What is the AELP and why it matters?

The African Exchanges Linkage Project will allow investors to trade in African stocks on a single platform and in doing so make the African capital markets vibrant as never before

By Rufus Mwanyasi

Introduction

Africa is widely considered to be the last frontier market when it comes to doing business. However, persistent challenges of different legal systems, heightened political and currency risks, poor infrastructure and fragmented markets have hindered its growth and that has caused it to be shunned by investors. Few initiatives in the past have had varying degrees of success while most have failed. A new one - the African Exchanges Linkage Project (AELP)1, is the latest pan-African project aimed at unifying key regional stock markets in the spirit of the Africa Continental Free Trade Area (AfCFTA). Previously, investors from any African country desirous to invest in a different African country had to set up a new account through a host stockbroker in that country - an often cumbersome and tedious process. With AELP, which is jointly piloted by the African Securities Exchanges Association (ASEA) and the African Development Bank (AfDB), investors can carry out cross-border trading in the continent from a single account set up in any African country.

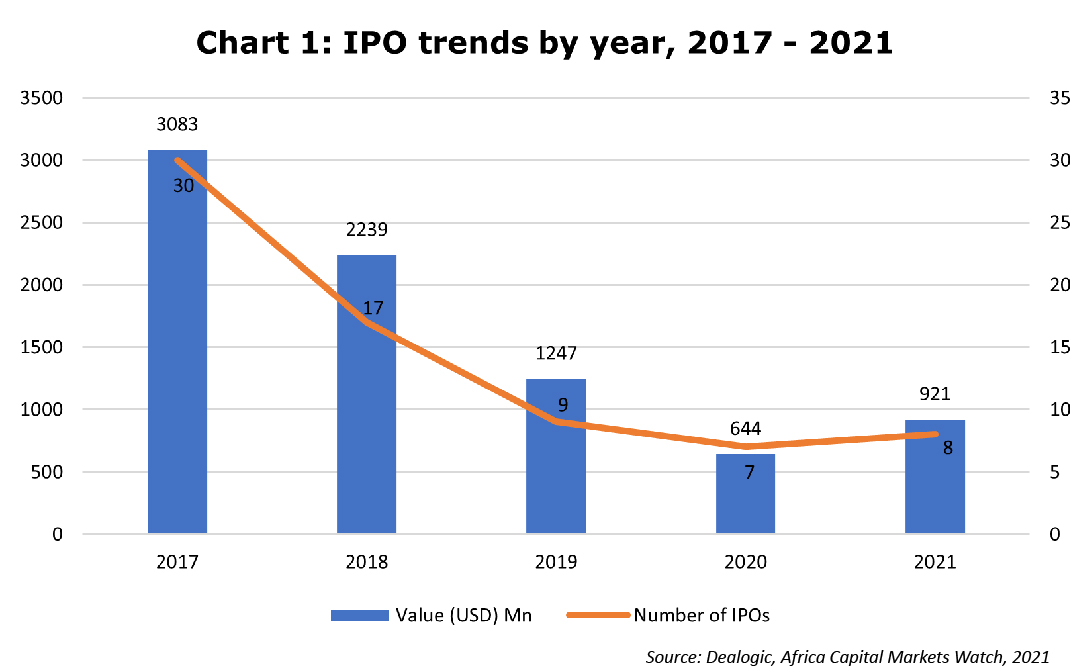

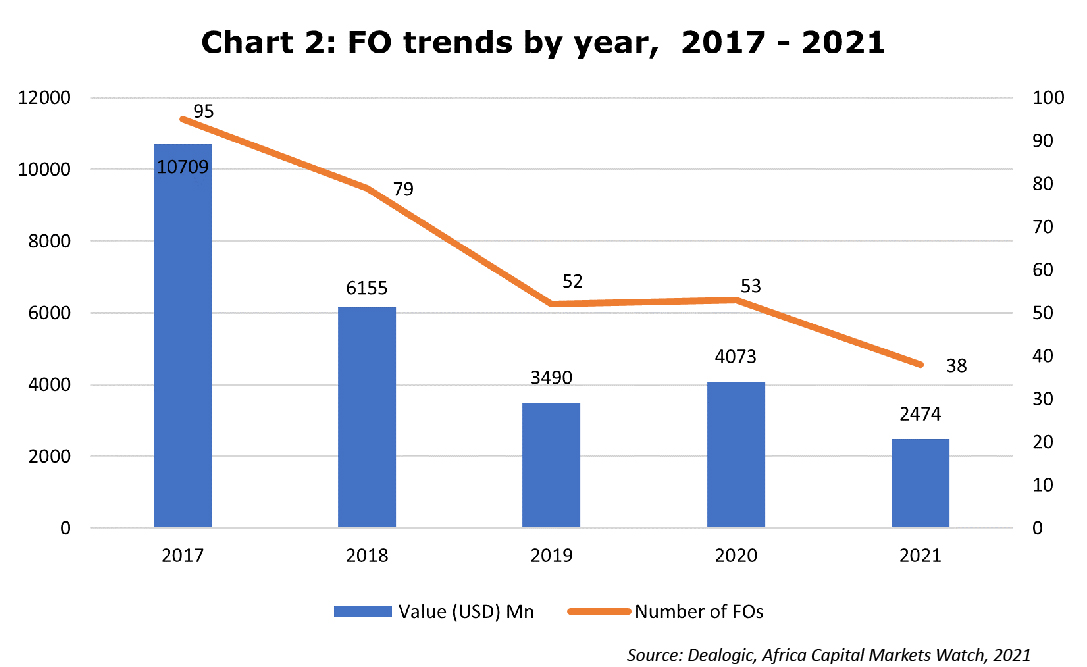

Although solving this major pain point is critical, the task ahead is huge. According to the Africa Capital Markets Watch (2021) report by PwC, initial public offers (IPO) and further offers (FO) trends over the past five years have been on a decline (See charts 1 and 2). Specific challenges holding back new listings are many and varied.

