Japan looks to deepen private sector role in Africa

PM Ishiba announces a US$5.5bn programme to enhance private sector engagement with Africa at TICAD 9

.jpg?sfvrsn=8f92a0a0_1) Photo source: Premium Times Nigeria

Photo source: Premium Times Nigeria

Japanese engagement with Africa is moving away from aid and towards spurring its private sector to invest on the continent, with a stronger emphasis on trade. At the ninth Tokyo International Conference on African Development (TICAD 9) which concluded in Yokohama in Aug Prime Minister Shigeru Ishiba pledged US$5.54bn programme that would allow African startups to collaborate with Japanese firms. The programme called the Expansion of the Enhanced Private Sector Assistance for Africa (EPSA) is part of a US$7.55bn support that Japan has announced for Africa.

In contrast to the previous TICAD, the focus this time was on mobilising Japanese private sector investment and supporting the development of local industries. A joint declaration at the close of the summit encouraged greater Japanese investment in Africa’s manufacturing sector, in response to shifts in global supply chains. It voiced support for the creation of pilot economic zones to foster industries such as electronics, green technology and automotive manufacturing. The declaration also highlighted the aim of helping African producers export more value-added goods to Japan, through initiatives such as agro-industrial zones, export certification hubs and buyer-supplier networks.

Digitalisation featured prominently on the agenda. Prime Minister Shigeru Ishiba, in his opening remarks, called for joint solutions that draw on Japanese expertise in artificial intelligence and digital transformation. He, for instance, highlighted an opportunity to use digital technology to conduct credit analyses and provide loans to taxi drivers in Africa who had previously struggled to access financial services. Drivers could use these loans to purchase cars and repay them over time.

Japan underscored the importance of expanding trade links, both to bolster African economies and to secure access to minerals critical for its own industries. The country has long sourced much of its platinum imports from Africa and is seeking reliable supplies of copper and cobalt, essential for hybrid and electric vehicles. Ishiba pointed to Japan’s initiative to develop the Nacala Corridor, which connects Zambia and Malawi to Mozambique’s Indian Ocean port of Nacala. Rich in minerals and farmland, the corridor is regarded in Tokyo as key to securing raw materials. Japan has already funded upgrades at Nacala port but sees further opportunities to expand transport links and industrial activity along the route.

He also announced an initiative to invigorate trade and investment between Africa and the wider Indian Ocean region – which Japan expects to be a major driver of global economic growth. Under the Indian Ocean–Africa economic zone initiative, Tokyo aims to channel investment into African projects from Japanese companies operating in India and the Middle East

He also announced an initiative to invigorate trade and investment between Africa and the wider Indian Ocean region – which Japan expects to be a major driver of global economic growth. Under the Indian Ocean–Africa economic zone initiative, Tokyo aims to channel investment into African projects from Japanese companies operating in India and the Middle East

