Bachelor of Business (Double Major)

Combine two complementary business fields in a single degree to broaden your skillset, enhance career options, and boost post-graduation outcomes.

Why stop at one? With the Bachelor of Business (BBus) with Honours (Double Major), you’ll dive deep into two complementary business disciplines, gaining the versatility to stand out to employers and boost graduate employability.

Major pairings are built on domain alignment and industry insights — and you can even choose Accounting as one of your majors within the BBus (Double Major) programme.

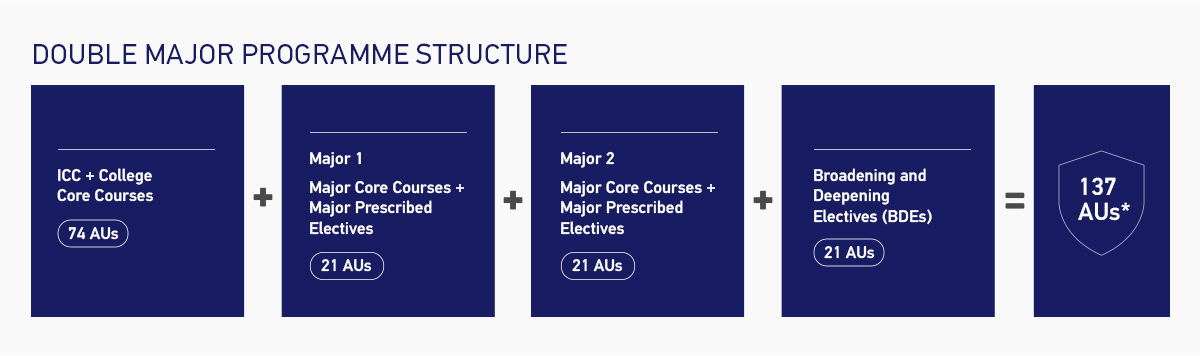

Programme Structure

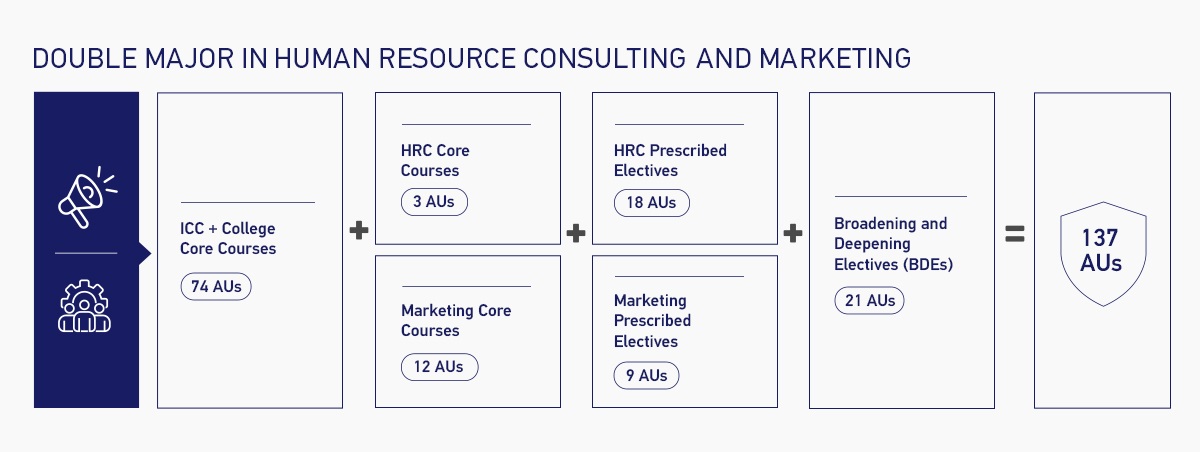

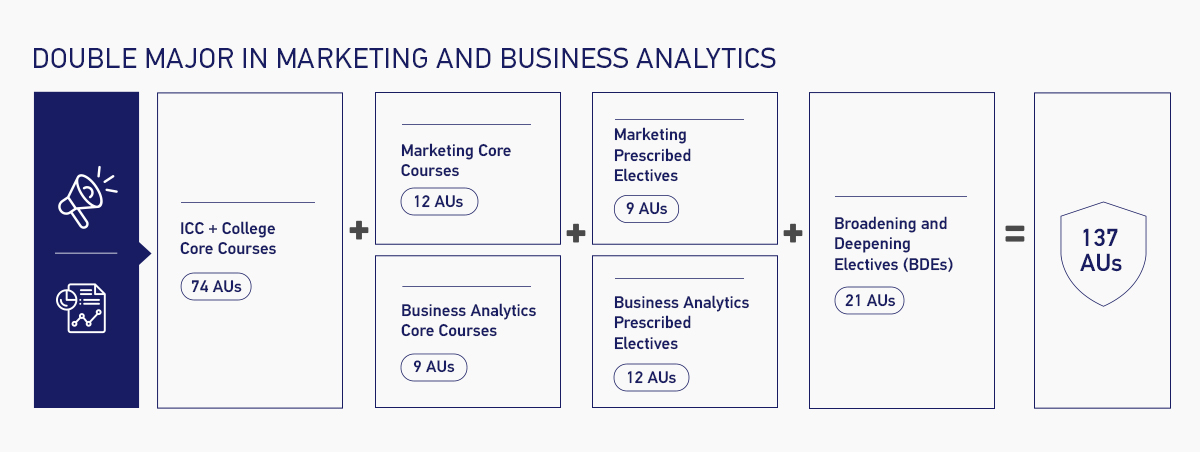

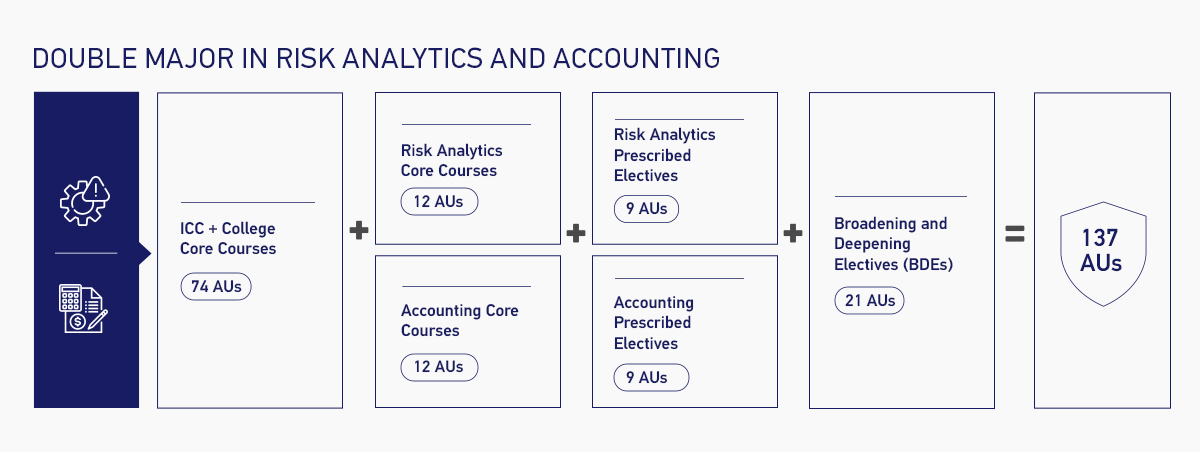

BBus (Double Major) students must complete a total of 137 academic units (AUs) within the normal candidature of four years – inclusive of 74 ICC and College Core Courses + 63 Major Core Courses and Major Prescribed Electives. The breakdown below shows how these parts come together to form a single, flexible, career-focused academic journey.

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

Students in the BBus programmes will read mandatory foundational courses designed to build essential competencies across various critical areas. For details on Interdisciplinary Collaborative Core Curriculum, refer here.

Choose from Ten Curated BBus (Double Major) Combinations

Actuarial Data Science and Business Analytics

Gain the tools to analyse and quantify uncertainty – and apply insights across the entire organisation.

Actuarial Data Science and Finance

Balance mastery of financial theory with statistical modeling, risk quantification, and data-driven decision-making.

Finance and Accounting

Build a strong, synergistic foundation for understanding and managing money, assets, and business performance.

