Bachelor of Business (Single Major) and Second Majors

Pursue deep expertise in one business discipline while customising your journey through focused tracks, credit-bearing internships, and global experiences.

Pursue a focused education in one of seven career disciplines, with the flexibility for broader and deeper education beyond your selected Major’s scope.

The BBus (Single Major) offers 33 Academic Units (AUs) of Broadening and Deepening Electives (BDEs), compared to the 21 allocated to the BBus (Double Major). The higher BDE count may be devoted to credit-bearing internships or even a Second Major from another college within Nanyang Technological University.

This flexibility ensures you can shape your BBus (Single Major) to match your career ambitions and intellectual interests.

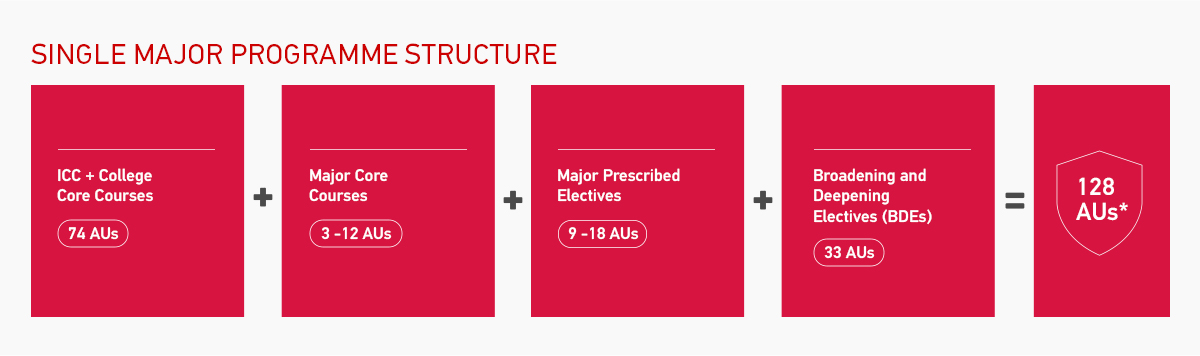

