Tax treaty changes to impact India investments via Mauritius

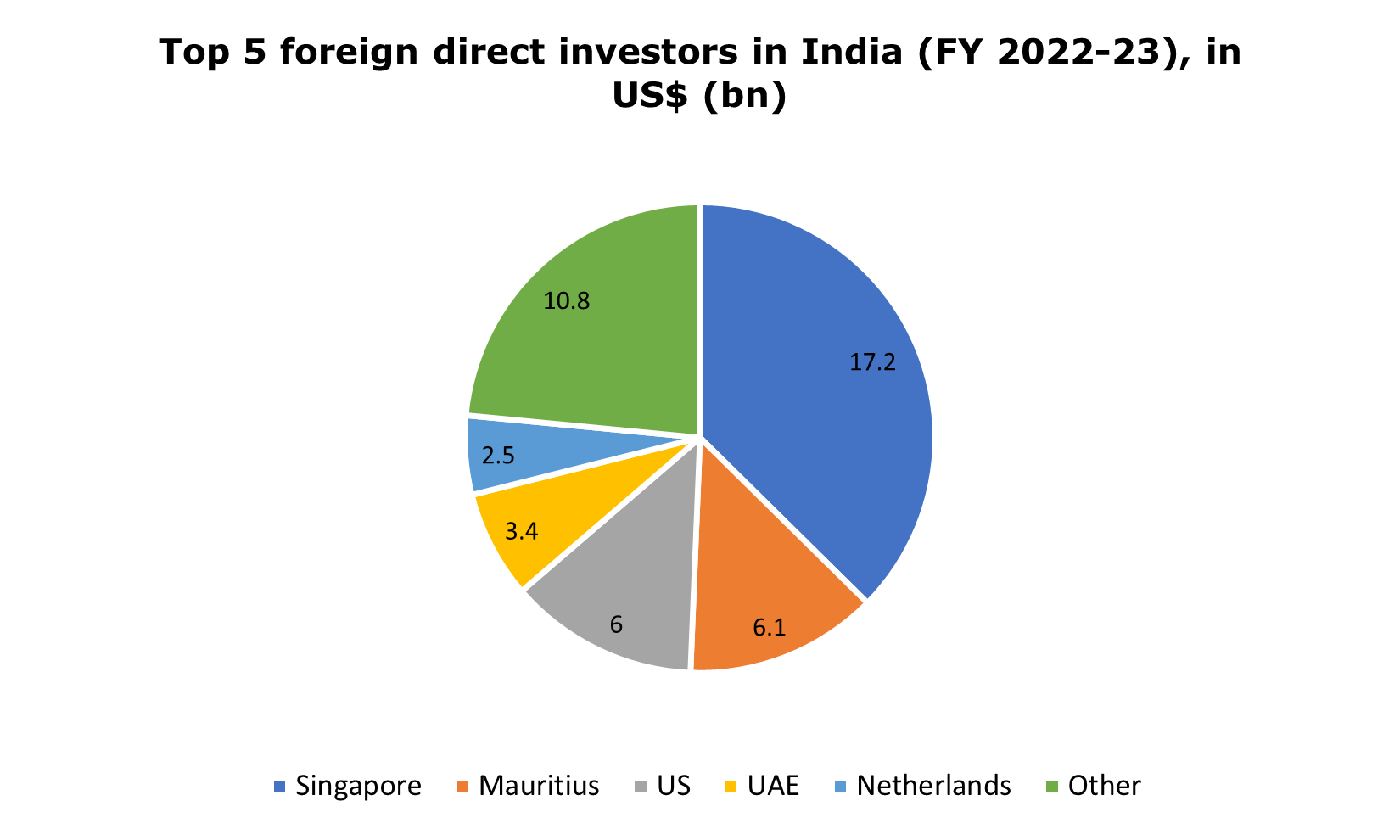

Mauritius is the second most significant source of foreign direct investment in India

Photo credit: Deccan Herald

Photo credit: Deccan Herald

In a major blow to its status as a much favoured financial centre for foreign investors looking to invest in India, the double tax avoidance treaty between India and Mauritius has been amended. This is expected to make the Indian ocean African island much less attractive as a financial hub – at least for those using it as a jurisdiction for evading taxes when routing investments into the fastest growing large economy in the world. The amendment, which was signed in March 2024, is aimed at curbing tax evasion, but the lack of clarity in its wording, has left investors uncertain whether the new rules will apply retroactively to investments made before the changes.

In 1982, India and Mauritius signed a Double Taxation Avoidance Agreement (DTAA), allowing investors from either country to operate in the other without incurring double taxation on the same income. For example, capital gains earned by a Mauritius resident from selling shares in an Indian company was taxable only in Mauritius, not in India. At the time New Delhi believed the agreement will facilitate Indian investments into Africa. What occurred was the reverse. The DTAA allowed investors to take advantage of the favourable tax regime in Mauritius by roundtripping their investments back into India via shell entities based in Mauritius.

Mauritius does not levy capital gains tax and maintains a corporate income tax rate of 15%. In contrast, India's capital gains tax begins at 10%, while most companies pay at least 25% income tax. Between 2000 to 2015, over a third of all foreign investments into India were channelled through Mauritius.

However, the Indian government recognised the significant tax revenue losses resulting from the DTAA. Consequently, in 2016, the treaty was changed to address these concerns. The revision granted India the right to tax capital gains on sales of shares in Indian companies, effective from 1 April 2017. Investments made before this date are exempted from such taxation.

The most recent amendment introduces a so-called principal purpose test (PPT), aimed at curbing tax avoidance. Under this test, tax benefits under the treaty will not apply if the primary goal of any transaction or arrangement was merely to obtain those benefits. Foreign investors must therefore prove to the Indian authorities that their financial entities in Mauritius are legitimate and not just for the tax advantages.

Investors are awaiting clarity on whether past investments, especially those made before April 2017, will be exempt from the amendments. India’s Income Tax Department has, however, said that concerns are premature as the amendments are yet to be notified and ratified.

References

‘Government notice no. 101 of 1983’, Mauritius Revenue Authority, 1983

‘Amendments to the India/Mauritius treaty’, Simmons & Simmons, 13 May 2016

‘Foreign direct investment flows to India: Country-wise and industry-wise’, Reserve Bank of India, 30 May 2023

'India: Corporate - Taxes on corporate income', PwC, 14 December 2023

'Capital gains tax (CGT) rates', PwC, 14 December 2023

‘India-Mauritius treaty amendment unlikely to have retrospective taxation’, CNBCTV 18, 12 April 2024

‘X post’, Income Tax Department, Government of India, 12 April 2024

‘India-Mauritius tax treaty revision: Should foreign investors be worried?’, NDTV Profit, 12 April 2024

‘Why text of amended tax treaty with Mauritius triggered stock sell-offs’, The Indian Express, 14 April 2024

‘Protocol to India-Mauritius DTAA signed to include principal purpose test’, Ernst & Young, 15 April 2024

‘Should FPIs be worried about latest change to India-Mauritius tax treaty’, Business Standard, 16 April 2024

‘India - Mauritius tax treaty update’, KPMG, 17 April 2024

‘Why an India-Mauritius tax amendment triggered a stock market slide’, Finshots, 18 April 2024

‘Tax benefits in Mauritius: The ultimate guide 2024’, Nomad Capitalist, Accessed 22 April 2022

‘FPI AUC country-wise (top 10 countries) data’, National Securities Depository Ltd., Accessed 29 April 2024