Unlocking Africa’s capital markets

Capital market access is key to economic and industrial growth, making countries less dependent on donor aid and loans from foreign governments to finance investment and expenditure.

by Ronak Gopaldas

Capital market access is key to economic and industrial growth, making countries less dependent on donor aid and loans from foreign governments to finance investment and expenditure. PWC views Africa’s debt and equity capital markets as relatively underdeveloped, with deal activity falling sharply in 2019. Observers expect the 2020 numbers to be materially worse, owing mainly to the Covid-19 pandemic.

Persistent global economic uncertainty has led to wild swings between risk-on and risk-off sentiment in secondary markets as investors scrutinise news flow for signs of impending market movements. However, many institutions are reluctant to commit to longer-term instruments, significantly muting activity in the primary markets.

A combination of economic strain, policy missteps and fiscal mismanagement on the continent raised the prospect of sovereign debt defaults and ensuing corporate market fallout. Emerging market (EM) debt is increasingly expensive, despite historic low yields in developed markets (DM.) Many institutions now demand a premium to hold risky African instruments. This trend comes when traditional funding lines are drying up, as is access to capital. Recently, African states diversified their funding sources by issuing Islamic, green and blue bonds. While creative, this solution is insufficient to offset the inherent risks in EM investments.

This analysis will unpack the current constraints to the growth of the continent’s capital markets. It will propose actions that both states and the private sector can pursue to seize what may well be a once in a lifetime opportunity for low interest rates. The issues cover:

- Why are local capital markets important?

- The current state of Africa’s capital markets

- What’s holding back their development?

- Understanding Africa’s external funding constraints

- What are the opportunities?

- What role can the private sector play?

A thorough grasp of these issues will enable investors to assess the balance between risk and return in the continent's investment opportunities. DM rates are likely to remain low for an extended period. Thus, selecting the right Africa EM capital market instruments may make the difference for institutional funds between material financial losses and strong market outperformance.

Why are local capital markets important?

Development financing remains a challenge for African states.[1] Ideally, capital markets lower funding costs, both for sovereign debt and corporate capital. Capital market access is an essential avenue for government funding in Africa. High unemployment levels, a large informal market and overreliance on volatile commodity income often mean tax revenue is insufficient to cover expenditures for social development and fixed capital costs.

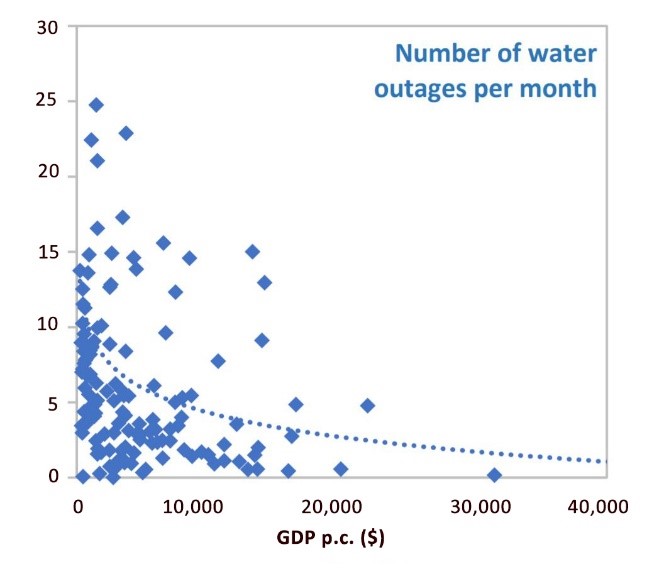

Estimates of Africa’s annual infrastructure funding deficit are well over USD50 billion.[2] Electricity generation and distribution, water purification and reticulation, road, rail and port infrastructure are among the most urgent needs. Without such infrastructure, companies face low-capacity utilisation rates, lost production and weak revenue growth. These lost opportunities place pressures on tax revenue and the fiscus.[3] As noted by the Brookings Institute[4], poorer countries suffer disproportionately from a lack of reliable infrastructure (figure 1). This gap is especially wide across most of Africa.