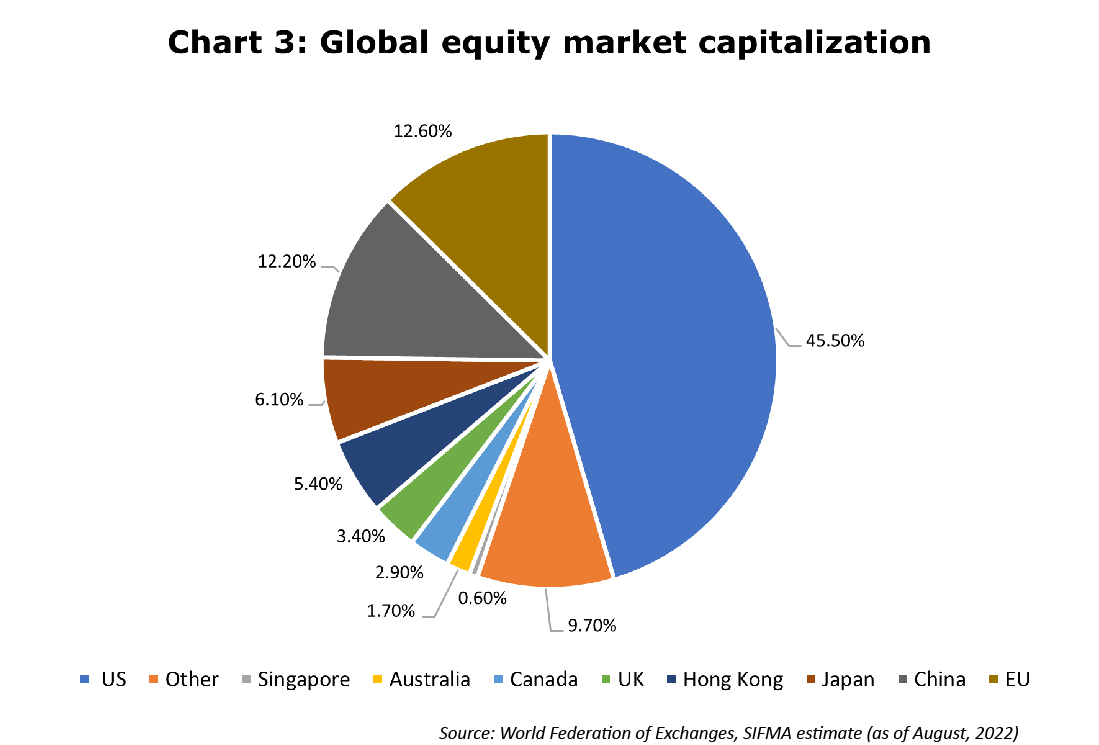

African markets have returned an average of 8.28% since 2002 to the end of October 2022 according to the MSCI Frontier Markets Africa Index (USD).15 This outperforms other markets – including those in Asia. In the ideal world such a remarkable performance should see strong inflows as investors search for high growth markets. Yet, high trading costs have proved to be a damper. Research by the UN Economic Commission for Africa (UNECA) shows the combined burden of fees and taxes on most African securities exchanges – including brokerage commissions, exchange fees for clearing and settlement, and securities transfer taxes – is significantly higher than in other developing countries. Uganda and Rwanda, for example, charge listing fee of 4.1% and 3.4%, compared with 0.46% and 0.57% charged by Peru and Thailand respectively.2 The small size of the market is another problem. Africa’s 1.3% market share in the global equity market capitalization stands at US$120.4 trillion,3 seems inconsequential.

The prevalence of US dollar-denominated debt by Africa has also had critical implications for Africa’s financial markets. Sudden change in US dollar funding conditions and shifts in investor sentiment continues to aggravate dollar liquidity and funding risks. Reliance on foreign portfolio investment flows remains a primary source of risk. Combined with weak macroprudential regulations, excess leverage and imbalances between foreign assets and liabilities could make African economies remain vulnerable to sharp capital flow reversals.

Be that as it may, AELP holds great promise. In the end, when trading costs come down, the different rules and regulations are harmonised, local currency debt increased, the visibility of investments raised and more markets digitised, the project will contribute to a more dynamic unified capital market with similar benefits enjoyed in other developed markets. Equally important, a successful African market aligns with the objective of the AfCFTA to establish a single and liberalised market; facilitating the movement of capital, supporting investment and deepening the economic integration of the continent. Achieving this milestone means realising the dream of the African Union’s Vision 2063 directive on the free flow of investment and capital.4

How can investors invest through AELP

