Start-up Funding in Africa Surges YoY in H1 2025

A strong performance in the first half of the year, driven by a record number of larger US$10m+ deals

By Max Cuvellier Giacomelli

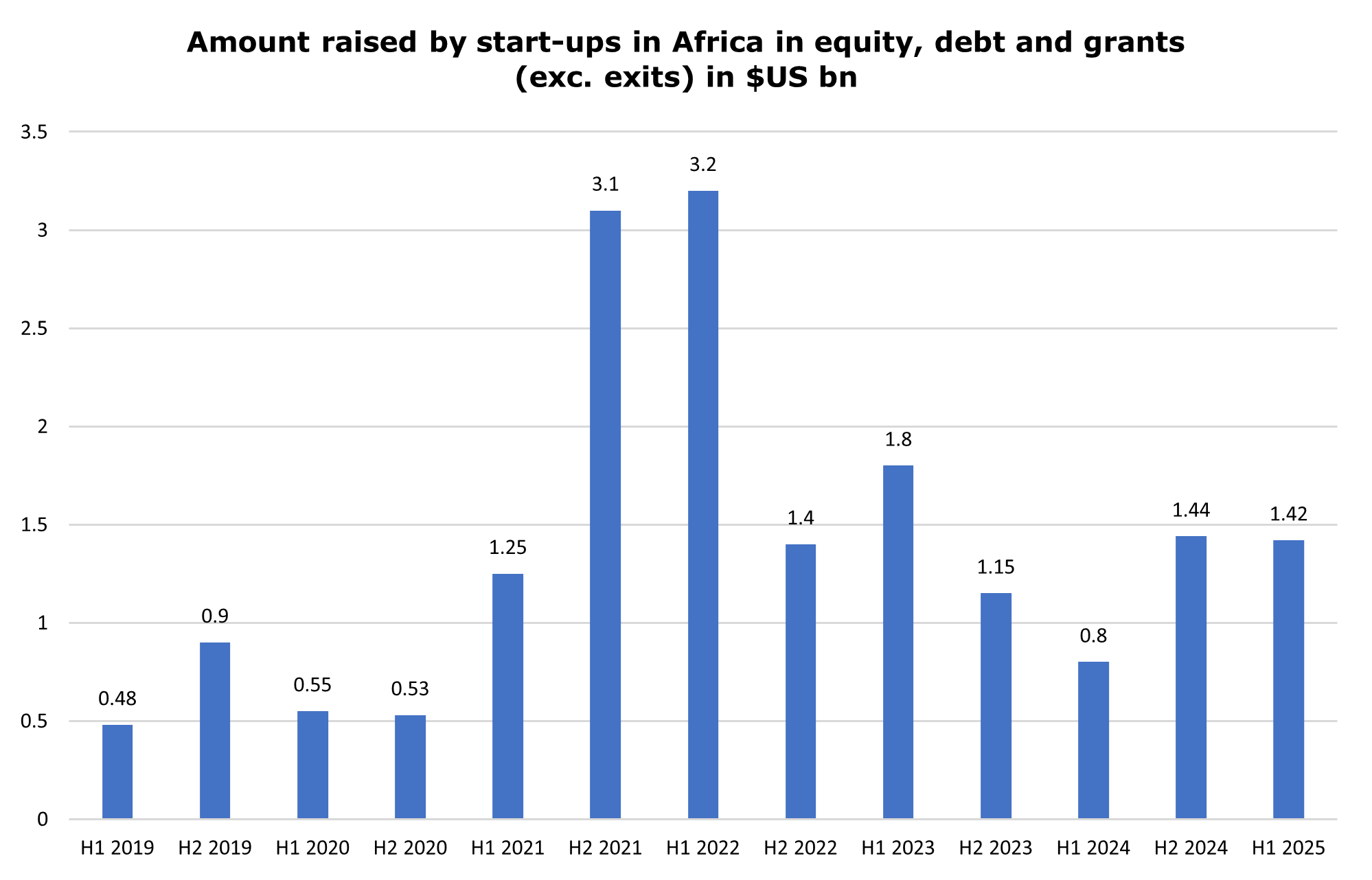

Start-ups across Africa delivered a strong performance in the first half of 2025, raising over US$1.4bn in funding and marking a solid 78% surge compared to the same period in 2024 when US$800m had been secured. This represents a notable comeback for the ecosystem, with June delivering particularly strong monthly results at US$365m, the best single-month performance in almost a year. The half-yearly figure closely matches the US$1.4bn raised in the second half of 2024, representing just a marginal 1.5% decrease compared to that period. The monthly average funding for the first six months of 2025 stood at US$237m, substantially higher than the US$187m average for 2024 overall and the US$133 m recorded on average monthly in the first half of 2024. What makes the H1 2025 performance particularly notable is the solid surge in large transactions. A record 39 start-ups successfully raised US$10 m or more during the period, the highest number of such deals in a half-year since the end of the funding heatwave in mid-2022. This represents a notable increase from the average of approximately 26 deals of this size recorded in each half-year over the previous five periods.

The funding split shows a balanced approach to capital raising, with equity accounting for US$950m of the total, a strong 79% increase compared to H1 2024 but a slight -7% decrease from H2 2024 levels. Debt financing performed well, reaching US$400m in H1, marking a solid 55% increase year-on-year and virtually matching the US$401m raised in H2 2024. June emerged as a strong month for debt financing in particular, with US$227m announced, the highest monthly debt funding figure recorded in over two years. This surge was largely driven by Wave Money's mammoth US$137m debt facility[1], which alone represented a significant portion of the month's debt transactions (60%).

The traditional "Big Four" markets – South Africa, Egypt, Kenya, and Nigeria – continued to dominate the funding landscape, capturing 78% of total investment, and a slightly lower share of number of US$100k+ deals (67%). However, the ranking within this elite group saw notable shifts compared to previous periods.

