Malaysian palm oil exports to sub-Saharan Africa surge

Heightened demand and export restrictions by Indonesia have resulted in a 51% jump in Malaysia palm oil exports

Malaysian palm oil exports to sub-Saharan Africa (SSA) have surged by 51% in the first quarter of 2023, compared to the same period last year, reaching a volume of 710,250 metric tonnes (MT), according to data from the Malaysian Palm Oil Council (MPOC). The significant growth is credited to factors such as the easing of import tariffs in certain countries, stronger demand due to religious festivals, and restrictions on palm oil exports from Indonesia.

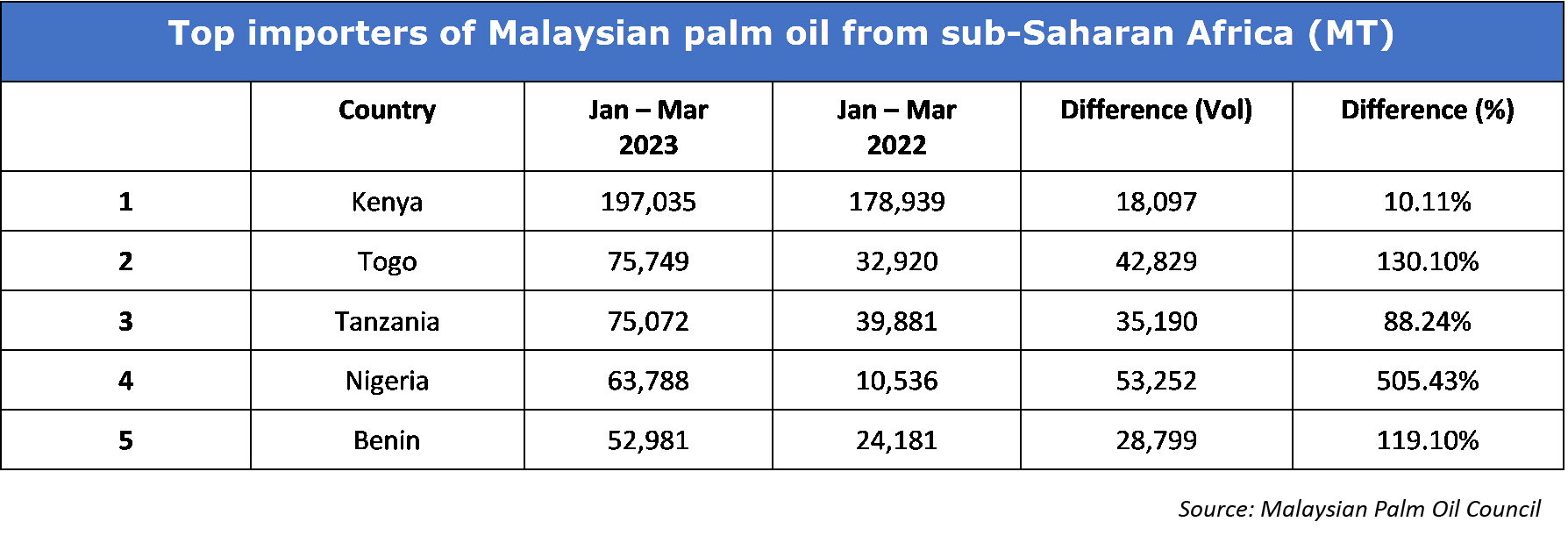

Between January and March, Kenya was the largest consumer of Malaysian palm oil in SSA, importing 197,035 MT, marking a 10% increase compared to the same period last year. It was followed by Togo, Tanzania, Nigeria, and Benin as the five largest importers from Malaysia. Tanzania experienced an 88% surge in imports, which the MPOC partly attributed to the abolishment of a 25% duty on crude palm oil, in 2022.

Among the five largest importers in SSA, Nigeria experienced the most substantial increase in Malaysian palm oil imports. The nation imported 63,788 MT, a jump of over 500% compared to the same period in the previous year.

