The state of African space industry

After India lands a craft on the moon could African space ambitions take flight?

By Ronak Gopaldas

Photo credit: ISRO

Photo credit: ISRO

India's landing on the moon has signalled its emergence as a new space power. Replicating this feat will be a challenge for African countries given their development constraints, but with smart and strategic thinking the continent can still play an important role in the global space race. The African nascent space industry is yet to take flight. It is decades behind its Asian counterparts. Part civilisational pride, part necessity, Africa should show more ambition in developing its own space programme. Despite significant obstacles in the way of it achieving its bold ambitions, Africa does have several advantages that could catapult it forward in the space race. Ideally situated geographically, Africa could also apply learnings from other countries in order accelerate up the development curve. Several foreign governments and private sector firms have committed to helping the continent develop its space sector, among them the EU, Russia, and China. Recent shifts in global geopolitics could see greater momentum in this “space”. Already Djibouti, Kenya, and Angola, are showing what is possible.[1] Here we examine the regions in Africa with burgeoning space industries and what the continent stands to gain when lift-off is achieved.

Back to the future: A brief overview of Africa’s place in the space sector

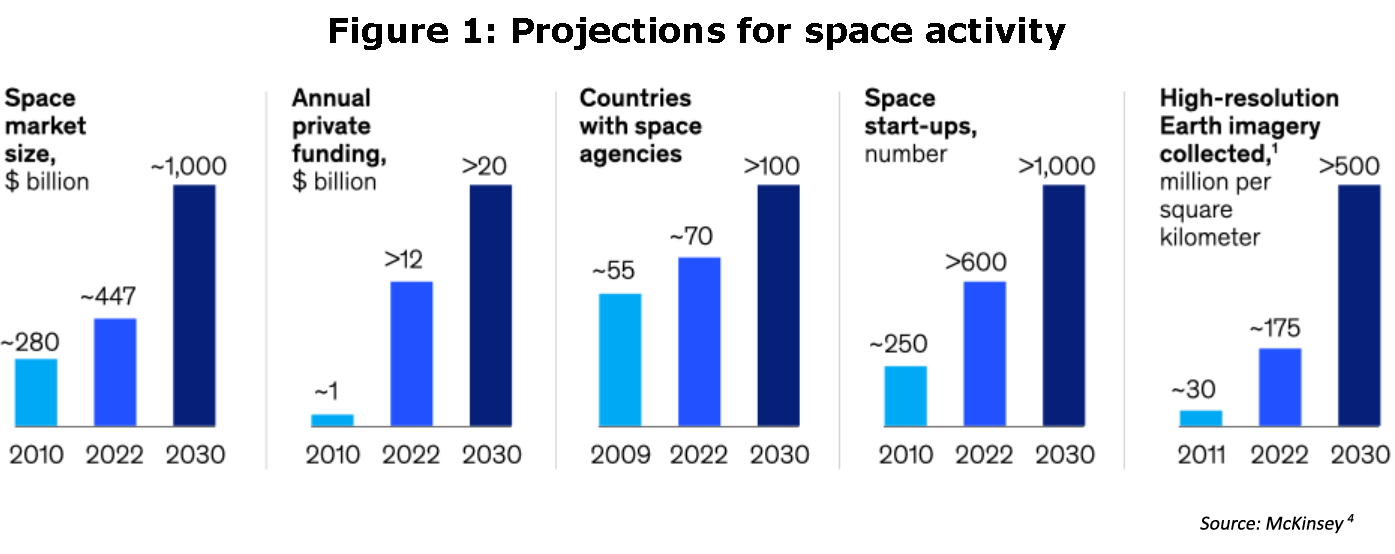

The global space economy grew 9% in 2021 to US$447bn, the fastest growth since 2014 and is expected to grow to US$634bn by 2026.[2] Commercial ventures account for more than three quarters of the market with much of that generated by private sector space firms[3] (figure 1). Space programmes that were once monopolise by the world’s superpowers, is now a contested territory. Advances in technology and reduction of costs have brought down some of the barriers to entry and several African countries have started to build their own space research and development (R&D) capabilities.