Although the project keeps the individual exchanges as is, AELP’s network of the seven African stock exchanges already signed, makes these markets operate as one market. Essentially, AELP’s order-routing system, on which all orders between the participating stockbrokers housed within will be channelled, collapses all walls that existed prior to this. Participating exchanges include Bourse Régionale des Valeurs Mobilières (BRVM), Bourse de Casablanca, The Egyptian Exchange (EGX), Johannesburg Stock Exchange (JSE), Nairobi Securities Exchange (NSE), Nigerian Exchange Limited (NGX), and Stock Exchange of Mauritius (SEM), which altogether represent over 90% of the continent’s total market capitalisation. More players are set to be added in subsequent phases of the project.

Such a structure solves the multi-account problem. All that an investor has to do is open an account with any participating stockbroker. Once a stockbroker sponsors a trade on the host exchange, it will be traded, settled and held in custody on the host exchange according to its market rules and practice. All investor groups, whether retail or institutional, foreign-based or local, will have access to this single market.

Why is this project important?

Meeting demand for capital: It is well known that Africa’s vast infrastructure gap – and most notably, its needs across the transport, logistics and utilities sectors – need urgent capital in anticipation of the increase in trade volume under the AfCFTA in the coming years. With an annual financing gap in the order of US$68bn-108bn according to the AfDB 5 and an additional US$81 billion annual trade finance gap 6 for SMEs, the need is massive. AELP can help mobilise capital and close this financing gap. Moreover, this pure capital demand can be easily seen by the steadfast bond issues coming from the continent; corporate, sovereign, and supranational bonds (See Chart 4). A record US$193.4bn of non-local currency debt, also referred to as foreign currency-denominated debt, was raised from 566 issuances over the past five years according to the Africa Capital Watch (2021) report.7

Need for an alternative channel: Turmoil in the financial markets and interest rate hikes by the US Federal Reserve Bank has made capital scare in the global stock markets. Investor appetite for emerging market debt is not what it used to be. If tapping capital was difficult earlier, it has become next to impossible now. To counter this shift requires Africa to diversify its capital raising strategies. The AELP could emerge as an alternative channel. What it offers African companies and governments is the ability to raise capital across multiple jurisdictions.

