Asian Infrastructure Investment Bank backs transport project in Benin

Deal follows lender’s pledge to invest up to US$1.5bn in African electricity project

Photo source: AIIB

Photo source: AIIB

The Asian Infrastructure Investment Bank (AIIB) has signed a US$200m loan agreement to finance a transport infrastructure project in Benin. The move comes as the Beijing-led lender, which focuses primarily on Asia, looks to ramp up its activities in Africa.

The project – AIIB’s first investment in the West African country – involves major enhancements to the public transport system in Grand Nokoué, Benin's principal metropolitan region along the southern coast. A key component of the upgrade is the development of the e-mobility sector, comprising electric buses, boats, and motorcycle taxis. The US$500m initiative is co-financed by the World Bank and private organisations.

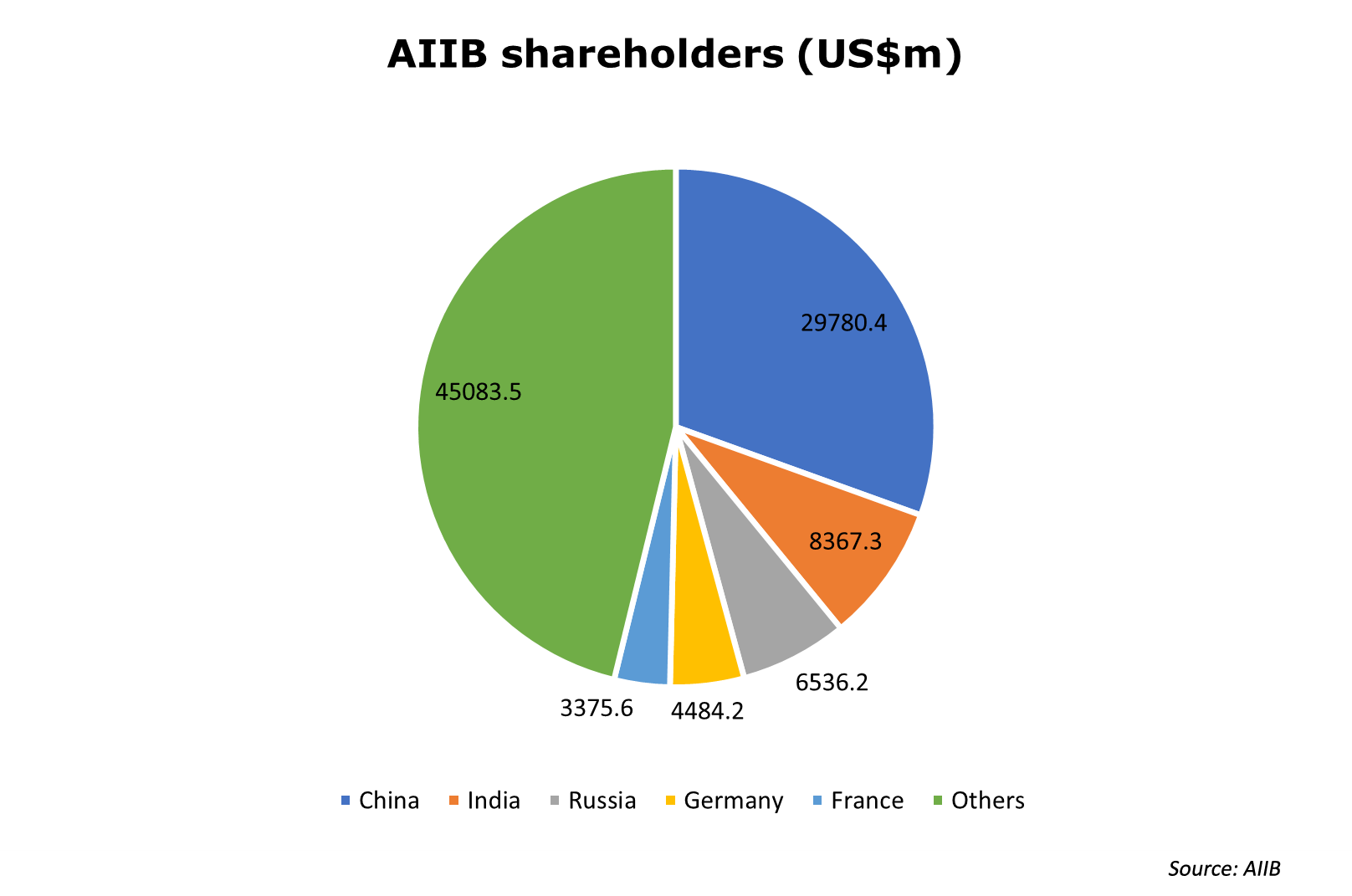

Founded in 2015, as an alternative to the Western dominated World Bank Group of lending institutions, the AIIB invests in Africa as part of its mandate to boost infrastructure ties between the continent and Asia. China is the bank's dominant shareholder with more than 30% of the equity, followed by India with 8.57%. Singapore is also a minor contributor to the AIIB having invested US$250 million into the pool that makes up its US$97.6bn total capitalisation.

In recent years, a wave of African governments became members of the AIIB, bringing the continent's total representation to over 20. While authorised to allocate up to 15% of its portfolio outside Asia, the lender currently directs only 5% to non-Asian markets. As of August, that translated to a total of US$2.48bn invested across Africa.

In recent years, a wave of African governments became members of the AIIB, bringing the continent's total representation to over 20. While authorised to allocate up to 15% of its portfolio outside Asia, the lender currently directs only 5% to non-Asian markets. As of August, that translated to a total of US$2.48bn invested across Africa.

Earlier in 2025, the AIIB pledged as much as US$1.5bn to 'Mission 300’, an initiative launched by the World Bank and the African Development Bank to connect 300m Africans to electricity by 2030. Projected to cost US$90bn, the scheme seeks to boost the generation and distribution of affordable power while improving regional energy integration.

So far the Bank’s African portfolio has concentrated heavily on Egypt, where the bank has invested over US$1.3bn in projects ranging from a solar farm to a metro line upgrade. In 2024, the lender made its first energy investment in sub-Saharan Africa, backing a project in Rwanda to provide clean cooking technologies to 80,000 households and distribute 50,000 solar home systems. It has also funded road infrastructure upgrades in northern Côte d'Ivoire and provided a US$200m loan to Morocco to help the country deal with the impact of climate change.

References

'AIIB’s investment portfolio in Egypt reaches $1.3bn with potential for over $1bn in various sectors: Maait', Daily News Egypt, 26 September 2023

'AIIB, IsDB pledge around $6 billion for Africa electrification push', Reuters, 28 January 2025

'African Development Bank, AIIB sign MOU renewing their collaboration on sustainable economic development for Africa', African Development Bank, 30 June 2025

'AIIB steps up financing for Africa’s development', CNBC Africa, 30 June 2025

'Asian Infrastructure Investment Bank in $1.5bn African energy push', African Business, 19 August 2025

'Morocco secures $200 million AIIB loan to boost climate resilience', Morocco World News, 22 August 2025

'AIIB signs landmark USD200 million loan for public transport system redevelopment in the Republic of Benin', AIIB, 16 December 2025

'2024 AIIB annual report', AIIB, 2025