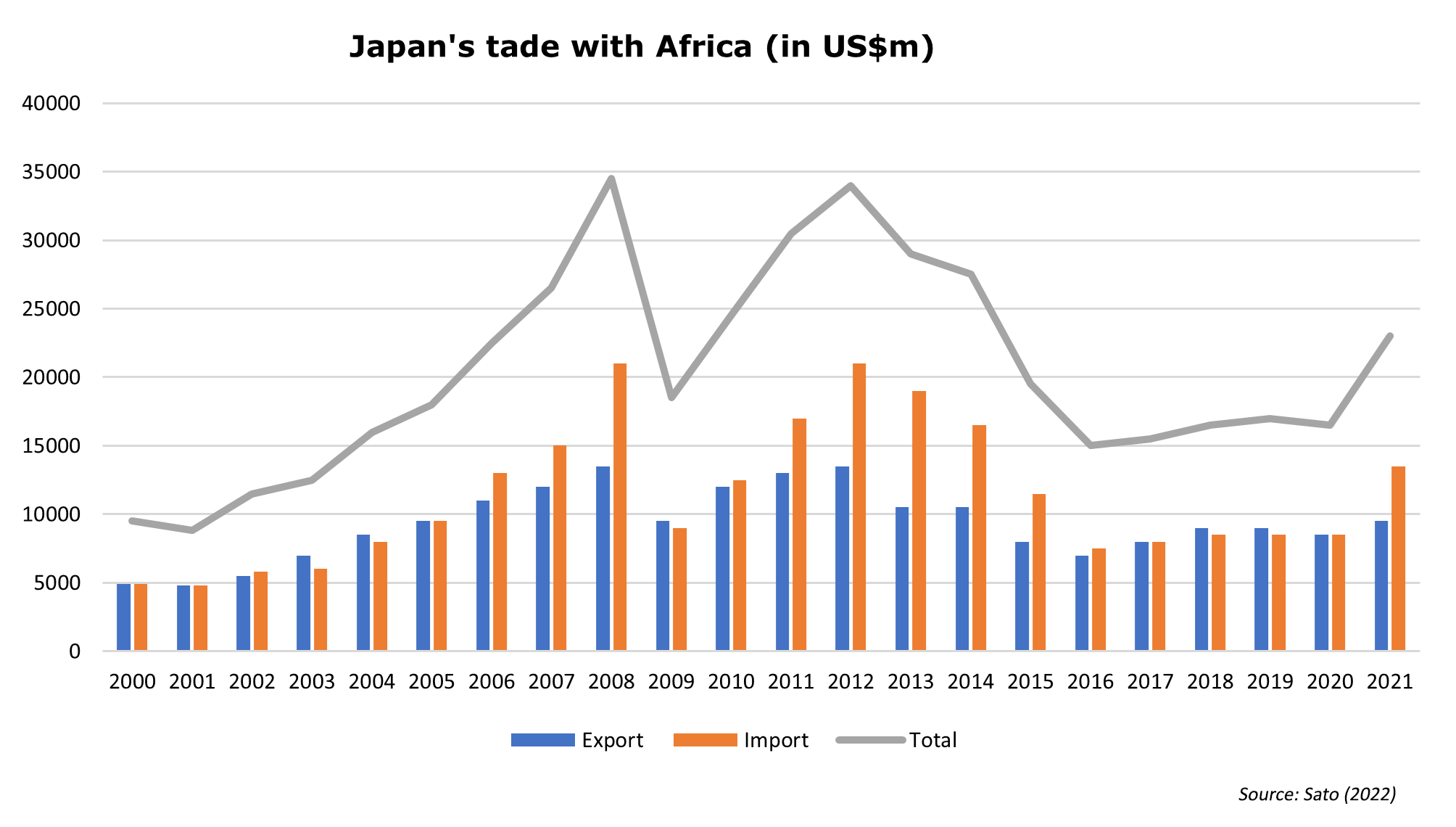

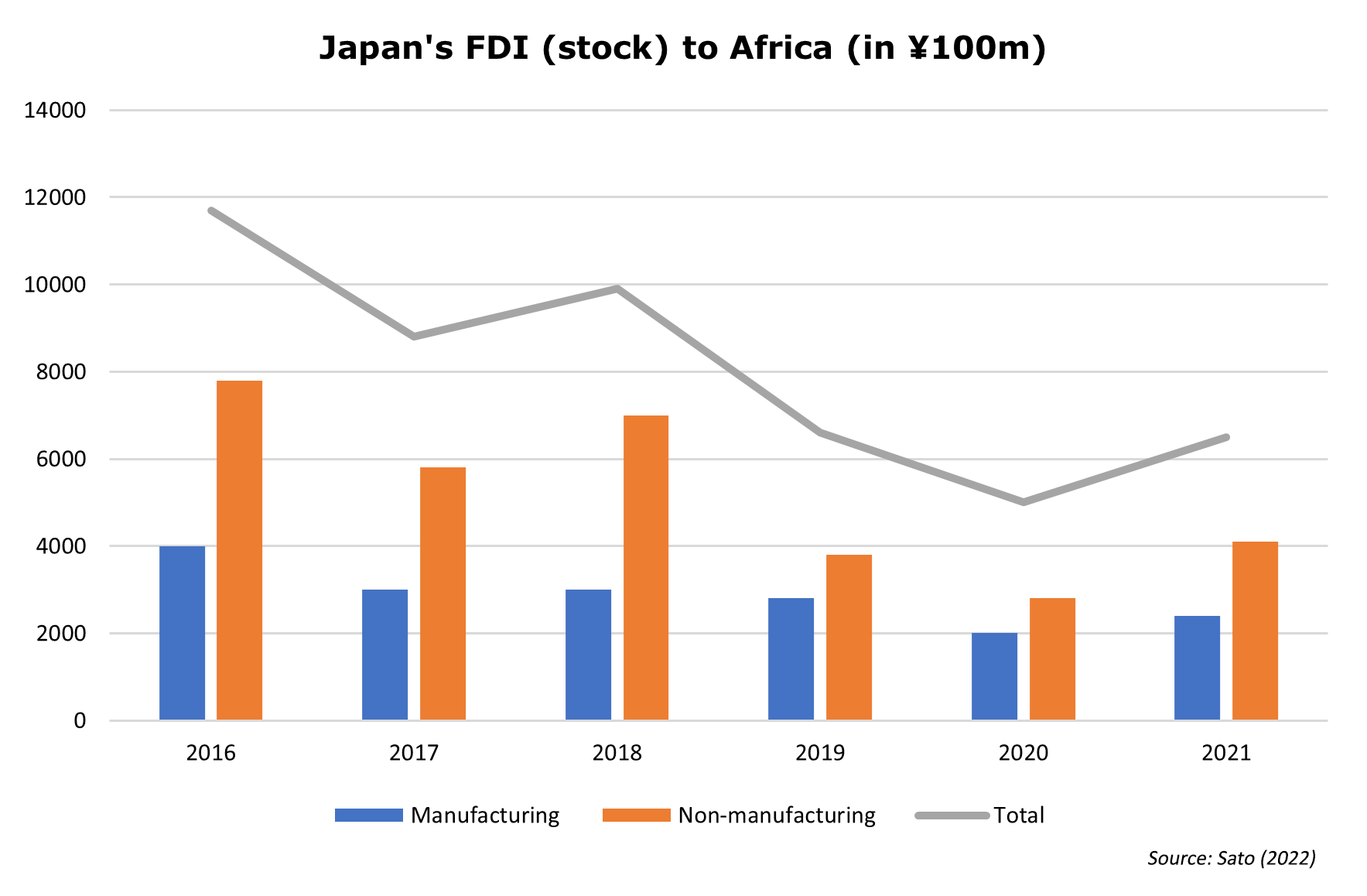

Japan was the very first countries in Asia to have identified Africa as a growth market. The first TICAD was held as far back in 1993 – years before China began engaging Africa. yet, trade between Japan and Africa still remains negligible – US$24bn. The total Japanese foreign direct investment (FDI) in Africa is only US$2.5bn. This is less than what Japanese firms have invested in Singapore. Japan does not have a Preferential Trade Agreement (PTA) with any African country. Only four African countries - Egypt, Morocco, South Africa and Zambia, have double taxation agreements (DTAs) with Japan. Only one African city, Cairo, has a direct flight to Tokyo. On company and asset protection, Japan has Bilateral Investment Treaties (BIT) with Angola, Cóte d'Ivoire, Mozambique, Egypt and Kenya. According to the Japanese Ministry of Finance Africa has received just 0.5% of Japanese foreign direct investment (FDI) by value in 2024. Mozambique the largest recipient of Japan's FDI on the continent. The most celebrated Japanese project in Africa is the Freedom Bridge over the Nile river in Juba. It was inaugurated in 2022. Prior to construction, residents of the South Sudanese capital had relied on a single ramshackle crossing. The US$91m arched steel bridge was funded by JICA, the Japan International Cooperation Agency. Dai Nippon Construction was the main contractor, while the works were overseen by another Japanese firm CTI Engineering International. JICA has a scheme called Private Sector Investment Finance, in which it allocates funds to help cover the cost of feasibility studies for Japanese companies that are willing to invest in projects. The agency has announced a US$40m injection into the so-called Global Supply Chain Support Fund which is aimed at supporting African SMEs and strengthening cross-border supply chains.