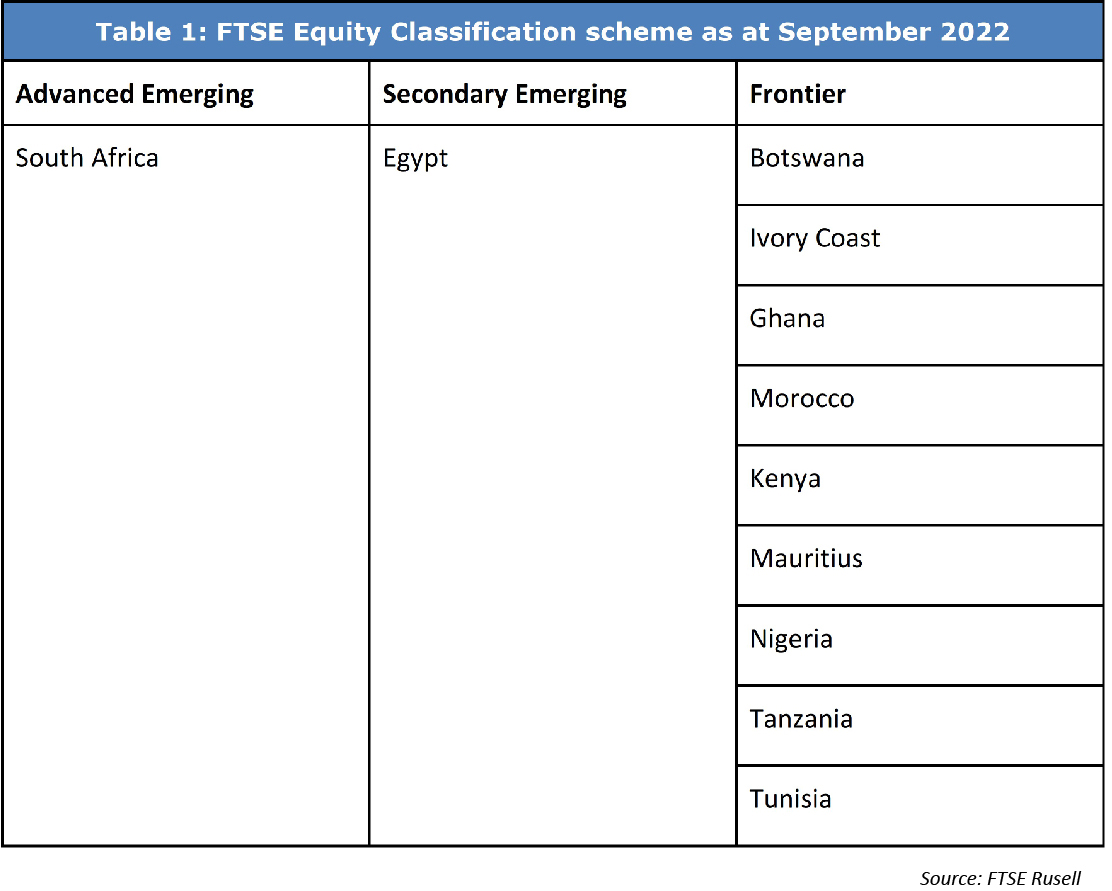

The inclusion of African markets to international world indices signals Africa’s readiness to engage with the international investment community. To this point, the retaining of African key economies, South Africa and Egypt, in the MSCI Emerging Markets Index as at the end of September, 2022 by the global index provider MSCI means investor testifies of the growing confidence in African markets.8 Likewise, when the FTSE Rusell, another leading index provider, retained the same countries in its widely followed FTSE Emerging Index as at the end of October 2022, it proves that African markets are coming of age.9 FTSE Rusell also elected to retain nine African countries in its influential FTSE Frontier Index (See Table 1).

Furthermore, in this year’s FTSE annual review, Ugandan government bonds were added to the FTSE Frontier Emerging Markets Government Bond Index, a move reflecting positive feedback from global investors relating to the country’s coverage.10 The biggest material effect of an index addition is the amount of money a country’s capital markets can attract as these benchmarks hold considerable power in global investment. MSCI, for instance, notes that over US$14 trillion in equity assets are benchmarked to MSCI Indexes globally and that 99 of the top 100 global asset managers are among its clients as of December 2022.11

What are the opportunities for the International Investor?

One market, one account: Basically, AELP seeks to create a “single” market operated from a single account essentially tackling the double challenges of illiquidity and higher transaction costs. In addition, the use of the English language and the publication of financial information using internationally recognised standards makes it easy for the international investor market. In short, investors, such as those represented by the South Asian Federation of Exchanges (SAFE), an associate member of the ASEA, will not only experience operational convenience, greater regulatory harmonisation and the added diversification benefits, but will interact using a common language.

