No end to the funding winter for start-ups in Africa

While the number of US$1m+ deals continued to pick up, investments on the continent were at a 3-year low in Q1 2024

By Max Cuvellier Giacomelli

.jpg?sfvrsn=14ba82c2_3)

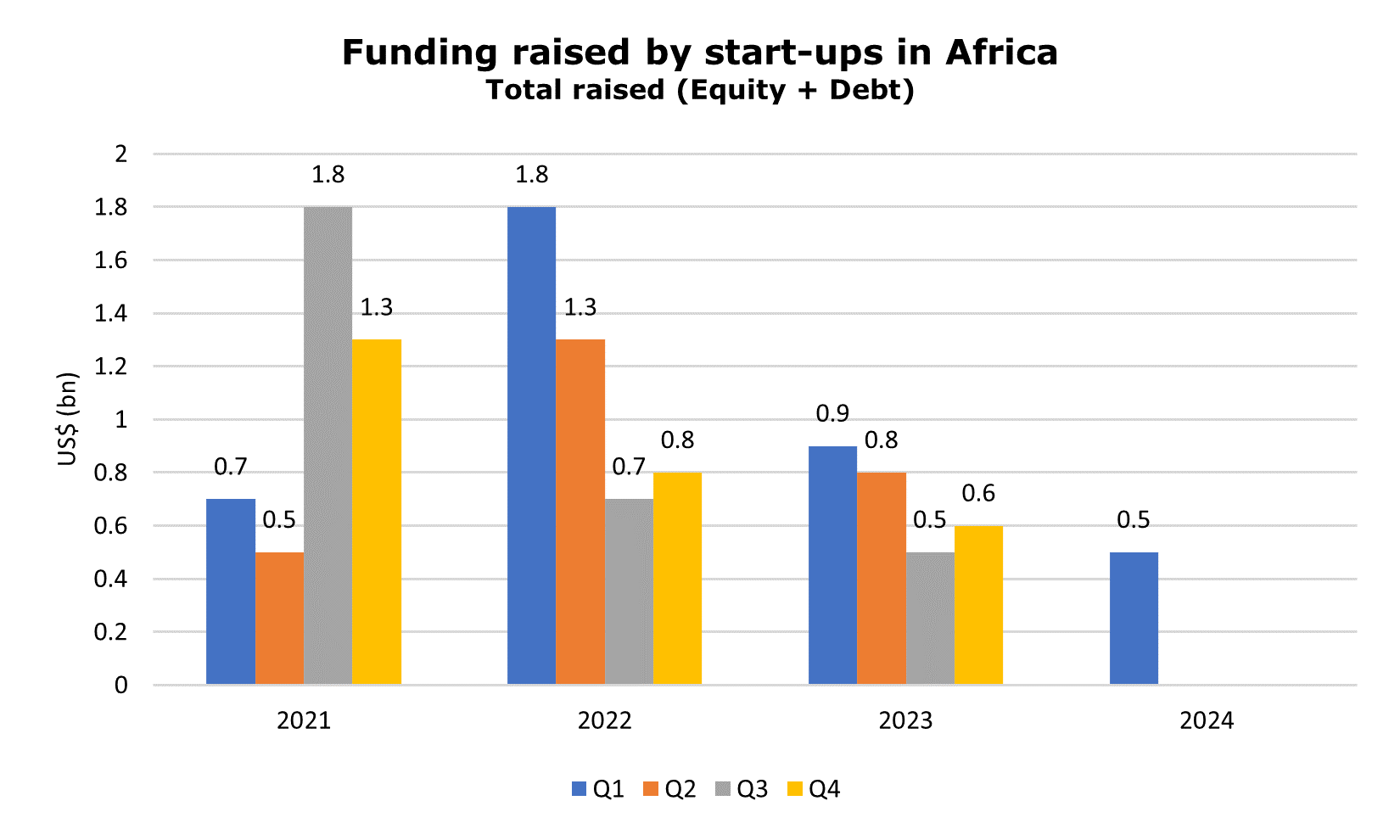

Despite a few encouraging signs, the so-called ‘funding winter’ is still in full swing globally, and Africa is no exception: in Q1 2024, start-ups on the continent have raised a total of US$466m in funding through US$100k+ deals, which represented a 27% drop Quarter-on-Quarter (QoQ) and a -47% fall Year-on-Year (YoY). This is the lowest amount raised in a quarter since Q4 2020, i.e. in more than three years.

