Will Africa benefit from another commodity supercycle?

The United Nations defines a ‘supercycle’ as a decades-long, above-trend movement in a wide range of base material prices generated by shifting demand.

by Ronak Gopaldas

The first one came in the mid-2000s. Then, commodity prices rallied from a low of 60% below the long-term commodity price index at the start of the cycle, to 40% above the long-term average, with many commodities more than doubling in price over less than five years. During that cycle, Africa’s economy and fiscal position benefitted enormously. It was hard to find any losers. Africa saw solid and sustained economic growth. South Africa, Mozambique, Angola, Nigeria, and Zambia were just a handful of the many African countries that reaped the benefit of surging demand and stratospheric prices. But they were ultimately victims of their early success, having prepared inadequately for a turn in the cycle. Political uncertainty, poor policy and implementation, corruption, and the shock of the Covid-19 pandemic have left many African countries highly indebted. Early this year three global banks – Citi, Goldman Sachs, and JP Morgan - foresaw the beginning of another supercycle. Commodity prices received a significant lift from record fiscal stimulus, interest rate lows, and the rapid recovery in Chinese economic growth. Oil, natural gas, gold, copper, and many other mineral prices continue to push higher, suggesting the world is entering a structural bull market for commodities akin to the mid-2000s. But for a continent so dependent on commodity production and exports its governments invested little of the proceeds in infrastructure and sustainable growth. Can the continent find a way to protect itself from these boom and bust cycles?

Africa has a narrow window of opportunity to recover from the devastating impact of the pandemic, leverage the recent commodity upcycle and avert a repeat performance of the past when the gains made out of rising commodity prices were squandered. But this will require political will to resist populism and invest for the future (especially in infrastructure). This piece addresses five critical questions:

1) Do Africa’s economies occupy a very different space today?;

2) Must bad politics always result in bad economics?

3) How can Africa forsake short-term gains for long-term sustainability?;

4) Will Africa learn from the past?; and

5) Can Africa accelerate private sector growth and economic diversification?

What is different about the commodity price rise this time around

The first commodity supercycle coincided with the exceptional growth of China. The Asian industrial powerhouse clocked an average annual GDP growth of 10% between 1992 and 2008.

Figure 1:

That drove the demand for commodities such as iron ore, coal, copper, and oil. During this period, the price of oil nearly tripled from US$50 per barrel to US$147 per barrel, while iron ore rocketed from less than US$ 50 per tonne to just north of US$200 per tonne (Figure 2).

Figure 2:

The first commodity supercycle impacted more than industrial minerals. Rising consumer affluence in China also spurred demand for vehicles and jewellery. It boosted demand for platinum and diamond as well and Sub-Saharan Africa (SSA) benefitted handsomely. Its economic growth averaged nearly 6% during this time (Figure 3).

Figure 3:

The spinoffs for African economies were immense. Commodity exports soared along with prices. (Figure 4.)

Figure 4:

Mining majors invested heavily in the continent to cash in on the boom. They also hired more staff to meet higher production requirements. Rising employment and increased incomes spurred domestic household consumption. SSA registered an average annual GDP growth of 3.3% during this period, well ahead of the global average of 2.5%[1]. Foreign direct investment (FDI), infrastructure expenditure and exports saw revenues soar. Fiscal deficits narrowed dramatically, and some governments even reported budget surplus.[2] One after another African economies saw their sovereign credit ratings improve. China’s rise was a golden period for much of the continent.[3]

The situation today is very different from those heady days. The consequences of the 2008 global financial crisis, disunity in Europe, deteriorating ties with the US, and the disruption caused by Covid-19 have seen Chinese growth slow and placed the African continent in a far weaker fiscal position than what had been at the onset of the last commodity supercycle.