An exit route for inbound FDI: By the end of 2021, FDI flows to Africa reached US$83 billion accounting for 5.2% of global FDI according to World Investment Report 2022.12 It is important to note that although European investors remain by far the largest investment group in Africa, led by the United Kingdom (US$65 billion) and France (US$60 billion), South East Asian countries are increasing their investments in the region. Singapore, for instance, is now a top 10 investor in Africa having recently increased its allocation by US$3 billion in the period between 2016 to 2020 (see chart 5 below). In fact, over 100 Singaporean companies are reported to operating across 50 African countries in the oil and gas, consumer, digital, agri-business and trade sectors, an increase from 60 in 2018.13 Singapore’s total trade with Africa has grown to over US$10 billion in 2022, up 25% from 2021.

It is probable that the absence of a pan-African wide market may partially explain why private equity funds have not utilised this listed market route. Exits are difficult to make. Survey by the African Private Equity and Venture Capital Association shows that in 2021, exits by public offering accounted for only 3% of the total volume of exits reported on the continent.14 Typically, exits take place through buyouts by other private equity funds. AELP holds the promise of easy exit route for investors.

Risk Factors

Heightened Liquidity and Currency risks: Concerns relating to volatile currencies and market illiquidity are not new to Africa. As recent as the Covid-19 pandemic, most African economies experienced capital flight and as a result, most currencies drastically lost value egged on by downgrades from credit rating agencies. For some economies such as Nigeria, foreign exchange instability has been a persistent issue. As a result, due to international investors reporting significant ongoing delays to repatriate capital from the country since 2020, this year FTSE Rusell elected to add the country to their Watch List for potential demotion from Frontier to Unclassified market status.18 This is not the first time, Nigeria has experienced similar delays before that have resulted in similar FTSE Russell announcements.

Likewise, in August 2022, FTSE Russell froze any index changes for Ghana and Kenya due to clients reporting a lack of liquidity in local foreign exchange markets, which in turn have resulted in significant delays to the repatriation of capital. With AELP giving broader access, natural hedges such as portfolio diversification across different countries and sectors, is expected to serve as a currency risk mitigation mechanism. Additionally, some individual markets such as the Johannesburg Stock Exchange (JSE) have a well-functioning derivatives market that allow investors to hedge against short-term currency risks using currency futures contracts. The Nairobi Securities Exchange also has a derivatives arm that investors can use to hedge risks in case of illiquidity in the underlying markets.

Fewer listings: With the exception of South Africa, Nigeria, Egypt and Morocco, most African markets are modest in size with market capitalization ranging between US$1–30 billion. AELP is expected to increase listings as it is set to go for the outbound business - listings outside of Africa. The Africa Capital Markets Watch (2021) report showed an increase in outbound capital raising activity between 2020 and 2021 - African issuers raised a total of US$798m in 62 capital raising transactions involving listings on exchanges outside Africa over the last five years.

