FDI in Africa goes green as investment outlook turns dim

Renewable energy potential remains a bright spot even as foreign investments shrinks

By Ronak Gopaldas

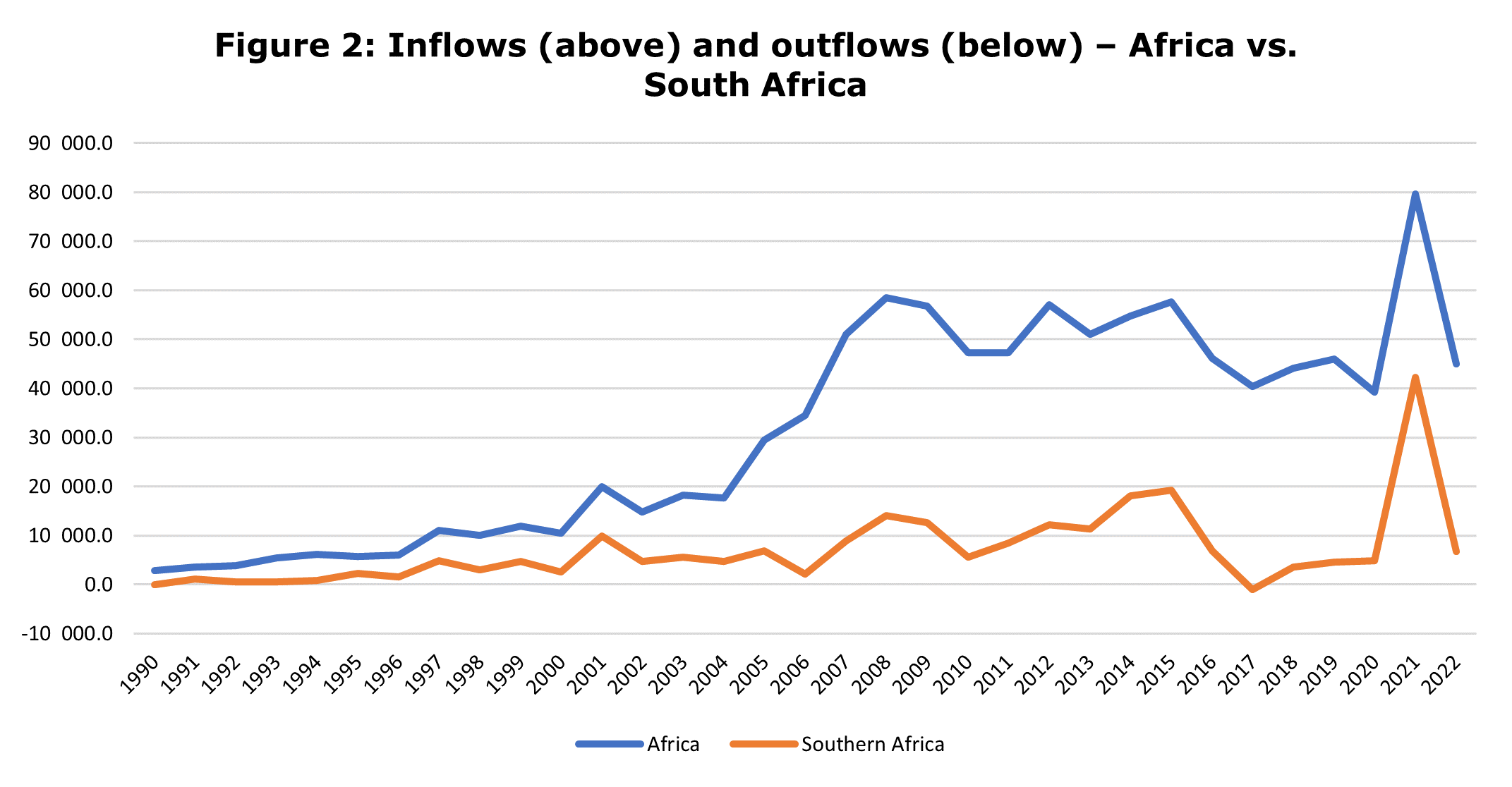

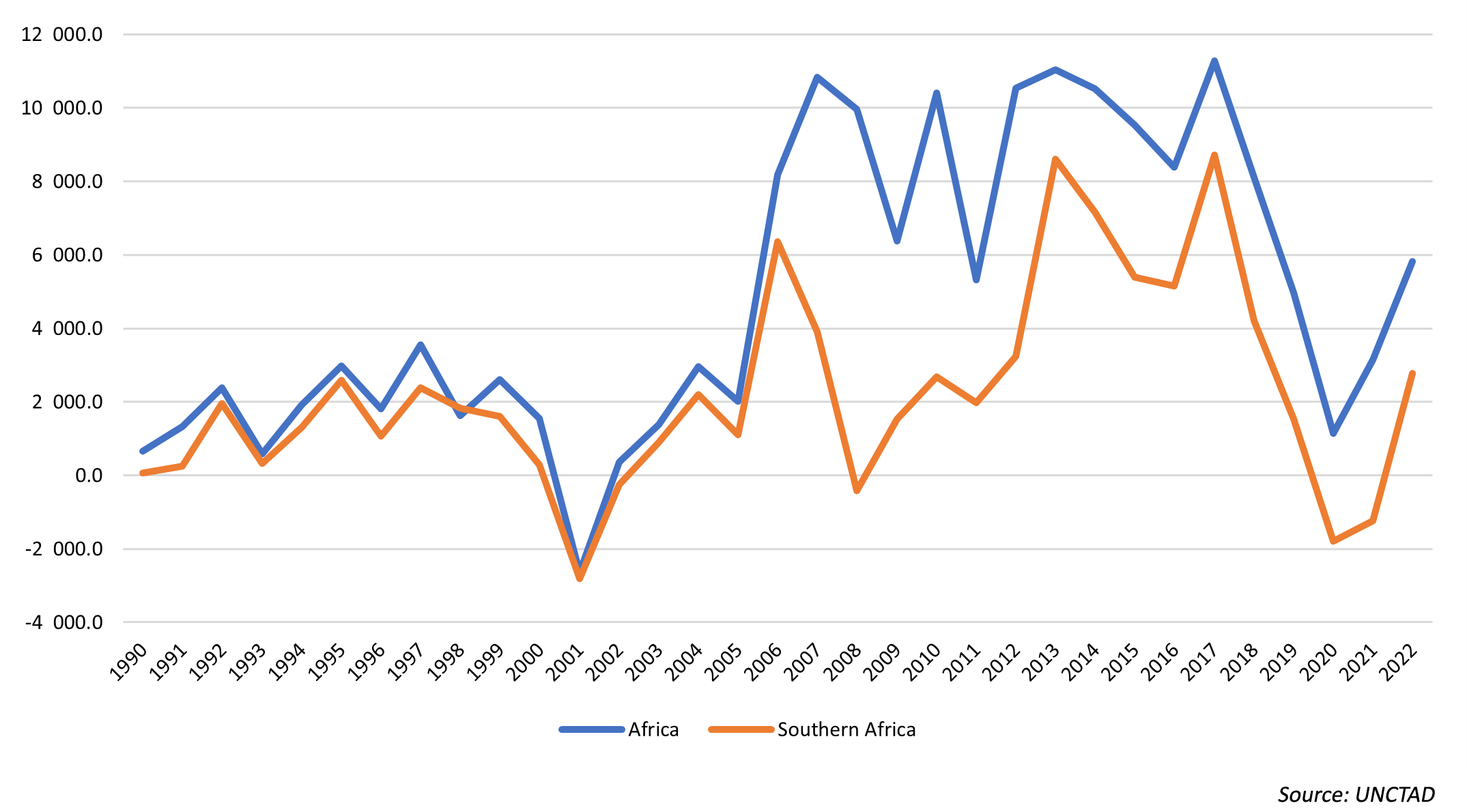

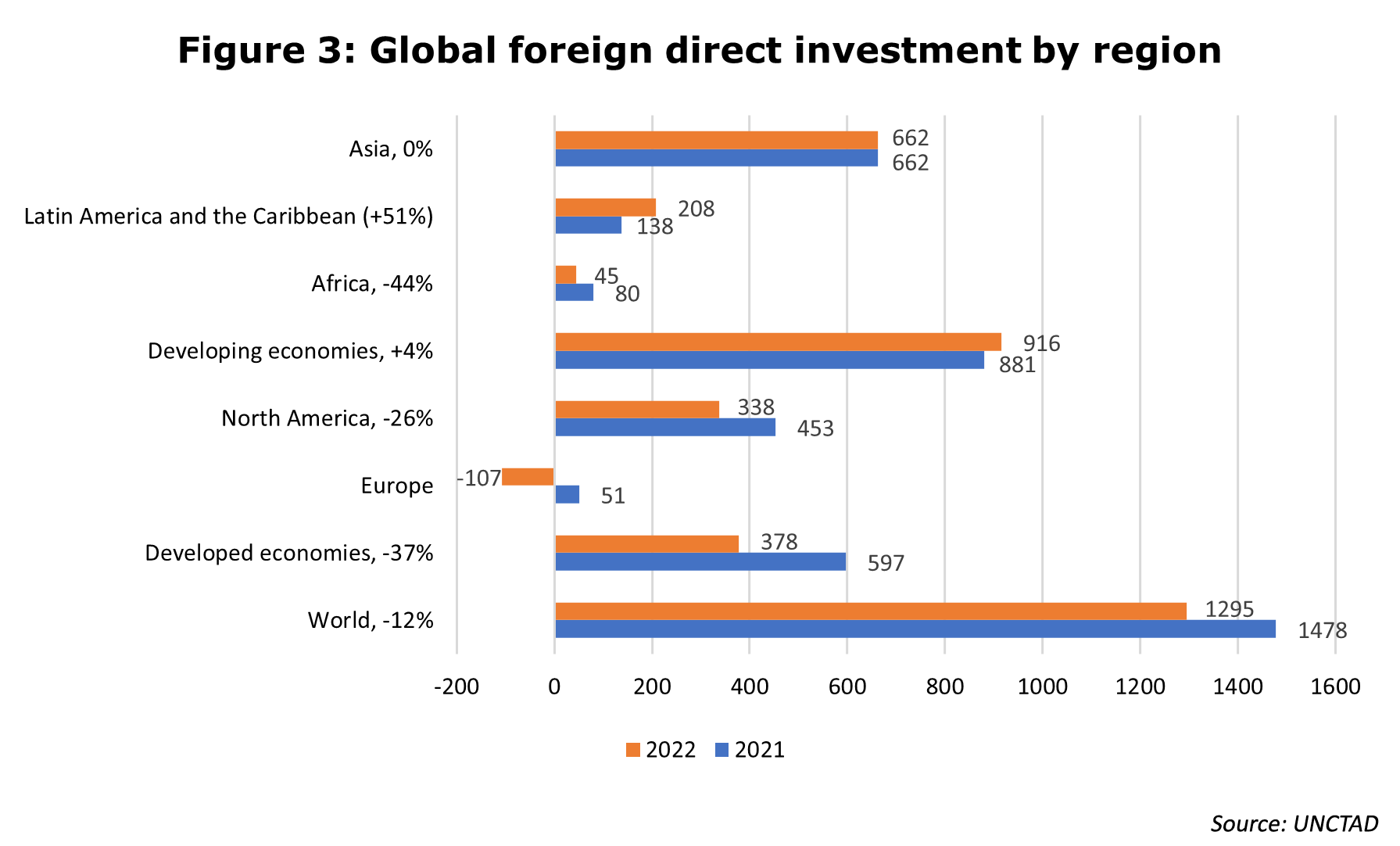

The United Nations Conference on Trade and Development’s (UNCTAD) 2023 World Investment report (WIR) shows that foreign direct investment (FDI) into Africa fell 44% to US$45bn in 2022 from the record US$80bn in 2021. At face value, it is a very concerning trend reversal. The reality, however, is more nuanced and there are important reasons not to be too pessimistic about the headline figure. Stripping out a one-off event that inflated the FDI growth figure for Africa in 2021, African FDI still grew at 7% year-on-year, certainly more modest but still ahead of continental growth.

The medium-term economic outlook, however, is deteriorating and African countries are going to have to look at new areas of competitive advantage if they want to grow or even maintain their share of global foreign direct investment flows.

An uncertain economic outlook

Africa accounts for just 3.5% of global FDI.[1] African countries face multiple headwinds and some are likely to negatively impact FDI over the short to medium term. The era of ultra-accommodative monetary policy is over. Despite rate hikes inflation remains stubbornly high in both developed (DM) and emerging (EM) markets. While higher inflation was stoked by record low rates and Covid-19 induced supply disruptions, its trajectory has been aggravated by the war between Russia and the Ukraine, both major global grain producers and exporters. Russia is also a major oil and gas producer and sanctions have seen a spike in energy prices. Add elevated corporate, household, and sovereign debt (US$15trn) accumulated during the low interest rate cycle and global growth prospects look dim over the short to medium-term.

Geopolitical tensions have added to investor concerns. Mixed messages from the US on its Taiwan stance have annoyed China while the Chinese continue to provoke the Taiwanese. The world’s two largest economies are already at odds on how to manage Russia’s invasion of Ukraine. At the same time, the US, EU countries and China are also competing for a foothold in Africa.

