Start-ups in Africa record the lowest quarterly performance since 2020

They raised just over US$300 million in Q2 2024

By Max Cuvellier Giacomelli

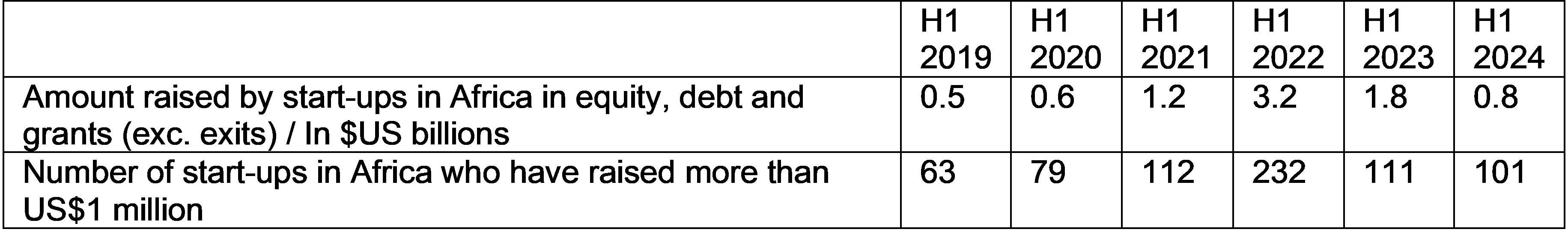

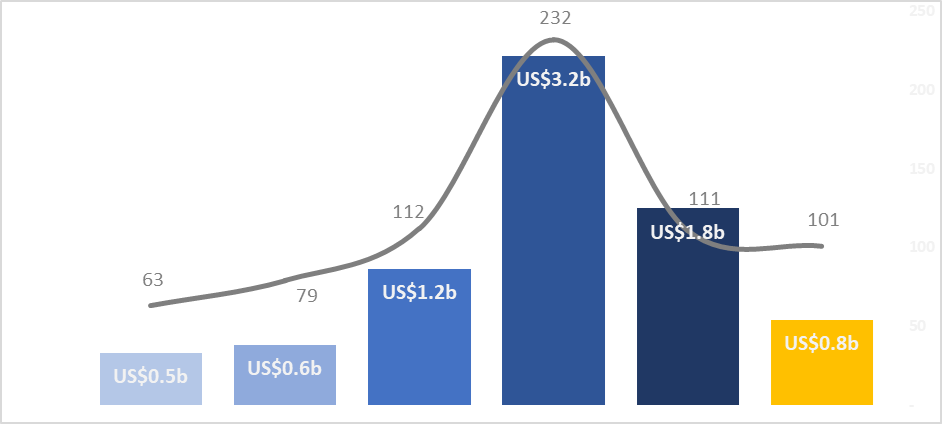

It has been another difficult period for start-up investments in Africa. They raised just over US$300 million in Q2 2024 in equity, debt and grants (exc. exits) - the lowest quarterly performance since late 2020. Combined, start-up investments on the continent have reached $780 million in H1 2024, much lower than in previous periods: US$1.8b in H1 2023, US$3.2b in H1 2022 and US$1.2b in H1 2021. More encouragingly, there have been 1011 ventures who raised at least US1 million in the first half of the year on the continent, a number pretty much comparable to H1 2023 and H1 2021 levels (111 and 112 respectively), though considerably lower than at the height of the heatwave in H1 2022 (232).

Two thirds of the US$780 million invested in start-ups in Africa in H1 were in the form of equity, one third in debt, and a negligible amount in other vehicles including grants. This split is on a par which 2023 numbers, which marked a clear change with the previous years when debt typically represented less than 10% of the amount invested – and disclosed – in start-ups on the continent. The consequence is that the US$513m of equity raised in H1 2024 not only compares quite unfavourably with the three previous periods, but are also only just above H1 2020 and H1 2021 levels.

