VC funding in Africa slows down

Yet African start-ups succeed in raising US$4bn in the first three quarters of 2022

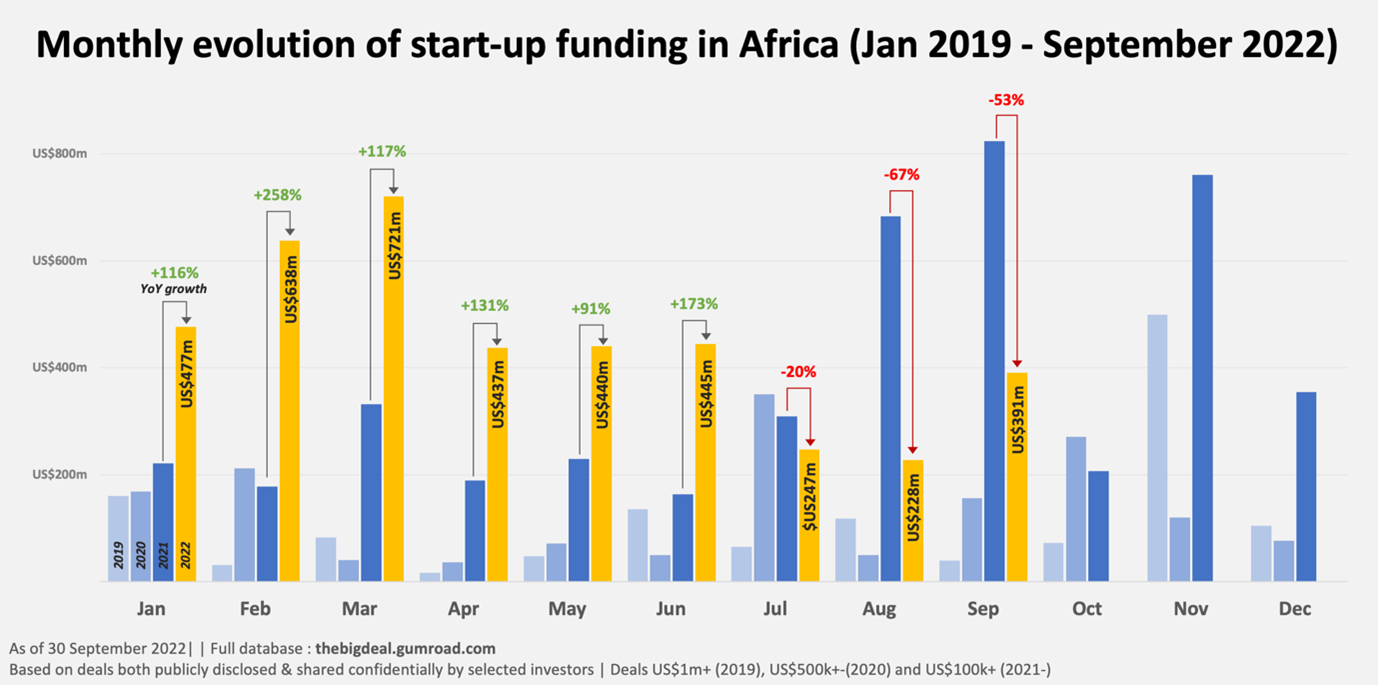

In Q3 2022 (July to September), start-ups in Africa raised an estimated US$866 million through more than 150 deals over US$100k in value. Though decent in absolute terms, the numbers represent a serious loss of lift when compared to recent quarters. Indeed, the total amount of funding raised in Q3 2022 is less than half the amount raised a year earlier in Q3 2021 (-53% YoY), which remains the most successful quarter the ecosystem has known to date in terms of fundraising. Each of the three months making up Q3 have registered a year-on-year decline: -20% YoY in July, -67% YoY in August, and -53% YoY in September.

After a year of raising over US$1bn per quarter, Q3 2022 is the first quarter since Q2 2021 during which start-ups in the ecosystem did not manage to reach the billion milestone. In comparative terms, with its steep -53% YoY decline, Q3 2022 ends an impressive streak of six consecutive quarters of very high YoY growth between Q1 2022 and Q2 2022, with even triple-digit YoY growth during most of the period (Q2 2021 to Q2 2022).

This performance is particularly notable as the continent had managed to avoid the downturn faced by most regions. While Africa was boasting +125% YoY quarterly growth in terms of funding raised in Q2 2022, all other regions had recorded a dip ranging from -26% YoY in Europe and the US to -29% YoY in China, and a staggering -69% YoY for Latin America. In Q3 2022 however, the funding raised by start-ups in Africa has dropped -53% YoY and -34% QoQ, almost exactly in line with the global trends. The continent is still holding up better than Latin America, the other ‘emerging’ region, which crashed -83% YoY.

