How far has AfCFTA come to meet its true potential?

An assessment of the most ambitious single market experiment

By Faith Tigere Pittet

The African Continental Free Trade Area (AfCFTA) agreement was signed in 2018 but came into effect three years later. It was the culmination of an audacious idea of turning the entire continent of Africa into a single market and is now widely touted as African Union’s (AU) most audacious projects. All but one (Eritrea) signed up. The framework ties together the largest number of member countries of any trade agreement since the establishment of the World Trade Organisation (WTO) in 1995. Its backers call it a ‘game changer’.[1] Trade within Africa is only at 17% of total African exports.[2] UNCTAD forecasts show the agreement could boost intra-Africa trade by about 33% and cut continental trade deficit by 51%. The World Bank estimates that the agreement if implemented fully, could boost African GDP by 7% (US$450bn) by 2035 and pull 30 million people out of extreme poverty by 2035, in part by reducing import tariffs, but more importantly by eliminating non-tariff barriers.[3] The AfCFTA had become topical even before its formal launch. Members of the business community have eagerly awaited the implementation of the AfCFTA. But two years since it was formally launched how far has the AfCFTA come in ushering the ‘new era’ of African integration it promised?

Status of the AfCFTA

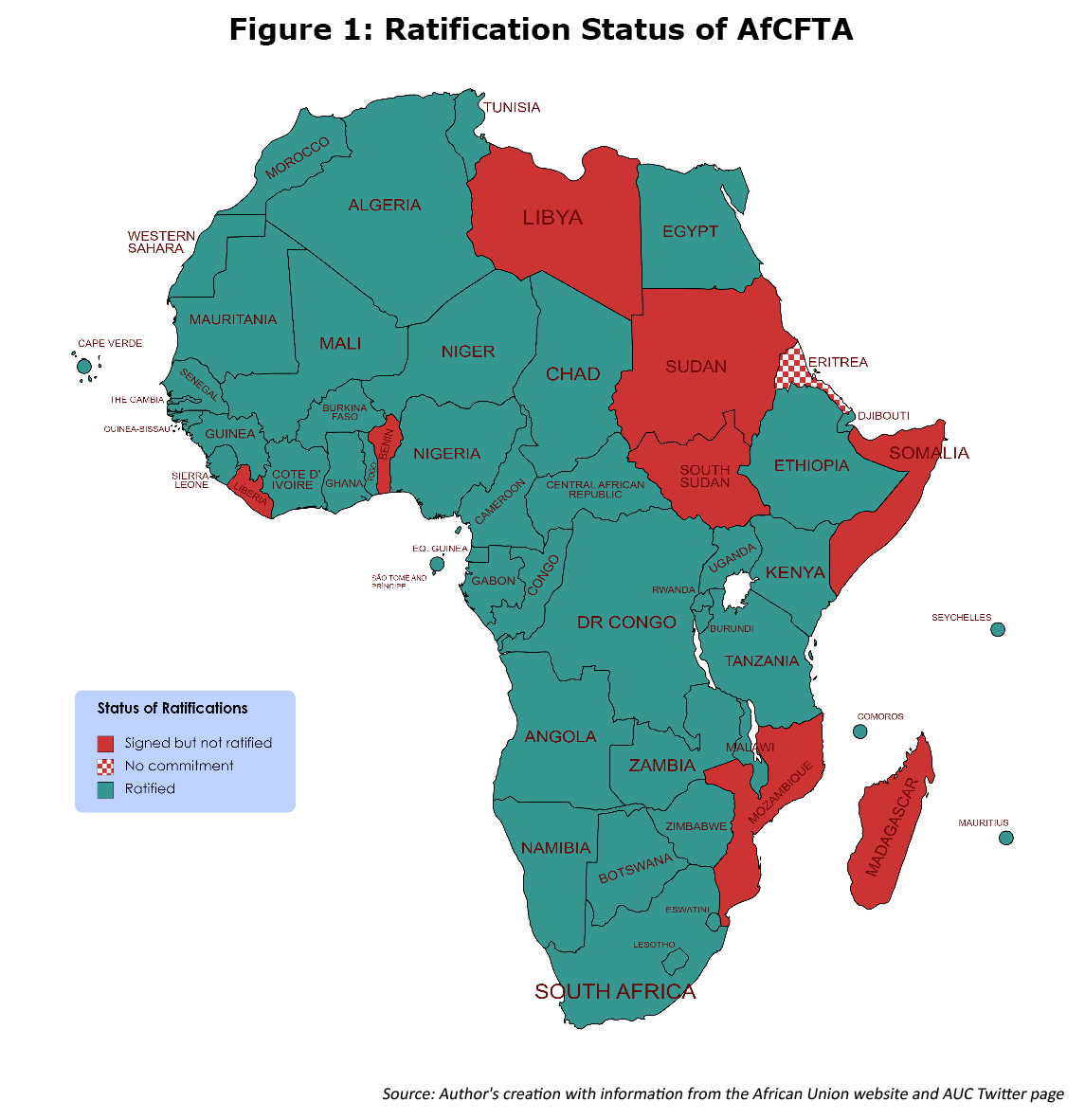

