Lagos Free Zone emerges as an economic lifeline for Nigeria

The iconic industrial zone run by a Singapore-based conglomerate Tolaram remains a beacon for investors in Nigeria even as manufacturing suffers

By Jaco Maritz

.jpg?sfvrsn=13a40ab8_3) Photo credit: Amit Jain

Photo credit: Amit Jain

In late January, the largest container vessel ever to berth in Nigeria, the CMA CGM Scandola, with a capacity of 14,800 standard containers, docked at the new Lekki Deep Sea Port on the outskirts of Lagos.[1] At a depth of 16.5m, this port, which officially opened about a year ago, can accommodate vessels four times larger than the ones that can currently dock at the existing ports that service Lagos.

The port is situated within the Lagos Free Zone (LFZ), an 850ha private industrial zone built by Tolaram, which provides businesses with key infrastructure and benefits such as tax-free remittance of profits and dividends, the ability to bring finished goods into the Nigeria Customs Territory, and exemption from government taxes, levies, and rates. Companies also have the advantage of free movement of goods to and from Lekki Deep Sea Port.

.jpg?sfvrsn=2667beda_3) Photo credit: Amit Jain

Photo credit: Amit Jain

It was Tolaram’s early experience in manufacturing that set the tone for its later foray into infrastructure. When chairman Mohan Vaswani first travelled to West Africa in 1977, he discovered an untapped market for consumer goods in Nigeria. By late 1980s, what started out as a textile business pivoted to instant noodle imports. Today the firm produces a variety of fast-moving consumer goods (FMCG) in joint ventures with global majors such as Arla Foods, Colgate-Palmolive, Kellogg’s and Kimberley-Clark. It has thus far invested over US$500m in 24 manufacturing facilities across Nigeria.

Moving into infrastructure

Dinesh Rathi, CEO of the LFZ, says that when Tolaram conceptualised the zone, research showed that port logistics and electricity supply were critical challenges for local businesses. Nigeria, a country of over 220m people dispatches less than 5,000 MW of electricity to the grid, forcing companies to rely on generators for up to ten hours a day or more.[2] The ports of Apapa and Tin Can Island which currently service Lagos are plagued by congestion and excessive red tape, causing significant delays for both importers and exporters. Both have fare poorly in the World Bank Container Port Performance Index.[3] Inspired by Jebel Ali Free Zone in Dubai as well as ports in India and China, Tolaram realised the importance of building an industrial ecosystem around the port, which led to the idea for the LFZ. The master plan for the zone was developed by Singapore-based urban planning outfit Surbana Jurong, and the zone was established in 2012.

Rathi anticipates the zone's 300ha first phase to be entirely completed by the end of 2024. The only remaining tasks are the completion of a pipeline to supply gas directly to the power plant – currently, gas is transported by truck – and the finishing of a commercial tower that will accommodate various company offices.

The LFZ has been financed partly through bonds, which have so far raised almost US$100m. In the most recent issuance, in March 2023, the Lagos Free Zone Company raised NGN17.5 billion (approximately US$38m at the time). With a 20-year term and an annual fixed interest rate of 15.25%, the bond drew investments from 10 Nigerian pension funds and an insurance company. Ashish Khemka, the chief financial officer of LFZ says the bond issuances showed that domestic institutional investors had the ability to finance critical infrastructure in Nigeria.[4]

But the port project did not come without its own set of challenges. In 2012, the company was on the brink of financial closure with the backing of a consortium of six banks and institutions, including Africa Finance Corporation (AFC) and Standard Chartered Bank. However, Nigeria experienced political and financial instability in the following years. Oil prices halved between June 2015 and February 2016, the naira devalued by a third, and business sentiment reached a new low. By the end of 2016, nearly all its partners had withdrawn, citing high risks. "That was the lowest moment," said Navin Nahata, managing director for fintech and infrastructure at Tolaram, in an earlier interview.

However, Tolaram redesigned the project and brought on China Harbour Engineering Company as an engineering, procurement and construction partner and investor. The current shareholders in Lekki Port LFTZ Enterprise Limited (LPLEL) – which was awarded the concession for the development and operations of the facility – are China Harbour Engineering Company, holding 52.5%, Tolaram with a 22.5% stake, and the Lagos State Government and the Nigerian Ports Authority owning the remaining shares. The port officially started operations in April 2023.[5]

Creating a West African industrial hub

Nigeria's manufacturing sector contributes about 8% to the GDP and employs 7% of the workforce.[6] Its capacity to create jobs and reduce Nigeria's reliance on imports presents a compelling argument for enhancing the industry, especially in areas where Nigeria has shown potential, such as fertilisers, food packaging, and FMCG.

However, the manufacturing sector faces several challenges. Last year, consumer goods giant P&G announced it would close its manufacturing operations in Nigeria, shifting its focus to imports.[7] The company, which generated approximately US$50m per year in Nigeria from sales of brands like Pampers diapers, Ariel detergent, and Oral-B toothpaste, cited currency issues and a challenging macroeconomic environment as reasons for its exit. P&G's downsizing is indicative of a wider trend of multinational corporations withdrawing from or reorganising their operations in Nigeria. In August, British pharmaceutical giant GSK also announced its exit, following earlier statements about the economic challenges and a foreign currency crisis adversely affecting its operations. Earlier in 2023, Unilever withdrew its OMO, Sunlight, and Lux home and skin care brands from Nigeria.