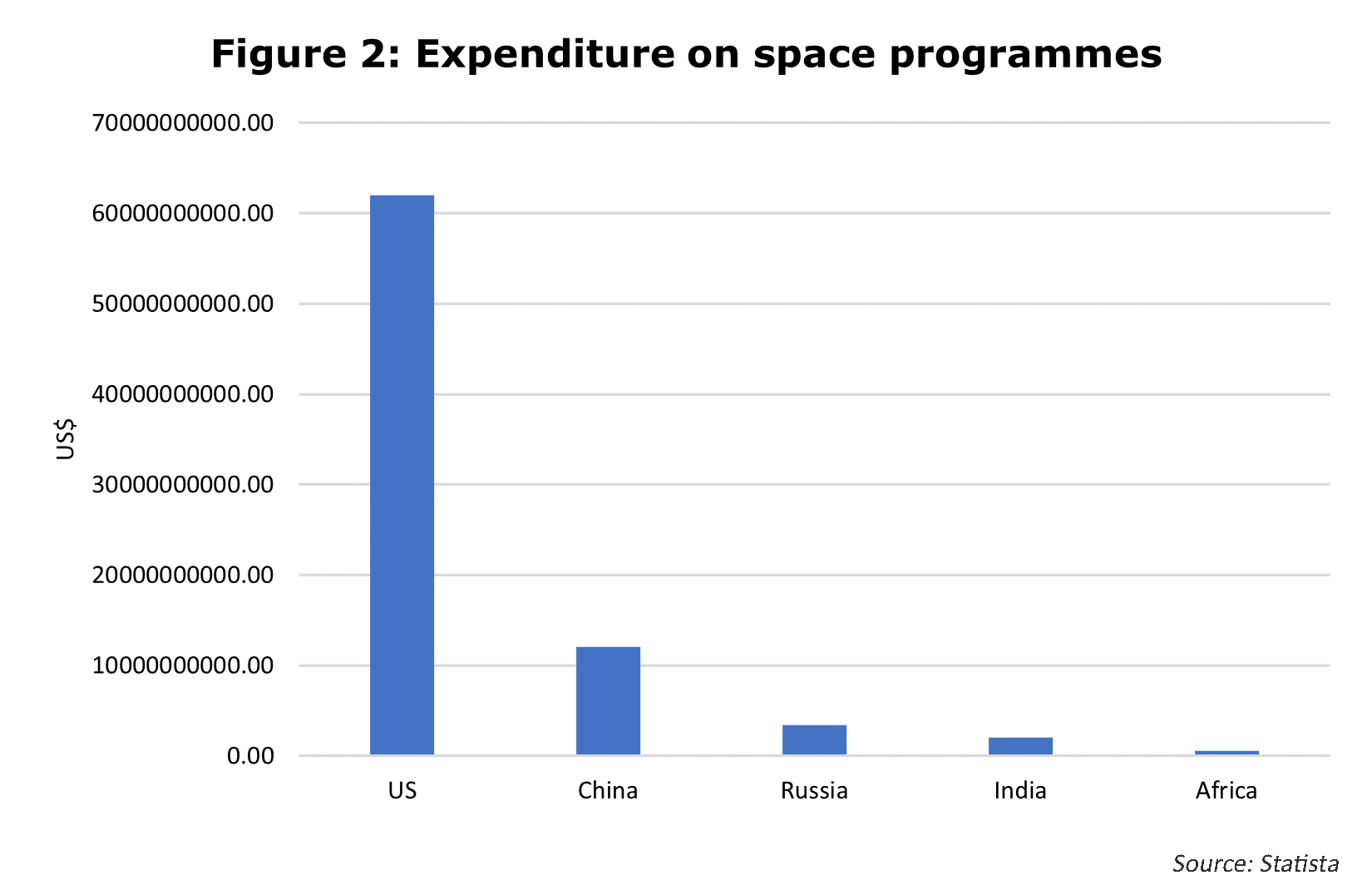

The African space economy was valued at US$19.49bn in 2021 and is projected to grow 16.16% to US$22.64bn by 2026. For context, India, which made its first successful lunar landing in Aug 2023 (Chandarayaan-3), sees space as the new commercial frontier. The government of India has eased rules for the private sector to launch satellites and rockets instead of simply supplying to the state-run Indian Space Research Organisation (ISRO). The reforms mean that startups are getting access to ISRO facilities such as launchpads and laboratories and turbocharging Indian commercial space ambitions. In 2022, Beijing carried out 64 satellite launches while India did only five. But by 2025, the value of India’s satellite launch services could almost double to US$1bn. The African space sector spending is dwarfed by developed nation budgets, and funding remains one of the largest hurdles to Africa achieving space independence (figure 2).