Two years after the agreement became fully operational in January 2021, 54 out of 55 countries have signed the AfCFTA and 46 have deposited the instruments of ratification with the African Union (AU) Commission. This means that more than 80% of ‘State Parties’ (as the signatories are called) should be implementing the agreement.

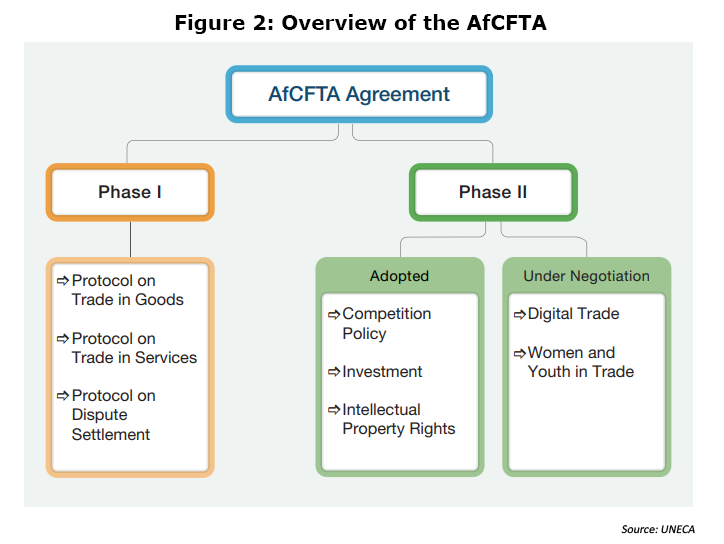

Yet trade between member states under the AfCFTA has barely got off the ground. The agreement is still far from achieving its full potential. The AfCFTA Secretariat in Accra has been focused on supporting signatories to implement the agreement while simultaneously finalising aspects of the first two phases of the agreement. The negotiations for the AfCTA have been conducted in two phases (Figure 2 below). Phase I of the agreement pertains to the liberalisation of trade in goods and services and dispute settlement. Phase II covers five protocols on Investment, Intellectual Property Rights, Competition, E-commerce and Women and Youth. These protocols and the framework agreement constitute the legal instruments of the AfCFTA. State Parties have adopted Phase I protocols but negotiations to finalise certain aspects of the agreement such as rules of origin and tariff schedules continues. Under Phase II they have adopted some of the instruments including Intellectual Property, Competition and Investment Protocols. Currently, negotiations for the Protocol on E-Commerce and Women and Youth are well underway.

