China-Africa trade hits record US$348bn as deficit balloons

Green tech and machinery exports contribute to record trade figures

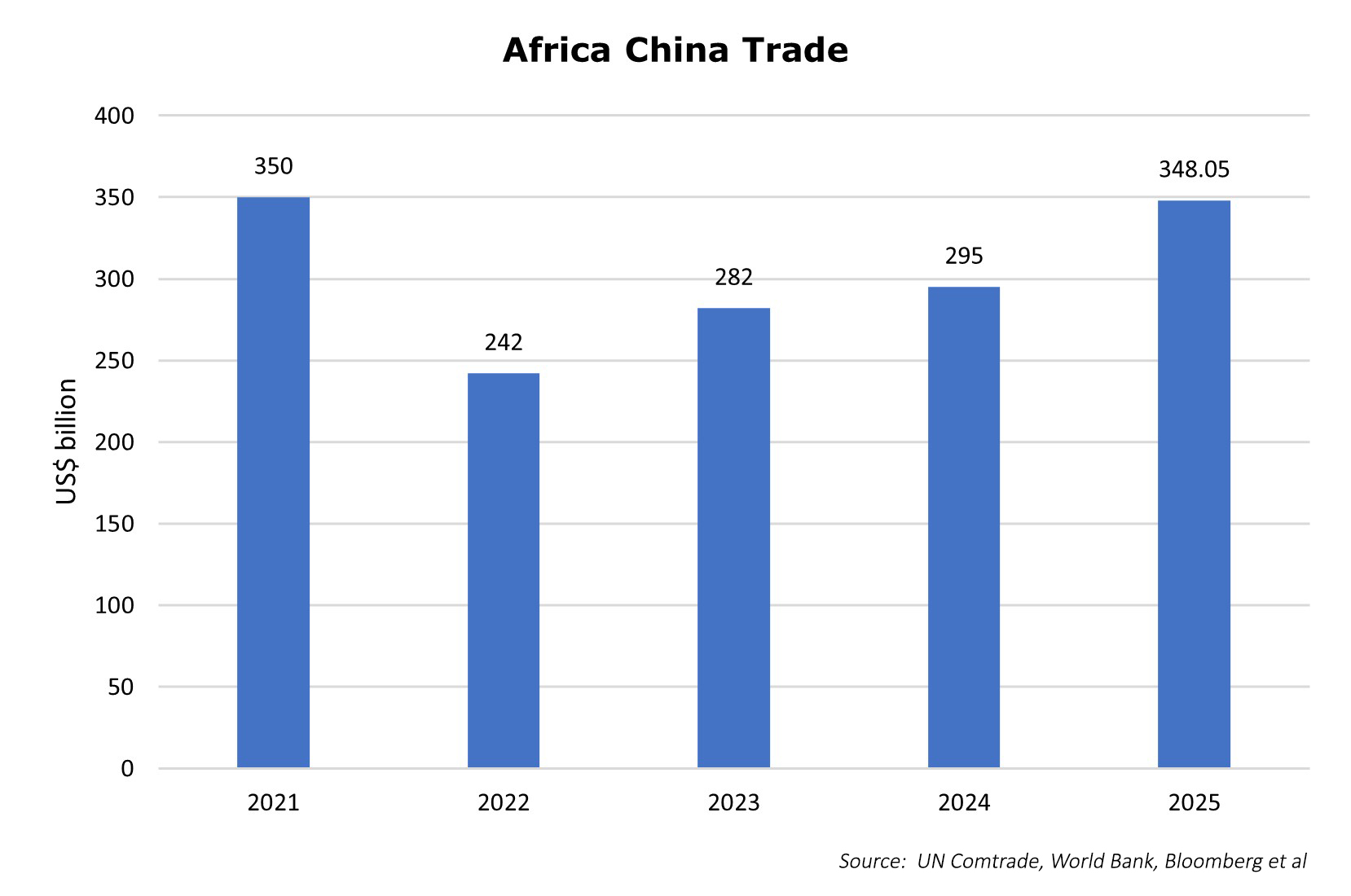

Total trade between China and Africa surged to a record US$348.05bn in 2025, a 17.7% annual increase that underscores Beijing’s intensified focus on emerging markets in the face of US tariffs. However, Africa’s trade deficit with China ballooned by 64.5% to US$102.01bn. This widening gap has sparked concerns among some observers that the continent is becoming a dumping ground for cheap Chinese goods, potentially undermining the industrialisation ambitions of African nations.