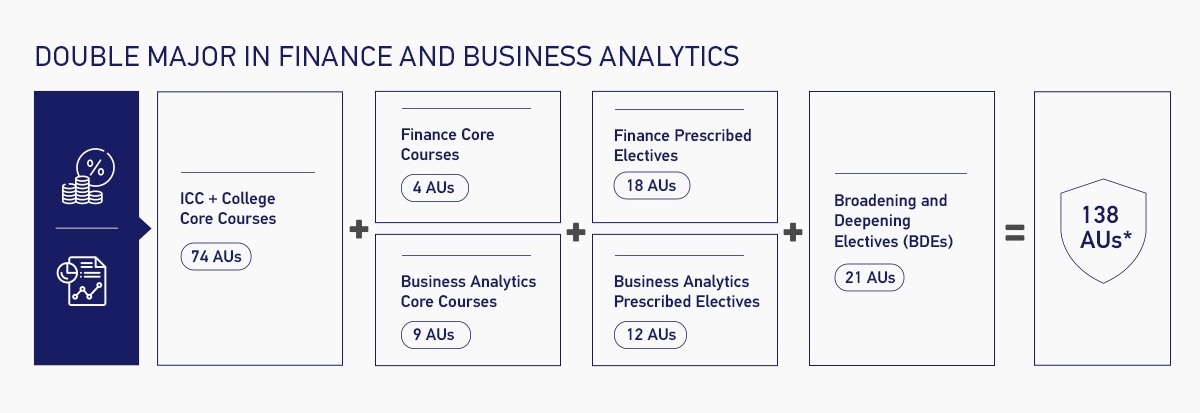

Finance and Business Analytics

Gain mastery in the analysis of complex financial data and creating actionable, high-impact strategies.

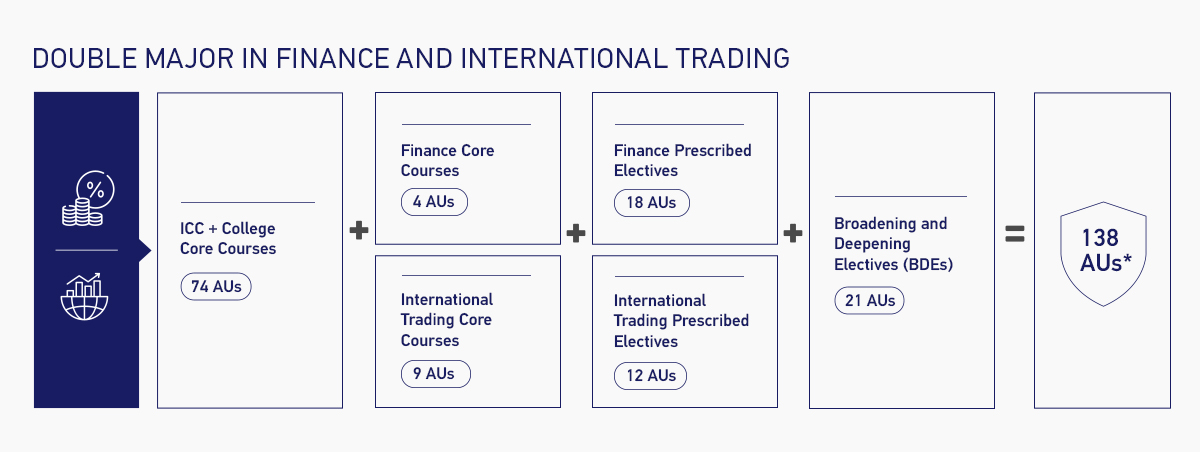

Finance and International Trading

Shape global business decisions by understanding macroeconomic forces and applying financial tools to manage risk, move capital, and capture cross-border opportunities.

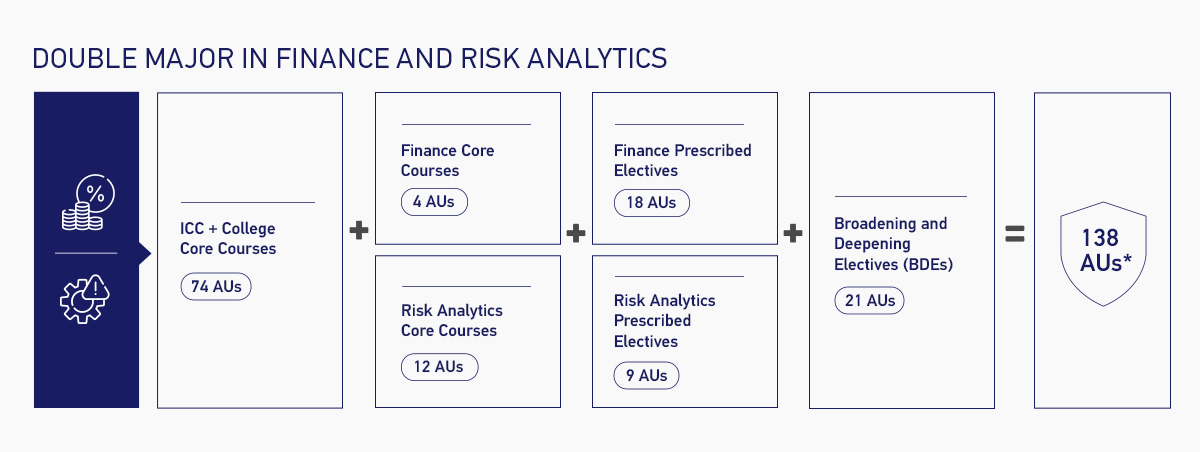

Finance and Risk Analytics

Learn how businesses and markets generate financial value – and how to manage risks that can threaten that value.