Economic growth slowed significantly following the global financial crisis, which led to the fall in commodity prices. The price of oil dropped by more than half and is yet to recover.[4] Sino-American relations soured after former US President Trump imposed punitive tariffs on Chinese imports. Weaker demand for Chinese-made goods in the US in turn resulted in the softening of demand for African raw materials from Chinese manufacturers. But just as the world economy was beginning to recover [5] came Covid-19. For Africa, the abrupt trade disruption caused by the pandemic has led to a slide in commodity prices and worsening fiscal condition. The additional costs imposed on the state as a result of the health crisis have put public finances under stress. Many SSA countries, which were already struggling to deal with rising debt levels, found themselves unable to service debt. (Figure 5).[6]

Figure 5:

The market has reacted predictably. Bond spreads have grown and sovereign credit ratings have been cut (Figure 6). In November 2020 Zambia became the first African country to default on its sovereign debt.[7] The IMF has classified more than 16 African countries as being at high risk of debt distress.[8]

Figure 6:

But more recently China’s post-pandemic recovery, rising vaccination rates and optimism about a broader economic rebound has seen a rise in the prices of some commodities. Iron ore prices have jumped 78% (Figure 2). The prices of other metals such as nickel and aluminium have also risen. Copper, long a bellwether for other industrial metals, leapt from below US$2,000 to almost US$10,200 per tonne.[9] Stock prices of commodity trading firms in Asia, which fell in 2020 have started to pick up again.[10] But it may yet be too early to say if the recent surge in commodity prices justifies the tag ‘the new commodity supercycle’[11]. While prices may have doubled in some cases how long this rally will last remains to be seen. What is certain, however, is that Africa is on the back foot. It must dramatically alter how it uses this commodity dividend if it is to benefit from the global recovery in the long-run.

Bad politics and worse economics: Decoupling from resource dependence

The erosion of Africa’s ability to capitalise on the latest surge in commodity prices goes beyond the fiscal domain. After nearly a decade of incremental improvement, governance is once again beginning to slide.[12] Performance on the Mo Ibrahim Index of African Governance[13] had begun to slide even before the Covid-19 outbreak, despite nearly a decade of incremental improvements. The decline reflects deteriorating performances in three of the four categories measured by the index - participation, rights and inclusion, security, the rule of law, and human development (Figure 7).

Figure 7:

Democratic processes were undermined when elections were postponed in Chad, Nigeria, Liberia, Gabon, Zimbabwe, Ethiopia, Kenya, and Somalia.[14] Measures that were supposed to contain the spread of the virus were used by the ruling incumbent in some places to disrupt election monitoring and manipulate voter participation.[15] In South Africa, weak oversight of emergency funding for the procurement of personal protective equipment (PPE) resulted in fraud and tender rigging.[16]

The African Union (AU) has identified ‘poor governance’ as being a ‘major obstacle preventing Africa from realising its development potential.’ In its Africa Governance Report 2019 the AU said, “The lack of adequate implementation of natural resource governance across the continent, due to weak institutions and policies in this sector, results in short-term gains rather than at long-term development.” With an average score of just 32, SSA remains the worst performing region on Transparency International’s 2020 Corruption Perception Index.[17] Bad politics inevitably leads to poor economic performance.

How can Africa avoid the mistakes of the past?