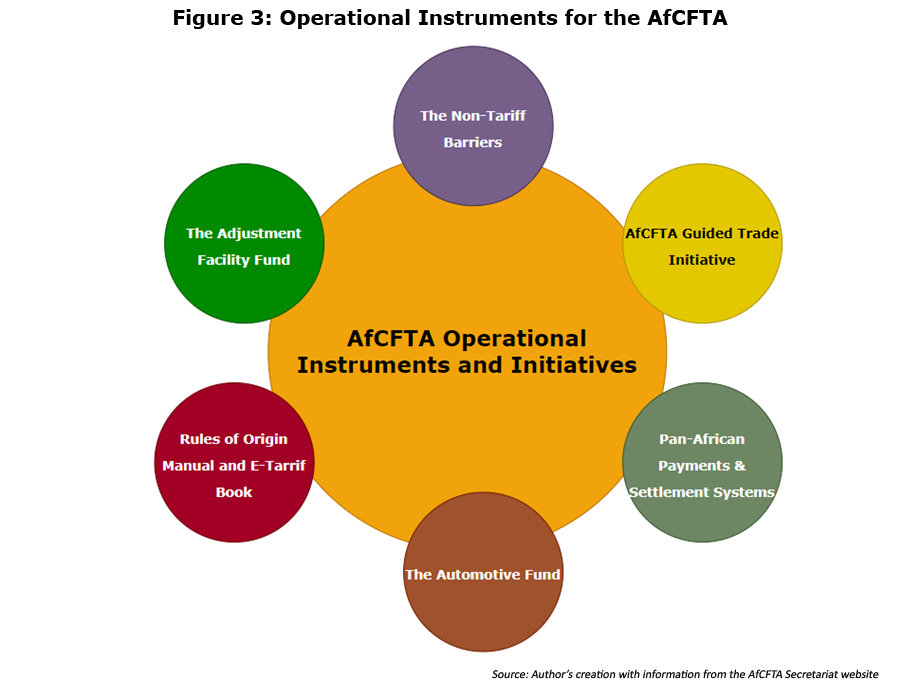

Meanwhile, the AfCFTA has seen some notable developments take place that aid the implementation of the agreement. Among these are the Pan-African Payments and Settlements System (PAPSS), the AfCFTA Adjustment Fund, the Automotive Fund, the E-Tariff Book, AfCFTA Non-Tariff Barrier (NTB) Online Monitoring Mechanism, and the AfCFTA Guided Trade Initiative. It is important for investors to stay on top of these instruments if they are to capitalise on the opportunities presented by the AfCFTA. The following sections will discuss all the operational instruments and what they entail for investors.

The AfCFTA Guided Trade Initiative

So far only a few businesses have traded under the AfCFTA. Kenya has shipped cars and truck batteries as well as a consignment of Kenyan-grown tea to Ghana. Rwanda has exported processed coffee beans to Ghana. Ethiopian Airlines, DHL, and the African Electronic Trade Group comprising of South Africa, Ghana, Ethiopia, Guinea, and eSwatini have also traded under this new regime.[4] But intra-African trade under the AfFCTA is still being conducted on the margins.

The Guided Trade Initiative (GTI) was launched in October to allow commercially meaningful trading, and to test the operational, institutional, legal and trade policy environment under the AfCFTA. The initiative matches companies and products for trade. It has earmarked ninety-six specific products. This includes ceramic tiles, batteries, tea, coffee, processed meat products, corn starch, sugar, pasta, glucose syrup, dried fruits, and sisal fibre. The GTI removes a critical hurdle for the private sector. It helps them identify the product ready for trade under AfCFTA. Cameroon, Egypt, Ghana, Kenya, Mauritius, Rwanda, Tanzania, and Tunisia are taking the lead on GTI as a pilot. If successful, other State Parties may decide to join later.

Pan-African Payments and Settlements System (PAPSS)