VC funding is currently being deployed at a much slower rate globally, due to various factors both economic (inflation, strong USD...) and geopolitical (war in Ukraine, pressure on the supply of food products and raw materials) that have had a significant impact on the risk appetite of VCs, large and small. In most regions, the trend started in Q1 and was accentuated in Q2, then Q3. The fact that it took longer to affect Africa has sometimes been attributed to the fact that investors in start-ups on the continent are by design more prone to take risk, and might have taken longer to adjust their practices. This said, VC funding – both in Africa and globally – remains ‘available’, especially given the record amounts raised by VCs in 2021; it is just taking longer to deploy than usual and comes with more strings attaches. But it will have to get deployed eventually. Some argue that as soon as indicators start looking better, funding will start rushing back into start-ups as VCs catch up on allocating the ‘dry powder’ they are accumulating to satisfy their LPs.

If we look closer at the US$866m in Q3 2022 in terms of sectors, fintech continues to be the space that attracts most funding with 45% of the total ‘VC equity’ amount, and 35% of the deals. These percentages are roughly on par with the previous quarter. A year earlier however, in Q3 2021, fintech also represented a third of the deals, but was attracting a much larger share – two thirds – of the overall amount.

It is also interesting to note that despite the fact that the ‘Big Four’ (Nigeria, Kenya, Egypt, South Africa) have as usual attracted the majority of the funding on the continent, the proportion (58%) is significantly lower than in previous quarters (e.g. 83% in Q2 2022), if we take into account the US$88.9m to debt raised by Wave Mobile Money in Senegal and Cote d’Ivoire, and the acquisition of PEG Africa by Bboxx in West Africa (see more details below). The weight of such transactions encourages us to look at the performance of ‘VC equity’ (therefore excluding debt, non-dilutive capital, M&A or PIPO) which paints an even darker picture with a decline of -74% YoY in amount invested in start-ups on the continent, fuelled by an increased number of debt and M&A activity as an alternative to ‘VC equity’ to finance growth or consolidate one’s market position.

This is a good segue to introduce the three deals to be spotlighted in this quarterly column - an acquisition (PEG Africa), a debt facility (Wave Mobile Money), and an equity investment (TeamApt).

In early September Bboxx confirmed their acquisition of solar energy provider PEG Africa.[1] Founded in 2013 by off-grid solar veterans Hugh Whalan and Nate Heller – who are credited with the first off-grid solar exit in Africa – PEG Africa had launched operations in four markets (Ghana, Ivory Coast, Senegal, and Mali) and financed its growth through Series A (2016), B (2017) and C (2019) rounds worth a combined US$50m. The acquisition will enable Bboxx to build a much stronger presence in West Africa and serve an estimated 3.5 million customers across 10 markets. Though no amount has been officially disclosed, the transaction is believed to have been worth some US$200m.

The off-grid power sector in Africa is showing signs of maturing, and consolidating. Earlier in the same quarter competitor d.light announced a US$50m debt financing deal a few weeks after unveiling a US$238m financing facility.[2]

Another notable transaction in Q3 2022 was the US$88.9m financing package secured by Wave Mobile Money[3], and led by the International Finance Corporation (IFC). This comes after Wave’s US$200m Series A round announced in September 2021 - by far the largest such round ever disclosed on the continent. It was co-led by Sequoia Heritage, Founders Fund, Stripe, and Ribbit Capital. IFC had participated in the round as a co-investor along with Partech Africa. It also comes at a time when Wave decided to halt its geographical expansion and focus on two markets - Senegal & Côte d’Ivoire. The deal underlines the appetite of Development Finance Institutions for fintech investments; beyond IFC, at least two other DFIs (Finnfund and Norfund) are contributing to the package. Moreover, this deal illustrates a growing trend of start-ups deciding to communicate on debt raising; in the past such a transaction would probably not have made the news.

Finally, one of the large transactions of this quarter is TeamApt.[4] Though no amount has been confirmed yet, the equity financing is believed to be north of US$50m, which would make it one of the largest in Q3. The company raised its Series B last year. It is a reminder that despite the overall slowdown in investment in the past quarter fintech remains a very attractive value proposition for many investors. In this instance, the round was led by US fintech-focused investor QED investors and is their first foray into Africa. They bring considerable experience, having backed 180 companies across 14 countries, 27 of which are unicorns. Aligned with the earlier comment on DFIs, at least one DFI (British BII) participated in both the Series B and this latest round.

Find out more about the African start-up ecosystem at Africa: The Big Deal, a project by Max Cuvellier and Maxime Bayen.

References