Japan also in African multilateral institutions. It holds a 5% equity stake in the Abidjan-headquartered African Development Bank (AFDB) and maintains a close relationship with the infrastructure lender African Finance Corporation (AFC) to which powerhouse Japanese banks, such as Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC) and Mizuho Bank, all of which have been consistent lenders. In recent years, the AFC has secured two “Samurai loan” facilities – a yen-denominated syndicated loan that allows non-Japanese entities to borrow from Japanese financial institutions. Most recently, in 2022, it raised US$382m and ¥1bn (US$6m) through a dual-currency lending facility. The AFC received a boost in its efforts to cement its reputation in the Japanese market in July 2025, when it received an A+ credit rating from the Japan Credit Rating Agency. It raised the credit standing of AFC among Japanese investors and opened doors to even more funding. The AFC has already used its position in Japan to benefit some of its member countries. In November 2023, it acted as a re-guarantor for a ¥75bn (US$508m) Samurai bond issued by Egypt. In July 2025 Côte d’Ivoire issued a ¥50bn (US$339m) Samurai bond, becoming the first country in sub-Saharan Africa to tap into the Japanese bond market. It did so after JBIC acted as a guarantor. Kenya has been able to secure a US$169bn Yen-denominated loan backed by the Nippon Export and Investment Insurance (NEXI) to expand automobile assembly plants and reduce energy transmission losses.

