Africa set to be the second fastest-growing region in the world in 2024

Niger set to lead African growth with an annual GDP growth of 12.8%

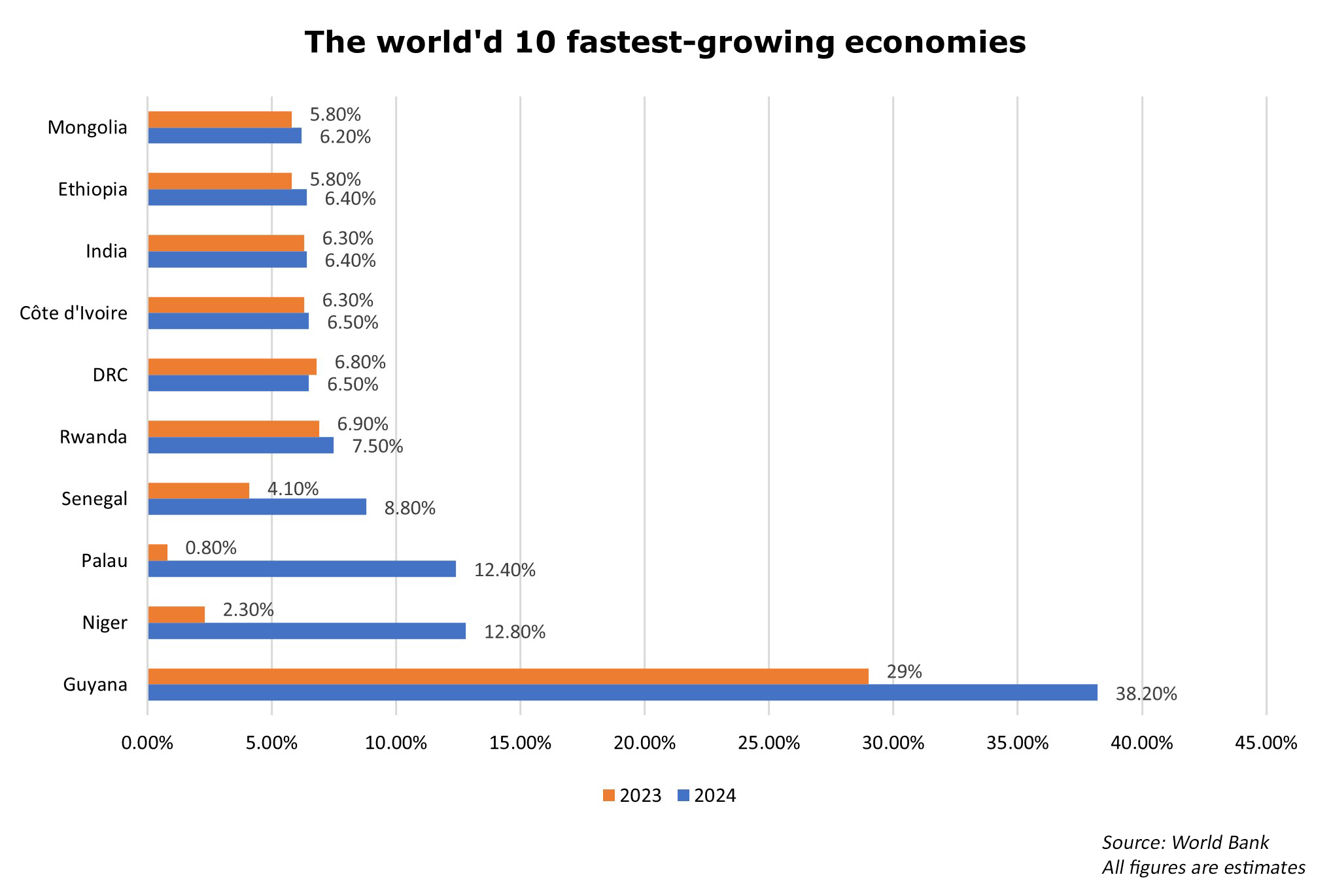

Africa is set to emerge as the second fastest-growing region in the world this year with six sub-Saharan African (SSA) countries – Niger, Senegal, Rwanda, the Democratic Republic of Congo (DRC), Côte d'Ivoire, and Ethiopia –to become the top 10 fastest-growing economies in 2024. This according to the Global Economic Prospects report released by the World Bank. Growth in SSA is projected to be 3.8% in 2024, up from an estimated 2.9% in 2023. Driven by the services sector, the East African Community countries – Ethiopia, Kenya, Uganda, Rwanda, Tanzania, and the DRC -- will record growth between 5-6%.

