Cocoa production in Ghana and Côte d'Ivoire collapses

Chocolates could become more expensive as cocoa prices soar

Photo credit: Amit Jain

Photo credit: Amit Jain

Chocolate lovers in Singapore could see a sharp markup in prices of their favourite brands as Cocoa prices hit record highs in the global market. This is because Ghana and Côte d'Ivoire, which together account for 55% of global cocoa supply, are facing dramatically reduced harvests. In Ghana, the cocoa output is expected to be nearly 40% below the targeted 820,000 tonnes. Similarly, Côte d'Ivoire anticipates 30% decrease in its cocoa output. The reductions are attributed to a confluence of adverse weather, disease, and illegal mining activities has led to sharp fall in production. Global cocoa production fell 11% in 2023-24. The volume of cocoa being converted into cocoa products fell by around 5% and the ratio of cocoa bean stocks to grounded beans fell below 30% - the lowest in a decade.

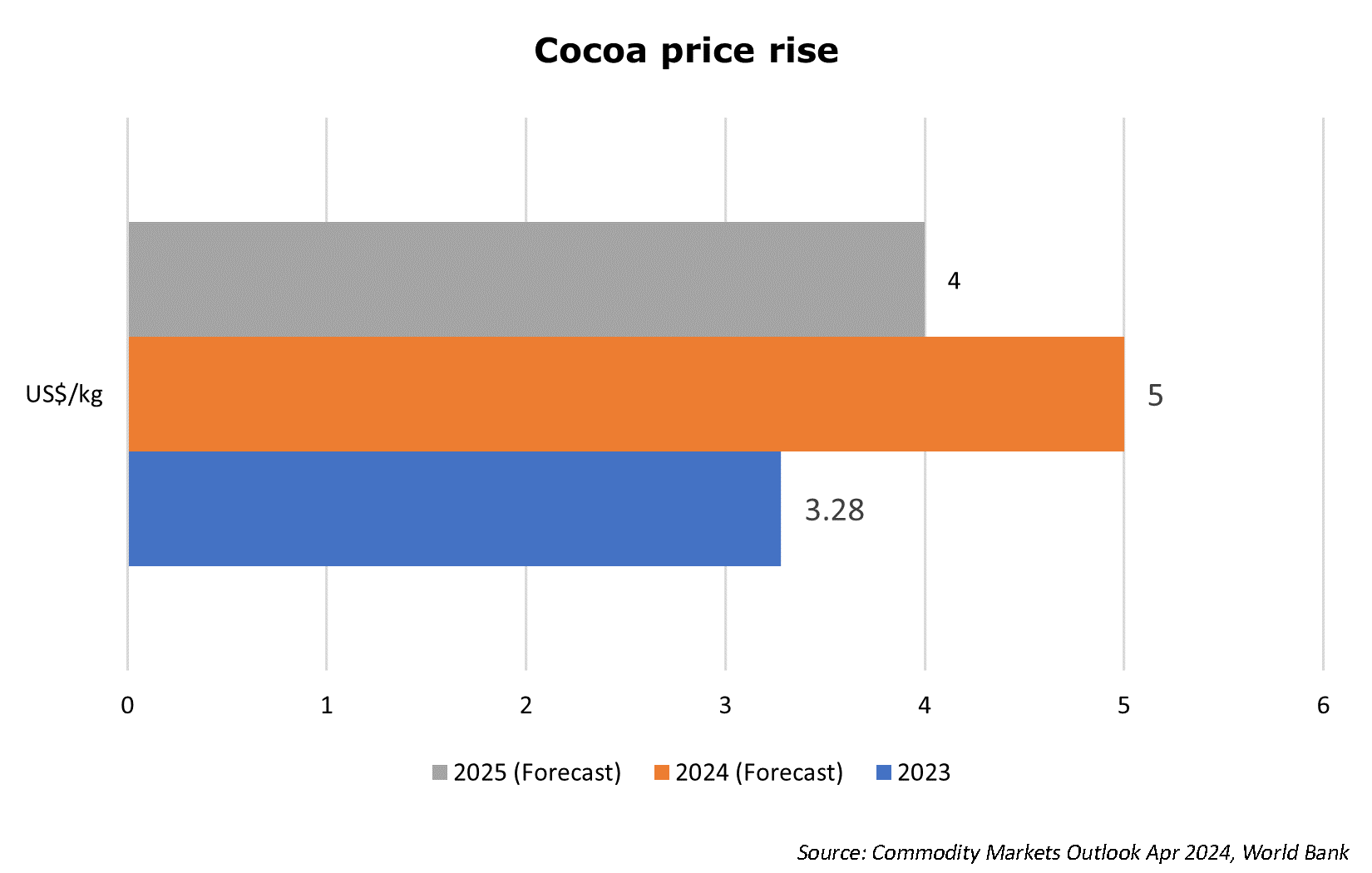

Since Jun 2023, the price of cocoa beans – essential for chocolate production – has surged 133%. Prices exceeded US$7/kg in March 2024 and were as high as US$10/kg earlier this month (April). Making the situation worse is excessive speculation. Non-commercial investors now hold over 60% of total open interest across cocoa futures and options at the New York commodity market. By mid-April 2024, cocoa futures in New York soared to an unprecedented $11,578 per tonne, a stark increase from $2,831 in early March 2023. Cocoa prices this year are forecast to increase by a whopping 52.4% over 2023.

The sharp hikes in cocoa bean prices, however, may take some time to trickle down to the retailer next door. That is because the industrial users of cocoa – the big chocolate and confectionaries firms, for example – lock their purchase price of cocoa through fixed long term supply contracts. Nonetheless, even if chocolate prices do not rise immediately, the long-term outlook suggests higher costs for chocolate lovers all over the world, including Asia.

In December 2023, the West African region witnessed substantial rainfall – more than twice the 30-year average for that time of year – which caused numerous plants to be affected by black pod disease. Soon after, in February 2024, droughts ensued, drastically reducing yields.

In Ghana, the swollen shoot virus has infected approximately 590,000 ha of the country’s 1.38m ha cocoa plantations. Within one year of swollen shoot infection, yields decrease by 25%, and by 50% within two years. Typically, the trees perish within three to four years. Once a plantation is infected, it must be cleared and the soil treated before replanting cocoa.

Compounding these agricultural challenges, illegal gold mining has escalated in Ghana, leading to the destruction of cocoa plantations for mining operations. Many farmers, facing tough economic conditions, have sold parts of their land to miners.