Japan also in African multilateral institutions. It holds a 5% equity stake in the Abidjan-headquartered African Development Bank (AFDB) and maintains a close relationship with the infrastructure lender African Finance Corporation (AFC) to which powerhouse Japanese banks, such as Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC) and Mizuho Bank, all of which have been consistent lenders. In recent years, the AFC has secured two “Samurai loan” facilities – a yen-denominated syndicated loan that allows non-Japanese entities to borrow from Japanese financial institutions. Most recently, in 2022, it raised US$382m and ¥1bn (US$6m) through a dual-currency lending facility. The AFC received a boost in its efforts to cement its reputation in the Japanese market in July 2025, when it received an A+ credit rating from the Japan Credit Rating Agency. It raised the credit standing of AFC among Japanese investors and opened doors to even more funding. The AFC has already used its position in Japan to benefit some of its member countries. In November 2023, it acted as a re-guarantor for a ¥75bn (US$508m) Samurai bond issued by Egypt. In July 2025 Côte d’Ivoire issued a ¥50bn (US$339m) Samurai bond, becoming the first country in sub-Saharan Africa to tap into the Japanese bond market. It did so after JBIC acted as a guarantor. Kenya has been able to secure a US$169bn Yen-denominated loan backed by the Nippon Export and Investment Insurance (NEXI) to expand automobile assembly plants and reduce energy transmission losses.

To fully realise its ambitions in Africa, however, Japan will need to persuade its risk-averse companies to scale up their operations in Africa. According to a survey on the Business Conditions of Japanese Companies in Africa, conducted by the Japan External Trade Organisation (JETRO) in 2020, a third of these companies were in the manufacturing sector, with the highest number located in Southern Africa. Japanese VCs have recently started to invest in technology and health sectors in the continent. PM Ishiba signalled support for their efforts by committing US$1.5bn in impact investments, launching the African Healthcare Investment Promotion Package and contributing up to US$550m over the next five years to the GAVI Vaccine Alliance for vaccine supply. He also unveiled a programme that will train 300000 Africans in Artificial Intelligence (AI). Other initiatives include launching the Economic Region Initiative of Indian Ocean-Africa to promote trade and investment between Africa and the Indian Ocean region.

A recent survey of Japanese entities already active on the continent, conducted by the JETRO, found that the main reason most of them have a presence in Africa is because of its long-term market potential. The continent’s population is anticipated to grow to over 2bn people by 2040, from about 1.5bn today. But just over 50% of respondents said they expect their profits in Africa to increase in 2025. The survey also underlined the obstacles. Two-thirds of companies pointed to regulatory uncertainty, with cumbersome administrative procedures cited as the biggest problem. About 60% highlighted financing and foreign exchange related issues, with unstable foreign exchange rates a particular problem. Securing human resources, unreliable electricity supply, and complicated customs clearance procedures were also highlighted as challenges. Asked which industries offered the greatest promise, nearly half of companies identified resources and energy. Kenya was considered the most attractive investment destination, followed by South Africa, Nigeria, Egypt and Côte d’Ivoire.

But it has not all been good news coming out of TICAD this year. A decision by JICA to designate four Japanese cities – Imabari, Kisarazu, Sanjo and Nagai - as ‘African hometowns’ triggered a wave of xenophobic reaction online. Critics misinterpreted the status to mean that people from specific African countries would be given special permission to live and work in these towns. The controversy has forced Japanese officials to issue clarifications and retract their decision.

References

‘Survey on business conditions of Japanese-affiliated companies in Africa’, Japan External Trade Organisation, 12 December 2024

‘Japan proposes ‘economic zone’ linking Indian Ocean to Africa, seeks greater role in the region’, AP, 20 August 2025

‘TICAD9: Opening remarks by H.E. Mr. ISHIBA Shigeru, Prime Minister of Japan’, Ministry of Foreign Affairs of Japan, 20 August 2025

‘Launch of the region-wide co-creation for common agenda initiative for Mozambique, Malawi and Zambia’, Ministry of Foreign Affairs of Japan, 20 August 2025

‘Announcement of Economic Region Initiative of Indian Ocean-Africa’, Ministry of Foreign Affairs of Japan, 20 August 2025

‘Japan calls for private investments in Africa at TICAD 9’, Nippon, 21 August 2025

‘TICAD 9 Yokohama Declaration: Co-create innovative solutions with Africa’, African Union, 22 August 2025

‘TICAD 9: Japan shifts from aid to trade as private sector prioritised’, African Business, 22 August 2025