African start-up funding rebounds in 2025

Capital flows recover after two years of decline, though imbalances remain

By Max Cuvellier Giacomelli

Funding bounces back

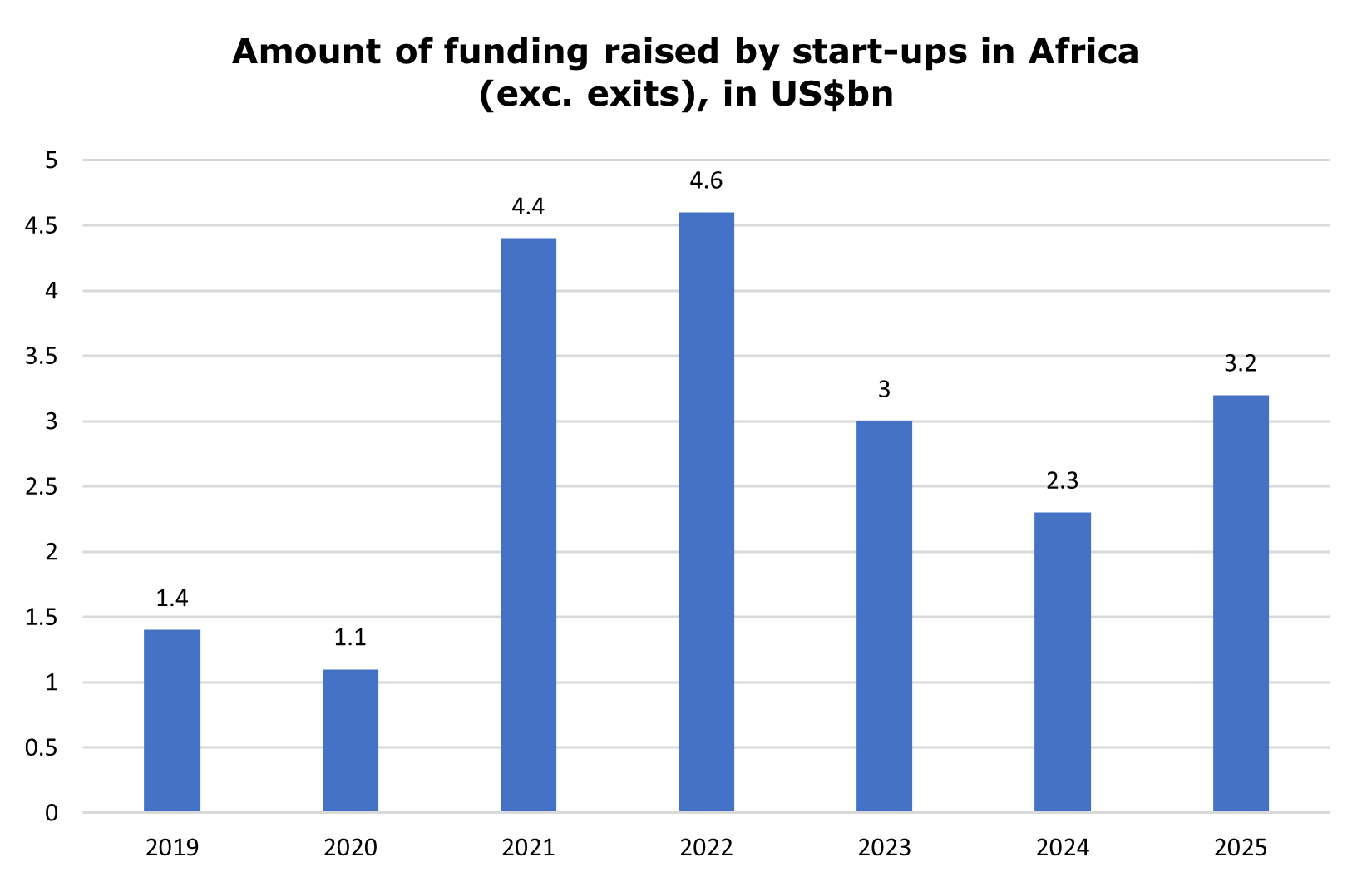

Start-ups in Africa raised US$3.2 bn in 2025 (excluding exits), marking a +40% year-on-year increase after two consecutive years of contraction (-35% YoY in 2023 and -25% YoY in 2024). Of this total, US$1.9bn was equity (61%) and US$1.2bn debt (37%), the highest proportion of debt on record. By year-end, funding had moved back above both 2023 and 2024 levels, signalling a clear recovery.