Most of the funding in Q1 was raised in the form of equity (US$332m, 71%); the rest was mostly debt (US$132m, 28%). Both equity and debt funding levels were almost halved year-on-year, however QoQ trends are significantly different, due to the strong performance of debt fundraising in 2023 overall. Indeed, while equity funding only decreased by -9% QoQ, debt levels fell by -44% over the same period. Due to the growing importance of debt relatively to equity in the past few quarters, this counter performance therefore dragged numbers down. Indeed, the equity to debt ratio stood at 2.5:1 in Q1 2024, compared to an average of 1.6:1 in 2023 overall. Despite this change, the ratio remains much higher than in previous years when it stood at 5:1 in 2022 and 14:1 in 2021.

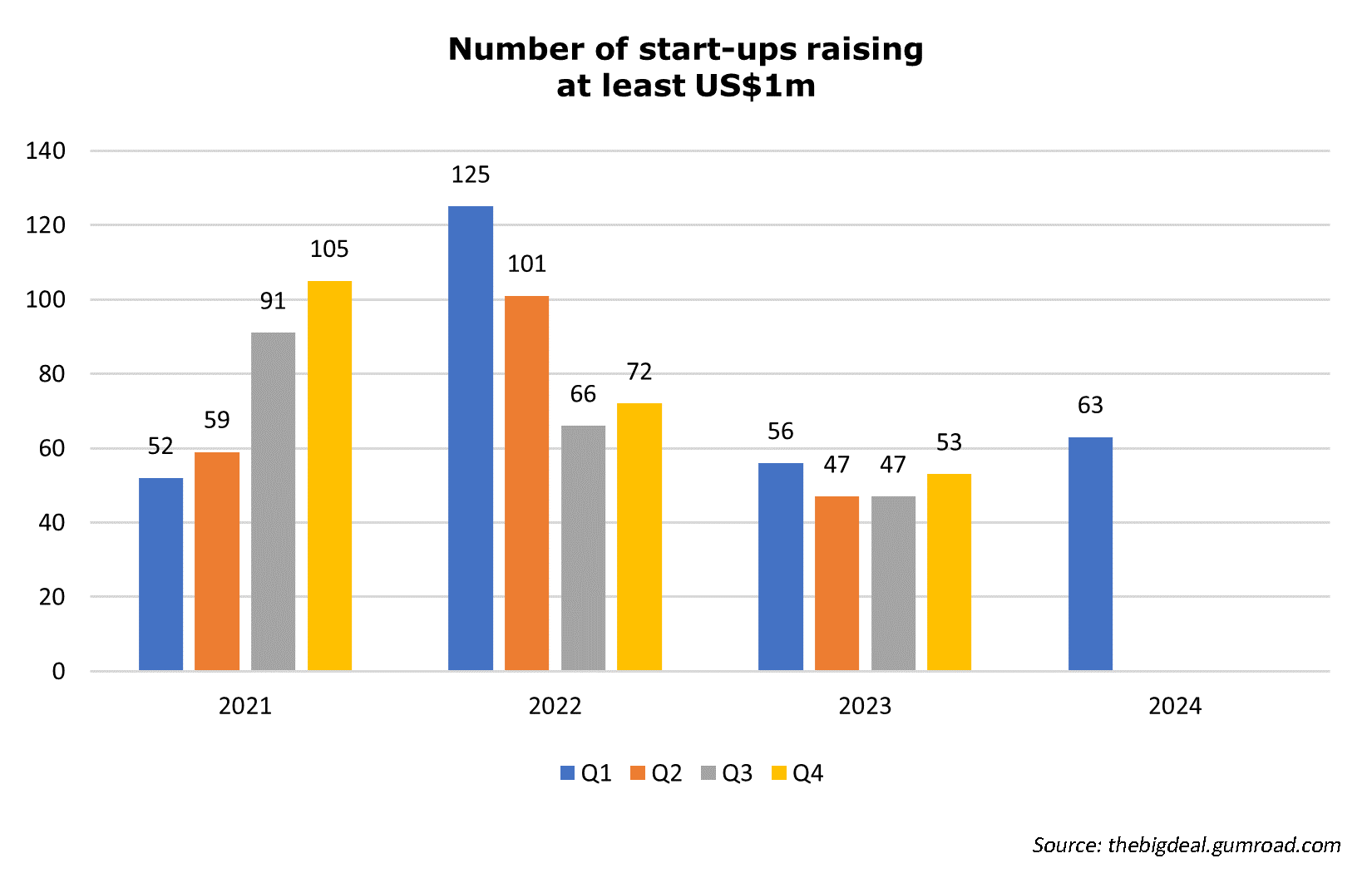

On a positive note, the overall number of start-ups raising US$1m and above (both in equity and debt) increased again in Q1 2024 for the fourth consecutive quarter to reach 63 in total. While deals might be smaller on average, the increase in deal activity could be a sign of regained optimism in the potential of the continent; it also reflects the fact that many Africa-focused funds were announced in the past 18 months and are starting to get deployed. And as investors will continue to also judge the investability of the continent based on their ability to eventually exit their investments, it is worth noting that seven exits were announced last quarter, including HRtech PaySpace’s acquisition by Deel1] - rumoured to be over US$100m– and fintech nCino’s acquisition of DocFox[2]for US$75m, both in South Africa.