The African space economy was valued at US$19.49bn in 2021 and is projected to grow 16.16% to US$22.64bn by 2026. For context, India, which made its first successful lunar landing in Aug 2023 (Chandarayaan-3), sees space as the new commercial frontier. The government of India has eased rules for the private sector to launch satellites and rockets instead of simply supplying to the state-run Indian Space Research Organisation (ISRO). The reforms mean that startups are getting access to ISRO facilities such as launchpads and laboratories and turbocharging Indian commercial space ambitions. In 2022, Beijing carried out 64 satellite launches while India did only five. But by 2025, the value of India’s satellite launch services could almost double to US$1bn. The African space sector spending is dwarfed by developed nation budgets, and funding remains one of the largest hurdles to Africa achieving space independence (figure 2).

There are currently more than 270 space companies in Africa developing and offering space technologies and services, many of them start-ups and the sector employs approximately 19,000 people across the continent – the US space industry employs more than 183,000 people.[5]

There are currently more than 270 space companies in Africa developing and offering space technologies and services, many of them start-ups and the sector employs approximately 19,000 people across the continent – the US space industry employs more than 183,000 people.[5]

The African space industry is still in its infancy, with most of the continent’s space agencies having only been established over the last 20 years. The African Space Agency (AfSA) established by the African Union to promote space cooperation between member states was itself only inaugurated in January 2023.[7] It is working closely with the European Space Agency (ESA) to develop an African space policy in line with the African Space Strategy. This will allow Africa to borrow from their learnings and accelerate the continent’s development programme.

The African space industry is still in its infancy, with most of the continent’s space agencies having only been established over the last 20 years. The African Space Agency (AfSA) established by the African Union to promote space cooperation between member states was itself only inaugurated in January 2023.[7] It is working closely with the European Space Agency (ESA) to develop an African space policy in line with the African Space Strategy. This will allow Africa to borrow from their learnings and accelerate the continent’s development programme.

Despite expected growth of near 17% year-on-year over the short-term, the continent’s space ambitions remain constrained by a lack of funding, and totalled just US$535m in 2022, up just 2% from the previous year. The nature of African space projects also remains relatively rudimentary, focussed mainly downstream on satellite deployment, astronomy, environmental monitoring, communication, connectivity, and television.

Africa’s first satellite was the Egyptian owned NileSat 101, launched by the European Space Agency in April 1998.[8] It was followed by South Africa and its launch of Sunsat-1 in 1999. Sunsat-1 was designed by postgraduate students at the University of Stellenbosch and launched aboard a Delta II rocket from Vandenberg Airforce Base in the US. Ethiopia launched its first observatory satellite into space in 2019. The 70-kg remote sensing satellite is to be used for agricultural, climate, mining, and environmental observations. There are now over 20 African countries that have established national space programmes whose mandates range from space observatories to telecommunications and rocket launches (figure 3). There have been more than African 50 satellites launched over the past 10 years. South Africa and Egypt account for more than half the African satellites in space – 12 and 11 respectively. Others include Algeria (7), Nigeria (6), and Morocco (3) with Ghana, Sudan, Ethiopia, Angola, Kenya, Rwanda, Zimbabwe, Uganda and Mauritius each having their own satellites. Only nine of these were designed, manufactured, and assembled in Africa and led by African states, and the bulk of them are “cubesats” – small satellites roughly the size of a Rubik’s cube with a lifespan of just two years.[9] None were launched by or in an African country and were secondary payloads on foreign launch vehicles. Funding and human capital constraints inhibit it from competing head-on with developed countries.

Africa, however, does have some comparative advantages when it comes to space. The sizeable, open, and mostly flat landmass that runs along the tropics makes Africa an ideal location from which to launch rockets into space. That is because the ‘slingshot’ effect of the gravitation pull of the earth is stronger when it is closer to the equator – thereby reducing the amount of fuel required. A relatively less urbanised continent also means less light pollution, which makes it ideal for space observation. African states are understandably eager to shed the scepticism and their image of being space dilettantes, and while budgets remain modest, plans are afoot to accelerate domestic space programmes.[10] Three countries in particular, Nigeria, Djibouti, and South Africa, have grand ambitions to propel Africa into the final frontier. Nonetheless, it is important to distinguish ambition from reality.