BBus (Single Major) Programme Structure

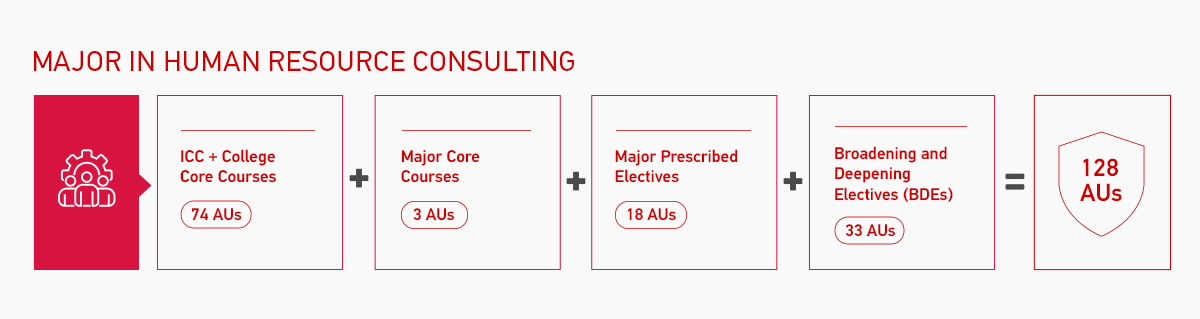

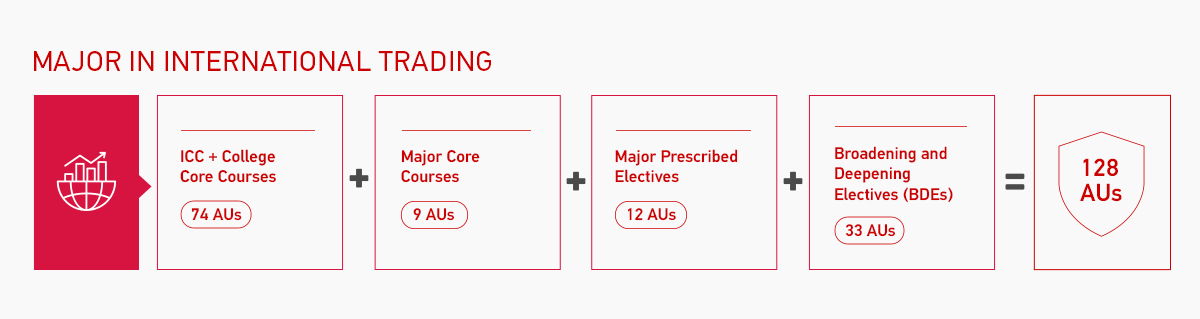

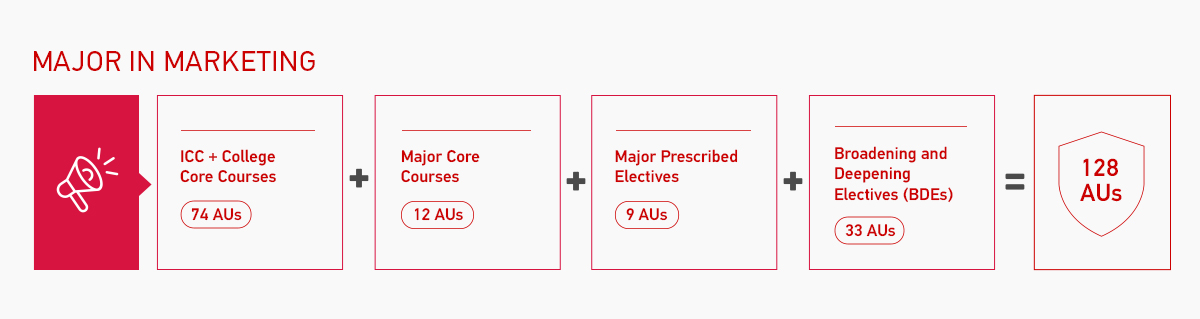

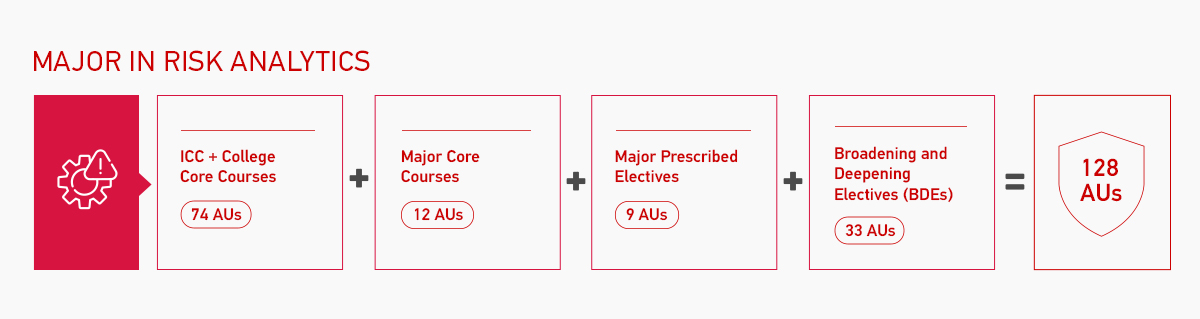

BBus (Single Major) students must complete a total of 128 AUs within the normal candidature of four years – inclusive of 74 Core Curriculum + 54 Major Core Courses and Electives.

The breakdown below shows how these parts come together to form a single, flexible, career-focused academic journey.

*Finance Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, Finance Majors must complete a total of 129 AUs.

Students in the BBus programmes will read mandatory foundational courses designed to build essential competencies across various critical areas. For details on Interdisciplinary Collaborative Core Curriculum, refer here.