Figure 1: Country water and electricity outages per month by per capita income

Thus, poorer countries may appear caught in a seemingly inescapable cycle, where poor economic performance leads to the lack of foreign and domestic investment capital that handicaps their development. Local capital market development that aggregates domestic private sector funds offers a path to break this vicious cycle. Deploying local capital to fund infrastructure investments that enhance performance will ultimately crowd-in private sector businesses and attract foreign debt and equity capital.

Additionally, China’s debt-trap diplomacy has long been a bone of contention. Raising debt through the markets will make African countries far less dependent on loans from China and the United States, where a default could trigger the surrender of strategic assets to the lender. This was purportedly the case for the Sri-Lankan port of Hambantota.[5] Despite their willingness to restructure loans to African governments in response to rising Covid-19 debt burdens, the continent would do well to diversify its funding mix further.

Local capital pools will never compete with the power and size of large governments or international funds. However, healthy domestic capital markets provide less expensive funding in the local currency. Recipients thus have less exposure to foreign exchange volatility. Greater local market participation is also an essential cushion for both corporate and sovereign issuers, which are then less exposed to offshore events and volatile risk appetites.[6]

When governments use capital market debt efficiently to build enabling infrastructure such as roads and ports and develop small and emerging enterprises, the dividends will surface all along the value chain.[7] First time home buyers benefit from affordable urban accommodation. Small-scale farmers benefit from access to affordable government financing and more efficient and cost-effective transport to get their products to market.[8]

The current state of Africa’s capital markets

Despite being home to more than 36 stock exchanges that serve 43 economies, Africa’s capital markets remain relatively underdeveloped.[9] North American, European and the major Asian markets have greater scale, participation and depth, and attract enormous capital flows. In 1993, the African Securities Exchange Association (ASEA) emerged to help develop and promote the capital market landscape on the continent and to catalyse economic growth and societal transformation. The resulting efficiencies enabled broader market participation, increased intra-African flows, deepened market liquidity and expanded access to funding. However, much more remains to be done.[10]

Africa’s capital markets remain concentrated in a handful of capitals. These include South Africa, Nigeria, Mauritius, Kenya and Egypt.[11] Several exchanges on the continent appeared only in the last two decades, including Angola, Cameroon, Lesotho, Libya, Rwanda and Seychelles. Some notable emerging markets[12] do not even host stock exchanges. This includes one of the continent’s fastest-growing economies, Ethiopia. However, its cabinet recently endorsed establishing an exchange.[13] See figure 2.

Figure 2: Africa’s capital market concentration

The market capitalisation-to-GDP ratio is the best indication of the level of development of the continent’s equity capital markets.[14] The metric is the value of all domestically listed stocks divided by the country’s gross domestic product (GDP), expressed as a percentage. A ratio between 75% and 90% suggests that the stock market reflects the broader economy. Ratios for nations such as the US and UK with highly developed capital markets are above 100%.

Apart from South Africa (352%), the market capitalisation to GDP ratio of most of Africa falls below 30%. Nigeria (10%), Namibia (21%), Tunisia (22%), Kenya (26%) and Rwanda (31%) all have under-penetrated equity capital markets. They are insufficiently developed to reach their potential in generating private sector growth[15], while Mauritius (61%) is in line with the global average (figure 3).

Figure 3: Market capitalisation-to-GDP ratio of select countries

This number reflects several contributing factors. These include the informal economy’s size, the ratio of household/pension savings and the accessibility of the banking sector. To contextualise the structural mismatch of the continent’s capital markets, remittances to Africa by the African diaspora in 2018 (USD 40 billion) was more than the total amount raised by all IPOs in Africa over the last five years.[16]

South Africa’s poor track record confirms that well-developed capital markets are no guarantee of economic growth, expanding well below the sub-Saharan average despite its well-developed capital markets. Despite the relative under-representation of the broader continent’s capital markets, they attract significant offshore investment interest. However, concerns over stalling global growth and the more recent Covid-19 impact led to capital flight.