The company that raised the largest amount of funding on the continent in Q1 2024 was by far moove. The transport-tech start-up – with an ambition to become the world's largest integrated vehicle financing platform for mobility entrepreneurs, using technology and productivity data – has raised US$110m last quarter alone, representing a quarter of the total funding raised in Africa in Q1. Its US$100m Series B[3] – at a valuation of US$750m – attracted a lot of intention due to its lead investor, global mobility behemoth Uber. Other contributors to the round included UAE sovereign wealth fund Mubadala who had led moove’s previous round[4] last year, as well as African serial investors AfricInvest (who announced their latest US$400m+ Fund IV last year[5]) and Future Africa. The remaining US$10m raised by moove last quarter were debt funding provided by venture debt fund Stride Ventures[6], and earmarked to grow its activities in India, a market moove entered in 2023. All in all, moove has now announced more than US$420m of funding since 2021, making it the fifth largest fundraiser in Africa (equity+debt) in the past 5 years after fintechs MNT-Halan (#1, US$815m), Opay (#3, US$570m), and Flutterwave (#4, US$455m), and energy tech Sun King (#2, US$634m).

Given their relative weight, the moove deals have a strong influence on the ranking of sectors by amount of funding raised, with Transport & Logistics coming on top (32%; US$151m), followed by Fintech (23%, US$105m). With ~US$50m raised each, Agriculture & Food, Energy, and Healthcare complete the Top 5. From a number of US$100k+ deals point of view though, Fintech continued to lead. If we focus on the countries where the start-ups are headquartered, we find 87% of the funding going to the Big Four with Nigeria in the top spot (35%, US$160m), followed by Kenya (24%, US$108m), South Africa (16%, US$76m), and Egypt (12%, US$53m). Only two other countries attracted US$10m or more during the quarter: Uganda (US$16m) and Ghana ($US10m). Women-founded and women-led ventures continued to be critically underfunded in Q1 2024: only 15% of the funding was invested in start-ups with at least a female founder (vs. 99% for start-ups with at least a male founder), and only 6.5% were invested in start-ups with a female CEO.

Finally, compared to global trends and other regions – using CB Insights data[7] – Africa underperformed in Q1 2024. While equity funding on the continent shrank by -9% QoQ, it grew by +11% QoQ globally, thanks to strong performances from the US (+33%) and Europe. Asia (-20%) and Latin America (-38%) however, suffered stronger QoQ losses than Africa. YoY though, Africa registered the strongest setback as equity funding was nearly halved in a year (-47% YoY); all other regions registered double-digit contractions, except for Europe, that even managed to registered some level of YoY growth (+3%). Overall, less than 1% of the funding globally went to start-ups in Africa in Q1 2024; start-ups in the US alone attracted 100x times more funding than their African counterparts.

That said – and to end on a more encouraging note -, a few signs could be pointing to more positive future trends and a future rebound in Africa. Firstly, the positive QoQ growth in the US and Europe, and even the positive YoY growth in the latter. Indeed, we have observed in the past that the trends in the US and Europe usually take a couple of quarters before they impact Africa. This was the case for instance with the so-called funding winter which started in early 2022 in the Global North, but only struck the continent in mid-2022. To this, we should add the consistent growth in number of US$1m+ deals in the past quarters, the encouraging number of exits in Q1, and the involvement of high-profile global players (Uber) and extra-African investors (Mubadala, Stride Ventures) in the recent moove deals.

References

[1] https://techcrunch.com/2024/03/05/deel-acquires-payspace-500m-arr/

[2] https://techmoran.com/2024/03/20/fintech-firm-ncino-acquires-south-africas-docfox-for-75-million/

[3] https://techcrunch.com/2024/03/19/uber-leads-100m-investment-in-african-mobility-fintech-moove-as-valuation-hits-750m/

[4] https://techcrunch.com/2023/08/10/moove-takes-in-76m-equity-debt-from-mubadala-and-blackrock-at-a-550m-valuation/

[5] https://www.africinvest.com/news-and-media/news/africinvest-closes-flagship-africinvest-fund-iv-with-411m-in-commitments/

[6] https://techpoint.africa/2024/02/14/moove-receives-funding-india-expansion/

[7] https://www.cbinsights.com/research/report/venture-trends-q1-2024/