Programme Overview

Designed to fast-track professional growth in accounting and finance, the MSc in Accountancy (MACC) at Nanyang Business School, Singapore's first established accounting school offers 2 tracks: General and Data Analytics (DA), tailored to align with your post Masters career aspirations. Regardless of the track you choose, the comprehensive curriculum can be completed within one year on a fulltime basis.

For module descriptions, please refer to the Module Information. Upon successful completion of the DA track, the specialisation will be reflected in the academic transcript.

Programme Calendar

Our MACC programme is delivered entirely in English on the vibrant main campus at Nanyang Technological University in Singapore.

Note: Programme calendar provided is only applicable to the admission year 2023 cohort.

If you are considering enrolling into the MACC programme from 2024 onwards, please refer to the snapshot provided below for more details.

Data Analytics Specialisation

-programme-structure.jpg?sfvrsn=708af76f_1)

The MACC programme is offered in 12 months with 2 tracks: General and Data Analytics for admission year 2024 onwards.

You may refer to the snapshot here for more information.

Academic Calendar

Full-Time (Admission Year 2023)

| Dates | |

|---|---|

| Trimester 1 | 7 Aug - 4 Nov 2023 (13 weeks) |

| Recess | 5 Nov - 12 Nov 2023 (1 week) |

| | |

| Trimester 2 (1st half) | 13 Nov - 23 Dec 2023 (6 weeks) |

| Recess | 24 Dec 2023 - 7 Jan 2024 (2 weeks) |

| Trimester 2 (2nd half) | 8 Jan - 24 Feb 2024 (7 weeks) |

| Recess | 25 Feb - 3 Mar 2024 (1 week) |

| | |

| Trimester 3 | 4 Mar - 1 Jun 2024 (13 weeks) |

| | |

| Optional: | |

| Jul - Dec 2024 | Internship |

| Sep - Dec 2024 | Fall term overseas exchange at partner university |

Full-Time (Admission Year 2024)

| Dates | |

|---|---|

| Trimester 1 | 5 Aug – 25 Oct 2024 (12 weeks) |

| Recess | 4 Nov – 10 Nov 2024 (1 week) |

| | |

| Trimester 2 (1st half) | 11 Nov - 20 Dec 2024 (6 weeks) |

| Recess | 23 Dec 2024 - 5 Jan 2025 (2 weeks) |

| Trimester 2 (2nd half) | 6 Jan - 14 Feb 2025 (6 weeks) |

| Recess | 24 Feb – 2 Mar 2025 (1 week) |

| | |

| Trimester 3 | 3 Mar – 23 May 2025 (12 weeks) |

| | |

| Optional: | |

| Jul – Dec 2025 | Internship |

| Sep – Dec 2025 | Fall term overseas exchange at partner university |

Module Information

With AI and Automation fast changing the world of accounting, we have updated our curriculum to include Data Analytics & Machine Learning for Accounting, as well as Forensic Accounting and Digital Forensics.

In total, the MSc in Accountancy curriculum at Nanyang Business School consists of 15 modules:

- Business Analysis and Equity Valuation

- Accounting for Decision Making and Control

- Accounting Information Systems

- Accounting Recognition and Measurement

- Assurance and Auditing

- Company Law

- Data Analytics & Machine Learning for Accounting

- Financial Accounting

- Financial Management

- Forensic accounting and Digital Forensics

- Management of Legal Obligations in Business

- Risk Management and Advanced Auditing

- Risk Reporting and Analysis

- Strategic Management

- Tax Management

At the end of this programme, you will be able to successfully master the language of business and finance. You will also be able to gain direct access to the Professional Programme of the Singapore Chartered Accountant qualification.

The course focuses on identifying, assessing, and applying information for the purposes of analysing and valuing business activities and entities. The course employs the agency framework within a capital market context to help students develop the necessary analysis and valuation skills. You will learn about the roles of accounting and the implications of Financial Accounting for capital market efficiency.

Cases and projects are used to help you integrate the accounting, capital market efficiency, business analysis, and valuation concepts. Healthy scepticism is emphasized, as you will be encouraged to challenge the assumptions and facts related to each issue.

The aim of this course is to introduce you to the design and use of management accounting information for planning, control, and decision making within business organisations.

The major topics covered in this course include product costing, activity-based costing and management, strategic cost management practices, transfer pricing issues, tools for decision making, such as cost- volume-profit (CVP) analysis, and performance evaluation and measurement issues, including sustainability measurement.