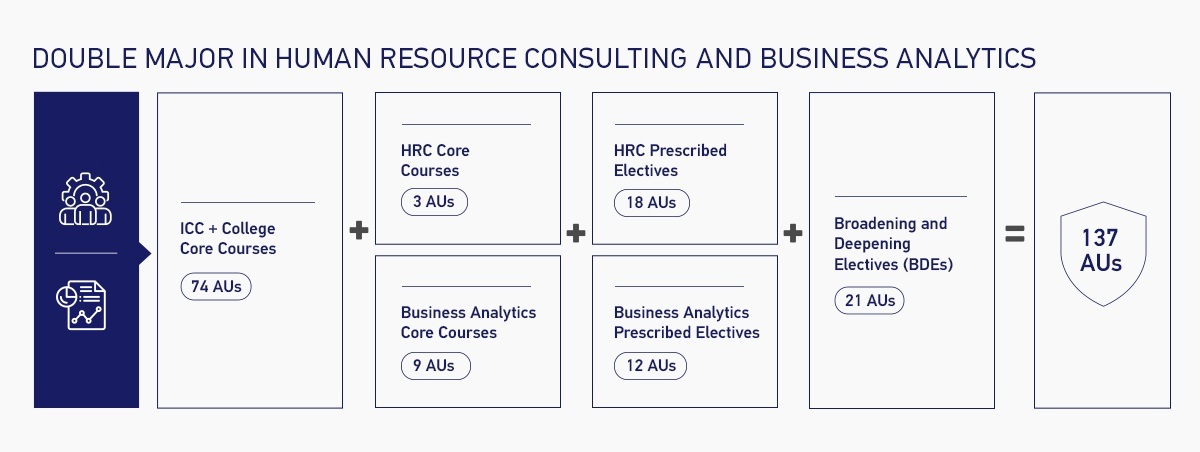

Human Resource Consulting and Business Analytics

Help organisations make smarter workforce decisions drawing on evidence-based insights.

Human Resource Consulting and Marketing

Study complementary disciplines in business strategy, employee engagement, and organisational growth.

Marketing and Business Analytics

Blend creativity with data to transform instincts into strategy and ideas into tangible business outcomes.

Risk Analytics and Accounting

Make smarter financial decisions by analysing performance and identifying key risks like credit, operational, and market exposures.

Get ready for a career solving complex business challenges and guiding high-stakes decisions. This Double Major balances risk modelling skills with business insight – preparing you to drive smarter decisions, optimise strategy, and solve complex problems with confidence.

Our courses in statistical modelling, predictive analytics, and applied forecasting will help you measure credit, insurance, and operational risks. At the same time, you’ll learn to interpret business data, design performance dashboards, and communicate findings persuasively.

By integrating actuarial methods with analytics tools, you’ll be able to solve cross-functional problems like pricing optimisation, fraud detection, or customer trend analysis – which all require a combination of quantitative depth and business context.

Graduates of this Double Major will be prepared for careers where data and risk intersect, including Actuarial Analyst, Quantitative Risk Consultant, and Financial Data Analyst. Opportunities also include roles such as Enterprise Risk Manager, Predictive Pricing Strategist, or Strategic Data Consultant, where you will help organisations balance performance with resilience using evidence-based insight.