Among the five largest importers in SSA, Nigeria experienced the most substantial increase in Malaysian palm oil imports. The nation imported 63,788 MT, a jump of over 500% compared to the same period in the previous year.

This jump comes after a decline in Malaysia's palm oil exports to Africa’s largest economy in 2022, during which exports fell by 27%, from 309,911 MT in 2021 to 227,035 MT. Despite its status as the region's top palm oil producer – with an annual output exceeding 1.2m MT – Nigeria continues to rely heavily on palm oil imports.

Nigeria has implemented various measures to reduce imports and promote the local production of palm oil. The federal government added the importation of crude palm oil to a list of 41 items ineligible for accessing foreign currency at the official exchange rate. It has also imposed a 35% tariff (comprising a 10% duty and a 25% levy) on such imports. While the MPOC did not offer specific reasons for the export boom, Nigerian media underscored that the country's crude palm oil is often less competitive than imported alternatives, primarily due to high production costs. Consequently, local manufacturers who rely on the commodity as a raw material for production often opt to import rather than support local producers.

Singapore-based agribusiness firm Olam reported an increase in pre-tax earnings for its palm oil venture in Nigeria. It operates a 200-tonnes-per-day facility that converts crude vegetable oils into refined products, including bleached and deodorised palm oil and palm olein (a more refined version of the commodity, often used for cooking). Olam managed to navigate the import barriers by concentrating on sourcing and processing local raw materials.

Crude palm olein (a liquid fraction obtained during fractionation of palm oil), crude palm oil and cooking oil were the three largest palm oil-related products exported from Malaysia to sub-Saharan Africa, accounting for 41%, 22% and 22% of sales, respectively.

In addition to factors like uncompetitive local production and relaxed import restrictions in countries like Nigeria and Tanzania, the MPOC attributed the increased uptake of palm oil to stronger overall demand, which was partly driven by Muslim festivals in April 2023, as well as Indonesia's Domestic Market Obligation policy. This regulation requires Indonesian exporters to sell a portion of their palm oil domestically before receiving a permit to export the remainder of their production. Indonesia, the world's largest palm oil producer, introduced the policy to control rising cooking oil prices. These measures contributed to an 8.5% decline in exports in 2022 compared to the previous year.

Palm oil is widely used for cooking in many African countries and is also an essential ingredient in the processed foods and beauty products industries. In 2021, sub-Saharan Africa produced a total of 3.3m tonnes of palm oil. Major contributors to the region's production, aside from Nigeria, include Ghana, Côte d'Ivoire, and Cameroon. Although these countries have consistently increased their output since 2015, sub-Saharan Africa remains a net importer of palm oil, primarily sourcing it from Malaysia and Indonesia. In 2019, the region imported an estimated 5.4m tonnes.

References

‘Palm oil opportunities’, OFI Magazine, July/August 2021

‘Nigeria - country commercial guide’, International Trade Administration U.S. Department of Commerce, 13 October 2021

‘Relief as edible oil prices start dropping in Tanzania after tax measures’, The Citizen, 15 July 2022

‘Indonesia's 2022 palm oil exports fell 8.5%, output sluggish’, Reuters, 25 January 2023

‘Indonesia again clamps down on palm oil exports to control domestic prices’, Gro Intelligence, 9 February 2023

‘Nigeria’s palm oil imports from Malaysia rises by 505% in Q1’, Leadership, 26 April 2023

‘Olam Group Limited Annual Report 2022’, Olam Group, April 2023

‘Malaysian palm oil exports performance to sub-Saharan Africa region (January – March 2023)’, Malaysian Palm Oil Council, Accessed 04 May 2023

‘Monthly palm oil trade statistics : January – December 2022’, Malaysian Palm Oil Council, Accessed 04 May 2023

‘Sub-Saharan Africa: Oils & fats situation 2021 & 2022 forecast’, Malaysian Palm Oil Council, Accessed 04 May 2023