Deal volume remained largely unchanged. Almost 500 ventures raised at least US$100000 in 2025, broadly flat compared to 2024 and 2023. In fact, the recovery was driven more by larger ticket sizes than by deal count. 215 ventures raised US$1m or more, up from 193 in 2024 (+11% YoY). At the top end, 69 start-ups raised more than US$10m, compared to 40 in 2024 (+73% YoY), making 2025 the second-strongest year on record for large rounds, after 2022. Eight start-ups announced rounds exceeding US$100m, concentrated in energy - d.light[1], Sun King[2], M-Kopa[3], Spiro[4] - and fintech - Wave[5], MNT-Halan[6], Moniepoint[7]. Driven in part by these larger deals, the three top sectors by funding in 2025 were fintech (37%), energy (27%) and logistics and transport (10%).

Deal volume remained largely unchanged. Almost 500 ventures raised at least US$100000 in 2025, broadly flat compared to 2024 and 2023. In fact, the recovery was driven more by larger ticket sizes than by deal count. 215 ventures raised US$1m or more, up from 193 in 2024 (+11% YoY). At the top end, 69 start-ups raised more than US$10m, compared to 40 in 2024 (+73% YoY), making 2025 the second-strongest year on record for large rounds, after 2022. Eight start-ups announced rounds exceeding US$100m, concentrated in energy - d.light[1], Sun King[2], M-Kopa[3], Spiro[4] - and fintech - Wave[5], MNT-Halan[6], Moniepoint[7]. Driven in part by these larger deals, the three top sectors by funding in 2025 were fintech (37%), energy (27%) and logistics and transport (10%).

Investor participation remained stable. At least 554 investors joined US$100k+ deals, likely underestimating smaller angels. 31% of investors were involved in more than one deal, 7% in five or more. Digital Africa[8] led with at least 23 investments.

Since 2019, African start-ups have now raised almost US$20bn (excluding exits). More than 2,200 ventures have raised at least US$100000, including 1,000+ raising US$1m+, nearly 300 raising US$10m+, and 33 surpassing US$100m. MNT-Halan tops the charts with over US$1bn raised. Over 2,500 investors have participated in at least one deal.

The Big Four continue to dominate

Capital remains concentrated. The Big Four - Egypt, Kenya, Nigeria and South Africa - captured 82% of funding in 2025, despite accounting for 30% of Africa’s population and 40% of its GDP. This share remains mostly unchanged since 2019. By deal count, 64% of start-ups raising US$100000+ were in these four markets, though the proportion varies heavily depending on the size of the round: 81% of US$10m+ rounds happened in the Big Four vs. 69% of US$1m–10m, and 56% of US$100000–1m rounds. Earlier-stage activity outside of the Big Four should hopefully translate into future growth in ‘tier two’ markets.