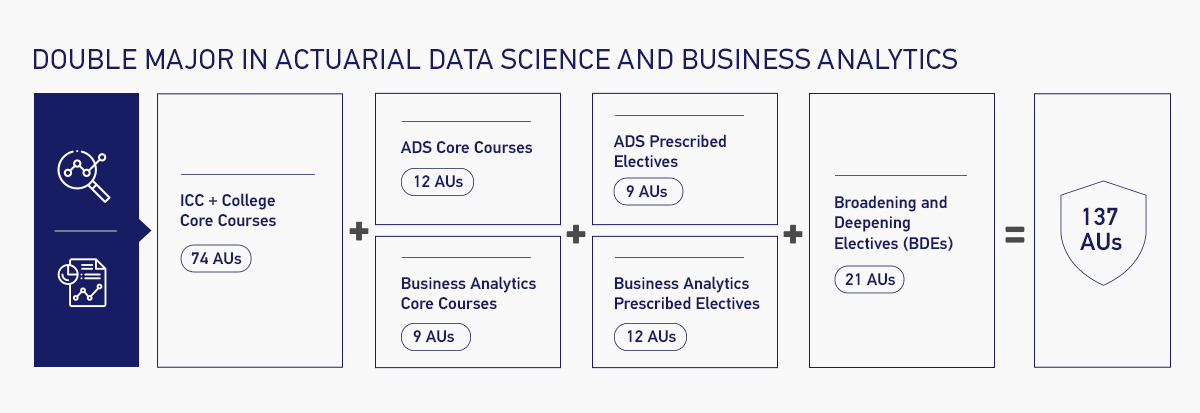

Programme Structure

For specific core courses and electives in each component major, see the majors listings on Actuarial Data Science and Business Analytics in the Single Major page.

Blend finance with actuarial data science to model uncertainty, quantify risk, and solve complex problems in today’s evolving financial world.

You'll learn to evaluate market, credit, and insurance risks with advanced statistical models, then apply those insights to guide investment and capital planning decisions. By combining actuarial rigour with financial strategy, this Double Major prepares you to operate confidently in environments where risk and value creation intersect.

Through tools such as time series modelling, Monte Carlo simulations, and actuarial valuation techniques, you’ll develop both the technical precision and strategic judgement needed to support institutions navigating today’s complex financial landscape.

Graduates of this Double Major are well placed for careers as quantitative analysts, financial risk managers, and actuaries in insurance or pension funds. Others may pursue investment analysis, credit risk, or financial planning, as well as emerging opportunities in fintech and data-driven consulting where actuarial insight supports innovation in finance.

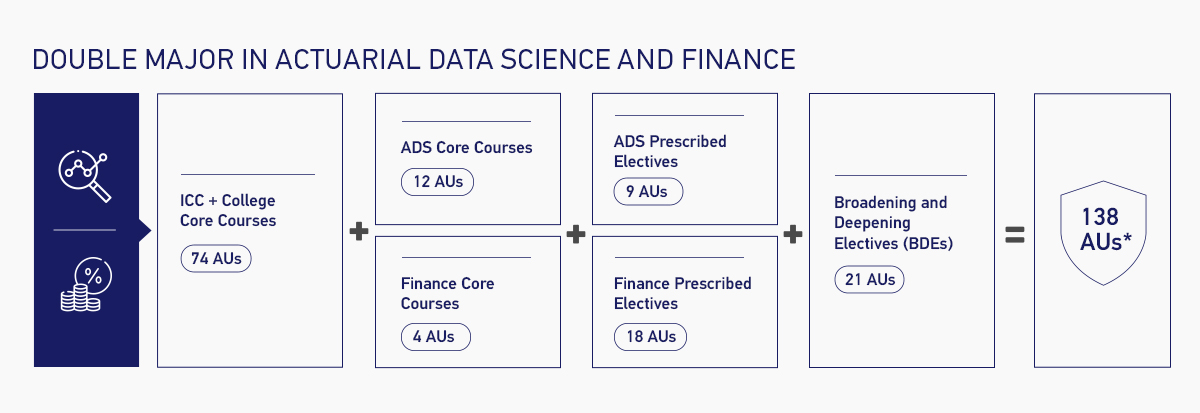

Programme Structure

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

For specific core courses and electives in each component major, see the majors listings on Actuarial Data Science and Finance in the Single Major page.

Master the numbers that drive business success. This Double Major equips you with accounting’s precision in tracking and reporting finances, and finance’s strategic insight to analyse markets, allocate capital, and manage risk.

Studying Finance alongside Accounting gives you a comprehensive understanding of how businesses create, manage, and report value. Accounting and Finance together provide both the detail and the strategy needed to guide organisations through growth, transformation, and compliance.

Learn how tax, audit, and regulatory requirements shape decision-making, and how financial planning can be used to manage uncertainty and support corporate strategy. By integrating historical accuracy with strategic analysis, you’ll be equipped to deliver insights that matter to both executives and stakeholders.

Double Major graduates will be ready for diverse roles across financial services and industry, including auditing, corporate finance, management accounting, tax consulting, and even long-term progression to senior leadership positions such as finance director or chief financial officer.