African Equity capital market performance slowed markedly in 2019 in both volume and value terms as concerns around US and Chinese growth began to mount.[17] Ahead of elections in Nigeria and South Africa, investment caution contributed to years of economic stagnation. This weakness in the continent’s two biggest economies weighed heavily on company earnings and investor appetite. The year marked the lowest amount of capital raised in a decade according to PWC’s Africa Capital Markets Watch 2019 report and saw a near 50% drop in initial public offerings (IPOs) compared to 2018. No new company listings appeared on the Johannesburg Stock Exchange (JSE) over the year, but there were several de-listings of small to mid-cap players. Of the nine new companies to be floated in the year, three were in Egypt, two in Nigeria, and one each in Namibia, Mozambique and Malawi. The ninth transaction, the unbundling of Multichoice from Naspers, was technically not a capital raise (figure 4).

Figure 4: African Equity Capital Market Activity

There were also 20 less further offerings (FO) or rights issues than in 2018. With a further offering, a company issues more shares, thus diluting shareholder value. While 2020 data is yet to be aggregated, the deceleration in equity markets likely worsened in the face of the pandemic. Today’s outlook is not all gloom, however, as enormous fiscal (tax cuts and money printing) and monetary policy (lower interest rates) stimulus by governments across the world have left markets awash with cash and interest rates at record lows, particularly in developed markets (DM). The current search for yield suggests a growing investor appetite for emerging market (EM) listings and even FOs in 2021. This pattern began to appear in 2020, when global stock markets reached record highs toward the end of the year, after a more than 30% plunge in the second quarter. This trend bodes well for Africa.