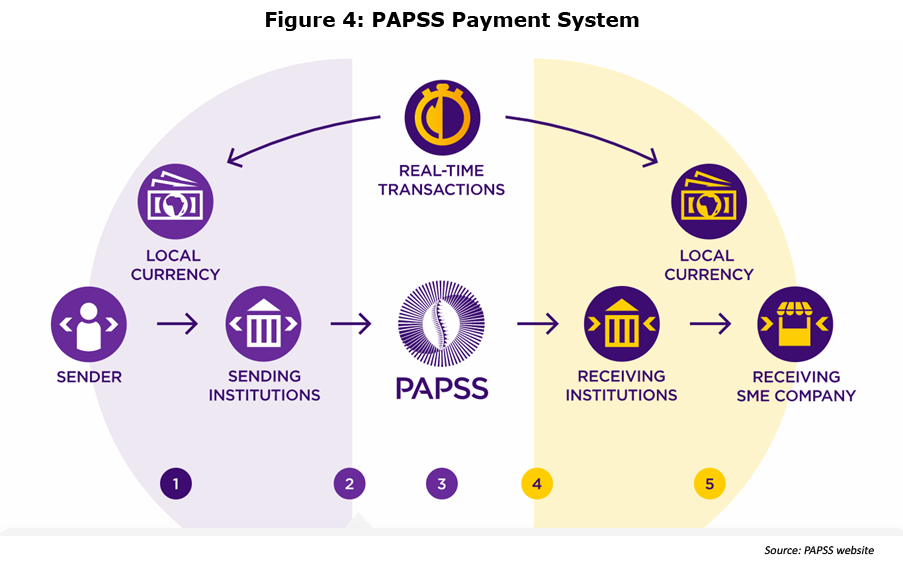

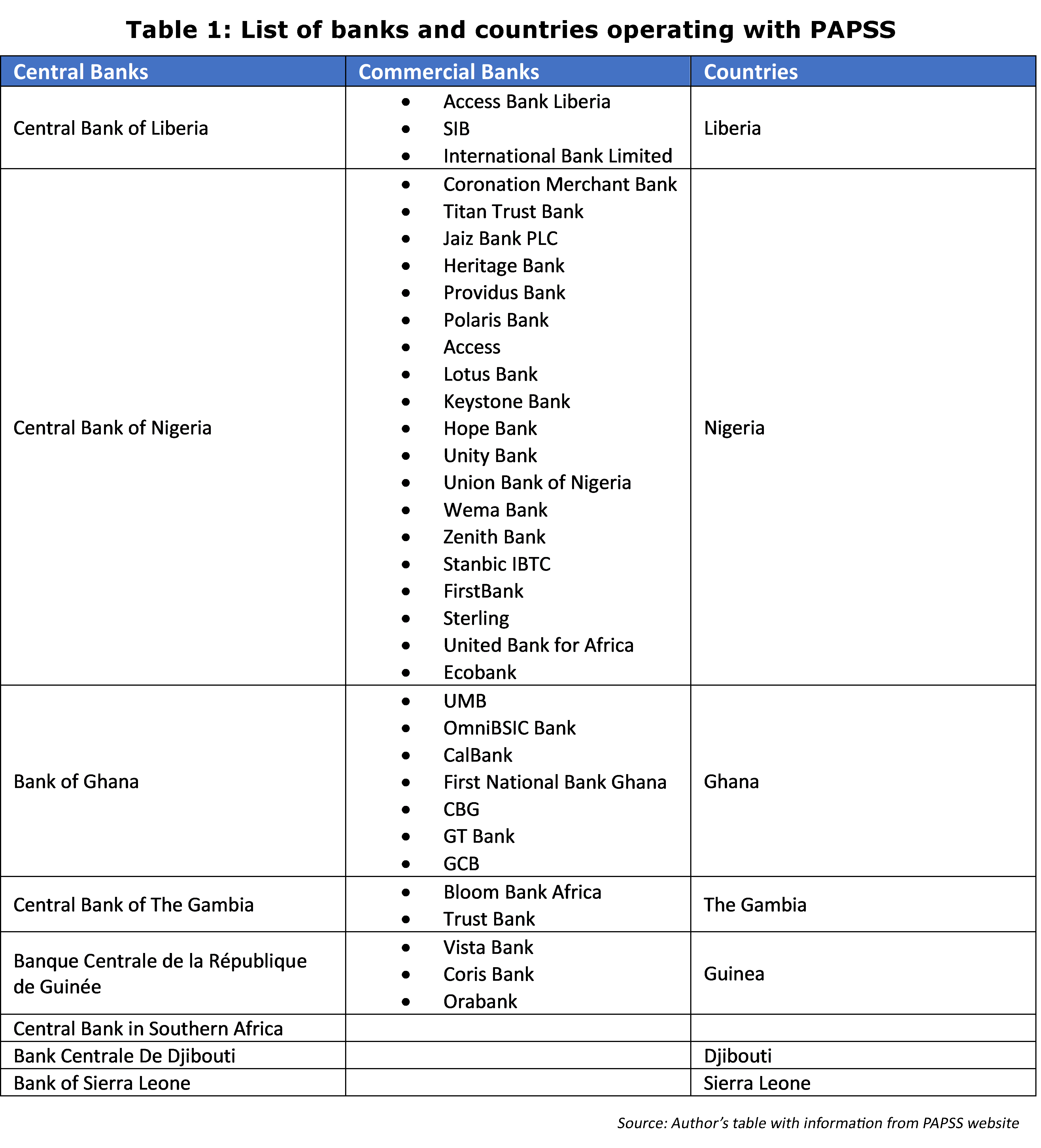

To facilitate a centralised intra-African payment and settlement system to support trade, the AfCFTA Secretariat and Afrexim Bank have developed PAPSS. The electronic payment system allows a trader to make cross-border payments in local currency (See Figure below for illustrative steps). Thus, it allows a buyer in Country A to make payment in his or her national currency and the seller in country B to receive payment in their local currency. This means that businesses across Africa will enjoy instant payments, which is projected to increase trust and trade volumes.[5] The system also aims to address complexities associated with cross-border payments, including jurisdictional and operational differences. While the payment system has been officially launched and successful trials conducted in eight countries, it has yet to be widely adopted.

Afrexim Bank estimates that PAPSS will save the continent at least five billion dollars in transfer and settlement charges.[6] Central banks of all the State Parties are expected to sign up by the end of 2024 followed by all commercial banks a year later.[7] PAPSS also plans to collaborate with other regional and continental cross-border payments systems to extend its range beyond the African borders to support the growth of trade and investments with the African continent.[8] For investors, this creates opportunities for businesses in the banking sector and emerging fintech ventures across Africa.

The Rules of Origin Manual and E-Tariff Book

The Rules of Origin (RoO) Manual sets out guidelines for rules and procedures determining the origin status of goods under the AfCFTA. The overall benefit for investors is that it allows exporters to enjoy reduced tariff rates if they obtain the certificate of origin. The RoO certificate is critical for trading as it shows where the goods originate and so qualify for preferential tariff treatment, or cheaper import taxes, within the ACFTA countries. For instance, in Kenya, applying for an RoO certificate has been made simple by the Kenya Revenue Authority (KRA) through a streamlined process which takes one working day to obtain one. The exporter is required to fill out an application form indicating the Harmonised system code (HS) of the product and export destination. This code is then indicated in the RoO certificate which is then checked against the HS list in the AfCFTA agreement. The RoO certificate aids the customs officials of the receiving (importing) country clear the goods. A small fee is typically charged by the national authority and in the case of Kenya a physical inspection is carried out by KRA before giving the certificate. Once the exporter gets the AfCFTA RoO certificate, they can export the good at the prevailing concessional AfCFTA tariff. Overall, the RoO manual gives investors the certainty that once a product is produced in Africa, it will meet the AfCFTA rules of origin requirements and benefit from free circulation across the continent without impediments.[9]