Chinese exports to African nations climbed 25.8% to US$225.03bn in 2025, while imports from the continent rose a more modest 5.4% to US$123.02bn. China’s imports from Africa remain dominated by raw materials such as crude oil, copper, cobalt, and iron ore, while its exports to the continent consist mainly of higher-value manufactured goods, including machinery, electronics, and green technologies.

Chinese exports to African nations climbed 25.8% to US$225.03bn in 2025, while imports from the continent rose a more modest 5.4% to US$123.02bn. China’s imports from Africa remain dominated by raw materials such as crude oil, copper, cobalt, and iron ore, while its exports to the continent consist mainly of higher-value manufactured goods, including machinery, electronics, and green technologies.

African countries imported 15,032 MW of Chinese solar panels in the year ending 30 June 2025 – a 60% jump from the previous period. Exports of transformers and converters, essential components for renewable power, also climbed by over 51% during the first eight months of the year.

Shipments of construction machinery to the continent rose 63% year-on-year in the first seven months. This aligns with a surge in infrastructure activity: African nations awarded US$30.5bn worth of contracts to Chinese construction firms in the first half of the year, a five-fold rise from a year earlier. Key financing deals include a US$286m tranche released by the China Development Bank for a Nigerian railway and extended loan facilities for projects in Egypt.

Consumer goods also gained momentum, with auto exports up 67% in the first five months. In the smartphone sector, four of Africa’s top five brands are now Chinese, with Huawei and Xiaomi recording the largest market share gains.

China’s decision last year to scrap tariffs on imports from all 53 African diplomatic allies could help to rebalance trade. The move is seen as a direct counter to recent US tariffs on African exports. This measure expands on China’s existing policy of granting duty- and quota-free access to African least-developed countries. Under the new plan, higher-income economies such as South Africa, Nigeria, Egypt, Morocco, and Kenya are eligible for preferential treatment. Eswatini remains the only African nation excluded, due to its diplomatic recognition of Taiwan.

Africa currently accounts for just 1.5% of global manufacturing output and while the lifting of tariff on African goods is welcome that alone may not correct the imbalance in trade. There are deeper structural issues that inhibit African value-added exports to China along with non-tariff barriers that still remain in place.

That said, the policy presents a distinct opportunity to lure foreign direct investment from corporations attempting to dodge high levies imposed elsewhere. For such entities, Africa serves as a cost-effective gateway into China’s economy. This repositioning could bring much-needed capital to the continent, alongside vocational programmes that enhance the skills of the local labour force.

References

'China-Africa trade scenarios amid global tariff war', NTU-SBF Centre for African Studies, 05 September 2025

'China’s exports to Africa are soaring as trade to US plunges', The New York Times, 08 September 2025

'China hits growth goal after exports defy US tariffs', BBC News, 19 January 2026

'Chinese goods pour into Africa, widening trade gap to record US$102 billion amid US pressure', South China Morning Post, 21 January 2026

'Africa's trade deficit with China hits $102bn in 2025, up 64.5% YoY', Ecofin Agency, 23 January 2026

'How are US tariffs and trade barriers redrawing China's export map', South China Morning Post, 23 January 2026

'Opportunity for Africa to act and grow', China Daily, 25 January 2026

'Can zero-tariff policy rebalance China-Africa trade?', Brookings Institution, 27 January 2026