Seven Majors to Choose From

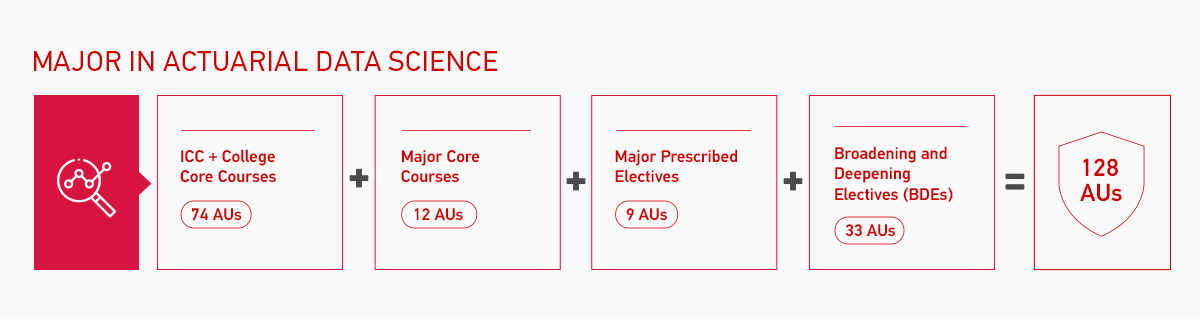

Actuarial Data Science

Use mathematics, programming, and statistics to forecast risk and support financial decision-making.

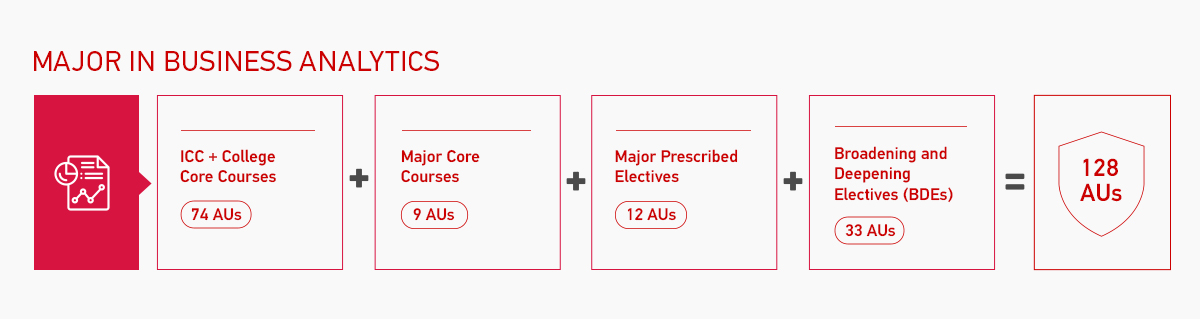

Business Analytics

Turn big data into business insight using predictive, prescriptive, and visual analytics tools.

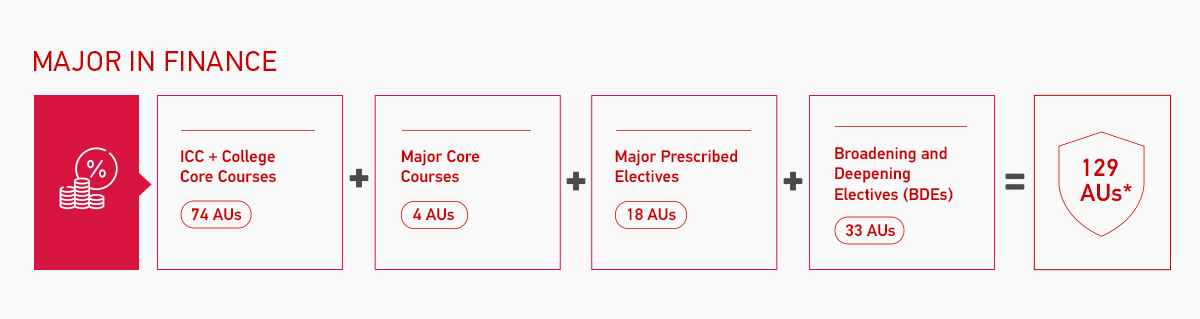

Finance

Manage assets, markets, and investments with tools in fintech, sustainability, and behavioural finance.