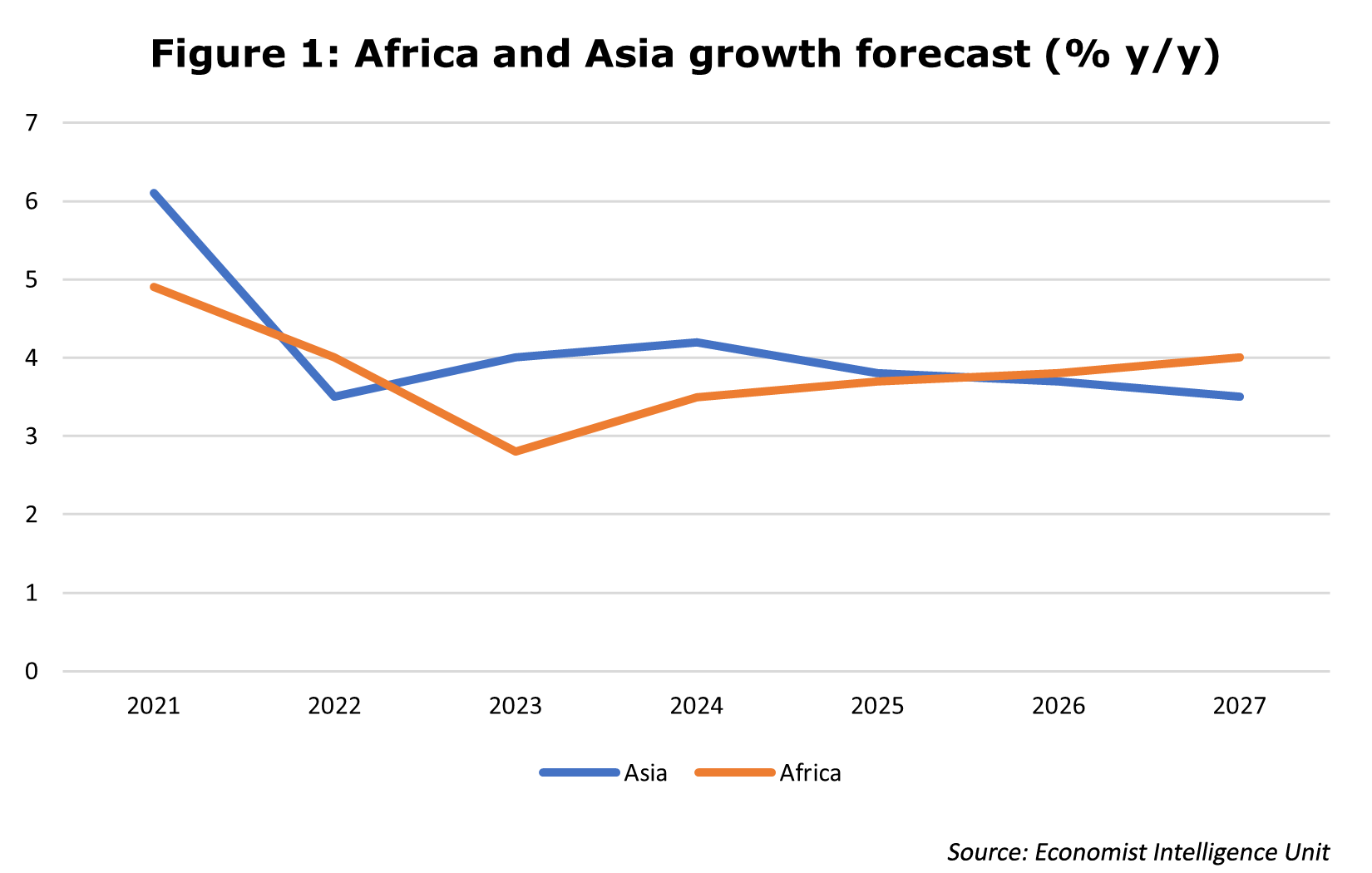

Perhaps more worrying for investors is the level of market uncertainty. Hopes of US Federal Reserve easing interest rates have been dashed multiple times. While consumer prices in the US have eased, the Fed remains cautious. In China, consumer and business sentiment has turned negative creating expectations of fiscal stimulus. The result has been that financing is harder to come by, and more expensive, and investors are adopting a wait-and-see approach until economic clarity begins to surface. Africa has by no means been immune to the fallout. FDI in Africa fell sharply in 2022, and the prospects for 2023 and the following two years are less sanguine (figure 1).

70% of global FDI is going to emerging markets. But FDI to Asia is 15 times the size of African inflows (figure 3). The forecasted African growth outlook is also less persuasive over the short-term, although it is predicted to bottom out in 2023 and eventually surpass Asian growth rates from 2025.

As challenging as the outlook may be, Africa is still a compelling investment case. It delivers market-beating returns, has developmental gaps that need bridging, and is likely to remain pivotal to the energy security of the developed world.

Searching for Alpha in Africa

The fall Africa experienced in foreign direct investment in 2022 is in large part, due to the corporate structural reconfiguration of South African technology and communications company, Prosus / Naspers[2] the prior year. The transaction, which saw various companies in the group spun out and listed under Prosus in the Netherlands resulted in a sharp inflow of funds into South Africa, after which much was repatriated (outflows) to the newly listed entity. The US$42bn deal[3] was bigger than the total investment into the rest of the continent that year (2021) and nearly 10 times what South Africa receives on average annually.

On the face of it, it was a hugely positive investment injection but the following year (2022), that investment left the country just as quickly as it arrived. This points to an important challenge that South Africa – and indeed Africa - needs to overcome, not just attracting FDI, but retaining it. The volatility of inflows and outflows impacts everything from balance of payments to currency stability and employment. Longer term investment projects will go a long way to smoothing continental economic and currency volatility.

Discounting the impact of the one-off Prosus/Naspers transaction, FDI into Africa nevertheless increased by 7% year-on-year in 2022 to US$45bn , with much of the investment going to energy, renewables and mining.

(note: NET FDI inflow = FDI Inflow – FDI outflow)

(note: NET FDI inflow = FDI Inflow – FDI outflow)

The jump in North African FDI was mainly the result of large mergers and acquisitions (M&A) activity in Egypt.[4] The current economic challenges faced by Egypt and an IMF engagement for a US$3bn facility has seen the government commit to offering selling off stakes in 32 state owned companies spanning sectors such as water, banking, energy and petrochemicals.[5] Announced greenfield projects in Egypt have also doubled to 161. Investments from Saudi Arabia and the UAE will likely boost FDI in 2023 despite the high base of 2022.[6] In East Africa, Ethiopia, which remained the second largest FDI recipient on the continent, saw inflows moderate to US$3.7bn with investors taking advantage of a recently announced tax and import duty exemption for capital goods in order to drive growth at its industrial parks. As in the case of Egypt, the country is moving toward privatisation, selling off a 40% stake in state-owned Ethio Telecom. FDI to Uganda (Lake Albert Oil field JV and East African Crude Oil Pipeline). West African FDI investment was hurt by a net US$187mn outflow from Nigeria (equity divestments). Nevertheless, greenfield project announcements in the country increased 24% with Indian Bharti Airtel subsidiary, Airtel Nigeria, announcing the development of a US$731m data centre.