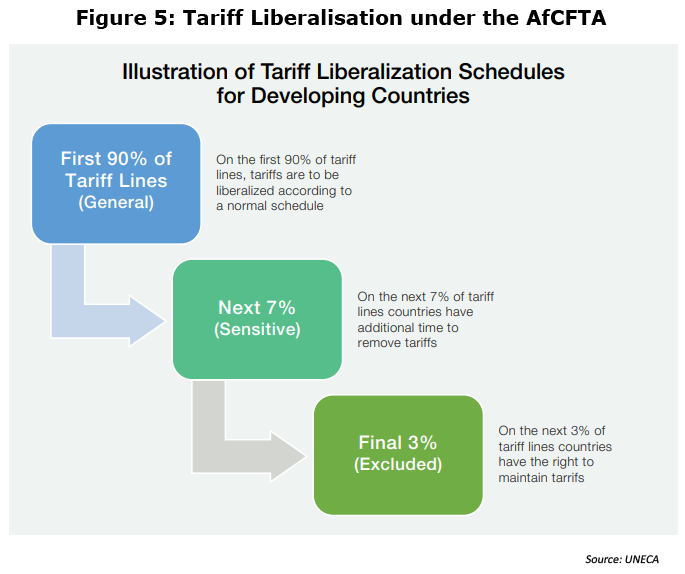

The E-Tariff Book sets out the tariff commitments for AfCFTA with approved and officially published tariff schedules. Under the AfCFTA, State Parties have committed to eliminating tariffs on 97% of tariff lines over an agreed period, while excluding a maximum of 3 percent of total tariff lines from liberalization. 90% of the 97% of goods will have tariffs removed over the course of five years in developing countries and ten years in the least developed countries (LDCs). While the remaining 7% of tariff lines fall under sensitive products. These will be reduced and eliminated over an extended timeframe. For developing countries, elimination will occur over 10 years, while the LDCs will eliminate tariffs over 13 years. To illustrate this, if you are a producer in one African country and want to export your goods to another, then you can expect tariffs to come down steadily. For example, a product in the 90% category imported by a developing African country in 2020 and charged a 30% duty would only be charged a 25% duty in 2021, a 20% duty in 2022 until the tariff is zero in 2026. This will help companies clarify and keep track of the changes in trade at the international and regional levels.[10] In real terms, this means that firms will be aware of the possible export opportunities but also the tariffs of potential export destinations under the AfCFTA, as well as the implications for competition from imports.

AfCFTA Non-Tariff Barrier (NTB) Online Monitoring Mechanism

NTBs are regulatory and procedural measures other tariffs and customs duties that hinder trade. Standard examples of NTBs include quantitative restrictions, sanitary and phytosanitary measures (SPS), technical barriers to trade (TBT), pre-shipment inspections, licensing procedures and administrative red tape. NTBs slow down the movement of goods and cost importers and exporters billions of dollars annually through excessive compliance costs, complex rules of origin, excessive document requirements, cumbersome packaging requirements and lengthy procedures at the borders. As a result, NTBs have a detrimental impact on intra-African trade. Cutting red tape and simplifying customs procedures will bring significant income gains.[11] UNCTAD estimates that African countries could gain US$20 billion each year by eliminating NTBs at the continental level – in contrast to the $3.6 billion they could gain by eliminating tariffs.[12] While the United Nations Economic Commission for Africa (UNECA) estimates that the AfCFTA has the potential to boost intra-African trade by 52.3% by eliminating import duties and could double trade if NTBs are also reduced.[13] Thus to tackle this challenge, the AU developed the AfCFTA NTB Online Monitoring Mechanism.

This mechanism was launched in 2019 and became operational in 2020 with a dedicated website.[14] The tool was designed for identifying, reporting, and monitoring NTBs. Hence any party including the private sector may register a complaint. The tool is operational, and parties are using the mechanism to lodge complaints. However, due to low trading under the AfCFTA, the effectiveness of the mechanism is yet to be fully tested. Issues including accessibility, and speed of processing complaints when all the countries are trading will be critical for the functioning of the mechanism. As of March 2023, six complaints have been lodged in total and one has been resolved.[15] Thus far, it appears the mechanism is functioning. This tool is critical especially for businesses to lodge complaints. It could also potentially evolve into an alternative mechanism available to companies to resolve some of their disputes encountered under the agreement.[16]

The AfCFTA Adjustment Facility Fund

With the financial backing of the Afriexim bank a $5 billion fund has been launched to assist AfCFTA member countries adjust to some of the short and medium term fiscal impact of the trade agreement. The so-called AfCFTA Adjustment Facility Fund is a combination of a base fund, general fund, and credit fund that will provide financing, technical assistance, grants and compensation. It is estimated the Fund will eventually require at least US$10 billion. No funds, however, have been disbursed yet since its launch in March 2023. Nonetheless, Afreximbank has invested over $1.7 billion recently in supporting the development of regional value chains to accelerate the process of industrialization and lift the supply-side constraints that have undermined the growth of African trade.