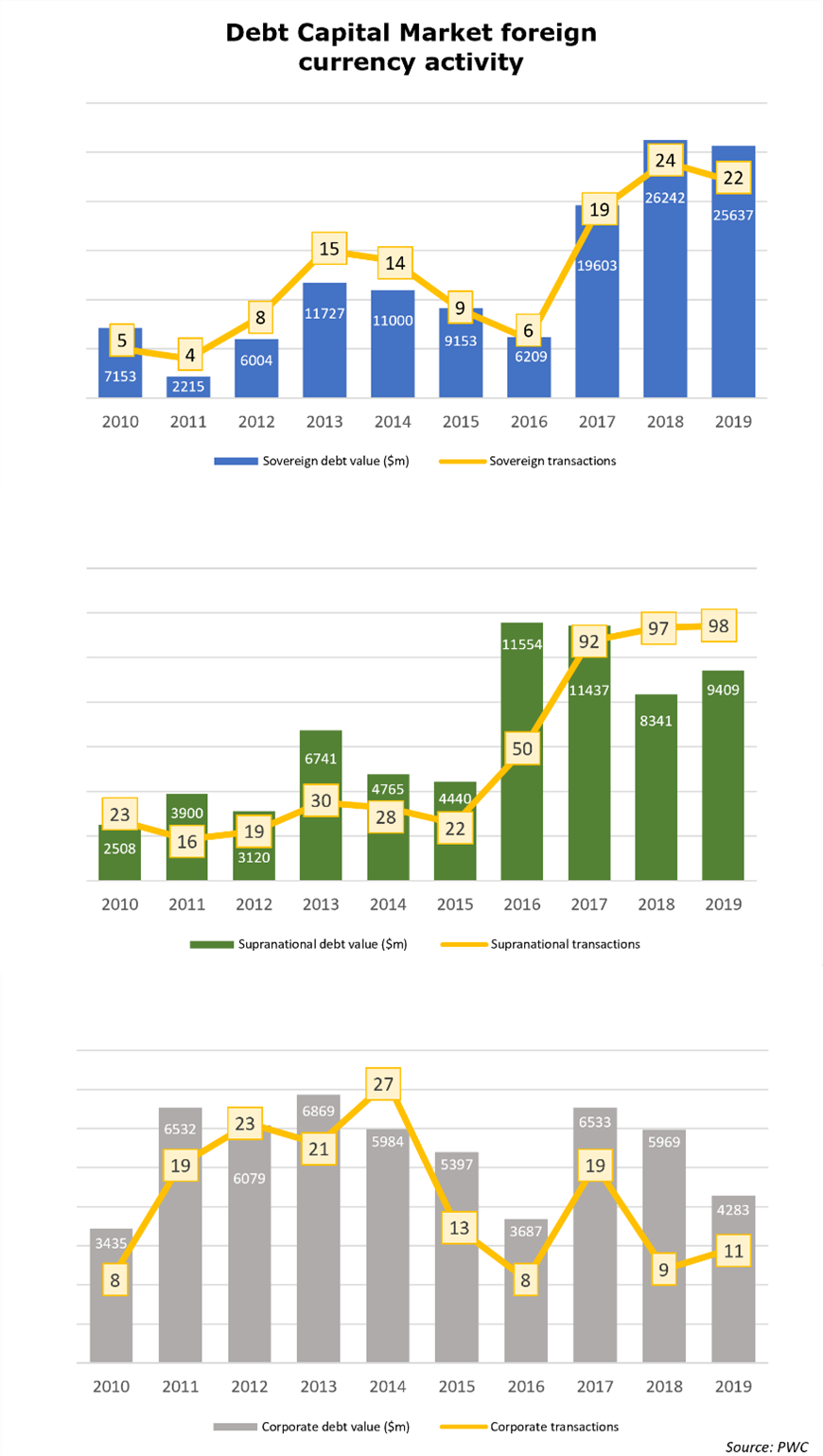

The outlook for bonds is somewhat more opaque but follows the same yield-search pattern. EM debt fell out of favour in the early parts of 2020 when investors fled EMs for the low yield (but low risk) safety of DM bonds. As the economic recovery slowly begins to take hold, record low real yields (sometimes negative) in DMs and deep liquidity pools imply that EM debt will soon regain favour. While debt market volumes remained relatively stable between 2018 and 2019 across sovereign (country), supranational (development finance institutions) and corporate (companies) issuances, values fell for both sovereign and corporate offerings (figure 5).

Figure 5: Debt Capital Market foreign currency activity

As with African equities, African bond issuances are set for a recovery in 2021 across corporate, supranational, and sovereign domains as each debt class takes advantage of favourable bond yields and healthy investor appetite. A sharp drop in fixed foreign direct investment in Africa in 2020 (also likely in 2021) may motivate investors to hold asset classes that can quickly be liquidated in the event of market disruptions. Even so, an increase in new issuances will be insufficient to offset three consecutive years of decline in the continent’s USD 45 billion FDI space. Instead, they may encumber sovereign balance sheets, which must do the heavy lifting in the absence of private foreign fixed investment.

Much of Africa’s debt capital market activity is likely to come from sovereigns who seek to re-price their debt at more favourable rates. Development finance institutions are under pressure to aid state-owned enterprises' economic recovery (particularly in South Africa). Many face crippling funding constraints. Unlike in Mozambique (Hidroeléctrica de Cahora Bassa) and Morocco (Maroc Telecommunications), the privatisation of state-owned entities in South Africa faces strong opposition. It is unlikely to garner either support from the government or interest from investors.

What’s holding back their development?

South Africa’s refusal to dispose of or privatise underperforming state assets is emblematic of Africa's broader privatisation challenge. Instead of divesting loss-making entities such as airlines and power generation through IPO,s the State supports them with public funds or bond issuances. This lack of government support for market forces drives down the competitive forces that lead to efficiency. While the merits of this stance are beyond the scope of this paper, policymakers can clearly do a great deal more to encourage domestic and offshore private sector participation in African capital markets.

Some African countries are warming to the privatisation trend. Morocco raised almost USD 1 billion from the sale of 8% of its stake in Maroc Telecom In 2019. Public listings of formerly state-owned enterprises are underway in Ethiopia, Nigeria, Malawi and Ghana.[18] Ethiopia will dispose of Ethio Telecom and the Ethiopian Sugar Corporation while Angola will float its national airline, telecoms utility and credit provider. Ghana will list its Electricity Company of Ghana to close its fiscal gap. Angola is set to privatise several state-owned companies by 2022.