Investors see a green energy future in Africa

The economic and geopolitical fallout from the war in Ukraine (energy supply concerns) as well as the pressure on countries to decarbonise and shift power generation from fossil fuels to renewables (COP27) has seen an increased investor interest in projects aimed at shoring up energy security. Africa, which has some of the largest stores of untapped renewable energy potential has been a notable beneficiary.

North Africa’s abundant solar potential, renewable energy investment as a feed-in for the production of green hydrogen, and the region’s proximity to Europe make it ideally placed to supply European countries with electricity and clean hydrogen and the region could truly become a hotbed of FDI by European green energy investors. In 2023, Indian renewable energy firm ACME Group announced the development of a US$13bn plant to produce 2.2 million tonnes of green hydrogen while its local competitor ReNew Power is planning a US$8bn green hydrogen plant in the Suez Canal Economic Zone. UAE-based water solutions provider Metito, South African renewable energy firm Scatec and Egypt’s Orascom Construction are also in talks to build, own and operate a 400MW, US$1.5bn solar powered desalination plant in Egypt.[7] In Morocco, the US$213m Dakhla Agriculture project will convert 52 square kilometres of unused land into a fruit, vegetable and animal feed producing region serviced by solar energy and desalinated water.[8] In Tanzania the Masdar renewable energy project accounted for US$2.5bn worth of FDI investments received in 2022. Although East Africa has extensive renewable energy potential, the region did not receive as much renewable energy investment as North Africa and Southern Africa, with projects largely remaining extractive.

In Central Africa, Niger announced the construction of a 16MW diesel processing facility, a 15 MW battery storage facility and a 16 MW solar power plant sponsored by Enernet Global of the US as well as a German sponsored green hydrogen project although these investments are at best likely to be paused given the recent coup.[9]

Investments in West and Central Africa remain dominated by infrastructure, mining and oil and gas, but are now seeing a shift toward renewable energy. In Nigeria Sun Africa of the US will begin building a 936MW solar power plant and 443 megawatt-hour battery storage facility for US$1.8bn. While FDI to Ghana fell 39% to $1.5bn and Senegalese FDI remained unchanged at US$2.6bn, Senegal announced a Saudi sponsored 300,000 cubic metre per day reverse osmosis plant. Ghana has unveiled has plans to diversify its energy mix toward renewables.

South Africa and Mozambique were by far the biggest recipients in 2022, receiving inflows of US$9bn and US$2bn respectively. South Africa’s 2022 inflows are still double the average of the past decade as the country embarks on large renewable energy projects to ease its crippling energy supply shortages. One such project is the recently announced US$10bn South African Green Hydrogen project.[10]

