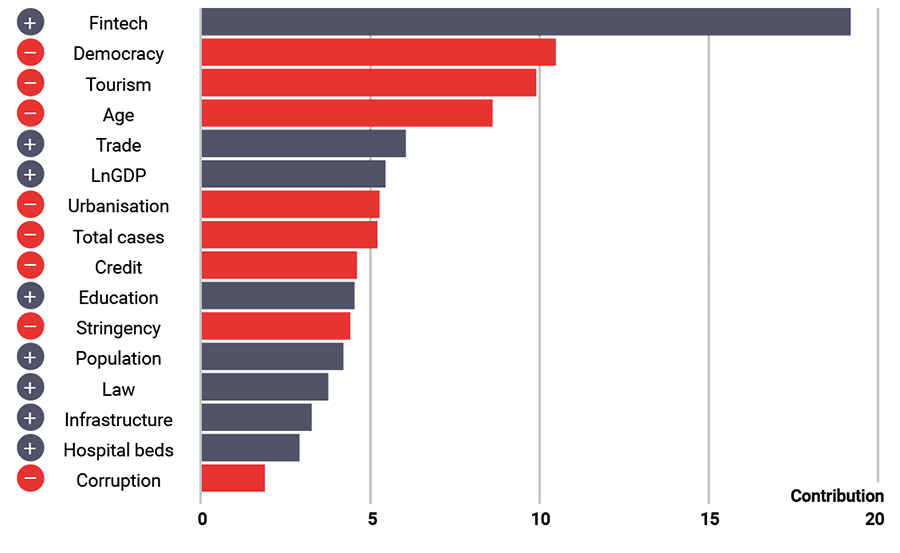

Country-level factors’ contributions to the cross-country variations in GDP growth during the pandemic

This figure ranks 16 factors based on their contributions to the cross-country variations in GDP growth, which are computed using the Shapley–Owen R2 decomposition analysis. The sum of the contributions is 100%. The signs in parentheses indicate the positive or negative effects of factors on GDP growth amid the pandemic.

Fintech and economic recovery

Chang, Deng and their colleagues’ results revealed that developing countries and those countries with an underdeveloped Fintech industry saw more significant surges of demand for Fintech during the pandemic. Stronger Fintech development was observed to be positively linked to GDP growth and negatively associated with unemployment rates.

Regardless of the effects of COVID-19, those countries with better developed Fintech before the pandemic experienced higher GDP growth. The team observed that economic development, better education, lower average population age, and less reliance on tourism had positive impacts on GDP growth. Countries with stronger Fintech before COVID-19 were also shown to have better employment recovery with more resilient employment levels. Furthermore, the researchers found that a country’s GDP per capita before the pandemic, the maturity of their digital infrastructure, population size, and the rigour of their social distancing policies had a more positive influence on employment rate changes than Fintech. In terms of statistical significance, Fintech development before COVID-19 is the most important factor among all 16 country-level factors when explaining the cross-country differences in GDP growth during the pandemic.

A new economic resilience measure

The research team developed an innovative economic resilience measure that captures the speed and strength of a country’s economic resistance and their recovery following the pandemic shock. They analysed economic resilience using changes in GDP growth and changes in unemployment rate and modelled the simulated changes over time. Both analyses resulted in curves. They applied the model to each country, taking the baseline as the GDP growth or unemployment rate before the pandemic. They termed the contraction period as the time taken to reach ‘rock bottom’, the lowest point on the curve. The recovery period described the time taken to rebound and was defined as six months after pre-pandemic levels are achieved. During this six-month period, a country’s economic growth could raise their recovery beyond pre-pandemic levels. Adding the area between the curve and the baseline during the contraction and recovery periods gives a country’s resilience value.

_v1.png?sfvrsn=4f96af63_3) GDP resilience around the world

GDP resilience around the world

This map depicts the global distribution of GDP resilience amid COVID-19. The figures under country codes represent the country’s level of economic resilience based on the TLMS model. The resilience increases as the colour changes from green to red.

Rock bottom and recovery

The team’s analysis found that, on average, it took three months for a country to reach its lowest GDP growth rate and between seven and eight months to reach its lowest employment rate. Moreover, countries with a higher economic resilience value recovered to their pre-pandemic levels more quickly. In terms of the economic resilience measure, Ireland, Vietnam, Turkey, China, and Kenya demonstrated relatively stronger GDP growth resilience. Unemployment rate resilience, however, displayed different patterns, with Mongolia, Italy, France, Greece, and Kenya performing relatively better.

Impacts on economic resilience

So, what factors might be behind these values? The researchers found that mobile payments had a positive effect on both GDP growth rates and employment rates. Contactless payments have remodelled consumer habits and fast-tracked the development of the contactless economy. Digital investments also had a positive impact on GDP growth rates, whereas digital banking had a positive effect on unemployment rate changes.

When COVID-19 hit and the world retreated into a global financial crisis, some countries were able to rebound – but not all recovered equally.

When COVID-19 hit and the world retreated into a global financial crisis, some countries were able to rebound – but not all recovered equally.

Analysis of Google search volume data revealed that searches for terms relating to Fintech peaked following the outbreak of the pandemic – and have remained consistent ever since. The researchers also found that the demand for Fintech in South-East Asia was representative of the global trends with a 50% increase in demand at the outbreak of the pandemic. In line with the global trend, the interest surrounding mobile payments increased to 80% during the same period, confirming that mobile payments led the overall demand for Fintech services. The team concludes, "Our analysis reveals that Fintech can serve as an essential enabler and accelerator of economic growth, contributing to economic stability and resilience from the global health crisis.".

Note: This research paper was published by the Social Science Research Network, on 20 March 2023.

Xin Chang, Simba is a Professor of Finance at Nanyang Business School and Associate Dean (Research) overseeing PhD programs and research activities at Nanyang Business School. He specializes in corporate Finance, especially capital structure, mergers and acquisitions, and stock valuation. He had taught various courses to undergraduate, honours, master, and PhD students at HKUST, the University of Melbourne, the University of Cambridge, and NTU.

Xin Deng, Cindy is an Associate Professor (Practice) in Banking and Finance department at Nanyang Business School, Nanyang Technological University. She mainly works on empirical corporate finance and Fintech. She has taught undergraduate, MBA and doctoral courses including corporate finance, international financial management, theory of corporate finance, corporate finance empirical studies and blockchains and finance.

This study is a joint work with the following researchers:

Cai Cen is a PhD candidate in Finance at Shanghai University of Finance and Economics. Her research interests center on behavioral finance and FinTech.

He Yu is an Assistant Professor at China University of Geosciences (Beijing). She specializes in corporate finance, especially corporate environmental responsibilities and corporate innovation.

Peng Jiaxin is a PhD candidate in Finance at Shanghai University of Finance and Economics. She specializes in corporate finance, especially FinTech and information disclosure.

Peng Zhuozhen is a PhD candidate in Finance at Nanyang Technological University. Her research interest lies in empirical corporate finance, behavioral finance, and emerging finance topics (e.g., sustainable finance and Fintech).

This article is based on the following research paper by the authors:

Financial Technologies and Economic Resilience from COVID-19

This article was first published by Research Features:

Fintech, economic resilience, and the COVID-19 pandemic