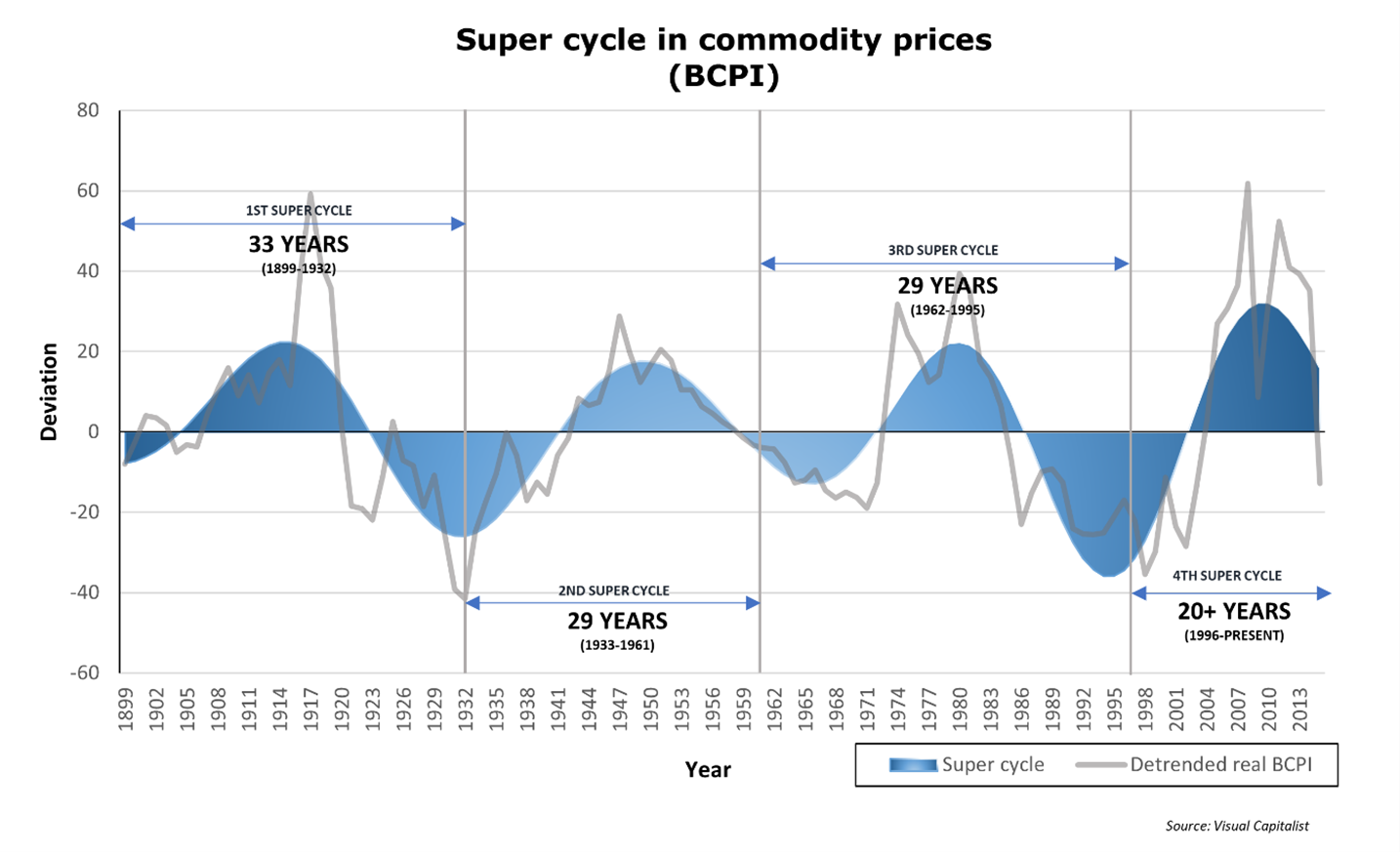

Policymakers must first view a supercycle as just that – a cyclical change. They must not be led into complacency. Markets do not always remain buoyant and nor do prices.[18] (Figure 8).

Figure 8:

Supercycles are transient and often occur decades apart. Boom need not be followed by a bust. Regulators must exert discipline and use the commodity windfall to diversify. Malaysia and Indonesia are great examples of how this can be done. Indonesia used the gains from surging oil prices in 2002 to diversify into agriculture and manufacturing, a strategy that ultimately saw its non-commodity exports increase 40% between 2013 and 2017. Malaysia vertically integrated crude oil extraction with downstream refining thus capturing more value from natural resources and reinvesting the gains in developing retail, tourism and financial services sectors.[19]

To reduce its dependence on commodities Africa must diversify its economy. Economic diversification will go a long way in reducing the continent’s dependence on commodity exports. Just as China used manufacturing to put excess labour into employment and eventually improved living standards Africa too must consider manufacturing to cushion its economy from the volatility of the commodity market and create sustainable growth. As of today, manufacturing makes up only 10% of SSA’s GDP.[20] Despite recent improvements in infrastructure poor transport links, erratic power supply and patchy internet connectivity makes producing goods in Africa uncompetitive. The market size of most African countries is also relatively small and although the Africa Continental Free Trade Area (AfCFTA) has come into force easing of cross-border trade will take some time to make manufacturing viable.