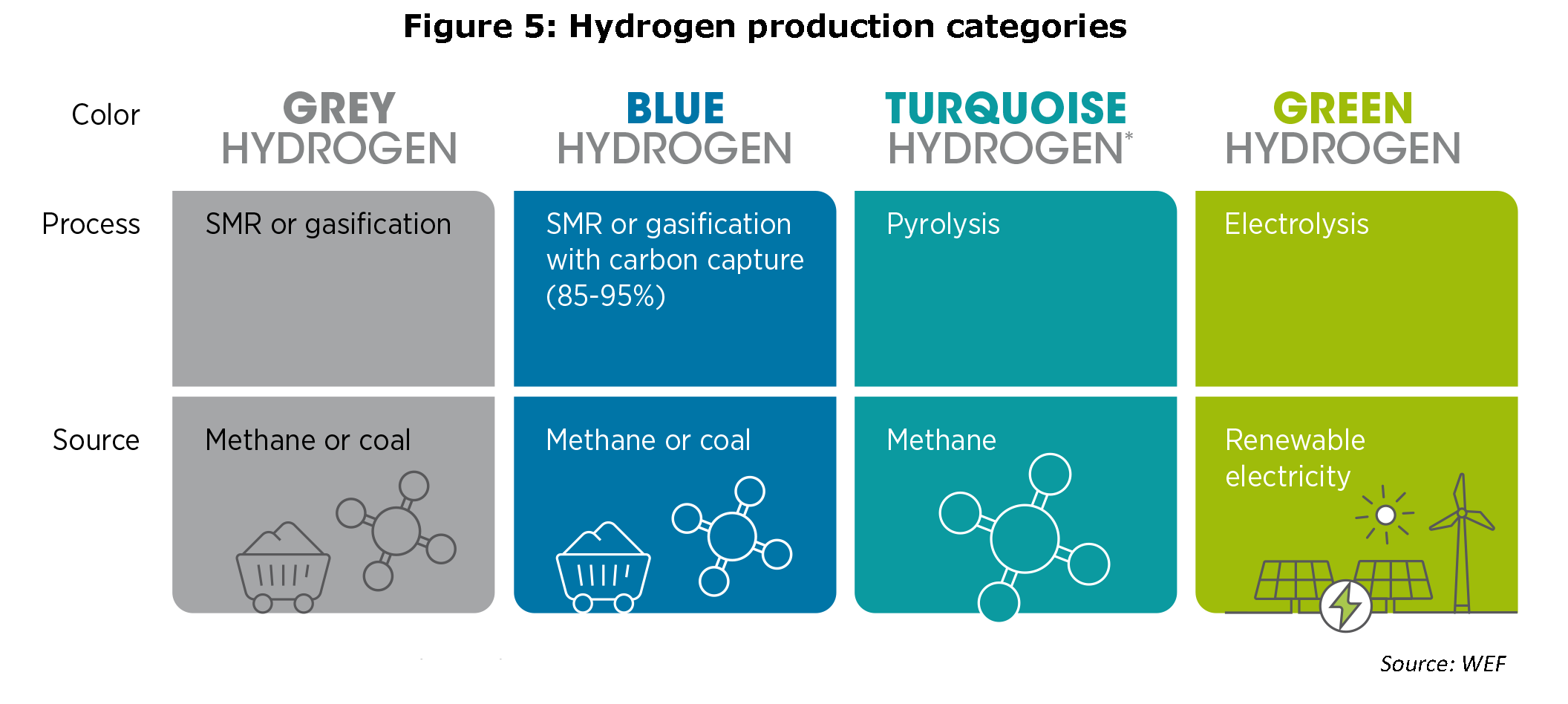

There has never been a better opportunity for Africa to seize on the heightened foreign investment interest in green energy. But it must use that to bridge the wide energy access gap at home as much as to raise hard currency through exports. Take green hydrogen, for example. Most of the FDI made in the production of green hydrogen in Africa is for exports – not for the purpose of domestic consumption. Global demand for hydrogen reached 87 million metric tons in 2020 and is expected to exceed 500 million metric tons by 2050.[11] When the source of energy required to split water molecules is renewable the resulting hydrogen produced is called Green hydrogen. Currently, only 0.1% of the global hydrogen production is generated is green, but falling cost of renewable energy and a gradual shift away from fossil fuel is likely to see green hydrogen become the dominant form, powering everything from power stations to cars and homes in the not too distant future[12], and Africa could become a top source of this form of energy.