Human Resource Consulting

Design people strategies, workforce analytics, and change initiatives for modern, tech-driven workplaces.

International Trading

Navigate global trade, commodities, and finance with a tech-forward, supply chain–savvy skillset.

Marketing

Create data-driven, tech-powered strategies to build brands, influence behaviour, and drive consumer engagement.

Risk Analytics

Quantify, manage, and model financial and enterprise risk using AI and statistical techniques.

Prepare for a future career quantifying and managing risk. With this Major’s advanced training in statistics, economics, and financial modelling, you’ll qualify for roles in insurance, pensions, and investment.

Two optional tracks allow further specialisation in actuarial science or quantitative finance.

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your Major in Actuarial Data Science.

- Intermediate Economics

- Financial Mathematics

- Principles of Probabilities and Statistics

- Quantitative Risk Management and Statistical Learning

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose three of the Major Elective Courses in the table below that align with the skills you aim to build for your career path, or that match one of the two available tracks in this Major.

Tracks Under the Major in Actuarial Data Science

Tracks are optional, focused disciplinary pathways within selected individual Majors. Completing a track can lead to specific recognition or preparation for professional qualifications.

Under the BBus (Single Major) in Actuarial Data Science, you can choose to undertake two tracks – an Actuarial Science Track and a Quantitative Finance Track – by selecting the checked electives under each track in the table below. These are optional, and you may choose not to pursue a track in this Major.

- Actuarial Science Track prepares students to become qualified actuaries, advising on long-term financial security. It covers all IFoA Part I up to six subjects. Students who are interested to get full exemptions need to fulfil ALL four modules in the track.

- Quantitative Finance Track prepares students to enter quant jobs, applying mathematical models to guide investment strategies and complex financial decisions across global markets. It also prepares students to qualify for a fast-track MSc in Financial Engineering (MFE) programme.

| Major Prescribed Elective Courses | Actuarial Data Science: 2 Possible Tracks | |

|---|---|---|

| Actuarial Science Track | Quantitative Finance Track | |

| Actuarial Modeling I | ✅ | |

| Actuarial Modeling II | ✅ | |

| Stochastic Process for Financial Modeling | ✅ | ✅ |

| Asset and Liability Valuations | ✅ | ✅ |

| Numerical Methods for Financial Engineering | ✅ | |

| Advanced Programming for Financial Engineering | ✅ | |

| Corporate Finance and Strategy1 | ✅ | |

1. Completing our BF3215 Corporate Finance and Strategy (Finance course) exempts MSc Financial Engineering (MFE) students from the Corporate Finance course, potentially hastening their graduation from the MFE programme. MFE students can apply for exemptions of up to a maximum of three MFE core courses, subject to approval. Students who are interested in receiving full exemptions need to fulfil all four modules.

*Course list is subject to change by NBS

Master the skills to turn data into strategic advantage. Under the BBus (Single Major) in Business Analytics, you’ll learn to manage databases, apply predictive techniques, and deliver actionable insights – preparing you for in-demand roles in data analytics, consulting, operations, and digital transformation across sectors from finance to healthcare.

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your Major in Business Analytics.

- Designing & Developing Databases

- Analytics I: Visual & Predictive Techniques

- Analytics II: Advanced Predictive Techniques

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose four of the following Business Analytics Courses that align with the skills you aim to build for your career path.

- Supply Chain Analytics

- Prescriptive Analytics with Generative AI

- Financial Service Processes & Analytics

- Lean Operations & Analytics

- Business Analytics Consulting

- Programming for Business Transformation

- AI in Accounting & Finance

- Service Operations Management

*Course list is subject to change by NBS

Gain the expertise to navigate global financial markets with confidence. The BBus (Single Major) in Finance equips you with investment principles, ethical foundations, and advanced tools in FinTech, sustainable finance, and portfolio analysis – preparing you for careers in banking, asset management, investment research, and the fast-evolving world of financial technology.