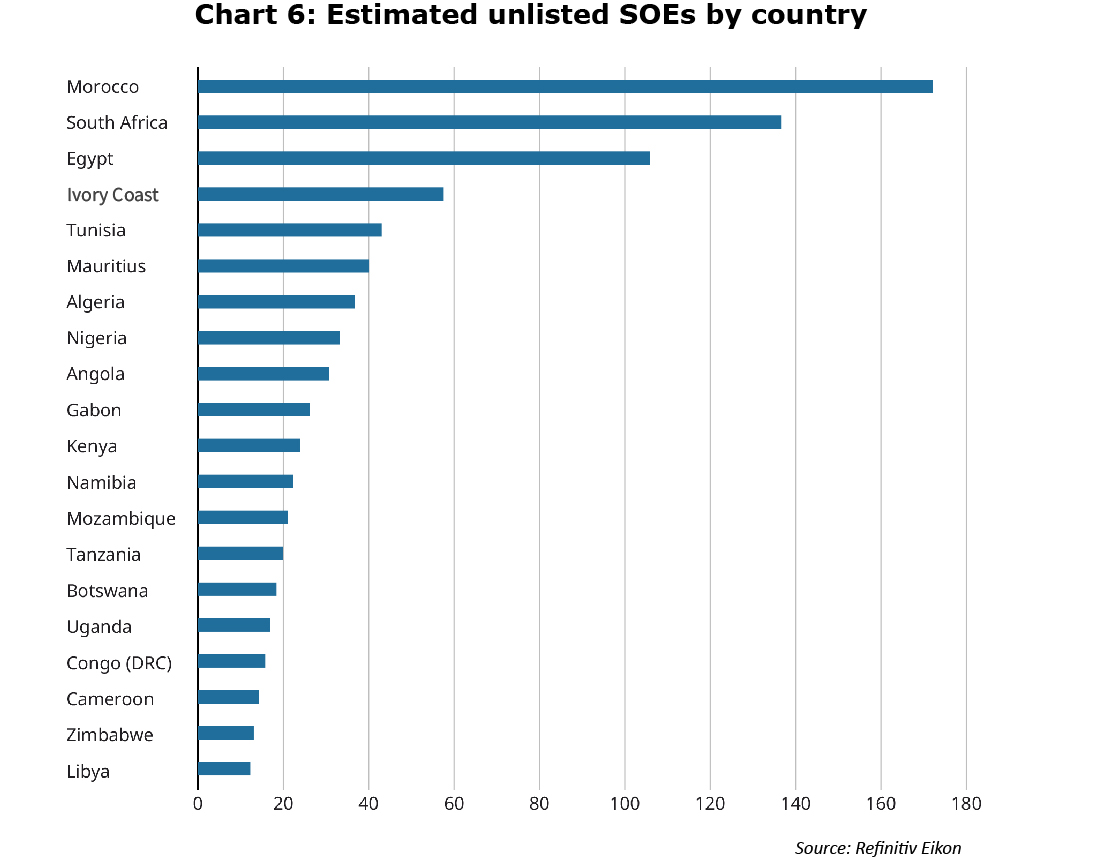

Besides, a large proportion of African state-owned enterprises (SOEs) remain unlisted. The World Bank estimates there are over 1200 African SOEs currently not listed on the stock market (See Chart 6 below).19 Most are in need of capital injection and operate in critical sectors such as financial services, telecommunications and oil and gas. An average of 10-15 such unlisted firms can be found in most African countries.

Different legal and payment systems: Long-standing payments issues have also held back development for Africa capital markets. Customarily African companies and their local banks will use correspondent banks - often outside of Africa - to settle payments between two African currencies in a third, external currency, usually dollars and Euros. This lack of interoperable system for payments and settlements across African central banks has held back the development of African capital markets. The introduction of the Pan-African Payment Settlement System (PAPSS), formally launched in January 2022, could change that. It seeks to solve this issue by centralising payment and settlement for intra-Africa trade.20 Through the platform, transactions will be able to clear and settle in the host market using their local currency in compliance with the host market’s rules and regulations. More importantly, PAPSS is expected to reduce the costs, and accelerate the settlement and payment of trade transactions.

Lessons from the Asian financial crisis

As Africa seeks to raise the standard of its financial markets through the AELP project, it has taken some lessons it can learn from the 1996 Asian financial crises. One is the facilitation of the local currency bond market. The absence of a local currency bond market was acutely felt when the Asian financial crisis struck and countries struggled to find financing options. Foreign-currency denominated liability was shown to be a key vulnerability and many South East Asian struggled to service their foreign currency debts. Since then, the region has created a vibrant domestic bond markets and prefers to borrow in its own currency. Through the Asian Bond Markets Initiative (ABMI)21 established in December 2002, Asia has managed to develop efficient and liquid local currency bond markets to better channel its vast savings to more productive long-term investments. In turn, broader and deeper bond markets are mitigating currency and maturity mismatches.

In a similar fashion, the AELP seeks to prevent the currency-mismatch problem through the listing of local currency bonds. In an environment of tightening financial conditions, a rising dollar and heightened global protectionism, foreign currency-denominated debt has a pernicious effect on the debt service burden as interest rates rise. This makes AELP timely. Continuing the development of local currency bond markets across the region remains pivotal to mobilising long-term finance.

In the aftermath of the financial crises the South-East Asia community established four major regional initiatives/institutions aimed at creating financial safety nets and building resilience against future financial vulnerabilities. AELP hopes to replicate a similar model. On this front, the African Development Bank (AfDB) serves as an overarching body spearheading regional economic integration and private sector development through AELP. Financial crises highlighted the need for regional cooperation and effective coordination across national and international institutions to build financial resilience and safeguard financial stability.