This course aims to equip you with the knowledge of how Accounting Information Systems (AIS) are deployed in common business transactions as well as information flow in fundamental accounting processes. You will be taught how data is captured, processed, stored, and accessed for generating management information and business reports and documents.

You will also gain hands-on training on AIS usage via lab sessions on SAP – an industry standard package. This will help you to gain an appreciation of the underlying workings of a typical AIS package.

From this course, you will develop a strong conceptual foundation in AIS, a necessary pre-requisite for effective performance of business professionals in the current digital era. It will also enable you to understand, evaluate, and use AIS effectively in your future role as a business manager, professional accountant, or consultant.

This course equips you with strong conceptual and technical knowledge of the recognition and measurement of various financial statement elements.

The course begins with a discussion of objectives of financial reporting and general recognition, as well as measurement issues and concepts. It provides you with a critical examination of recognition and measurement issues and authoritative pronouncements related to various elements of the financial statements.

Topics include fair value measurement, leases, financial instruments, deferred taxes, revenue recognition, construction contracts, and share-based payments.

This course provides you with an in-depth understanding of key assurance concepts and methodologies, as well as the skills and attitudes essential to the effective and efficient conduct of financial statements audits and assurance services.

In terms of pedagogy, this course emphasizes active learning at both individual and group levels through project work, seminar discussions, and activities. The course is designed to inculcate in you critical knowledge, skills, and attitudes that an effective assurance professional should possess.

Critical skills that are developed and reinforced through the various course activities include problem solving, critical thinking, research, communication, teamwork, and interpersonal skills.

Important attitudes and values that this course aims to impart include professional values and ethics, social responsibility, receptiveness to differing views, healthy scepticism, and a passion for proactive self-learning.

This course aims to provide you with a firm understanding of the legal and regulatory mechanisms that govern companies and how they operate and function in a business environment.

The main objective is to provide a clear understanding of the impact of the law on the key relationships between corporations and their stakeholders, as well as between different stakeholder groups. This is achieved by examining the rights and obligations of the various interest groups in pertinent issues relating to the primary aspects of company formation, organisation, and control; corporate management; corporate finance; corporate restructuring; and rescue and corporate insolvency.

There has been an exponential growth of data over the past decade that can provide organisations the opportunities to derive insights to better support their decision making. Similarly in the field of accountancy, the use of Data Analytics is likely to have a great impact on how accountants and auditors work in this modern economy.

This course introduces you to the key concepts of predictive analytics and the course will cover the processes and tools relating to Data Analytics. Using real-life case studies, you will be given the opportunity to gain hands-on experience on building analytical models that will guide decision marking for various business problems such as fraud detection, profit and revenue forecast, customer segmentation, and trend analysis.

This course will lay the foundation that will systematically introduce the process of developing a strong business analytic case starting from the exploration of the data context to finally obtaining the explanatory or predictive results. You will learn how to ask the right questions and how to draw inferences from the data by using the appropriate statistical and data mining tools.

This course focuses on key principles and concepts in financial accounting and the application of these concepts in business decision making. A strategic framework for accounting is adopted with emphasis on a user/decision-maker perspective.

The course covers the foundations of accounting theory, conventional measurement techniques, reporting procedures, and relevant accounting standards. The main focus will be on International Financial Reporting Standards and Singapore Financial Reporting Standards.

An important feature of this course is the extensive use of current business articles and cases dealing with contemporary issues in financial accounting.

The objective of this course is to provide a rigorous introduction to the foundations of financial management in competitive financial markets. The course is designed to equip you with the basic tools that are necessary in managing a firm in a dynamic financial environment.

The topics to be covered include the time value of money, risk and return, portfolio management, stock and bond valuation, cost of capital, capital budgeting, capital structure, dividend policy, corporate financing, agency theory, and financial derivatives.

Strategic applications of these concepts to real world problems will be given equal emphasis. The method of instruction, depending on the topic, will include lectures, case studies, and/or other pedagogical tools.

This course will introduce the concept of forensic accounting and the role of a forensic accountant. The course will cover different types of fraud schemes as well as various investigation techniques and tools. It will explore the key trends and developments in the forensic accounting field and provide practical insights on detecting fraud and other economic crime.

A digital forensics methodology will be introduced with an overview of e-discovery, email review and forensics Data Analytics. Using real-life case studies, you will be given the opportunity to demonstrate how theoretical frameworks and concepts in forensic accounting can be applied in the real world.