Africa is set to emerge as the second fastest-growing region in the world this year with six sub-Saharan African (SSA) countries – Niger, Senegal, Rwanda, the Democratic Republic of Congo (DRC), Côte d'Ivoire, and Ethiopia –to become the top 10 fastest-growing economies in 2024. This according to the Global Economic Prospects report released by the World Bank. Growth in SSA is projected to be 3.8% in 2024, up from an estimated 2.9% in 2023. Driven by the services sector, the East African Community countries – Ethiopia, Kenya, Uganda, Rwanda, Tanzania, and the DRC -- will record growth between 5-6%.

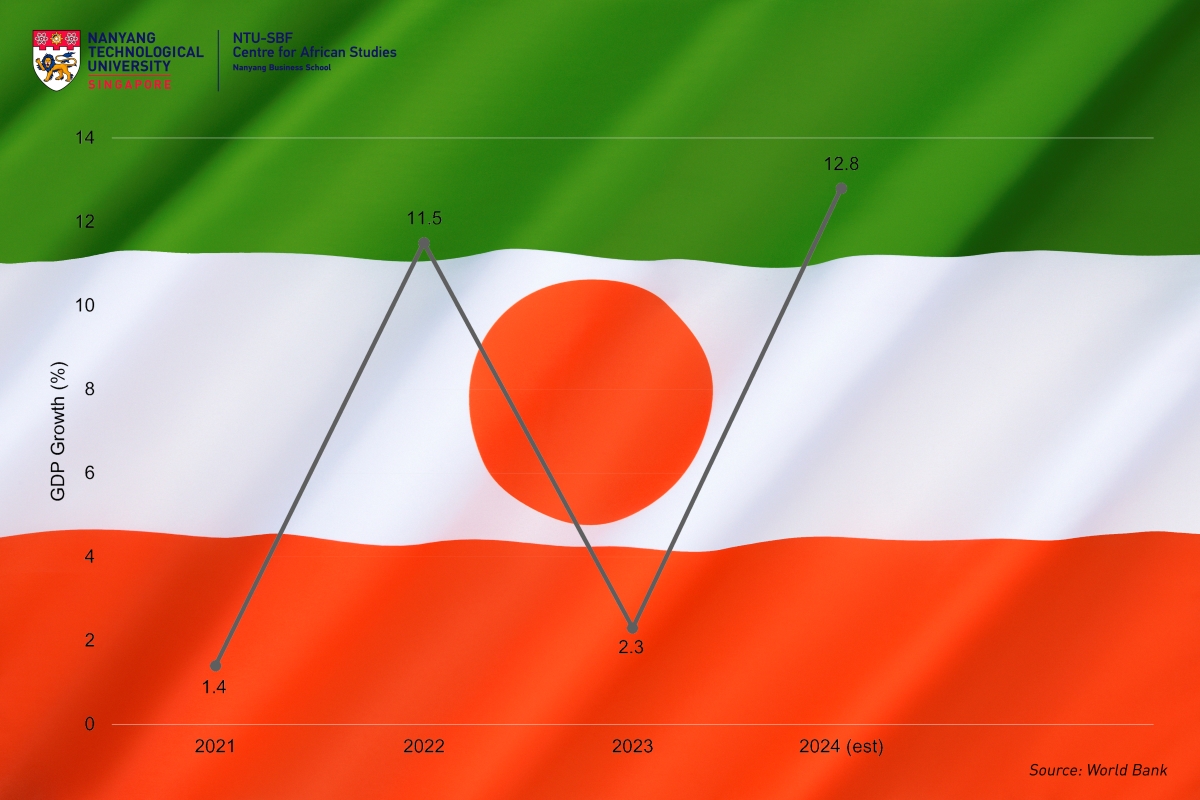

The military-ruled West African nation of Niger is expected to be an outlier - leading the continent's growth with a 12.8% GDP expansion this year. This surge will be driven predominantly by the commencement of large-scale oil production and exports. The country's oil output is expected to rise from the current 20,000 barrels per day (bpd) to over 100,000 bpd. Central to this upswing is the new Niger–Benin pipeline linking the Agadem oil fields to the port of Seme in Benin. Niger's 2023 GDP growth is estimated at a modest 2.3%, impacted by the economic repercussions, including international sanctions, following a coup in July that ousted President Mohamed Bazoum and led to military control. However, in 2022, Niger was again among the world's fastest-growing economies, with an 11.5% GDP increase, largely due to a boost in agricultural production. Niger’s economic trajectory, while robust, has witnessed similar fluctuations over the past decade, with GDP growth ranging between 2.4% and 10.5% from 2011 to 2019, mainly due to its reliance on agriculture and the impact of beneficial and adverse climate events. Niger is also expected to benefit from a possible revenue windfall from Uranium exports as renewed interest in nuclear energy draws investments and demand from countries other than France. Having severed ties with France, Niger is now freed from the obligation of selling uranium to Paris at a sharp discount. Border closures and sanctions imposed by the regional bloc ECOWAS, however, has hurt the Nigerien economy. In January, Niger along with its junta-ruled allies – Burkina Faso and Mali pulled out of ECOWAS accusing them of being ‘under the influence of foreign powers’.