You can pursue one of five optional tracks within the Finance Major, or consider taking a Second Major in Economics alongside your Finance Major.

*Finance Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, Finance Majors must complete a total of 129 AUs.

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your BBus (Single Major) in Finance:

- Investments (3 AUs)

- Ethics in the Investment Profession (1 AU)

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose six of the Finance Elective Courses in the table below that align with the skills you aim to build for your career path, or that match one of the five available tracks in this Major.

Tracks Under the Major in Finance

Tracks are optional, focused disciplinary pathways within selected individual Majors. Completing a track can lead to specific recognition or preparation for professional qualifications.

Under the BBus (Single Major) in Finance, you can choose to undertake one of five tracks, by selecting the checked electives under each track in the table below. Available tracks include:

- Wealth Management: Learn how to manage high-net-worth client portfolios, offer financial planning advice, and build long-term asset strategies.

- Asset Management: Gain skills in evaluating, constructing, and managing diversified investment portfolios across asset classes.

- Investment Banking: Explore corporate finance, M&A, capital markets, and financial modelling techniques used in high-stakes dealmaking.

- FinTech: Combine finance knowledge with digital tools, blockchain, and AI to innovate financial products and services.

- Sustainable Finance: Understand ESG integration, impact investing, and climate risk to drive responsible capital allocation.

These are optional, and you may choose not to pursue a track in this Major.

| Major Prescribed Elective Courses | Finance Tracks | ||||

|---|---|---|---|---|---|

| Wealth Mgt | Asset Mgt | Inv Bankg | Fin Tech | Sus Fin | |

| Finance Offerings | |||||

| Corporate Finance & Strategy | ✅ | ||||

| Equity Securities | ✅ | ✅ | |||

| Sustainable Finance | ✅ | ✅ | ✅ | ✅ | |

| Alternative Investments | ✅ | ✅ | ✅ | ||

| Global Financial Markets & Institutions | ✅ | ✅ | ✅ | ||

| Wealth Management | ✅ | ||||

| Carbon Markets & Pricing Fundamentals | ✅ | ||||

| Derivative Securities and Hedging Strategies | ✅ | ✅ | |||

| Fixed Income Securities | ✅ | ✅ | |||

| Introduction to Compliance | ✅ | ✅ | ✅ | ||

| Relationship Management | ✅ | ||||

| Impact Investing | ✅ | ✅ | |||

| Portfolio Management & Analysis | ✅ | ✅ | |||

| International Finance | ✅ | ✅ | ✅ | ✅ | |

| Behavioural Finance | ✅ | ✅ | |||

| Mergers and Acquisitions | ✅ | ||||

| Tech-related Finance Offerings | |||||

| FinTech in Investment Mgt | ✅ | ||||

| Financial Modelling | ✅ | ✅ | ✅ | ||

| Blockchain & AI in Finance | ✅ | ||||

| Equity Investing with Big Data | ✅ | ✅ | ✅ | ||

| Data Science for Finance | ✅ | ||||

| Cross-listed Offerings | |||||

| Financial Risk Management (RA) | ✅ | ✅ | |||

| Climate Risk Analytics (RA) | ✅ | ✅ | |||

| Sustainability Reporting (ACC) | ✅ | ||||

*Course list is subject to change by NBS

Develop the expertise to shape workforce strategy and drive organisational success. The BBus (Single Major) in Human Resource Consulting builds skills in talent acquisition, rewards, analytics, and AI-driven transformation – preparing you for impactful careers in consulting, talent management, HR strategy, and leading change across diverse industries and business environments.

To add another competency to your BBus (Single Major) in Human Resource Consulting, you may also consider taking a Second Major in Strategic Communication* or Psychology. Supplement your human resources strengths with insights into messaging or human behaviour, depending on the Second Major you choose.