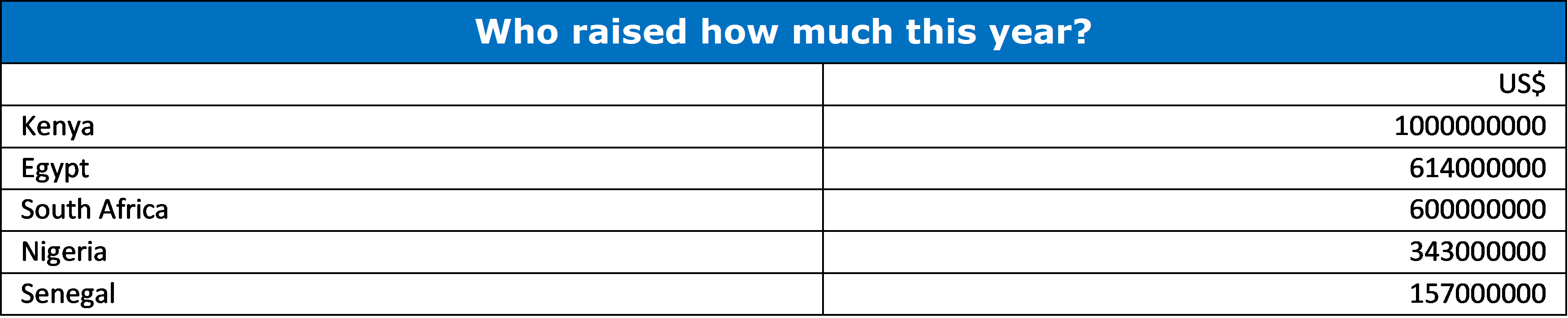

Kenya led with almost US$1bn, nearly a third of continental funding, growing +52% YoY. Large energy players - d.light, Sun King, M-Kopa, Burn[9], PowerGen[10] - drove the market. Debt was US$582m (+33% YoY), 60% of the total, while equity hit US$383m, nearly doubling YoY. However, ventures raising US$100000+ fell to 75 (-23% YoY). Egypt raised US$614m (+51% YoY, 20% of total), roughly half equity and half debt, with US$278m in debt funding. South Africa raised US$600m (+51% YoY, 19% of total), over 90% as equity (US$545m), making it the largest equity market (29% of Africa’s total). 83 ventures raised US$100000+ (+63% YoY). Finally, Nigeria underperformed, with US$343m (-17% YoY) and an 11% share of continental funding, the lowest since 2019. The country still remained the most active by venture count, with 86 raising US$100k+ (-14% YoY).

Beyond the Big Four, only Senegal (US$157m) - mostly driven by Wave’s US$137m debt round[5] - and Benin (US$100m) – almost entirely attributable to e-motorbike Spiro’s US$100m raise[4] - crossed the US$100m bar. Ghana, Morocco, Tunisia, Rwanda, Uganda, but also Togo, Mali and Côte d’Ivoire attracted between US$10m and $100m. In number of ventures, Ghana and Morocco kept the lead, beyond the Big Four. 26 countries had no deals above US$100000.

Unicorns and IPOs

No new unicorns were minted in 2025. Moove’s rumored US$300m equity and US$1.2bn debt facilities[11] have not materialized (yet). Africa’s unicorns raised around US$100m in equity via Moniepoint’s Series C[7], the lowest since 2020, when there was only one unicorn. Including the debt raised by Wave and MNT-Halan debt, the total funding was ~US$358m, also at its lowest since 2020. Given the low levels of funding activity, existing unicorns saw no valuation resets. On the IPO front though, the continent saw its first two events since pre-pandemic times: Optasia listed on the Johannesburg Stock Exchange[12], and Cash Plus on the Casablanca Stock Exchange[13]. Finally, M-Kopa[14] raised significant equity (a ~US$166m Series F) and turned its first-ever profit in 2025, giving serious signs of potentially getting closer to a $1bn+ valuation.

Walking into 2026 with cautious optimism

Looking ahead, optimism is cautious but real. Strong 2025 results and Africa’s six-month lag behind global trends suggest that funding could continue to surge in 2026. Observers will however keep an eye on two areas in particular: early-stage investment where because we’ve been seeing a relative loss of activity in smaller, earlier-stage deals which, if it continues, could hinder future growth[15]; and Nigeria, which led again in ventures raising US$100000+, but lagged in total funding raised. Investor focus will remain on exits, hopefully building on a record 50 in 2025 and the two IPOs mentioned above, highlighting the continent’s growing maturity.

References

[1] https://techpoint.africa/news/d-light-842m-consumer-financing/

[3] https://techcabal.com/2025/10/07/m-kopa-turns-first-ever-profit-revenue-surges-66-416/

[5] https://techcabal.com/2025/06/30/wave-raises-137-milion/

[8] https://www.digital-africa.co/en

[10] https://www.techinafrica.com/powergen-raises-50m-scale-renewable-energy-kenya/

[11] https://techpoint.africa/news/moove-300m-funding/ & https://www.dabafinance.com/en/news/moove-debt-funding-waymo-autonomous-vehicles

[12] https://www.dabafinance.com/en/news/optasia-jse-ipo-2025

[13] https://africancapitalmarketsnews.com/cash-plus-soars-61-after-ipo-oversubscribed-65x/

[14] https://techcabal.com/2025/10/07/m-kopa-turns-first-ever-profit-revenue-surges-66-416/

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)