Nigeria

The Nigerian National Space Research and Development Agency (NASRDA) which was founded in 1999 with a budget of US$93m, launched its first satellite (NigeriaSat-1) in 2003. NigeriaSat-1 was an earth observation satellite that became part of the Disaster Monitoring Constellation (DMC) in collaboration with the British, Chinese, Turkish and Algerian governments. Data from this partnership has been used by scientists in the wake of the Indian Ocean Tsunami in 2004 and Hurricane Katrina in 2005 to better understand natural disasters. Subsequent satellites launched for Nigeria have been used to track Boko Haram militants in the north-east.[11] The republic also plays host to one of the United Nation’s Platforms for Space-based Information for Disaster and Emergency Management (UN-SPIDER) support office. Since its inception, it has cooperated with the UK, China, Ukraine, and Russia on space technology projects and images and data from the country’s space programme has been used for mapping, tracking environmental change, information to inform the agriculture and mining industries as well as education.

The country has loftier ambitions, however, having announced in 2005 that it was planning to be the first African country to send an astronaut into space by 2030 and develop and deploy a vehicle (rocket) to launch Nigerian made satellites from a spaceport in the country[12] – there are currently no spaceports in Africa (figure 4).

While there is already a Nigerian manufactured satellite, the financial and technical challenges of developing a fully-fledged space programme remain formidable. NASRDA has no astronaut training programme or plans for a spaceport.[14] The Centre for Space Transport and Propulsion (CSTP), a technical arm of NASRDA tasked with developing satellite launch vehicles, did manage to launch three test rockets in 2019, albeit with mixed success and remains well behind its development timeline.[15] There have also been some moves toward privatisation in the country’s space sector, particularly considering budgetary constraints. In 2018, Nigeria gave a US$550m equity stake in state owned satellite operator NigComSat to Chinese satellite company, China Great Wall in exchange for two communications satellites[16] which would speed up the deployment and commercialisation of the Nigerian space satellite sector. Of all countries looking to partner with Africa in the space sector, China has been the most willing. The latest Asian foray into Africa’s space sector was agreed between Hong Kong and Djibouti and holds the potential to be a gamechanger for the continent.[17]

While there is already a Nigerian manufactured satellite, the financial and technical challenges of developing a fully-fledged space programme remain formidable. NASRDA has no astronaut training programme or plans for a spaceport.[14] The Centre for Space Transport and Propulsion (CSTP), a technical arm of NASRDA tasked with developing satellite launch vehicles, did manage to launch three test rockets in 2019, albeit with mixed success and remains well behind its development timeline.[15] There have also been some moves toward privatisation in the country’s space sector, particularly considering budgetary constraints. In 2018, Nigeria gave a US$550m equity stake in state owned satellite operator NigComSat to Chinese satellite company, China Great Wall in exchange for two communications satellites[16] which would speed up the deployment and commercialisation of the Nigerian space satellite sector. Of all countries looking to partner with Africa in the space sector, China has been the most willing. The latest Asian foray into Africa’s space sector was agreed between Hong Kong and Djibouti and holds the potential to be a gamechanger for the continent.[17]

Djibouti

In January 2023, Djibouti signed a US$1bn deal with Hong Kong Aerospace Technology to build Africa’s first satellite launch facility by 2030 worth an estimated US$1bn.[18] The construction will include 7 satellite launch pads and 3 rocket-testing pads, a port facility, a power grid, and highway to facilitate the transportation of aerospace materials. The deal was signed in partnership with Touchroad International Holdings, a Shanghai based conglomerate[19] already invested in the Djibouti Economic Zone project under China’s Belt and Road Initiative (BRI). All funding will come from China.

Currently, Djibouti has no satellites but is testing two locally developed satellites as part of the country’s first national space project. Djibouti-1A and 1B are environmental monitoring CubeSats being designed and assembled by Djiboutian engineers in collaboration with the space division of the University of Montpellier in France.[20] Part of Djibouti’s appeal is its proximity to the equator, which for space travel, means less energy is required to reach orbit. More importantly though, the tiny republic in the horn of Africa is strategically located at the chokepoint of one the world’s busiest trade routes - the Red Sea. It hosts the US, French, as well as Chinese naval bases.[21]

Geopolitics aside, for rest of the continent, the spaceport in Djibouti could earnestly be the start of a fully-fledged continental space programme.[22] The spin-offs in the fields of science, engineering, and education could benefit industries across the continent, from agriculture and mining to environmental protection, security, and big data.[23] It will catalyse much needed investment on the continent and allow African countries to launch satellites at lower cost, from the continent itself.