Over the past year, the Nigerian naira has experienced a significant depreciation, reaching record lows of over NGN1600 to the US dollar in recent months, although it has stabilised somewhat. This depreciation is due to various economic factors, including eased foreign currency controls, reduced foreign investments, and a decline in crude oil exports, a crucial revenue source for Nigeria. The weakening naira has reduced the converted dollar earnings for foreign companies.

In addition to currency-related issues, manufacturing in Nigeria is hampered by inadequate electricity, poor quality roads, an underdeveloped rail system, problematic port infrastructure, complex customs clearance and port management protocols, and a shortage of skilled labour.

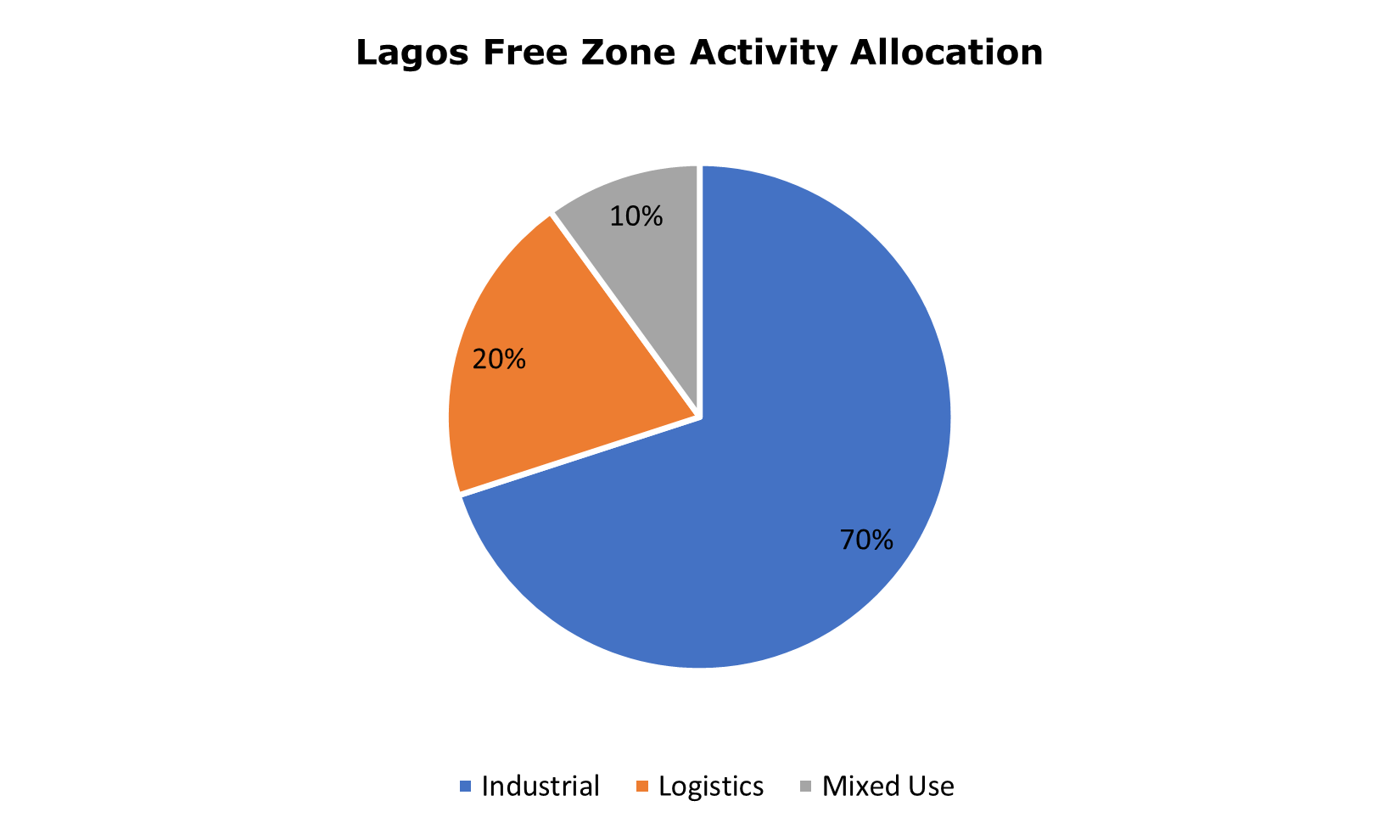

The LFZ could, however, be a major boost for the sector as it addresses many of the challenges of operating in Nigeria, thereby enabling companies to focus on their core business. Tolaram aims to position the LFZ as a manufacturing hub for the Western African region.

