Debt, energy, and the rebound of African start-up funding in 2025

East African energy ventures drive record debt issuance as the continent’s investment recovery takes hold

By Max Cuvellier Giacomelli

African start-ups raised an estimated US$785m in the third quarter of 2025. This total marks a notable improvement compared to Q3 2024 (+21% YoY in value), and the best Q3 since 2021, which coincided with the beginning of the ‘funding heatwave’. At least 57 ventures secured US$1m or more, and an additional 87 between US$100k and US$1m.

Debt mega deals define the quarter

The two headline deals of Q3 were both debt deals, in the energy sector, and with companies with strong roots in East Africa. d.light secured US$300m in a new securitised financing facility arranged by African Frontier Capital (AFC) to scale its consumer credit business and solar home system distribution network.[1] The structure combines asset-backed securitisation with institutional investment, expanding on earlier partnerships involving the U.S. International Development Finance Corporation (DFC) and Norfund. With this latest round, d.light aims to accelerate access to affordable solar energy and deepen its reach in markets such as Kenya, Nigeria, and Tanzania.

Fellow off-grid solar pioneer Sun King announced a US$156m securitisation arranged by Citi.[2] The transaction was backed by receivables from Sun King’s pay-as-you-go solar customers, providing local-currency liquidity to finance new solar home systems for an estimated two million Kenyans. Investors in the deal included both international and local institutions, reflecting the growing appetite for structured climate-linked investments. Taken together, these two transactions underscore East Africa’s leadership in innovative debt structuring and the energy sector’s capacity to attract large-scale blended capital on the continent.

Smaller in size yet notable, South African earned wage access platform Paymenow raised a US$22.5m working-capital facility from Rand Merchant Bank[3], on the back of another debt facility raised through RMB in 2023. The largest equity deal was in Nigeria where fintech Kredete – focused on helping African immigrants build credit and access financial services – secured US$22m in a Series A round led by AfricInvest, with participation from Partech and Polymorphic Capital.[4]

Energy rivals fintech as the leading sector

Looking beyond Q3, cumulative data for the first three quarters of 2025 confirm an evolution of sectoral dynamics. Of the US$2.2bn raised between January and September, 33% went to fintech start-ups – approximately US$725m – while an equal 33% was captured by energy ventures. This marks the first time since tracking began in 2019 that another sector has approached fintech’s long-standing dominance. Four of the year’s eleven largest fundraisers are in energy – d.light, Sun King, Burn, and PowerGen – together accounting for nearly US$600m. This surge is largely debt-driven (more on this below). The sector’s strong showing has also lifted the broader climate tech category to a record 39% of total funding, consolidating a trend first observed in 2023. Since 2019, over US$5bn have been invested in climate-tech start-ups across the continent, including US$2.7bn in the past three years alone.

Geographically, the “Big Four” markets – Kenya, South Africa, Egypt, and Nigeria – continue to dominate, accounting for more than 80% of total capital raised. Kenya’s leadership in 2025 is driven by its energy champions, while South Africa remains the leading destination for equity capital. Nigeria and Egypt continue to underpin the fintech landscape, reinforcing a concentration of funding on the continent around the main innovation hubs of Cairo, Cape Town, Johannesburg, Lagos, and Nairobi.

Debt continues its ascent

Debt financing has become a defining feature of African venture capital. As of September 2025, start-ups had raised US$935m in debt – already surpassing full-year totals for both 2022 and 2024, and on track to exceed the US$1.1bn record set in 2023. Debt represents 42% of total funding in 2025 YTD, the highest share since our tracking began in 2019.

Several factors explain this structural shift. As the ecosystem matures, more start-ups are reaching the operational scale and revenue stability needed to service debt. Specialized financial players have emerged to provide tailored instruments, while development finance institutions and blended capital vehicles have widened their mandates to include structured credit. In addition, as equity investment slowed following the 2021–22 boom, founders and investors alike became more open to alternative financing routes that preserve ownership and provide predictable returns.

Sectorally, energy continues to dominate debt issuance. Energy start-ups have raised US$585m in debt in the first three quarters of 2025, almost as much as all sectors combined in 2024. 63% of all debt funding this year has gone to energy ventures, compared with 29% for fintech. Since 2019, energy accounts for 49% of the US$3.9bn in debt we have been tracking, compared with 32% for fintech and 11% for logistics and transport. The increasing sophistication of debt instruments – from securitisation to receivables financing and revenue-based lending – points to a deepening of financial markets that could make growth-stage funding more accessible to African ventures in the years ahead.