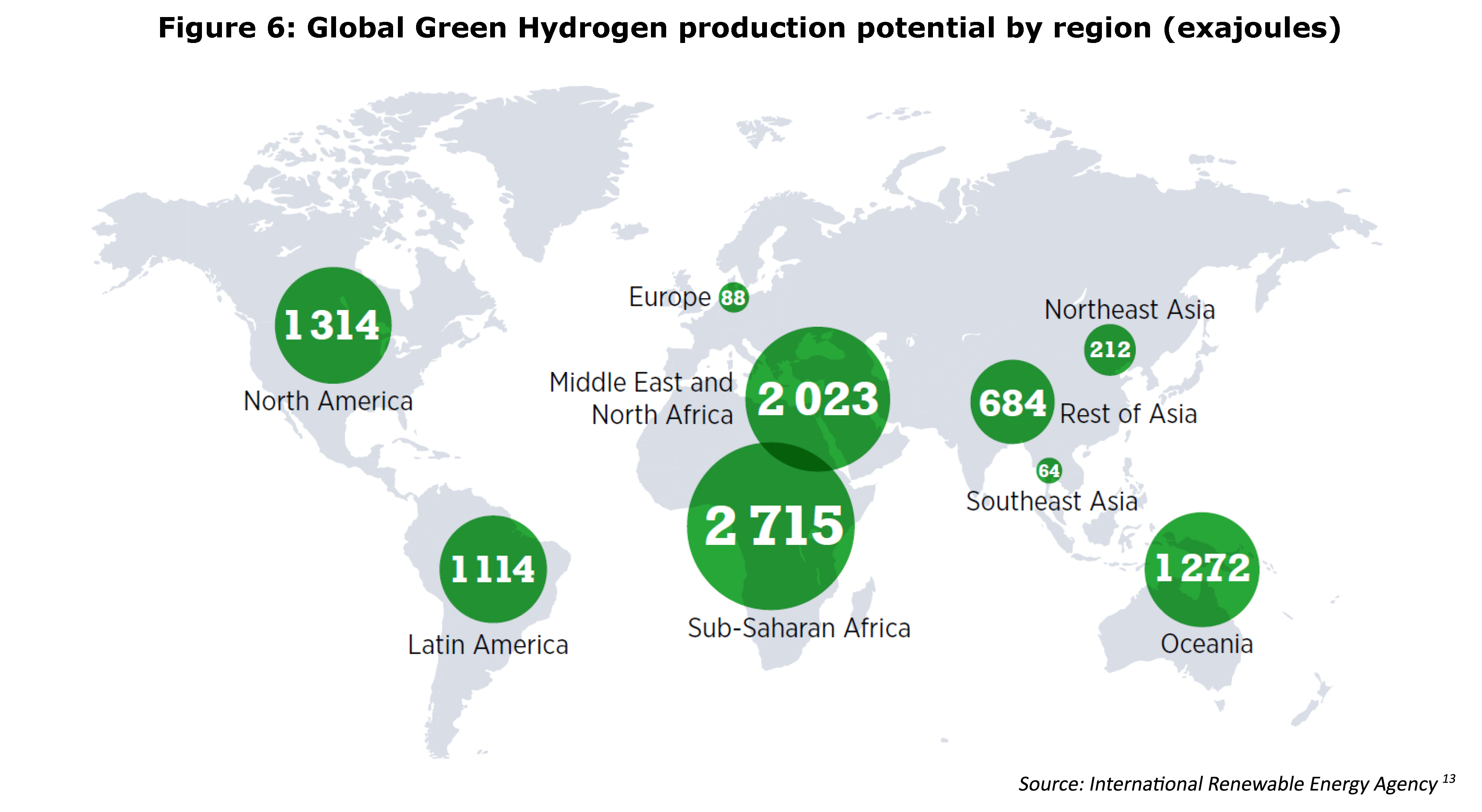

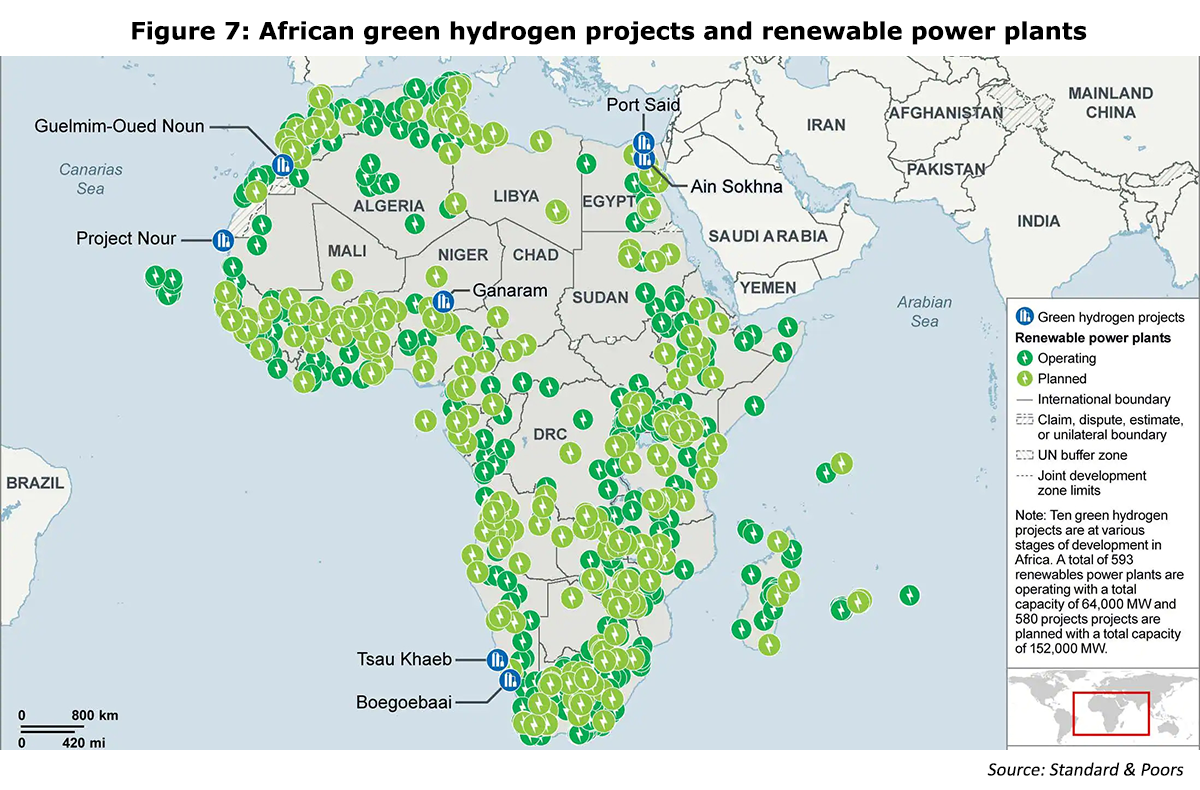

The total green hydrogen potential in Africa is estimated to be 50m tonnes annually by 2035. Standard and Poor estimates show that there are at least ten green hydrogen power projects in various stages of development all across Africa.

The total green hydrogen potential in Africa is estimated to be 50m tonnes annually by 2035. Standard and Poor estimates show that there are at least ten green hydrogen power projects in various stages of development all across Africa.