Now let us consider agriculture. 60% of the world’s uncultivated arable land lies in Africa. McKinsey estimates that with suitable investments Africa could boost its agricultural output threefold and spur the development of the agro-processing sector.[21] Infrastructure deficits and policy uncertainty, however, are the main barriers to unlocking this potential.

The continent rapidly adopted digital cell phone technology. This tool provided a foundation for mobile payments, e-commerce and digital learning. A few African countries achieved notable success in establishing innovation hubs. However, substantial funding gaps and a lack of mission-critical network infrastructure are barriers to reaching the full potential of IT across the digital divide.[22]

Financial services offerings vary widely across Africa. They are advanced in South Africa, Mauritius, and Kenya, yet almost non-existent in others. Businesses and households must rely on informal services in many communities. This makes them vulnerable to economic shocks. With greater financial inclusion and access to finance Africa can build resilience against commodity volatility.

Forsaking short-term gain for long-term sustainability

The “resource curse” (or “poverty paradox”) describes a situation where countries rich in natural resources are trapped in poverty. When commodity prices rise governments of resource-rich nations often squander the financial gains on frivolous projects and populist programs instead of diversifying the economy and investing in infrastructure that could support long-term sustainable growth.[23] Politicians in Africa often succumb to the temptation of using the short-term gains from commodity windfalls to cement the loyalty of their support base by splurging on public sector wages, fuel subsidies or expensive prestige projects aimed at boosting their image. But when the boom comes to an end, they are forced to roll back such programs. It hits social spending too. But cutting wages and rolling back subsidies often comes at a heavy political cost that politicians are loathe to suffer. So, they turn to the markets and borrow eventually taking debt to unsustainable levels. South Africa is a testament to this.

Political interference and policy flip-flopping can also make matters worse. In 2019, the South African government tried to push through the Mineral and Petroleum Resources Development Act, which would have undone the work done by mining firms to meet the expectations of the Black Economic Empowerment (BEE) program. This involved transferring equity stakes to the disadvantaged sections of the society in order to redress the wrongs of the past and accelerate economic inclusion. Similarly, Tanzania adopted a host of sweeping changes to the country’s mining policies that significantly increased the state’s control of the mining sector.[24] Instances of government overreach have occurred in Nigeria, Angola and Zimbabwe too.[25] Such interference seeks short-term gain but often leads to unintended consequences. Political interference damages business confidence and deters investments. Mining majors such as South32, Glencore and BHP sold off their assets in Africa after coming up against political and regulatory interference. As public finances come under stress as a result of the Covid-19 crisis governments across Africa may be tempted to extract more out of mining firms that are starting to benefit from the commodity market uptick. But they must resist this pressure and continue to try and create a more business-friendly environment. It will not only avoid scaring away investors but eventually improve the fiscal situation of a country and help the economy reduce its dependence on commodities.

Lessons from the previous commodity supercycle

The first lesson one can draw from the previous boom is that African governments will need a transparent and credible plan to bring their debt-to-GDP ratios below the debt ‘distress’ threshold, as defined by the IMF (Figure 6). In the wake of increased borrowings following the Covid-19 crisis, many African countries have come under debt stress. The spreads on African sovereign bonds have widened reflecting market worries that some may not be able to service their debts. To meet this rising service cost African governments must either renegotiate debt repayment with their creditors or spend a larger part of their commodity export revenue to service the debt. That means less money for infrastructure and social spending, which is essential for sustainable long-term growth.