Conclusion

In the age of financial globalisation, deepening financial interconnectedness presents enormous opportunities. By creating a unified capital market the AELP has the best chance of attracting local as well as international investors. It will give them an opportunity to participate in the growth of Africa by investing in household names such as BHP Billiton, Richemont, Access Holdings, Dangote Cement, Naspers, Orascom Construction, Vodacom, Old Mutual, and Remgro as well as the not-so-well known ones. The objective is to plug Africa in the global capital markets as well as mobilise domestic savings to fund its own needs.

Although the risk of financial contagion is never far away, as shocks emanating from one part of the system in the world can easily be amplified and transmitted through exposure to African markets, the opportunities far outweigh the negatives. AELP is primed to make the once moribund capital markets in Africa vibrant and competitive.

References

1 AELP, African Exchanges Linkage Project (AELP) goes live on cross-border trading, (November, 2022), https://africanexchangeslink.com/african-exchanges-linkage-project-aelp-goes-live-on-cross-border-trading/

2 Economic Report on Africa (2020), Innovative Finance for private Sector Development in Africa, (2020), (https://www.uneca.org/sites/default/files/fullpublicationfiles/ERA_2020_mobile_20201213.pdf

3 SIFMA, Global Equity Markets Primer, (November 9, 2021) https://www.sifma.org/resources/research/insights-global-equity-markets-primer/

4 African Union, Agenda 2063, (2015), https://au.int/sites/default/files/documents/36204-doc-agenda2063_popular_version_en.pdf

5 AfDB, Africa’s Infrastructure: great potential but little impact on inclusieb growth, (2022), https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/2018AEO/African_Economic_Outlook_2018_-_EN_Chapter3.pdf

6 AfDB, African Development Bank approves USD 175 million regional trade finance funded risk participation agreement facility for Eastern and Southern African Trade and development Bank, (13th July, 2022), https://www.afdb.org/en/news-and-events/press-releases/african-development-bank-approves-175-million-regional-trade-finance-funded-risk-participation-agreement-facility-eastern-and-southern-african-trade-development-bank-53276

7 PwC South Africa, Africa Capital Markets Watch 2021, (March, 2022), https://www.pwc.co.za/en/publications/africa-capital-markets-watch.html

8 MSCI https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

9 FTSE Russell, https://www.ftserussell.com/products/indices/awallen

10 FTSE Russell, https://research.ftserussell.com/products/downloads/Fixed_Income_Country_Classification_September_2022_Results.pdf

12 World Investment Report, Regional Trends Africa, (2022) https://unctad.org/system/files/non-official-document/WIR2022-Regional_trends_Africa_en.pdf

13.Macfarlane, Alec, Singapore and Africa: A South to South Story, (September 2022), https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/singapore-and-africa-a-south-south-story

14 African Private Equity and Venture Capital, African Private Capital Activity Report, (April 2022), https://www.avca-africa.org/media/2971/02034-avca-african-private-capital-activity-2021-public-9-1.pdf

15 Index factsheet, MSCI Frontier Markets Africa Index (USD), (October, 2022), https://www.msci.com/documents/10199/4dd589f6-6929-4ec7-a6ff-d40d5d882406

16 Index factsheet, MSCI Emerging Markets Index (USD), (October, 2022), https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

17 WFE Research Team, What attracts international investors to emerging markets?, (4th Dec, 2018), https://www.world-exchanges.org/storage/app/media/research/Studies_Reports/2018/WFE%20attracing%20int%20investors%20report%20FINAL%20VERSION%20updated%205.12.18.pdf

18 FTSE Russell, FTSE Equity Country Classification September 2022, (September, 2022), https://research.ftserussell.com/products/downloads/FTSE-Country-Classification-Update-2022.pdf

19 World Bank, SOE Listings - Is There a Business Case for Africa? (2021), https://thedocs.worldbank.org/en/doc/8ea933199fd290631f0527a976198501-0430012021/original/Africa-NYC-IFC01211-002-OW-World-Bank-publication-June18.pdf

20 Trade.gov, Pan-African Payment and Settlement System, (May, 2022), https://www.trade.gov/market-intelligence/pan-african-payment-and-settlement-system

21Asia Development Bank, Asia Bond Market Initiative, https://aric.adb.org/initiative/asean3-asian-bond-markets-initiative

22 The Economist, African Pension Funds have grown impressively, October 2021), https://www.economist.com/middle-east-and-africa/2021/10/02/african-pension-funds-have-grown-impressively

23 Toesland, Finbar, Insurance: Africa’s Sleeping Giant, (2021) https://newafricanmagazine.com/27373/