The AfCFTA Private-Sector Engagement Strategy

The AfCFTA Private-Sector Engagement Strategy was developed as an engagement plan to guide the Secretariat's efforts in collaborating with the private sector and other important stakeholders to boost intra-Africa trade and production. The engagement plan is the outcome of extensive consultations with industry players and associations in the priority value chains, development finance institutions and African Union institutions. Ultimately, the plan serves as a point of entry for the private sector to engage directly with the secretariat in identifying opportunities and how to benefit from the AfCFTA. For example, under the plan, five sectors with a high investment potential were selected - automotive; agriculture and agro-processing; pharmaceuticals; and transport and logistics. These were selected based on their potential to meet African demand through local production as well as their potential value as exports to the rest of the world. Together, these five sectors represent $130 billion in goods and services imports.[17] Through the engagement plan, businesses can better understand the AfCFTA's priorities and help boost trade. This plan is critical for businesses through access to information that goes beyond the negotiations and policy discussions throughout the implementation process. In addition, it also provides opportunities for business associations with the technical expertise to develop accessible tools for firms to better understand the implications and new market opportunities.[18]

The AfCFTA Dispute Settlement Mechanism (DSM)

Trade disputes arise when State Party believes that another State Party has violated a commitment it has made under the trade agreement. For example, under the WTO a dispute would arise if a State Party C imposed an import on certain products without proper justification of the measure. that would result in a dispute for State Parties that export that product to that country. Hence, the Appellate Body would rule in favour of State Parties exporting that product under WTO rules Article XX (g) (general exceptions) and Article XI (prohibition on quantitative restrictions). It is in this context that the AU members established a Dispute Settlement Mechanism (DSM) with a Dispute Settlement Body (DSB) under the Protocol on Rules and Procedures on the Settlement of Disputes (the Protocol).[19]

The DSB is not fully functional, however, but the process is already underway. Appellate body members have been selected and awaiting final approval by the member states. This body is critical as it is the only body dedicated to dispute settlement under the AfCFTA. However, the protocol only mandates settling inter-state disputes. It does not assist the private sector. Their recourse to remedies will largely depend on the home states where their investment is. Ultimately, private parties will have to look to other forms of dispute settlement available including bilateral investment treaties, and domestic courts among others. For investors, it will be crucial to consider the territory of investment and how the rule of law is implemented. Dispute settlement by an independent and impartial adjudicating system is a central element in providing security and predictability.

However, considering that African countries have little history of litigating against each other under the WTO it remains to be seen how frequently the AfCFTA DSM will be used for dispute resolution. For now, State Parties have been subject to the investor-state dispute settlement mechanism under another DSM at the International Centre of Settlement of Investment Disputes (ICSID) and those were all instituted by investors.

Other initiatives such as the Automotive Fund Strategy which is critical for the automotive sector are not operational. The Automotive Fund is an instrument with a Strategy within the AfCFTA framework to facilitate continental values in the automotive sector. However, the Fund is not operational as negotiations on RoO are still ongoing which are critical to the automotive value chains in Africa.

What it means for investors

The AfCFTA is about to become the world’s largest free trade area which means the creation of a large single market with free movement of goods and services. Significantly, markets and economies across the continent will be reshaped, leading to the creation of new industries and the expansion of key sectors.[20] In furtherance of this, the agreement would also boost African states' competitiveness on the world stage by eliminating tariffs, reduction in input costs and facilitating the integration of African products into global supply chains. It is anticipated that having tariff-free access to a sizable, unified market will motivate manufacturers and service providers to boost output. As demand rises, production will follow, resulting in lower unit costs. According to the Mo Ibrahim Foundation, if successfully implemented, the AfCFTA could generate a combined consumer and business spending of $6.7 trillion by 2030.[21] Ultimately, opportunities abound, and the AfCFTA promises to diversify markets, attract foreign investment, and increase competitiveness and integration into global value chains among others. With the operational tools already in place, the AfCFTA promises to increase Africa’s exports and overall welfare.