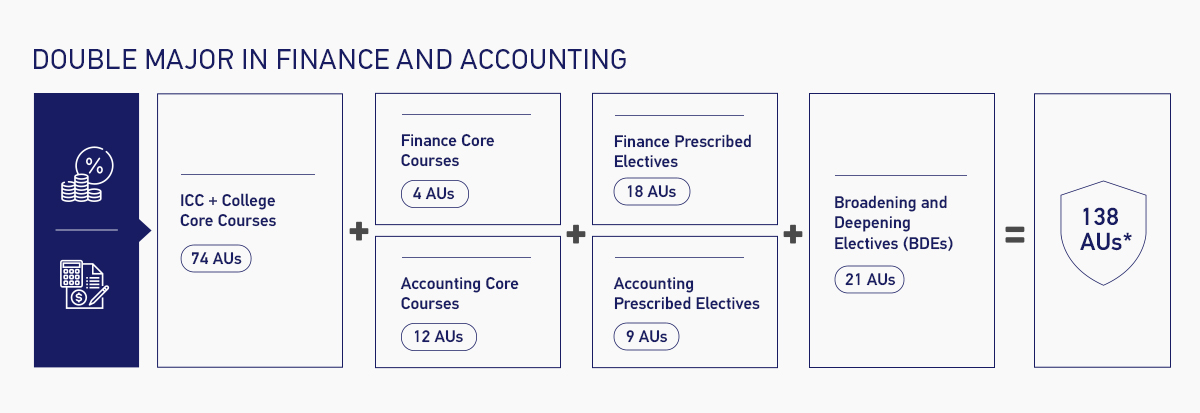

Programme Structure

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

For specific core courses and electives in each component major, see the majors listings on Finance in the Single Major page, and Accounting in the section below.

Master the language of money and the power of data. This Double Major in Finance and Business Analytics equips you to make sharper, evidence-based financial decisions.

Finance gives you the knowledge to manage capital, evaluate investments, and assess risk, while analytics adds the ability to work with data at scale: building models, tracking performance, and generating insights that guide strategy. What results is an agile skill set that combines financial acumen with the tools to turn information into action.

In terms of specific skills, you’ll learn to construct dynamic forecasting models, analyse business performance through dashboards and KPIs, and apply predictive techniques to anticipate risks and opportunities.

By uniting financial knowledge with analytical depth, you’ll be able to explain outcomes clearly and optimise decisions in fast-moving markets.

Graduates of this Double Major will be well-suited for roles such as financial analyst with an analytics focus, business intelligence analyst, and corporate finance associate. Many also pursue opportunities as risk analysts, FP&A specialists, or fintech data analysts, where both financial understanding and analytical expertise are critical for success.

Programme Structure

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

For specific core courses and electives in each component major, see the majors listings on Finance and Business Analytics in the Single Major page.

Lead from the centre of global trade and finance. Through this Double Major, you’ll gain the essential tools you need to navigate global markets: combine finance expertise with real-world trade insights to manage cross-border risk, capital, and opportunity.

You’ll develop expertise in trade finance structures such as letters of credit and FX hedging, while also learning to analyse macroeconomic trends, regulatory changes, and commodity movements that influence global business.

The integration of financial modelling with trade insight ensures you can evaluate opportunities across borders, manage liquidity and risk, and contribute to strategic planning for international expansion.

Graduates of this Double Major will be primed for careers as global trade finance analysts, corporate treasury and FX strategists, and commodities trading analysts. Opportunities also extend to roles in supply chain finance, export credit, and market intelligence, where the ability to connect financial decision-making with global trade dynamics is in high demand.

Programme Structure

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

For specific core courses and electives in each component major, see the majors listings on Finance and International Trading in the Single Major page.

Master value creation and risk control in a single four-year programme. This Double Major equips you with the financial expertise to analyse markets, optimise portfolios, and guide strategic investment decisions – alongside the analytical skills to identify, quantify, and manage market, credit, and operational risks.

This unified approach to Finance and Risk Analytics will give you the strategic judgement to grow businesses sustainably while protecting against shocks in markets, credit, and operations.

You’ll learn to apply quantitative techniques to guide financial decisions, simulate market volatility, and balance risk-adjusted returns against profit potential. The combination also deepens your understanding of regulatory frameworks such as Basel III and IFRS, building the confidence to ensure compliance while advising on risk-aware strategy. By mastering both growth and control, you’ll be ready to play a key role in financial resilience and long-term planning.