To be sure, there are many hurdles to overcome. Politics is just one of those hurdles. While the realisation of the spaceport is many years away, Djibouti and all African countries with space programmes and ambitions should begin laying the groundwork to seize on what could be a new era for the continent. Once commercialised, it would also be an important step for Africa in moving away from resource dependence and toward a knowledge economy. On this score, South Africa already leads the continental charge in terms of commercialising its space industry and like Djibouti, South Africa is also on the precipice of a new space era.

South Africa

South Africa already has the most advanced space industries in Africa, with more satellites in orbit than any other. The South African National Space Agency (SANSA) was established in 2010. Its space division is considered world class and employs top notch scientists. its Hartebeesthoek facility has been host to NASA’s satellite tracking and data acquisition network since 1960. SANSA has also conducted pre-testing for the Mars Perseverance rocket launch.[24] [25]

Its latest projects will begin after winning the bid (with Australia) to host one of the US$2.2bn Square Kilometre Array (SKA) Observatories as well as the build of Africa’s only Deep Space Ground Station with NASA in Matjiesfontein[26] to communicate with the Artemis space craft headed to the moon in 2025. The construction of the largest radio telescopes in the world will consist of 133 parabolic dishes being added to the existing 64 of the SKA-precursor telescope, MeerKAT in the Karoo region of the country. Information from the SKA will give insight into the origins of the universe, test existing theories in astrophysics and search for extra-terrestrial life. Construction is slated to be completed by 2028

Given the country’s developmental needs and budget constraints, its ambitions are more grounded, and it has opted not to develop an astronaut training programme, instead focussing on earth observation, space engineering, space operations and space science. The outcomes of these projects provide a greater return on investment and are better aligned to the country’s immediate development needs.[27]

The country’s space sector has already benefitted greatly from its academic institutions in terms of satellite design and development and is increasingly looking to foster private sector investment and involvement.[28] There are even ambitions to partner with the nimbler private sector to develop launch facilities in Arniston on the Western coast which are envisaged to provide launch facilities for Africa and the country’s BRIC partners.

Space is quickly becoming more democratised and South Africa has a number of venture capital and private sector companies already engaged in space related activities. C5 Capital founded by South African Andre Pienaar owns a majority stake in Axiom, a company working on additions and expansions to the International Space Station. Astrofica is a satellite technology company based in Cape Town specialising in manufacturing and assembly as well as systems testing for international clients.[29] Twoobii, based in South Africa’s capital, rents out individual satellite terminals and offers a range of voice, video and broadband services helping connect off-grid locations through satellite technology. The country is also exploring a license for Starlink, Elon Musk’s satellite communications company, but local ownership rules mean the company’s entry date is still uncertain – Starlink already works in many other African countries[30] (Rwanda, Nigeria, Mozambique). To truly accelerate growth in the industry, Africa should look to the east. Investment into the African space sector is also coming from an unlikely quarter.

Christopher Luwanga at the Galamad satellite design lab in Singapore

Christopher Luwanga at the Galamad satellite design lab in Singapore

In February this year Galamad Aerospace, a Singapore-based start-up closed a pre-seed round of US$1.05m to design and build reusable satellites. According to its Malawi-born CEO Christopher Luwanga the objective of Galamad Aerospace is to build cost-efficient satellites. The engineering and design of the satellites will be done in Singapore, but the assembly and testing will take place in Malawi.

Looking to the stars, and to the East

China, India, and Japan were once spectators to the space race between the US and Russia but are now among its biggest global participants. For China, real growth came in 2014 when the country relaxed the rules for private sector participation.[31] The country’s private sector space companies are now expanding into Africa, as can be seen with the Djibouti spaceport venture. Many of these projects, however, are ultimately government backed but demonstrate how quickly the private sector demand can create new industries and avenues for growth.