South Africa claimed the top position with US$344m raised, marking its strongest half-year performance since H1 2023. The country secured 37 deals above US$100,000 and recorded the highest number of ventures announcing at least US$1m in funding (26). The three largest South African deals were hearX, a healthtech company that secured US$100m[2], followed by fintech companies Stitch with a US$55m Series B round[3] and Naked with a US$38m Series B2.[4]

Egypt delivered a similarly strong performance, raising US$339m, also its best half-year showing since H1 2023. The country was home to 42 ventures raising at least US$100,000, including 21 that secured US$1m or more. Three major deals made headlines in Egypt's funding landscape: the US$50 m bond issued by MNT-Halan's Tasaheel (fintech)[5], Bokra's US$59m sukuk (Islamic finance instrument) raise (fintech)[6], and Nawy's US$75m funding round (comprising a US$52m Series A plus debt)[7], by far the largest property tech deal ever recorded on the continent.

Kenya, traditionally a strong performer, experienced a more challenging period, raising US$227 m, its lowest half-year performance since H1 2021. The country also ranked fourth among the Big Four in terms of both start-ups raising US$100k or more (30 ventures) and those securing US$1m or more (16). The energy sector dominated Kenya's largest deals, with Burn Manufacturing securing US$85m[8] and PowerGen raising US$55m.[4]

Nigeria, despite being tied with Egypt for the highest number of ventures raising US$100,000 or more (42), recorded its lowest half-year funding performance since H2 2020, with total investment reaching US$176 m. The country did however maintain strong deal activity on the top end of the spectrum with 21 companies raising US$1m or more. Leading deals included LemFi's US$53m Series B round in fintech [4], OmniRetail's US$20 m Series A[9], and Arnergy's US$18 m Series B in the energy sector.[10]

Outside the dominant quartet, Senegal emerged as the only other market to surpass the US$100m threshold, raising US$148m. However, 93% of this total was attributable to Wave Money's substantial US$137m debt facility. The remaining notable large deals outside the Big Four were spread across several markets, demonstrating the growing geographic diversification of African start-up investment. These included Gozem (which is headquartered in Singapore) in Togo[11], Zeepay in Ghana[12], and Djamo in Côte d'Ivoire[13], all securing funding above US$10m. Ghana maintained its position as the most active market beyond the Big Four with 14 deals above US$100,000.