This time around, the effects on Africa of a commodity supercycle are likely to be far less pronounced, not due to a less dire debt predicament, but because the base from which China now grows is substantially bigger. China’s economy is nearly eleven times larger now than in 2000, making historical growth performance difficult to repeat[26] (Figure 9).

Figure 9:

Secondly, amidst growing debt concerns, this time the markets and investors are unlikely to give Africa a free pass on assurances of structural reform. That is not surprising given the consistency with which African governments have missed targets in the past. Commercial lenders are likely to adopt a wait-and-see approach. That said, significant opportunities can be found amidst the volatility. Investors seeking bargains could be tempted to pick up assets at depressed valuations while commodity traders could benefit from higher trade volumes.

For their part, policymakers must consider private sector needs while developing policy. Consistency matters. Policy stability will attract more foreign direct investments in sectors of the economy that are not necessarily connected with commodities. It will also encourage the flow of portfolio investments in the non-resource sector.

Creating a sovereign wealth fund (SWF) may be yet another way to channel the gains made during commodity booms into areas that could help the economy diversify. But this will require legislation and a strong regulatory oversight to ensure public wealth is well invested. Botswana’s Pula Fund is one of Africa's largest and oldest sovereign wealth funds. It was created in 1994 to preserve and invest the revenues generated by the country’s diamond industry to deliver long-term economic and social returns. Managed by the Bank of Botswana – the central bank, Pula manages assets of almost US$4bn. Although criticised sometimes for weak oversight Pula has helped Botswana manage its foreign exchange surplus reasonably well and shielded the country from economic and foreign exchange rate shocks. Such stability has improved investor confidence in Botswana and allowed the government to sustain social spending. There are over a dozen SWFs in Africa, but many more resource-rich countries could consider setting up one.

Diversify the economy and accelerate private sector growth

As the shift from carbon-based fuels gains momentum, investors are starting to divest their interests in coal projects. Policies that encourage more private sector participation in renewable (solar /wind) energy projects could lay a foundation for long-term sustainable growth in Africa.

Besides energy Public-Private Partnerships (PPP) in telecommunications, roads and railways could deliver the foundational infrastructure necessary for African economies to diversify and accelerate private sector growth. Africa must take advantage of the recent resurgence in commodity prices and invest in building a foundation for sustainable future growth. If it does the recovery phase after Covid-19 could supercharge the continent’s economic expansion.

Conclusion

Africa benefitted greatly from healthy growth in its commodity revenues between 2000 and 2008. But this windfall is unlikely to recur despite the current surge in resource prices. Had Africa invested the surplus gained from the last commodity supercycle judiciously it could have provided a cushion during the subsequent downturn. But it did not. If the gains of the more recent rise in commodity prices are not to be wasted then Africa must learn from the past and prepare for the future. First, use the revenues from the commodity price surge to reduce the debt burden and invest the surplus into improving infrastructure. Second, shift attention to employment generation and avoid bulking up the public service headcount. Third, look at ways of diversifying the economy away from resource dependence – encourage private sector participation in manufacturing, technology, and financial services. This would act as a hedge against future commodity downturns. Seek a ‘buy-in’ from the private sector while implementing reforms. With the right policies, Africa could use the recent rise in commodity prices to usher in a new era of sustainable growth.

[2] Focus Economics. Fiscal Balance in South Africa. Focus Economics. [Online] February 27, 2021. https://www.focus-economics.com/country-indicator/south-africa/fiscal-balance.

[3] Zafar, Ali. Learning from the Chinese Miracle : Development Lessons for Sub-Saharan Africa. World Bank. [Online] December 13, 2017. https://openknowledge.worldbank.org/handle/10986/3702?show=full.

[4] https://www.cnbc.com/2021/04/20/dan-yergin-reasonable-for-oil-to-be-between-60-to-75-next-year.html

[6] Ndhlovu, Ronak Gopaldas and Menzi. How Africa can benefit from the new commodity supercycle. Daily Maverick. [Online] February 1, 2021. https://www.dailymaverick.co.za/article/2021-02-01-how-africa-can-benefit-from-the-new-commodity-supercycle/

[8] Ndhlovu, Ronak Gopaldas and Menzi. How Africa can benefit from the new commodity supercycle. Daily Maverick. [Online] February 1, 2021. https://www.dailymaverick.co.za/article/2021-02-01-how-africa-can-benefit-from-the-new-commodity-supercycle/.