It has been suggested that the EU’s deforestation regulations – which take effect from late this year – are also contributing to higher prices. According to these regulations, any operator or trader dealing with commodities such as cocoa must verify that their products are not sourced from recently deforested land or contributing to forest degradation. The industry will need time to adapt to the data and traceability requirements necessary to comply with these standards.

Singapore-based Olam and Valency International are significant players in the cocoa sectors of both countries. Olam has cocoa grinding operations in the Ivorian cities of San-Pédro and Abidjan to produce cocoa liquor, butter, and cake. In Ghana it sources cocoa beans from smallholder farmers and processes these at its factory in Kumasi. Valency International also sources cocoa beans from these nations and distributes them to its clients worldwide.

Prolonged periods of low cocoa prices have left West African farmers financially constrained, preventing investment in their ageing plantations. These farms often yield less cocoa, and the situation is compounded by rising costs for essential inputs like fertiliser. In response, regulatory bodies in both Ghana and Côte d'Ivoire have recently boosted the fixed prices paid to farmers by about 50% to encourage investment in their farms.

The surge in cocoa bean prices might spur new planting initiatives, as global cocoa consumption is projected to grow by roughly 2% annually through 2030. However, newly planted cocoa trees take several years to start producing beans. Ghana estimates that 40% of its coca trees need to be replaced.

References

‘Chocolate bite – El Niño-linked West Africa weather drives cocoa prices to record highs’, Daily Maverick, 28 March 2024

‘Chocolate prices to keep rising as West Africa’s cocoa crisis deepens’, Al Jazeera, 30 March 2024

‘Chocolate lovers, African cocoa farmers pay price as big brands see profits’, Voice of America, 30 March 2024

‘Cocoa hits record high as global shortage worsens in first quarter’, Financial Times, 18 April 2024

‘Why chocolate will get even pricier for SA snackers’, News24, 21 April 2024

‘Ghana's 2023/24 cocoa output seen almost 40% below target, sources say’, Reuters, 22 February 2024

‘Cocoa hits record on tight supply, threatening pricier treats’, Bloomberg, 08 February 2024

‘Illegal mining, smuggling threaten Ghana's cocoa industry’, France24, 20 December 2023

‘Cocoa’, Valency International, Accessed 27 April 2024

‘Ghana’, Olam International Limited, Accessed 27 April 2024

‘Côte d‘Ivoire’, Olam International Limited, Accessed 27 April 2024

‘The bitter truth in the cocoa world, decoded,’ Mint, 22 April 2024