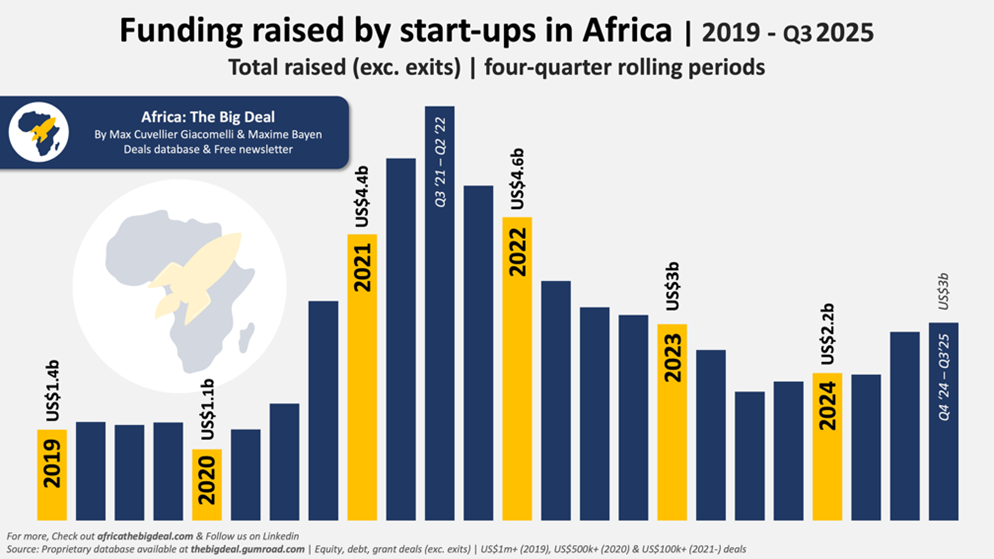

A rebound after two years of decline

After two consecutive years of contraction, 2025 is a turnaround year. Cumulative funding for the first three quarters reached US$2.2bn, nearly equalling the US$2.3bn recorded in the whole of 2024. Early Q4 figures, including Spiro’s US$100m round[5] and Moniepoint’s US$90m Series C top-up[6], suggest total annual funding could surpass US$3bn by year-end – potentially exceeding not only 2024, but also 2023 levels.

Importantly, this rebound is not merely the result of a few large transactions inflating the totals. When viewed over a rolling four-quarter period, investment volumes have now been rising steadily for approximately 18 months. The data suggests to a recovery in investor confidence, underpinned by greater sectoral diversity, the expansion of debt markets, and a gradual normalisation of deal flow after the global funding slowdown of 2023-2024.

The current cycle also highlights a more balanced ecosystem than in the previous boom years. Fintech remains central but no longer monopolises attention; energy, logistics, and climate-focused ventures have emerged as credible magnets for capital. As we have seen, East Africa’s energy innovators in particular demonstrate how blended financing can align commercial viability with social and environmental impact, an evolution that may well define the next phase of Africa’s digital and economic transformation.

References

[1] Techpoint Africa. d.light secures US$300 million consumer financing facility. https://techpoint.africa/news/d-light-842m-consumer-financing/

[2] Citigroup. Citi and Sun King securitization to deliver solar to 2 million Kenyans.https://www.citigroup.com/global/news/press-release/2025/citi-sun-king-securitization-deliver-solar-million-kenyans

[3] Disrupt Africa. SA earned-wage access startup Paymenow secures US$22.5m working capital facility.https://disruptafrica.com/2025/07/11/sa-earned-wage-access-startup-paymenow-secures-22-5m-working-capital-facility/

[4] TechCabal. Kredete raises US$22m. https://techcabal.com/2025/09/15/krede-raises-22m/

[5] Techcrunch. Spiro raises $100M, the largest-ever investment in Africa’s e-mobility . https://techcrunch.com/2025/10/21/spiro-raises-100m-the-largest-ever-investment-in-africas-e-mobility/

[6] Techpoint Africa. Moniepoint raises $90 million to close Series C as Visa and Google deepen Africa bets. https://techpoint.africa/news/moniepoint-series-c-extension/