This half-course focuses on the management of key aspects of legal obligations in business. It will begin with an introduction to the Singapore legal system and regulatory framework for doing business. It will give you an understanding of obligations in key business torts and contracts before introducing various legal tools commonly used to manage the obligations and strategies that enable contracting parties to best protect their interests. And will conclude with an examination of the legal issues when contracting through agents.

At the end of the course, you will:

- Have an understanding of the key legal considerations in doing business

- Be able to analyse and manage key aspects of contracts and the contracting process

- Be able to understand and explain how specific business torts operate.

To sustain value, corporations today recognize the need for active engagement in setting objectives and overseeing programs associated with Enterprise Risk Management (ERM). This shift in paradigm is driven by increasing stakeholder demands and performance expectations as well as growing public scrutiny after some spectacular corporate failures around the globe.

The first part of the course provides you with an overview of risks that can threaten the attainment of organisational objectives, and the ERM concepts, frameworks and techniques for identifying, assessing, and managing risks. You will also be exposed to hands-on application using generalised audit software to perform fraud risk analytics.

The second part of the course extends your basic auditing knowledge and techniques by examining advanced auditing concepts and complex issues faced by auditors and assurance providers in current practice. Topics include the auditing of complex issues related to revenue recognition, fair value estimates, and group financial statements.

The objective of the course is to provide you with a:

- Good understanding and appreciation of the operating and financial risks that firms face

- Strong conceptual and technical knowledge in the measurement, reporting, and analysis of these risks.

To provide focus to this course, emphasis is placed on two major areas:

a) Firms’ investment strategy as part of their Risk Management policy, and the resultant consolidated financial statements

b) Firms’ use of derivative financial

instruments as part of their Risk Management policy, and the impact of these hedging activities on the firms’ financial position and performances.

You are expected to have a strong foundation in the basic Financial Accounting issues and the associated technical competence before reading this course.

The course focuses on identifying and understanding the sources of superior firm performance through a process of analyses and syntheses. This entails an understanding of theoretical concepts and frameworks.

You will learn to analyse the external and internal environments of the firm, and formulate and execute different types of strategies with the considerations of ethics and the interests of various stakeholders.

Strategic issues are examined from the perspective of a chief executive or general manager who needs to formulate effective strategies and develop the necessary resources and capabilities to achieve sustainable competitive advantage in a highly volatile, competitive global environment.

This course is designed to provide you with a working knowledge of the concepts, principles, and applications of taxation laws and practices in Singapore, most notably those relating to the Income Tax and the Goods and Services Tax.

The emphasis of the course will be on the:

- Identification of tax issues faced by businesses and individuals in structuring their economic transactions

- Analysis of the impact that taxes may have on the decision-making processes of businesses and individual

- Formulation of strategies to mitigate and control such costs through legitimate tax planning

Students in the Data Analytics specialisation will complete another five modules which will be taught in Trimester 4.

Note: The 16 months Data Analytics specialisation is only applicable to admission year 2023.

The MACC programme will be offered in 12 months with 2 tracks: General and Data Analytics for admission year 2024 onwards.

Through this course, you will understand how databases support business processes and gather information for business analytics. In particular, you will be able to apply the knowledge and skills to analyse a variety of business processes, identify data requirements, and create corresponding data management strategies.

Most organisations are data rich and information poor. The large volumes of data in an organisation are “oilfields” rich in information content that are pending extraction with the right tools and models. Analytics involves the art of data exploration, visualisation, communication and the science of analysing large quantities of data in order to discover meaningful patterns and useful insights to support decision-making.

This course will you with the ability to create customised solutions to make informed business decisions, integrate statistical libraries for data analysis and create AI models to automate accounting and financial processes. It will provide you with individual hands-on practice to hone your coding skills and also opportunities to develop coding solutions in a team. The course utilises R and Python language as the medium of learning because it is one of the most in-demand coding languages and its user-friendly syntax is well suited for beginners. You will also utilise modern development tools to turn information into insights including Keras, Deep Learning model, Google Brain TensorFlow, Hadoop, Spark and Cloud.

This course examines the application of data analytics in audit, based on an underlying risk-based methodology with real-life examples. You will be able to apply what you have learnt in other courses as well as within the course to real-life examples as they learn about practical aspects in the audit analytics process such as extraction, transformation and loading of data as well as the actual execution of audit analytics tests and visualisation of the results in software such as Tableau.

Proper understanding and appreciation of blockchain technology is critical to any business in this era of a decentralised digital economy. Great collaborations come with greater risks, and every business moving out of silos into the ocean of blockchain applications is facing the challenges. This course will introduce you to the fundamental components of bitcoin, blockchain technology and cryptocurrencies, encompassing distributed systems, consensus protocols, incentive mechanisms and decentralised applications. You will learn the core ideas of immutability, consistency, attribution, authenticity, and automation that enable the fabric of decentralised applications, in addition to the relevant enterprise platforms, case-studies, applications and regulatory aspects of the technology.