Senegal is set to be Africa’s second-fastest growing economy in 2024, with a projected expansion of 8.8%, up from 4.1% in 2023. This growth will be partly driven by its emerging oil and gas sector, with both the Greater Tortue Ahmeyim and Sangomar fields set to start production in 2024. Investments in infrastructure, including power generation, transport, and information technology, along with contributions from agriculture and tourism, were also expected to bolster the economy. However, the decision by President Macky Sall to postpone elections now runs the risk of provoking mass social unrest and deter investors. As protestors take to the streets, the danger of violence looms large. As Senegal lurches into political uncertainty capital is likely to flee.

In contrast to Niger and Senegal, where hydrocarbons are expected to significantly contribute to economic growth, Rwanda, projected to be the third fastest-growing African economy at 7.5%, will rely less on commodities. Rwanda's economy is expected to be fueled by increased tourism revenues and construction activities, particularly the new airport, and supported by a resilient policy framework. While still heavily reliant on agriculture, Rwanda has made notable progress in diversifying its economy, especially in the air travel, ICT, and meetings and conferences sectors. On the export front, Rwanda has diversified meaningfully: its top five exports (gold, coffee, tea, zirconium ore, and tin ore), which accounted for 96% of total exports in 2000, had decreased to 61% by 2020.

Countries in Africa that depend on commodities are especially vulnerable to weather impacts on agriculture, as well as mineral and petroleum price shocks, which can hinder long-term economic growth. Growth is often uneven in mineral-reliant countries and challenging to maintain in agricultural ones. The World Bank highlights economic diversification as a crucial aspect of development, enabling a country to transition to a more varied production and trade structure. Diversification helps manage economic volatility and paves the way for stable, equitable growth. It involves transitioning labour from low-productivity areas like agriculture to higher-productivity urban sectors. For many developing countries, a growing workforce offers a chance for a demographic dividend. However, capitalising on this opportunity is difficult without diversified economies and private sector job growth.

SSA’s three largest economies – Nigeria, South Africa, and Angola – are likely to be a drag on the region’s overall growth. Excluding these countries, growth in the region is expected to accelerate from 3.9% in 2023 to 5% in 2024.

In Nigeria, growth moderated to an estimated 2.9% in 2023. This deceleration was partly due to the disruptions caused by a new banknote policy early in the year, offsetting the increase in oil output after years of decline. The nation's economic projection for the year stands at 3.3%, fueled by agriculture, construction, services, and trade. Inflation is expected to gradually ease as the impacts of the previous year’s foreign exchange rate reforms and the removal of fuel subsidies diminish.

Last year, South Africa's economic expansion further slowed to an estimated 0.7%, impacted by structural issues like the energy crisis and transport challenges, alongside weaker demand due to limited job creation, inflation, and high interest rates. Record power outages severely affected manufacturing and mining. The country's economy is expected to marginally recover to 1.3% in 2024. While anticipated energy sector reforms may enhance power availability in the medium term, persistent infrastructure bottlenecks are expected to hold back the nation's economic potential.

In Angola, growth slowed to an estimated 0.5% in 2023, largely due to declining oil production from maturing fields, resulting in revenue shortfalls and subsequent public spending cuts. The country's economy is expected to recover slightly, with a projection of 2.8% growth this year. This upturn will be primarily driven by non-oil sectors, as the hydrocarbons industry is anticipated to grow by only 1%, hampered by field depletion and limited investment.

References

‘Economic diversification: Why trade matters’, Trade for Development News, 04 June 2019

‘Niger: an attractive nation with an emerging oil industry’, African Business, 08 November 2021

‘Niger’, World Bank Group, April 2023

‘Senegal Economic Update 2023: Addressing the needs of vulnerable groups for national development’, World Bank Group, 21 June 2023

‘Senegal's growth prospects are strong’, International Monetary Fund, 12 July 2023

‘Niger coup could jeopardize oil production boost, create regional security vacuum’, S&P Global Commodity Insights, 28 July 2023

‘Africa's Pulse’, World Bank Group, October 2023

‘Niger commissions oil pipeline project’, Pumps Africa News, 07 November 2023

‘France closes embassy in Niger until further notice’, France 24, 02 January 2024

‘Petrofac secures contract for BP’s Greater Tortue Ahmeyim project’, Offshore Technology, 09 January 2024

‘Six African countries are among the world’s highest growth economies in 2024’, Semafor, 10 January 2024

‘Sangomar’, Woodside Energy, Accessed 14 January 2024

‘Rwanda’, African Center for Economic Transformation, Accessed 14 January 2024

‘Global Economic Prospects’, World Bank Group, January 2024