India, which opened its space market to private launches in 2020, has seen the number of space start-ups more than double over the past 3 years. Just last year, the country’s Skyroot Aerospace whose investors include Singapore’s Sovereign Wealth Fund, launched India’s first privately built rocket.[32] On a visit to the US in June 2023, Indian Prime Minister Narendra Modi and US President Joe Biden pledged to collaborate more closely on space exploration. Crowding in the private sector is already bearing fruit for India and Indian companies as US based Voyager Space has signed a memorandum of understanding (MOU) with the Indian Space Research Organisation (ISRO) to use Indian rockets and work with Indian space start-ups) (figure 5).

There are two key take-aways from the rocket-like growth of Chinese and Indian space industry. Firstly, the private sector must be crowded in as they are the real driver of investment, innovation, and growth. Secondly, government support through strong policy, international collaboration and the removal of red tape is key to kickstarting private sector interest, investment, growth, and job creation.

There are those who would question the need for Africa to in space programmes – given the more urgent development needs. For any country, particularly ones with newer space programmes such as China and India, successful space missions are a source of great national pride and a demonstration of technological development and prowess. This was the case for the US and Russia at the start of the Cold War space race and it would certainly be a statement of arrival for any African country. The continent’s developmental realities are, however, quite different. What little available funding there is would better serve basic infrastructure and industrial development. In Africa’s current stage in the developmental cycle, fully fledged space programmes would be hard to justify and considered little more than vanity projects. It’s also not about competing for status against nations with established space programmes but rather forging a space for themselves in the space value chain, whether that be space observation or satellite development.

This is precisely why I contend that state role in any African space programme should remain limited to that of a facilitator, developing an enabling space policy environment for the private sector and maintaining an oversight capacity. To be sure, all countries that have successfully landed on the moon (US, Russia, China, India) have done so through well-resourced and funded state-run space agencies which were the foundation on which the private sector was built. African foray into space, however, should be more about practical real-world applications and near immediate commercialisation. The private sector has both the funding and capacity to develop and build satellites, rockets and the software needed to drive innovative programmes for real world benefits for Africa. Further, unlike governments, the private sector’s survival is based on successful commercialisation, making them inherently more innovative and nimbler. The global space industry is changing, and Africa does not have to follow the state-as-a-catalyst model.

The US, UK, Germany, Sweden, and New Zealand have all deregulated their respective space industries and actively encouraged private sector participation. Lucrative commercial opportunities have naturally attracted a host of mature and start-up companies to venture into the space sector, contributing to new innovations, technologies, and economic growth.

Economic benefits aside, downstream space activities and technology hold real world benefits for Africa, in terms of improving regional security, driving agriculture, maritime resource protection and monitoring as well as developing climate change knowledge. As space opens more globally and to private participants, growth is set to accelerate exponentially, and Africa cannot afford to be left behind. To truly benefit from the new international race for space, African countries must leverage what geostrategic and geographical advantages it does have to drive investment, skills transfer, education, and technology development. Through international partnerships, greater funding, a conducive regulatory environment, and private sector innovation, Africa is poised to become a meaningful player in the space economy. Watch this space.

References

[1] Sumah, Kwaku. The African Space Opportunity. Space Hubs Africa. [Online] 17 October 2019. https://spacehubs.africa/insight/2019/theafricanspaceopportunity.

[2] Sheetz, Michael. The space industry is on its way to reach $1 trillion in revenue by 2040, Citi says. CNBC. [Online] 21 May 2022. https://www.cnbc.com/2022/05/21/space-industry-is-on-its-way-to-1-trillion-in-revenue-by-2040-citi.html.

[3] Porterfield, Carlie. Space Industry Grew To Record $469 Billion Last Year, Report Finds . Forbes. [Online] 27 July 2022. https://www.forbes.com/sites/carlieporterfield/2022/07/27/space-industry-grew-to-record-469-billion-last-year-report-finds/?sh=3991c6e017f1.

[5] Space in Africa. African Space and Satellite Industry Now Valued at USD 19.49 Billion. Space in Africa. [Online] 17 August 2022. https://africanews.space/african-space-and-satellite-industry-now-valued-at-usd-19-49-billion/.

[7] Spacewatch Africa. African Space Agency Formally Inaugerated. Spacewatch Africa. [Online] 30 January 2023. https://spacewatch.global/2023/01/african-space-agency-formally-inaugurated/.