[9] Home, Andy. Goldman proclaims the dawn of a new commodity supercycle: Andy Home. Reuters. [Online] January 5, 2021. https://www.reuters.com/article/us-metals-supercycle-ahome-idUSKBN29A1QM.

[12] The Economist. The Ibrahim index of African Governance. The Economist. [Online] October 5, 2015. https://www.economist.com/graphic-detail/2015/10/05/the-ibrahim-index-of-african-governance.

[13] The Mo Ibrahim Foundation. 2020 Ibrahim Index of African Governance. The Mo Ibrahim Foundation. [Online] November 25, 2020. https://mo.ibrahim.foundation/news/2020/2020-ibrahim-index-african-governance-key-findings.

[14] International Institute for Democracy and Electoral Assistance. Global overview of COVID-19: Impact on elections. International Institute for Democracy and Electoral Assistance. [Online] March 29, 2021. https://www.idea.int/news-media/multimedia-reports/global-overview-covid-19-impact-elections.

[15] The Mo Ibrahim Foundation. 2020 Ibrahim Index of African Governance. The Mo Ibrahim Foundation. [Online] November 25, 2020. https://mo.ibrahim.foundation/news/2020/2020-ibrahim-index-african-governance-key-findings.

[16] Planting, Sasha. Shining a spotlight on Covid-19 price gouging. Daily Maverick. [Online] August 3, 2020. https://www.dailymaverick.co.za/article/2020-08-03-shining-a-spotlight-on-covid-19-price-gouging/.

[17] Transparency International. CPI 2020: SUB-SAHARAN AFRICA. Transparency International. [Online] January 28, 2021. https://www.transparency.org/en/news/cpi-2020-sub-saharan-africa.

[18] LePan, Nicholas. What is a Commodity Super Cycle? Visual Capitalist. [Online] August 2, 2019. https://www.visualcapitalist.com/what-is-a-commodity-super-cycle/.

[19] UNCTAD. Commodity Dependence: A Twenty Year Perspective. UNCTAD. [Online] February 2019. https://unctad.org/system/files/official-document/ditccom2019d2_en.pdf.

[20] Signe, Landry. The potential of manufacturing and industrialization in Africa. Africa Growth Initiative. [Online] September 2018. https://www.brookings.edu/wp-content/uploads/2018/09/Manufacturing-and-Industrialization-in-Africa-Signe-20180921.pdf.

[21] Juma, Calestous. What is Africa’s agriculture potential? World Economic Forum. [Online] September 3, 2015. https://www.weforum.org/agenda/2015/09/what-is-africas-agriculture-potential/.

[22] Draper, Robert. How Africa's Tech Generation Is Changing the Continent. National Geographic. [Online] December 2017. https://www.nationalgeographic.com/magazine/2017/12/africa-technology-revolution/.

[23] Mittelman, Melissa. The Resource Curse. Bloomberg. [Online] May 19, 2017. https://www.bloomberg.com/quicktake/resource-curse.

[24] Kotze, Chantelle. Mining in Tanzania – the good, the bad and the ugly . [Online] February 20, 2020. https://www.miningreview.com/gold/mining-sector-reform-in-tanzania-the-good-the-bad-and-the-ugly/.

[25] Forest, Dave. Africa's mining industry is at risk of falling apart. Business Insider. [Online] February 17, 2015. https://www.businessinsider.com/government-interference-has-africas-mining-industry-in-disarray-2015-2?IR=T.

[26] Statista. Gross domestic product (GDP) at current prices in China from 1985 to 2020 with forecasts until 2026. Statista. [Online] 2021. https://www.statista.com/statistics/263770/gross-domestic-product-gdp-of-china/.

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)