Geographically, nearly three quarters of the funding in H1 was raised in Eastern Africa (37.5%, US$285m) and Western Africa (35.5%, US$270m) alone, followed by Northern (15%) and Southern Africa (11.5%); Central Africa continued to attract only a fraction of investments (.5%). At a country level, just four markets – the ‘Big Four’ – claimed 79% of the total amount: Kenya (32%), Nigeria (23%), Egypt (11%) and South Africa (11%). Western Africa was the only one of the four key regions where a significant portion of the funding (36%) was raised outside the regional Big Four (vs. 14% in Eastern Africa, 12% in Northern Africa and a mere 2% in Southern Africa). Illustrating this trend is the US$50 million debt facility negotiated by spiro with Afreximbank, one of the three largest deals of Q2 2024, announced mid-May.[1] The Benin-born Electric Vehicle company – the largest on the continent with now over 14,000 bikes – continues to finance its growth by raising large amounts of debt, following a US$63 million debt funding round with Société Générale in the summer of 2023.

The sector that attracted most funding in H1 2024 was in fact Logistics & Transport with US$218m, more than half of which were raised by moove alone who announced US$110m in funding in Q1, including a US$100m Series B (covered in my last article[2]). Fintech came second with US$186m raised, though it remained strongly in the lead when it came to the number of individual start-ups raising at least US$1m during H1 with a total of 30, compared to just 12 for Logistics & Transports and the other two sectors that made the top four in terms of both amount raised and number of start-ups raising US$1m+: Energy & Water (US$132m) and Agri & Food (US$74m). Beyond spiro, the other two largest deals of Q2 2024 were: a US$50m loan from DFC to M-KOPA in Kenya[3] which the company historically involved in pay-as-you-go solar home systems will be using to provide financing options to make smartphone affordable to digitally-excluded communities; and a US$27m+ round raised by another Kenya-based organisation, SunCulture[4], who attracted not only InfraCo Africa and impact investor Acumen Funds, but also some high-profile angel investors including Netflix co-founder Reed Hastings and Google co-founder Eric Schmidt. The company provides solar irrigation pumps which it makes affordable to smallholder farmers – and 50% cheaper than their diesel and petrol alternatives – by also applying a pay-as-you-go model. The success of both companies rides on Africa’s very own breed of Buy Now, Pay Later (BNPL) enabled by the large footprint of mobile money services in key markets like Kenya.

An area where we unfortunately see very little progress is the share of funding allocated to female-founder and female-run businesses. In H1 2024, 85% of the funding went to start-ups that either had a solo male founder or an all-male founding team; start-ups with a solo female founder or an all-female founding team on the other hand only attracted 1.6% of the total invested. As the CEO is almost always one of the co-founders, this reality has a direct impact on the share of funding raised by start-ups with a female CEO, which only reached 8% in the first half of the year.

Zooming out, and according to CB Insights’ latest data[5], equity funding globally has been growing QoQ for the second consecutive quarter in Q2, the first time two consecutive quarters of growth have been observed since the end of the global heatwave in late 2021. There was even some level of YoY growth in Q2 (+7%), something that hadn’t been observed since early 2022. While these are early and still feeble signals, the more optimist analysts are hoping it could be the beginning of a new period of growth for start-up investments globally. What could it mean for Africa? Immediately, probably not much, as global trends often take three to six months to impact the continent (as a reminder, while the funding winter started in the US and China in Q1 2022, it did not hit Africa until Q3 that year). But should this trend continue, we would hope it starts impacting numbers on the continent as well.

In the meanwhile, if we consider different hypotheses and extrapolate based on H1 numbers, we should expect funding for 2024 to reach between US$1.5 and US$2 billion by the end of the year. That said, numbers are usually swayed by mega deals, which have been hard to come by this year so far with only one in Q1 (moove’s US$100m Series B mentioned earlier), and none in Q2. Nevertheless, Q3 has been off to a very good start in this area with two such mega deals announced in the second half of July alone (d.light’s new USD$176m securitisation facility[6] and MNT-Halan’s $157.5m raise[7]), making July the most successful month in terms of fundraising on the continent since mid-2023, and already taking the total raised in 2024 as of late July (nearly US$1.2b) over the total amount raised in 2020 (US$1.1b), the last pre-heatwave year.[8] With a couple of large transactions rumoured to be negotiated as I type, new mega deals could well accelerate the funding growth trajectory in H2 2024…

References