Graduates can pursue careers as financial risk analysts, corporate treasury risk specialists, and investment risk managers. Other pathways include credit risk analysis, compliance and regulatory roles, and consulting positions where you will advise organisations on managing exposure during periods of expansion or transformation.

Programme Structure

*Finance Majors’ Major Core and Major Prescribed Electives add up to 22 AUs, one more than other BBus (Single Major) choices - as a result, AUs for any BBus (Double Major) taking up a Major in Finance add up to 138 AUs in total.

For specific core courses and electives in each component major, see the majors listings on Finance and Risk Analytics in the Single Major page.

Create people-centred strategies that are backed by evidence, not intuition. This Double Major prepares you to transform HR into a driver of business performance -- by merging behavioural understanding with data skills, you’ll learn to diagnose manpower challenges and recommend solutions with measurable impact.

The integration builds capabilities in predictive modelling, workforce forecasting, and performance analysis. You will be able to assess turnover risk, optimise recruitment pipelines, evaluate training ROI, and design interventions that align employee performance with organisational KPIs.

Analytics also enhances HR consulting by allowing you to conduct culture audits, benchmark compensation, and streamline inefficient processes through workflow analysis.

Graduates of this Double Major will be well-positioned for roles at the intersection of HR and analytics -- including People Analytics Specialist, Workforce Planning Analyst, and Talent Analytics Manager. Career opportunities also extend to roles like HR Strategy Consultant and Compensation & Benefits Analyst, with employers across industries increasingly seeking professionals who can connect human capital decisions with business data.

For specific core courses and electives in each component major, see the majors listings on Human Resource Consulting and Business Analytics in the Single Major page.

Programme Structure

Align brand promise with workplace culture. Pairing Marketing with Human Resource Consulting equips you to align what an organisation promises externally with the culture it builds internally.

Marketing develops your ability to understand audiences and shape compelling messages, while HR Consulting provides the frameworks to engage employees, design people strategies, and build resilient workplaces.

Together, they prepare you to strengthen both brand reputation and workforce performance.

Learn how to apply consumer insight to employee engagement, use storytelling to communicate change, and connect talent programmes with organisational goals. You’ll be well-versed in design initiatives that improve retention, foster inclusion, and ensure that internal culture supports the external brand.

By integrating people-focused strategy with communication skills, you will be ready to influence both market perception and employee experience – ideal skills for roles like employer brand manager, employee engagement specialist, and HR business partner with a focus on culture and communication.

Others may pursue roles in internal communications, CSR management, or consulting, where the ability to align brand and workforce strategy is a key differentiator.

Programme Structure

Turn creative ideas into proven results by combining customer insight with data to design campaigns that perform – and strategies that scale. By undertaking Marketing and Business Analytics learning in this Double Major, you’ll gain the ability to transform creative ideas into measurable results.

Marketing equips you to understand consumer behaviour, craft campaigns, and build brand loyalty, while Business Analytics provides the tools to test strategies, analyse data, and optimise performance. At the intersection of these disciplines, you’ll learn to design marketing initiatives that are both imaginative and evidence-based.

Specific skills learned in this Double Major include audience segmentation, predictive modelling, and campaign evaluation. This integration also trains you to communicate insights clearly, turning complex data into actionable recommendations for marketing teams and business leaders. Ultimately, you’ll gain the expertise to connect creativity with rigour, ensuring marketing investments deliver real impact.

Graduates will be prepared for roles such as growth marketing analyst, consumer insights specialist, and marketing data strategist. Career opportunities also include digital campaign manager, CRM and personalisation analyst, and marketing operations professional – positions where success depends on combining analytical insight with a deep understanding of customers.

Programme Structure

For specific core courses and electives in each component major, see the majors listings on Marketing and Business Analytics in the Single Major page.

Be the professional who sees beyond the numbers. This Double Major pairs precision in financial reporting with an ability to detect, quantify, and mitigate threats.

Accounting provides the discipline to ensure accuracy and compliance, while Risk Analytics adds the ability to detect anomalies, quantify exposures, and forecast future scenarios. Together, they prepare you to safeguard financial integrity while supporting informed, risk-aware decision-making at every level of an organisation.

You’ll develop expertise in financial analysis with a risk perspective: building controls and governance systems that prevent fraud, ensure compliance, and sustain transparency. Learn how to integrate risk assessment into reporting, use predictive tools to test resilience under different conditions, and communicate exposures alongside financial results to guide leadership on business sustainability.