Another challenge in Africa is that many countries maintain a monopolistic hold in sectors such as broadcasting, telecommunications, and mining. Tax funds prop up many of these SOEs instead of allowing competition. Encouraging new entrants would provide a steady tailwind for both debt and equity capital markets.[19]

Understanding Africa’s funding constraints

The already high debt levels of many African countries are a significant constraint on activity.[20] Even before the pandemic, many EMs demonstrated signs of unsustainable debt levels, stagnant GDP growth and few useful control measures.[21] For some, the ever-increasing debt burden led to downgrades of sovereign credit ratings, which drove bond yields higher, raising the cost of funding and making debt market funding far less attractive. Rating agencies downgraded eleven African countries in the first half of 2020 due to the growth and fiscal impact of Covid-19, with twelve more ratings lowered to negative.[22] This led to the African Union Peer Review Mechanism panel criticising the rating agencies for making it more challenging to raise capital market funding. Several countries, including Cameroon, Ethiopia and Senegal, became reluctant to raise further debt.[23]

Sub-investment grade ratings have impacts far beyond simply government borrowings. State-owned companies, banks and corporate bond issuers cannot be rated higher than the sovereign rating. Thus, as country ratings deteriorate, the cost of funding increases for the entire corporate sector, both listed and unlisted. The banks that borrow in the debt market to lend to businesses and individuals ultimately raise their interest rates to recover the higher funding costs.

Some countries are entirely shut out of the bond market. Between 2013 and 2014, three state-owned companies in Mozambique secretly took on more than USD 2 billion in debt that sovereign balance sheets did not disclose. These transgressions led several institutional investors to decline to engage with the country on raising further funding.[24]

African governments must ensure fiscal and monetary prudence, budget transparency and clear, consistent and unambiguous communication with the market to avoid spooking investors. The lesson applies to the private sector and the equity capital markets. A string of accounting and auditing scandals (Steinhoff International Holdings, Tongaat Hulett, EOH) cast doubt over the trustworthiness of company results.[25]

For their part, regulatory bodies and exchanges need to attract new listings. This will require reducing the cost and complexity of floating a new company. Several African countries have already opened the playing field to new exchanges that cater to small-cap companies and offer significantly reduced listing costs. South Africa, as an example, allowed new stock market entrants, the AltX, ZARX, A2X and 4AX, precisely for these reasons, although other countries on the continent lag far behind.[26]

In the long run, there is no substitute for growth-friendly economic policies. Government investment in catalytic infrastructure (energy, water, roads, rail and ports), support for small and medium enterprises and a stable policy environment bring investor certainty. These policies will attract both foreign and domestic capital to both the bond and equity market. A deep domestic savings pool will encourage diversification of asset allocations away from cash. A stable interest rate backdrop for this activity will make the continent’s real yields an attractive investment option that cannot be ignored. These are all well-known reforms consistently highlighted by the IMF, World Bank and rating agencies. McKinsey's recent study highlighted that the appetite for African debt and equity is already quite significant. This demand is demonstrated by oversubscribed bond issuances[27] – figure 6.

Figure 6: Investor appetite for Africa by type, region and size

What are the opportunities?

The best way for African countries to differentiate themselves and attract funding is by continually pushing new and innovative debt instruments.

The continent provided the market with several well-received green, blue and Islamic bonds. These pioneering opportunities emerge at a time when institutional investors scramble to deploy capital in high growth areas to beat the low returns in DMs.