1 exajoule (EJ) = 1018 (one quintillion) joules

South Africa, however, may be something of an outlier. It is perhaps the only notable African country (except for Morocco) that stands to benefit most from the entire production value chain of green hydrogen. It has the skilled labour force that can be employed readily; and established commercial off-takers that can purchase and use the green hydrogen for domestic use. South Africa is embarking on US$18bn worth of green hydrogen projects over the next decade.[14] The country has also attracted several battery storage projects ranging in capacity from 35MW to 300 MW. Namibia announced in 2021 a US$9.4bn green energy project set to enter production in 2026, generating 2 gigawatts of renewable electricity that could be bought by South Africa. Kenya, Mauritania, Morocco, Nigeria, Niger, and Egypt have all secured foreign funding commitments from the likes of the US, UK, Germany, France, Portugal, Japan, China, South Korea and Saudi Arabia (figure 7). Importantly, it is private sector multinationals such as Enel (Italy), Linde (UK) and Air Liquide (France) that are helping drive African investment. Chariot Limited, the UK firm building green hydrogen and renewable facilities in Mauritania recently acquired Singaporean ENEO to integrate the company’s solar powered reverse osmosis technology into its Project Nour Development.[15] [16] Singapore itself is pushing to move away from its almost complete dependence on natural gas for energy and has tasked several private sector firms with developing a green hydrogen value chain, and Africa could prove a valuable partner.[17]

For Africa, green hydrogen could be the longer-term cherry on top. Its immediate requirements are for energy generation and distribution. The investment in green hydrogen plants, which first requires extensive wind and solar energy investment, is a means to that end. Despite the push for green hydrogen, it is important to note that the technology to produce it is still a long way from maturity. Production costs remain prohibitively high and funding these ventures would require long term foreign commitment. Nonetheless, it is one area where Africa retains a distinct competitive advantage and is therefore likely to see continued foreign investor interest despite the global outlook for FDI turning dim.

For Africa, green hydrogen could be the longer-term cherry on top. Its immediate requirements are for energy generation and distribution. The investment in green hydrogen plants, which first requires extensive wind and solar energy investment, is a means to that end. Despite the push for green hydrogen, it is important to note that the technology to produce it is still a long way from maturity. Production costs remain prohibitively high and funding these ventures would require long term foreign commitment. Nonetheless, it is one area where Africa retains a distinct competitive advantage and is therefore likely to see continued foreign investor interest despite the global outlook for FDI turning dim.

References

[1] OECD. FDI in Figures. OECD. [Online] April 2023. https://www.oecd.org/daf/inv/investment-policy/FDI-in-Figures-April-2023.pdf.

[3] Reuters. South Africa FDI inflows jump in 2021, securities outflows soar. Reuters. [Online] March 29, 2022. https://www.reuters.com/world/africa/south-africa-fdi-inflows-jump-2021-securities-outflows-soar-2022-03-29/.

[4] Lutfi, Rawan. A positive outlook for M&A activity in Egypt despite a slight downturn in 2022: Baker McKenzie Report. Baker McKenzie. [Online] February 2023. https://www.bakermckenzie.com/en/newsroom/2023/02/ma-activity-in-egypt-despite-a-slight-downturn-in-2022#:~:text=14%20February%202023-,A%20positive%20outlook%20for%20M%26A%20activity%20in%20Egypt%20despite%20a,in%202022%3A%20Baker%20McKenzie%20Report&text.

[5] Ahram. 32 Egyptian state companies' shares to be sold within a year: PM Madbouly. Ahram. [Online] February 8, 2023. https://english.ahram.org.eg/News/487781.aspx.

[6] A.Moneim, Doaa. Egypt’s M&A activity shrinks to $4.2 bln in 2H of 2022: Baker McKenzie. Ahram. [Online] February 16, 2023. https://english.ahram.org.eg/News/488191.aspx.

[7] Aquatechtrade. Egypt's renewable Powered desalination plans progress ahead of COP27. Aquatechtrade. [Online] March 3, 2022. https://www.aquatechtrade.com/news/desalination/egypt-set-to-build-1-5-billion-desalination.

[8] Rahhou, Jihane. Morocco Launches Tender for $213 Million Farming Project in Dakhla. Morocco World News. [Online] September 9, 2022. https://www.moroccoworldnews.com/2022/09/351265/morocco-launches-tender-for-213-million-farming-project-in-dakhla.

[9] Landry Signé, Adrianna Pita. What underlies the coup in Niger? Brookings. [Online] August 9, 2023. https://www.brookings.edu/articles/what-underlies-the-coup-in-niger/.

[10] Largue, Pamela. Green hydrogen projects blazing a trail in South Africa. Power Engineering. [Online] May 17, 2023. https://www.powerengineeringint.com/hydrogen/green-hydrogen-projects-blazing-a-trail-in-south-africa/.

[12] Iberdrola. Green hydrogen: an alternative that reduces emissions and cares for our planet. Iberdrola. [Online] 2022. https://www.iberdrola.com/sustainability/green-hydrogen.

[14] Yohannes, Bitsat. Green Hydrogen – A viable option to transform Africa's energy sector? United Nations. [Online] 2022. https://www.un.org/osaa/news/green-hydrogen-%E2%80%93-viable-option-transform-africas-energy-sector.

[16] Burger, Johan. Tapping into Africa’s green hydrogen potential. Nanyang Technological University. [Online] 2021, 19 November.

[17] Tani, Mayuko. Singapore hydrogen strategy draws local energy firms, foreign tech. Nikkei Asia. [Online] February 3, 2023. https://asia.nikkei.com/Business/Energy/Singapore-hydrogen-strategy-draws-local-energy-firms-foreign-tech.

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)