*Title to be confirmed

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

This core course is essential for fulfilling the requirements of your BBus (Single Major) in Human Resource Consulting.

- Strategic HR Management & Consulting

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose six of the following Human Resource Consulting Elective Courses that align with the skills you aim to build for your career path.

- Total Rewards Management

- Talent Sourcing & Acquisition

- Managing & Consulting through Research

- Employment Law

- Talent Development & Management

- HR Analytics

- Cultural Intelligence: How to be an Explorer of the World

- Driving Strategic Change in the Digital Age

- Generative AI for HR

*Course list is subject to change by NBS

Build the expertise to excel in the fast-paced world of global trade. The BBus (Single Major) in International Trading covers commodity markets, trade finance, and digital tools across the trading lifecycle: an excellent background for future careers in commodities trading, supply chain finance, and international logistics with leading firms worldwide.

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your BBus (Single Major) in International Trading.

- Commodity Markets

- Trade Incoterms and Ship Chartering

- Trade, Structured and Supply Chain Finance

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose three of the following International Trading Elective Courses that align with the skills you aim to build for your career path, or that count toward the optional Digital Application Track.

Digital Application Track Under the Major in International Trading

Tracks are optional, focused disciplinary pathways within selected individual Majors. Completing a track can lead to specific recognition or preparation for professional qualifications.

Under the BBus (Single Major) in International Trading, you can choose to undertake a Digital Application Track by selecting the checked electives in the table below. Completing this track entitles you to a certificate of completion. The Digital Application Track is optional, and you may choose not to pursue a track in this Major.

| Major Prescribed Elective Courses | Digital Application Track |

|---|---|

| International Tax and Trading Law | |

| Commodities Trading and Risk Management | |

| Sustainability in Commodities | |

| Software and Coding Skills in Commodity Markets | ✅ |

| Digital Applications in the Life Cycle of a Commodity Trade | ✅ |

| Developing a Digital Application for the Commodity Market | ✅ |

| Strategic Management in Commodity Market | |

| Carbon Markets and Pricing Fundamentals |

*Course list is subject to change by NBS

Learn to craft strategies that connect brands with audiences. The BBus (Single Major) in Marketing blends branding, consumer insights, digital strategy, and data-driven techniques – equipping you for careers in brand management, digital marketing, and marketing analytics, where wielding creativity with analysis can help drive business growth in competitive markets.

To add another competency to your BBus (Single Major) in Marketing, you can also consider taking a Second Major in Strategic Communication* or Psychology. Supplement your marketing strengths with insights into messaging or human behaviour, depending on the Second Major you choose.

*Title to be confirmed

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your Major in Marketing.

- Consumer Insights

- Digital Marketing

- Marketing Analytics

- Strategic Brand Management

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose four of the following Marketing Elective Courses that align with the skills you aim to build for your career path.

- Marketing Intelligence in the Age of AI and Data-Driven Insights

- Integrated Marketing Communications

- Modern and Emerging Technologies in Marketing

- Marketing Sustainability for the Next Generation

- Tech-Powered Marketing Strategies for FMCG Brands

- Luxury Marketing

- Marketing Health

- Consumer Neuroscience

- Marketing Strategy

- Real-World Marketing Masterclass Series: Learn from Industry Experts

- Marketing Analytics II

*Course list is subject to change by NBS

Gain the skills to identify, assess, and manage risk in a complex business landscape. The BBus (Single Major) in Analytics trains you to model and mitigate financial and enterprise risks with data-driven tools—preparing you for careers in risk management, compliance, insurance analytics, and the broader financial services sector.

Refer to this section in our Programme Structure and Duration page for details on college core courses and Interdisciplinary Collaborative Core (ICC). This section in the same page offers details on Broadening and Deepening Electives (BDEs).

Major Core Courses

These core courses are essential for fulfilling the requirements of your BBus (Single Major) in Risk Analytics.