When you graduate, you’ll be prepared to advise leadership on financial health, risk exposures, internal controls, and long-term sustainability – in roles such as risk assurance consultant, fraud investigator, and finance controls and risk manager. Other opportunities include careers in audit analytics, regulatory reporting, and enterprise risk, where organisations need professionals who can connect financial accuracy with long-term resilience.

Programme Structure

For specific core courses and electives in each component major, see the majors listings on Risk Analytics in the Single Major page, and Accounting in the section below.

Offered exclusively within BBus (Double Major) combinations such as Finance and Accounting or Risk Analytics and Accounting, the Major in Accounting builds strong foundations in financial reporting, accounting systems, and risk management – with a focus on real-world application. Five optional specialised tracks prepare graduates for careers in accounting, audit, tax advisory, corporate finance, and ESG reporting.

Major Core Courses

These core courses are essential for fulfilling the requirements of your Major in Accounting.

- Accounting II (4 AUs)

- Accounting Information Systems (4 AUs)

- Enterprise Risk Management and Sustainability (4 AUs)

*Course list is subject to change by NBS

Major Prescribed Elective Courses + Tracks

Choose three of the following Accounting Elective Courses that align with the skills you aim to build for your career path.

Tracks Under the Major in Accounting

Tracks are optional, focused disciplinary pathways within individual Majors. Completing a track can lead to specific recognition or preparation for professional qualifications.

Under the Accounting Major, you can choose to undertake one of five tracks, by selecting the checked electives under each track in the table below. Available tracks include:

- Financial Reporting & Valuation: Master financial reporting standards and valuation techniques to analyse company performance and support business decision-making.

- Assurance & Forensics: Learn auditing principles, fraud investigation, and corporate governance to ensure transparency and detect financial misconduct.

- Taxation: Develop expertise in corporate tax laws, compliance, and planning strategies for businesses operating across jurisdictions.

- Analytics: Apply data analytics and visualisation tools to uncover insights from financial data and improve audit quality.

- Sustainability: Focus on sustainability reporting, ESG disclosure, and responsible business practices in line with global reporting frameworks.

These tracks are optional, and you may choose not to pursue a track in this major.

| Major Prescribed Elective Courses | Accounting Tracks | ||||

|---|---|---|---|---|---|

| Financial Reporting & Valuation | Assurance & Forensics | Taxation | Analytics | Sustainability | |

| Business Valuation: From Theory to Practice (3 AUs) | ✅ | ✅ | |||

| Forensic Accounting and Fraud Investigation (3 AUs) | ✅ | ||||

| Accounting and Audit Analytics (3 AUs) | ✅ | ||||

| Accounting Recognition & Measurement (4 AUs) | ✅ | ||||

| Assurance & Auditing (4 AUs) | ✅ | ✅ | |||

| Principles of Taxation (4 AUs) | ✅ | ||||

| Company Law & Corporate Governance (4 AUs) | ✅ | ✅ | |||

| Risk Reporting & Analysis (4 AUs) | ✅ | ||||

| Accounting Analysis & Valuation (4 AUs) | ✅ | ||||

| Sustainability Reporting (3 AUs) | ✅ | ||||

| Sustainability Assurance (3 AUs) | ✅ | ||||

| Study Mission on Sustainability Management (2 AUs) | ✅ | ||||

| AI in Accounting & Finance (3 AUs) | ✅ | ||||

| Advanced Taxation (4 AUs) | ✅ | ||||

*Course list is subject to change by NBS

More About Cross-Listed Courses

Cross-listed courses appear in the curriculum for more than one major – but only count towards fulfilling the requirements of one of the two majors, not both. The following courses are cross-listed between different single majors:

- Financial Risk Management: Cross-listed from Risk Analytics to Finance.

- Climate Risk Analytics: Cross-listed from Risk Analytics to Finance.

- Sustainability Reporting: Cross-listed from Accounting to Finance.

- Global Financial Market and Institutions: Cross-listed from Finance to International Trading and Risk Analytics.

- Carbon Markets and Pricing Fundamentals: Cross-listed from Finance to International Trading.

- Corporate Finance and Strategy: Cross-listed from Finance to Actuarial Data Science and Risk Analytics.

If the Double Major being taken includes a cross-listed course, you’ll need to take additional distinct courses to meet the total AU requirements for the other major.

For example: if you’re pursuing the BBus (Double Major) in Finance and Risk Analytics, and you take Climate Risk Analysis (which is a cross-listed Prescribed Elective for both Risk Analytics and Finance), this course will only be counted towards the Risk Analytics major.

You will then need to select another module to complete your Finance major requirements.

*Course list is subject to change by NBS