The integrated industrial zone offers investors high quality plug-and-play manufacturing infrastructure that includes warehouses, 24x7 power, modern offices, residential complex, and a variety of shared services - such as a medical centre, a fire station, and a police station - that enables them to operate in Nigeria hassle-free. LFZ also offers single-window clearance for business registrations and customs clearance. Additionally, there is an industrial skills training centre that upskills young people from the surrounding area, serving both as a corporate social responsibility initiative and a source of potential workers for companies in the zone.

The LFZ also extends various fiscal benefits to its tenants, including exemptions from government taxes, levies, and rates; duty-free imports for goods from outside the country; the ability to export finished products into the Nigeria Customs Territory; and tax-free remittance of profits and dividends. Furthermore, companies benefit from seamless movement of goods to and from the Lekki Deep Seaport.

Vote of Confidence

Tata International, the trading and distribution arm of the Indian conglomerate the Tata Group, has leased a 6,000m2 facility in the LFZ to assemble light commercial vehicles, a significant move considering the recent exit of multinationals from the country. German chemicals manufacturer BASF has also set up shop in the zone. It started out with a small factory before expanding to a larger premise. Another tenant is Sana Building Systems, a Middle Eastern manufacturer of prefabricated building materials. Currently, the Lagos Free Zone has over 30 registered enterprises, including Kellogg's, Colgate-Palmolive, Arla Dairy and BASF. The LFZ has also attracted financial institutions, with Stanbic IBTC, a subsidiary of South Africa’s Standard Bank, already operating a branch, and other lenders such as FCMB, UBA and First Bank currently in the process of establishing their own.

A game changing port

Until recently, Nigeria was not seen as a viable transshipment location due to its inadequate infrastructure. Its ports could only berth vessels carrying 5,000 to 6,000 containers. But the Lekki port now has the capability to accommodate ships up to three times larger. This means that Nigeria could soon emerge as a transshipment hub, handling cargo in transit for other destinations, and compete with the likes of Lome, which is today West Africa’s top deep seaport.

Centre Director Amit Jain has characterised the Lekki Deep Seaport as a ‘game changing’ project for Nigeria in Back to Growth: Priority Agenda for the Economic Revival of Nigeria. Its location right next to the massive Dangote Refinery – the biggest one in Africa –makes it one of the most valuable strategic asset of Nigeria. In December 2023, the Dangote oil refinery received its first cargo of 1 million barrels of crude oil, bringing the start of operations closer after years of delays. Once fully operation running, the 650,000 barrel-per-day refinery financed by the richest man in Africa - Aliko Dangote – could turn Nigeria into a net exporter of fuels.

Centre Director with Tolaram officials at the Dangote Oil Refinery

Centre Director with Tolaram officials at the Dangote Oil Refinery

The Lekki Deep Sea Port has handled over 100,000 containers since it officially commenced operations on 1 April 2023. It has since seen 75 vessels including the first LNG-powered vessel and the largest ship of 366 LOA dock in Nigeria and is the only deep seaport in Nigeria with the ability to handle 14,000 TEU container vessels. The development of the port is proceeding in stages. Its container terminal, with a capacity to manage 1.2m containers annually, is now fully operational and under the management of the French shipping company CMA CGM Group. Rathi says that the subsequent phase involves constructing the dry bulk and liquid terminals. The third phase will aim to double the capacity of the existing container terminal.

Playing the long game

Nigeria is in the midst of a severe economic crisis. The abrupt elimination of a longstanding fuel subsidy and an attempted relaxation of foreign currency controls has contributed to a significant depreciation of the naira, soaring inflation and a relative contraction of the economy.

However, the World Bank forecasts Nigeria’s GDP will grow by 3.3% in 2024, up from an estimated 2.9% in 2023, driven by sectors such as agriculture, construction, services, and trade. Inflation is expected to gradually ease as the effects of the previous year’s foreign exchange reforms and the removal of fuel subsidies diminish.[8]

Rathi says that while Tolaram is not immune to Nigeria’s current economic difficulties, the company maintains a long-term commitment to the country. He acknowledges the government's efforts to address the issues of foreign exchange and inflation, expressing confidence that once these are resolved, the country will be on the right trajectory. “We have always looked at business in Nigeria from a five to 10-year horizon rather than quarter to quarter,” he notes.

References

[1] ‘Lekki port receives 15,000 TEU CMA CGM Scandola — Largest container ship to visit Nigeria’, Ships & Ports, 30 January 2024

[2] ‘Nigeria power reform heralds biggest sector shakeup in 20 years’, Bloomberg, 12 June 2023

[3] ‘The Container Port Performance Index 2022’, World Bank Group, 2023

[4] ‘Tolaram’s Lagos Free Zone issues US$38m bond for further expansion’, NTU-SBF Centre for African Studies, 18 April 2023

[5] ‘Nigerian President inaugurates Lekki Deep Sea Port’, NTU-SBF Centre for African Studies, 27 January 2023

[6] ‘Back to growth: Priority agenda for the economic revival of Nigeria’, NTU-SBF Centre for African Studies, 2023

[7] ‘Procter & Gamble halts manufacturing in Nigeria amid economic headwinds’, NTU-SBF Centre for African Studies, 27 December 2023

[8] ‘Global Economic Prospects’, World Bank Group, January 2024

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)