The London Stock Exchange (LSE) works with African exchanges to help develop the continent’s capital markets and encourage intra-African capital raising and investment. Ibukun Adebayo has overseen the launch of green bonds in Morocco, Kenya and Nigeria. Now the LSE’s co-head of emerging markets, he believes that capital markets are the best way for a country to “democratise its wealth and meet its goals around social development and economic growth”.[28]

One green bond the LSE helped market was a USD 42.5 million instrument by Kenyan property developer Acorn Holdings. They plan to use the funds to develop sustainable student accommodation. Nigeria also saw vigorous green bond activity, as when Access Bank issued the first corporate green bond, raising USD 41 million. Around the same time, a Nigerian power utility raised USD 23.6 million via a green infrastructure bond. In 2018, the Seychelles issued the world’s first blue bond to help fund development in its ocean and maritime economy and spur growth in the sector[29], while Mauritius’ Bayport Management issued a USD 260 million “social bond” to finance social impact investments aimed at job creation and financial inclusion.[30]

Blue and green bonds rest on social and environmental impact performance metrics, including climate change mitigation, project carbon neutrality and ecosystem restoration, all tied to ethical investing. The requirement from institutional investors for more environmental, social and governance (ESG) accountability is becoming more stringent. To attract much-needed debt capital, Africa must ensure that it leads the field in governing compliance. This task is urgent as many banks are tightening up on funding fossil fuel projects – in 2019, South Africa’s Nedbank announced its withdrawal from funding two coal-fired power stations in South Africa, in line with its new sustainability initiatives.[31] Funding avenues are fast closing for countries, projects and companies that are not demonstrably working toward ESG goals. The green bond market alone is estimated to be worth USD 600 billion.[32]

The Islamic financing sector, estimated to have a value of USD 2 trillion, is an asset structure likely to attract extensive interest on the continent in the coming years. In 2018, Sub-Saharan Islamic finance assets grew 18% to USD 19 billion, surpassing Europe, the US and Australia. Sovereign Sukuk issuances from Morocco, Nigeria and South Africa are shariah-compliant, based only on assets aligned to the values of shariah law. The returns from these instruments do not attract interest but are instead growth-focused.

Blue, green and Islamic bonds are debt classes that have deep roots in Africa. They are favourably received by institutional investors under pressure from shareholders to invest ethically and sustainably. The demand and requirement for responsible investing are only likely to grow, and Africa has a real opportunity to capitalise on the growing demand.

What role can the private sector play?

While the onus is on the government to invest in productive assets that ease the cost of doing business and implement market-friendly policies, the private sector's role is critical in guiding governments to provide what they reasonably require to thrive. The private sector must be open to investing alongside the government in growth generating projects.

In South Africa, endemic corruption and misallocation of public funds pushed that country’s private sector to shun government bonds. Investors believed the government would either squander the funds or default. The country’s severe fiscal constraints led its government to moot prescribing the country’s massive asset management/pension fund industry to purchase government bonds needed to bail out failing state-owned companies and invest in infrastructure projects.[33] Asset managers, labour unions and the public fiercely resist the idea of prescribed assets, but the scheme remains one of the few options to the country whose sovereign debt levels are forecast to approach 100% of GDP in the coming years.

The public and private sectors must seek middle ground. One potential solution is for the private sector to take a far more active role in managing and overseeing projects. This move will ensure that unscrupulous middlemen do not insert themselves as power brokers to influence government tenders.

Private sector companies must also reduce resistance to new market entrants, particularly in sectors dominated by a handful of players. New entrants will encourage competition, drive down end-user cost and entice new entrants to the IPO market. Retail investors have an essential role to play. Even though small by comparison with the big players, the small investor’s demand that asset managers invest their savings in ethical and sustainable projects can help shape the investment types that come to market. They can further demand accountability. Investor oversight is a powerful tool for keeping value chains honest.

For their part, however, sovereign debt issuers must demonstrate a shift away from recurrent expenditure and a focus on infrastructure, clamp down on corruption and wastage and expedite project timelines. Until evidence emerges that these measures are implemented, private sector capital is likely to remain sceptical. Those willing to buy emerging market (EM) debt will demand an unaffordable premium return.

Conclusion

Africa’s capital markets are entering a new post-Covid-19 phase, where historical market performance is no longer a reliable guide for future outcomes. World markets are inexorably changed, and Africa now has a real chance to accelerate the development of its capital markets sector. This development is all the more critical given that traditional funding avenues are narrowing due to a complex mix of already high debt burdens, shifting ESG investment demands and a realignment of global politics.