- Quantitative Analysis

- Foundations of Risk Management

- Financial Risk Management

- Financial Risk Analytics I

*Course list is subject to change by NBS

Major Prescribed Elective Courses

Choose three of the following Risk Analytics Elective Courses that align with the skills you aim to build for your career path.

- Valuation and Risk Models

- Financial Risk Analytics II

- Climate Risk Analysis

- AI Risk Management

- Enterprise Risk Management

- Global Financial Markets and Institutions (Cross-listed Finance course)

- Corporate Finance and Strategy (Cross-listed Finance course)

*Course list is subject to change by NBS

Pick a Second Major to Augment Your Selected Major

Within the BBus (Single Major) degree programme, you can choose to take a Second Major from another School within Nanyang Technological University.

At the point of application, you have the option to choose a Second Major in either Entrepreneurship or Sustainability. Alternatively, you can select from the Second Majors listed below during the major streaming exercise conducted at the end of Year One of your candidature.

The study of Economics provides a broad understanding of markets and policy, while Finance gives you the tools for precise, data-driven execution.

By adding a Second Major in Economics to a BBus (Single Major) in Finance, you’ll seamlessly integrate both approaches in your career: combining theoretical models with financial applications; balancing macroeconomic perspectives with corporate finance strategies; and strengthening quantitative skills such as econometrics and financial modelling.

This versatility prepares you for roles in banking, consulting, government, and beyond – including (but not limited to) Corporate Finance Analyst, Economic Consultant, and Public Policy Analyst – positions that require both strategic foresight and detailed financial execution.

Combining Psychology with a BBus (Single Major) in Human Resource Consulting builds a skill set that links behavioural science to workforce performance. You’ll learn to view behaviour as a strategic asset – guiding decisions on hiring, leadership, and employee development with psychological insight.

This combination prepares you to diagnose workplace challenges using scientific rigour, evaluate candidates holistically by considering emotional intelligence and resilience, and design well-being initiatives that prevent burnout while fostering engagement.

Graduates of this Second Major combination will be well-placed for roles such as Employee Experience Designer, Leadership Development Advisor, and Talent Management Consultant – careers that integrate behavioural understanding with HR strategy.

Your BBus (Single Major) in Human Resource Consulting can be paired with a Second Major in Strategic Communication* – combining the art of persuasive messaging with the science of people strategy.

You will learn to build stronger employee engagement by combining motivational approaches with resonant communication, and to improve internal communication systems that deliver relevant, stakeholder-focused messages.

The combination also strengthens your ability to navigate crises, by providing the skill sets to address structural challenges while managing tone and narrative.

Graduates from this Second Major combination will be ideally suited for careers at the intersection of HR and communication – from Culture & Inclusion Strategists, to Employee Engagement and Communication Managers, to Organisational Change Consultants – all roles where success will depend on successfully aligning people, culture, and messaging.

*Title to be confirmed

Merging Psychology with Marketing offers a unique advantage: the ability to understand the human mind and translate that insight into persuasive, ethical campaigns.

This pairing equips you to use behavioural science to enrich market research, apply cognitive biases and emotional drivers to strategy, and design intuitive user experiences. You’ll also gain skills in creating emotionally resonant messages, and in using analytics for data-driven yet human-centred decision-making.

Career opportunities include roles such as Brand Psychologist, Consumer Behaviour Analyst, Digital Experience Designer, and Market Research Psychologist: positions that demand both behavioural insight and marketing expertise.

Pursuing a Second Major in Strategic Communication* alongside the BBus (Single Major) in Marketing equips you for a future career crafting cohesive, audience-focused messages that build trust, strengthen brand identity, and drive results.

Marketing knowledge provides the skill to interpret market data and consumer insights, while Strategic Communication adds stakeholder understanding and storytelling.

Graduates with this combination are prepared for a variety of roles at the intersection of marketing and communication, including (but not limited to) Brand Communications Strategists, Digital Content and Engagement Managers, and Marketing Specialists – positions that demand the ability to coordinate cross-channel strategies and manage media relations.

*Title to be confirmed