Fintech dominated in H1 2025, capturing 45% of all funding with approximately US$640m raised. This performance aligns with 2024 levels (47%) but represents a significant recovery from the sector's declining share in previous periods. The five largest fintech transactions were Wave Money, Bokra, Stitch, LemFi, and Tasaheel, already mentioned above. Kenya remained an outlier among the Big Four with only US$23m raised in fintech during H1 2025, compared to over US$100m for each of its Big Four peers. This difference can be attributed to the strength of the mobile money ecosystem in Kenya where 95% of adult Kenyans owning a mobile money account and 82% using it at least once a week.[14]

Energy emerged as the second-largest sector, attracting US$220m (20% of total funding) driven in particular by the Burn Manufacturing and PowerGen deals in Kenya. Healthcare claimed the third position with US$160m (11%), boosted significantly by hearX. Logistics and transportation followed at fourth place with US$116m (8%), while Property tech rounded out the top five thanks to Nawy's landmark raise. Climate tech - encompassing most energy deals along with select transactions in other sectors - collectively represented 21% of total funding (US$300m) and 28% of all deals above US$100,000. While these proportions are lower than peak levels recorded previously, they indicate continued investor interest in climate-focused solutions.

The investor landscape showed strong participation, with over 330 investors identified as having participated in at least one deal above US$100k during H1 2025. This represents an improvement from the 300+ investors active in H1 2024, though it remains below the 400+ recorded in H1 2023. The most active so far have been DEG (the German DFI, part of KfW group) through the financing and implementation of BMZ’s develoPPP grant programme - and Digital Africa, a subsidiary of French DFI Proparco. The top ten includes a lot of familiar names such as Launch Africa*, Renew Capital, BII - the UK’s DFI - and Partech Africa, as well as a new player: Investing in Innovation (i3). A total of 21 exits were recorded in H1 2025, roughly equivalent to the entire annual number of exits in both 2023 (20) and 2024 (22). June alone witnessed six announced exits – a level of activity not seen since 2022.

The H1 2025 performance indicates a maturing African start-up ecosystem with growing access to both equity and debt financing. The record number of large deals demonstrates increasing investor confidence in African ventures' ability to scale, while the geographic distribution shows both the continued strength of established markets and emerging opportunities in secondary hubs. With strong fundamentals established in the first half of the year and several major deals reportedly in the pipeline - including potential transactions for PalmPay (US$100 m)[15] and moove (US$300 m equity plus US$1.2 bn debt)[16] - the African start-up funding landscape seems well-positioned for continued growth through the remainder of 2025.

References

[1] https://fintechnews.africa/45533/senegal/wave-137m-debt-funding/

[2] https://hearxgroup.com/blog/hearx-and-eargo-announce-merger

[3] https://disruptafrica.com/2025/04/16/sas-stitch-raises-55m-series-b-funding-to-bolster-enterprise-payments-infrastructure-offering

[4] https://www.ntu.edu.sg/cas/news-events/news/details/welcome-to-the--new-normal----africa-s-start-up-ecosystem-in-q1-2025

[5] https://www.businesswire.com/news/home/20240726752409/en/MNT-Halan-Expands-Into-Turkey-With-the-100-Acquisition-of-Market-leading-Finance-Company-Tam-Finans

[6] https://africasolutionsmediahub.org/2025/05/12/africas-venture-capital-freeze-thaws-as-mega-deals-revive-funding/

[7] https://www.wamda.com/2025/05/nawy-secures-75-m-equity-debt-fuel-mena-expansion

[8] https://techpoint.africa/insight/techpoint-digest-1124/

[9] https://disruptafrica.com/2025/04/30/nigerias-omniretail-raises-20m-series-a-for-west-african-expansion/

[10] https://arnergy.com/arnergys-18m-boost-what-it-means-for-nigerias-solar-revolution/

[11] https://techcrunch.com/2025/02/26/gozem-nets-30m-to-expand-vehicle-financing-digital-banking-in-francophone-africa/

[12] https://www.africaglobalfunds.com/news/asset-servicing/verdant-imap-raises-18m-for-zeepay-ghana/

[13] https://partechpartners.com/news/djamo-hits-1m-active-customers-and-raises-17m-of-equity-to-double-down-on-digital-first-banking-services-for-users-across-francophone-africa

[14] https://www.gsma.com/sotir/

[15] https://techcrunch.com/2025/06/05/profitable-african-fintech-palmpay-is-in-talks-to-raise-as-much-as-100m/

[16] https://techpoint.africa/news/moove-300m-funding/ & https://www.bloomberg.com/news/articles/2025-07-02/uber-backed-moove-to-raise-1-2-bn-in-debt-for-waymo-fleet?embedded-checkout=true

* Full disclosure – the author of this article is an LP in Launch Africa