Africa must seize on the current low-interest-rate environment and deep market liquidity to re-price its debt and invest in the development-inducing infrastructure needed to ensure sustainable long-term growth. The continent already plays a leading role in the development of green, blue and Islamic financing. While a great deal more needs to be done, the capital markets are set to become a significant avenue for diversifying Africa’s funding structures.

Both the private and public sectors must change their path to market, moving from greater accountability to greater oversight and greater cooperation. The tumult in world markets is far from over. There has never been a better time for Africa to strengthen its funding base through a mix of privatisation (equity), tenor (debt maturity), currency (local and foreign) and bondholders (local and foreign).

References

[1] Songwe, Vera. Africa's Capital Market Appetite: Challenges and Opportunities for Financing rapid and sustained growth. Brookings Institute. [Online] April 7, 2016. https://www.brookings.edu/wp-content/uploads/2016/07/04-foresight-capital-market-growth-songwe-1.pdf

[2] Asamoah, Solomon. Infrastructure Financing Deficit In Africa: Glass Half Full Or Half Empty? Africa Policy Review. [Online] 2018. http://africapolicyreview.com/infrastructure-financing-deficit-in-africa-glass-half-full-or-half-empty/

[3] Kola-Lawal, Omawumi. Why Is It So Difficult to Fund Infrastructure Development in Africa? IISD. [Online] December 10, 2019. https://sdg.iisd.org/commentary/guest-articles/why-is-it-so-difficult-to-fund-infrastructure-development-in-africa/#:~:text=Investment%20in%20development%20infrastructure%20has,billion%20and%20USD%20170%20billion

[4] Madden, Genevieve Jesse and Payce. Figures of the week: Africa’s infrastructure needs are an investment opportunity. Brookings Institute. [Online] June 27, 2019. https://www.brookings.edu/blog/africa-in-focus/2019/06/27/figures-of-the-week-africas-infrastructure-needs-are-an-investment-opportunity/

[5] Gopaldas, Ronak. Lessons from Sri Lanka on China's 'debt-trap diplomacy'. ISS. [Online] February 21, 2018. https://issafrica.org/amp/iss-today/lessons-from-sri-lanka-on-chinas-debt-trap-diplomacy

[6] Buckholtz, Alison. Spotlight: Capital Markets in Africa. IFC. [Online] February 2020. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/africa-capital-markets

[7] African Development Bank Group. African equity capital markets activity see downward turn, but increase in domestic investors - Making Finance Work for Africa partnership and PricewaterhouseCoopers (PwC) Nigeria. African Development Bank Group. [Online] June 3, 2020. https://www.afdb.org/en/news-and-events/press-releases/african-equity-capital-markets-activity-see-downward-turn-increase-domestic-investors-making-finance-work-africa-partnership-and-pricewaterhousecoopers-pwc-nigeria-35900

[8] Buckholtz, Alison. Spotlight: Capital Markets in Africa. IFC. [Online] February 2020. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/africa-capital-markets

[9] Hajji, Karim. African Capital Markets. CFA Institute. [Online] 2019. https://www.cfainstitute.org/-/media/documents/article/rf-brief/rf-african-capital-markets.ashx

[10] ASEA. Connecting Capital Markets in Africa. African Exchanges. [Online] 2019.

[11] PWC. 2019 Africa Capital Markets Watch. 2019 Africa Capital Markets Watch. [Online] March 2020. www.pwc.co.za/capitalmarketswatch

[12] Reuters. Ethiopia's cabinet endorses establishment of a stock market - PM Abiy. Reuters. [Online] December 22, 2020. https://www.reuters.com/article/ethiopia-economy-idUKL1N2J21BY

[13] Minney, Tom. Ethiopia’s draft capital markets bill. African Capital Market News. [Online] September 21, 2020. http://www.africancapitalmarketsnews.com/

[14] Kenton, Will. Stock Market Capitalization-to-GDP Ratio. Investopedia. [Online] January 22, 2021. https://www.investopedia.com/terms/m/marketcapgdp.asp