References

[1] WEF, 6 Reasons why the AfCFTA is a Game Changer. https://www.weforum.org/agenda/2021/02/afcfta-africa-free-trade-global-game-changer/

[2] WEF, 6 Reasons why the AfCFTA is a Game Changer. https://www.weforum.org/agenda/2021/02/afcfta-africa-free-trade-global-game-changer/

[3] The World Bank, The African Continental Free Trade Area: Economic and Distributional Effects. https://openknowledge.worldbank.org/server/api/core/bitstreams/ef1aa41f-60de-5bd2-a63e-75f2c3ff0f43/content

[4] On implementing the AfCTA in 2021 - https://trade4devnews.enhancedif.org/en/op-ed/implementing-afcfta-2021 Trade for Development news

[5] Ibid, AU, The AfCFTA Guided Trade Initiative 2022.

[6] Remarks Delivered by Professor Benedict Oramah , President of African Export-Import Bank at the 12th Extraordinary Summit on Industrilaisation and Economic Diversification and the Extraordinary session on the AfCFTA, November 25, 2022 https://au.int/ar/node/42422

[7] World Economic Forum, AfCFTA A New Era for Global Business and Investment in Africa, 2023. https://www3.weforum.org/docs/WEF_Friends_of_the_Africa_Continental_Free_Trade_Area_2023.pdf

[8] PAPSS announces collaboration with Buna to build a payment gateway between Africa and the Arab region. https://papss.com/media/papss-announces-collaboration-with-buna-to-build-a-payment-gateway-between-africa-and-the-arab-region/

[9] UNECA (2023). AfCFTA What You Need to Know https://repository.uneca.org/bitstream/handle/10855/49411/b12025574.pdf?sequence=3&isAllowed=y

[10] World Economic Forum, AfCFTA A New Era for Global Business and Investment in Africa, 2023. https://www3.weforum.org/docs/WEF_Friends_of_the_Africa_Continental_Free_Trade_Area_2023.pdf

[11] WEF, 6 Reasons why the AfCFTA is a Game Changer. https://www.weforum.org/agenda/2021/02/afcfta-africa-free-trade-global-game-changer/

[12] African Union Unveils Online Platform to tackle non-tariff barriers. https://africabusinesscommunities.com/tech/tech-news/african-union-unveils-online-platform-to-tackle-non-tariff-barriers/

[13] African Union Unveils Online Platform to tackle non-tariff barriers. https://africabusinesscommunities.com/tech/tech-news/african-union-unveils-online-platform-to-tackle-non-tariff-barriers/

[14] AfCFTA Non-Tariff Barriers Online Monitoring Mechanism. https://www.tradebarriers.africa/

[15] Active complaints - https://www.tradebarriers.africa/active_complaints

[16] Kholofelo Kugler- The AfCFTA Success Depends on Effective Dispute Settlement Mechanism for the Private Sector. https://www.researchgate.net/publication/359530078_The_AfCFTA's_Success_Depends_on_Effective_Dispute_Settlement_Mechanisms_for_the_Private_Sector

[17] World Economic Forum, AfCFTA A New Era for Global Business and Investment in Africa, 2023. https://www3.weforum.org/docs/WEF_Friends_of_the_Africa_Continental_Free_Trade_Area_2023.pdf

[19] Protocol on Rules and Procedures on the Settlement of Disputes https://au.int/sites/default/files/treaties/36437-treaty-consolidated_text_on_cfta_-_en.pdf

[20] WEF, 6 Reasons why the AfCFTA is a Game Changer. https://www.weforum.org/agenda/2021/02/afcfta-africa-free-trade-global-game-changer/

[21] WEF, 6 Reasons why the AfCFTA is a Game Changer. https://www.weforum.org/agenda/2021/02/afcfta-africa-free-trade-global-game-changer/