Cracking the code in fintech

Digital payment is the new default mode of payment. Meet alumnus Louis Liu (EEE/2015) who co-founded FOMO Pay with two fellow engineering schoolmates. The trio boldly took the leap to venture into fintech without prior training in finance.

Text: Lester Hio

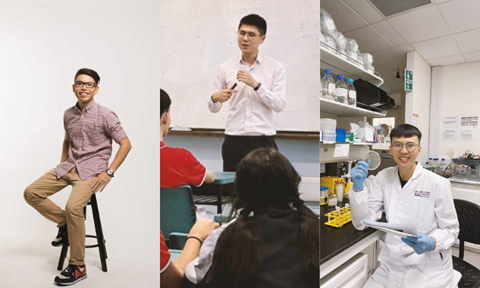

Louis Liu Xi

Louis Liu Xi

Co-founder and CEO, FOMO Pay

EEE/2015

Barely half a decade ago, QR codes were a novelty, used on business cards or marketing material to show how hip and on-trend tech companies were. Singapore was still very much a cash-based society, and mobile payments like Apple Pay and Samsung Pay were foreign concepts. Merchants who provided cashless options were limited to credit card payments, which came with transaction fees.

This was the world Louis Liu Xi, 28, lived in when he started FOMO Pay in 2015 with two friends and fellow engineering students from NTU. In true engineering fashion, they saw a problem they knew they had the solution to.

“We saw the popularity of cashless, mobile payments in China and India, such as AliPay and WePay,” said Louis. “But financial technology back in 2015 was unexplored – that’s why big institutions didn’t want to make the first step. We saw a chance to start something new and capture an untapped market.”

Today, you can’t escape the QR codes at the shopfronts of coffeeshop stalls, at the payment machines of your favourite café, and at the entrance of malls. In the last seven years, FOMO Pay has grown into a key player in Singapore’s fintech space. It is a one-stop mobile payment solution that consolidates payment options, from QR codes to e-wallets, for their clients. A merchant who signs up for FOMO Pay can offer one payment method – often a QR code – which customers from different banks and e-wallets can pay with.

“We don’t have any financial background, but as engineers, we said we would take the chance to try,” said Louis. “There was a mixture of both excitement and fear, as there was high pressure and high risk.” FOMO Pay currently has over 10,000 merchant customers, and works with a variety of clients such as OCBC, ICBC, Changi Airport, Marina Bay Sands Singapore and Resorts World Sentosa.

Being at the forefront of the fintech wave meant that the FOMO Pay team had no playbook to follow. Every situation was new and unique, and the team had to learn on the job and come up with creative solutions on the fly.

“There were no protocols to follow,” said Louis, who received the Nanyang Outstanding Young Alumni Award in 2018.

“At the beginning, the main challenge was getting merchants to trust us,” he said. “We were an early stage fintech startup processing their money. They were concerned with fund safety – how would they be assured that we wouldn’t run away with their hard-earned money? We needed to earn that trust. So, we continuously put regulatory compliance as our top priority, and obtained a licence from the Monetary Authority of Singapore. Having that made it easier to convince merchants we were legitimate.”

Having cut his teeth within the nascent growth of an entirely new industry, Louis and his team constantly innovate and keep the momentum going. FOMO Pay is now eyeing developments in cryptocurrency and the upcoming wave of advances that 5G will bring to payment systems within the Internet of Things.

Late last year, the company obtained new licences to operate three new regulated activities – local money transfer services, and more importantly, facilitate transactions with digital payment tokens such as cryptocurrency and central bank digital currency.

Related stories:

This article first appeared in issue 2 of U, the NTU alumni magazine.