[15] Tomdio, Alice. Africa’s capital markets on steady development to finance growth. African Bond Markets. [Online] June 17, 2019. https://www.africanbondmarkets.org/en/news-events/afmi-newsletter/article/africas-capital-markets-on-steady-development-to-finance-growth-159182/

[16] ibid

[17] Africa Global Funds. African capital market activity declines sharply in 2019 . Africa Global Funds. [Online] March 05, 2020. https://www.africaglobalfunds.com/analysis/analysis-and-strategy/african-capital-market-activity-declines-sharply-in-2019/

[18] ibid

[19] McDonald, Megan. African government debt: A constraint on capital markets activity. The Africa Report. [Online] September 21, 2020. https://www.theafricareport.com/42076/african-government-debt-constrains-capital-markets-activity/

[20] ibid

[21] Reuters. Emerging market government debt soars to record 59% of GDP -JPMorgan. Reuters. [Online] November 16, 2020. https://www.reuters.com/article/emerging-debt-jpmorgan-idUKL8N2I2610

[22] Cele, S'thembile. African nations downgrade their views on aggressive ratings firms. Aljazeera. [Online] October 30, 2020. https://www.aljazeera.com/economy/2020/10/30/african-nations-downgrade-their-views-on-aggressive-ratings-firms

[23] Mutize, Misheck. Why African countries are reluctant to take up COVID-19 debt relief. ENCA. [Online] August 10, 2020. https://www.enca.com/business/why-african-countries-are-reluctant-take-covid-19-debt-relief.

[24] The Economist. A $2bn loan scandal sank Mozambique’s economy. The Economist. [Online] August 24, 2019. https://www.economist.com/middle-east-and-africa/2019/08/22/a-2bn-loan-scandal-sank-mozambiques-economy

[25] Business Insider. The biggest South African business scandals over the past decade. Business Insider. [Online] January 11, 2020. https://www.businessinsider.co.za/the-top-south-african-business-scandals-the-past-decade-2020-1

[26] Jooste, Ruan. How are SA’s new stock exchanges doing? Daily Maverick. [Online] April 3, 2019. https://www.dailymaverick.co.za/article/2019-04-03-how-are-sas-new-stock-exchanges-doing/

[27] Kannan Lakmeeharan, Qaizer Manji, Ronald Nyairo, and Harald Poeltner. Solving Africa’s infrastructure paradox. McKinsey. [Online] March 2020. https://www.mckinsey.com/~/media/McKinsey/Industries/Capital%20Projects%20and%20Infrastructure/Our%20Insights/Solving%20Africas%20infrastructure%20paradox/Solving-Africas-infrastructure-paradox.pdf?shouldIndex=false

[28] Masie, Desne. Deepening and democratising African capital markets. African Business. [Online] May 11, 2020. https://african.business/2020/05/economy/deepening-and-democratising-african-capital-markets/

[29] Nathalie Rot, Torsten Thiele and Moritz von Unger. Blue Bonds: Financing Resilience of Coastal Ecosystems. 4Climate. [Online] March 2019. https://www.4climate.com/dev/wp-content/uploads/2019/04/Blue-Bonds_final.pdf

[30] PWC. 2019 Africa Capital Markets Watch. 2019 Africa Capital Markets Watch. [Online] March 2020. www.pwc.co.za/capitalmarketswatch

[31] Lilley, Chris Yelland and Roger. Nedbank goes fully green, withdraws funding for coal IPPs. Biznews. [Online] January 30, 2019. https://www.biznews.com/energy/2019/01/30/nedbank-withdraws-funding-coal-ipps

[32] Pronina, Lyubov. What are Green Bonds and how ‘green’ Is green? IOL. [Online] March 25, 2019. https://www.iol.co.za/personal-finance/what-are-green-bonds-and-how-green-is-green-20071020

[33] Business Tech. Government in talks with South Africa’s pension funds to access ‘big pool of liquidity’ for investment. Business Tech. [Online] November 3, 2020. https://businesstech.co.za/news/finance/445440/government-in-talks-with-south-africas-pension-funds-to-access-big-pool-of-liquidity-for-investment/

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)