Leading People Globally

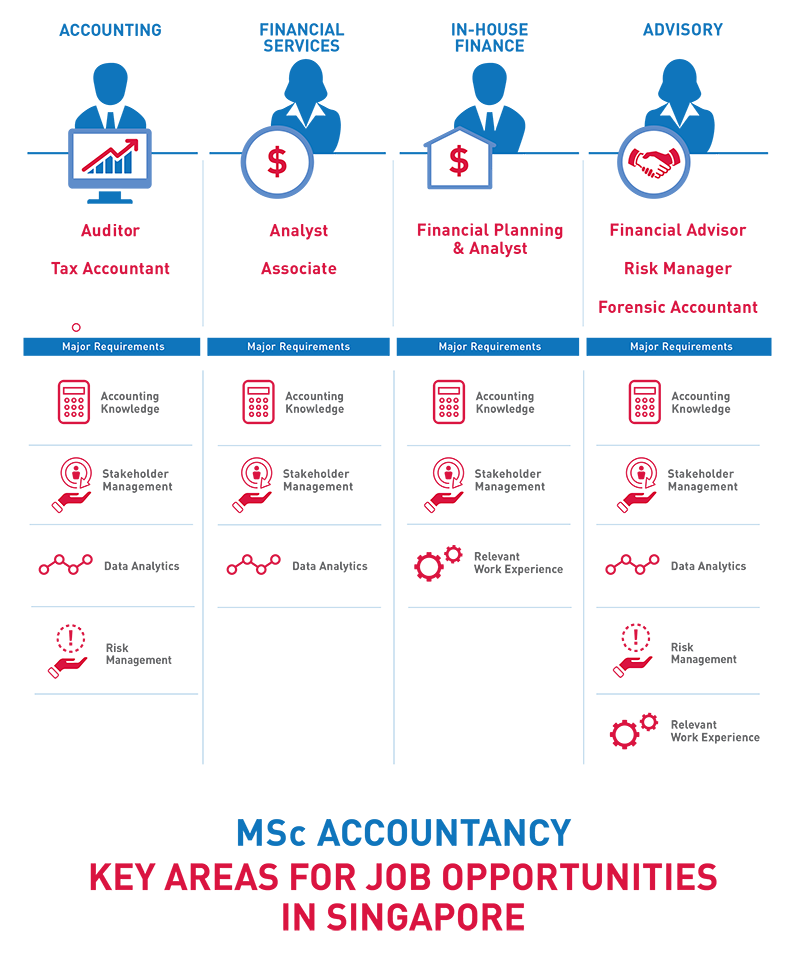

Our MACC graduates are sought after by premier employers for their ability to think analytically and creatively. In addition, they have initiative, are able to work collaboratively, and have a global perspective.

Here are the key job opportunities in Singapore which our graduates can look forward to.

Partner Universities

Participants enrolled in the MACC programme at Nanyang Business School can now embark on an overseas exchange with our partner institutions. The overseas exchange will give you the opportunity to fully immerse in a different culture and benefit from the international exposure. The exchange will take place from September to December at the end of the programme.

For further details on the exchange programmes available, please click on the respective university’s link below:

- Bocconi University

- Aalto University School of Economics

- Vienna University of Economics & Business Administration

- WHU Koblenz, Otto Beisheim Grade School of Management

- Victoria Business School, Victoria University of Wellington, NZ

- The Edwin L. Cox School of Business, Southern Methodist University, USA

- Erasmus University, Rotterdam, Netherlands

- ESSEC Business School, France

- EMLYON Business School, France

- McGill University, Canada (students must have at least 2 years’ work experience after bachelor degree)

- The University of North Carolina, Chapel Hill, USA

/enri-thumbnails/careeropportunities1f0caf1c-a12d-479c-be7c-3c04e085c617.tmb-mega-menu.jpg?Culture=en&sfvrsn=d7261e3b_1)

/cradle-thumbnails/research-capabilities1516d0ba63aa44f0b4ee77a8c05263b2.tmb-mega-menu.jpg?Culture=en&sfvrsn=1bc94f8_1)

7e6fdc03-9018-4d08-9a98-8a21acbc37ba.tmb-mega-menu.jpg?Culture=en&sfvrsn=7deaf618_1)