[8] National Government (SA). South African National Space Agency (SANSA). National Government (SA). [Online] 2023. https://nationalgovernment.co.za/units/view/285/south-african-national-space-agency-sansa.

[9] Toukebri, Tensai Ali and Rania. Africa. Space Generation Advisory Council. [Online] 2020. https://spacegeneration.org/regions/africa#:~:text=Twenty%2Done%20years%20after%20the,millions%20USD%20invested%20into%20it.

[10] Onyango, Conrad. Africa’s space industry attracting EU and Chinese investors. Mail and Guardian. [Online] 3 Oct 2022. https://mg.co.za/africa/2022-10-03-africas-space-industry-attracting-eu-and-chinese-investors/.

[11] Varada, Pranay. The Space Race Expands: Why African Nations Are Looking Beyond Earth. Harvard International Review. [Online] 15 April 2022. https://hir.harvard.edu/why-african-nations-are-shooting-for-the-stars/.

[12] Way, Tyler. Challenges and Opportunities of Nigeria’s Space Program. Aerospace Security. [Online] 24 June 2020. https://aerospace.csis.org/challenges-and-opportunities-of-nigerias-space-policy/#:~:text=The%202020%20budget%20allocates%20%2459.26,%249.54%20million%E2%80%94roughly%2016%20percent.

[14] Muanya, Chukwuma. Nigeria missing as space race gathers momentum. The Guardian. [Online] 6 August 2020. https://guardian.ng/features/nigeria-missing-as-space-race-gathers-momentum/.

[15] https://africanews.space/nigerias-cstp-completes-three-successful-experimental-rocket-launches/

[17] Douet, Marion. Djibouti announces construction of first spaceport in Africa. Le Monde. [Online] 20 February 2023. https://www.lemonde.fr/en/le-monde-africa/article/2023/02/20/djibouti-announces-the-first-spaceport-in-africa_6016532_124.html.

[18] Quartz. Africa will get a new $1 billion spaceport in Djibouti . Quartz. [Online] 18 January 2023. https://qz.com/africa-will-get-a-new-1-billion-spaceport-in-djibouti-184999482

[21] The Economist. A planned spaceport in Djibouti may give China a boost. The Economist. [Online] 19 January 2023. https://africanews.space/djibouti-1a-passes-another-miles

[24] Campbell, Rebecca. South Africa to have key role in supporting Nasa’s Artemis crewed Moon programme. Engineering News. [Online] 9 Novermber 2022. https://www.engineeringnews.co.za/article/south-africa-to-have-key-role-in-supporting-nasas-artemis-crewed-moon-programme-2022-11-09.

[26] Roelf, Wendell. South Africa's new ground station to help NASA track space flights. Reuters. [Online] 9 November 2022. https://www.reuters.com/lifestyle/science/south-africas-new-ground-station-help-nasa-track-space-flights -2022-11-08/#:~:text=The%20South%20African%20National%20Space,skies%20and%20low%20radio%20interference.

[27] Campbell, Rebecca. New space agency CEO outlines vision for stimulating local space industry. Engineering News. [Online] 23 June 2023. https://www.engineeringnews.co.za/article/new-space-agency-ceo-outlines-vision-for-stimulating-local-space-industry-2023-06-23.

[28] Campbell, Rebecca. New space agency CEO outlines vision for stimulating local space industry. Engineering News. [Online] 23 June 2023. https://www.engineeringnews.co.za/article/new-space-agency-ceo-outlines-vision-for-stimulating-local-space-industry-2023-06-23.

[30] Moore, Maia. African space agencies have the potential to lead the global space race. Space News. [Online] 2 May 2023. https://spacenews.com/african-space-agencies-have-the-potential-to-lead-the-global-space-race/#:~:text=A%20booming%20space%20industry&text=The%20act%20established%20the%20African,the%20African%20Space%20Agency%20operational.

[31] Sumah, Kwaku. How Asia developed its Space Industry. Space Hub Africa. [Online] 19 April 2023. https://spacehubs.africa/insight/2023/2/how-asia-developed-its-space-industry

[32] power, India readies moon mission aimed to stake claim as a space. India readies moon mission aimed to stake claim as a space power . Reuters. [Online] 13 July 2023. https://www.reuters.com/technology/space/india-readies-moon-mission-aimed-stake-claim-space-power-2023-07-13/.