Can Singapore unlock finance for Africa through carbon credit?

African need for finance and Singapore desire to decarbonise makes for a promising partnership

By Amit Jain*

![]()

Africa has a veritable war-chest in its natural biodiversity. It has the second-largest rainforest cover in the world and some of the longest stretches of mangroves and peatlands. These ecosystems are the last natural buffers left in our arsenal to fight climate change. They absorb millions of tons of CO2 out of the atmosphere annually and help reduce the pace of global warming. In an ideal world Africa should be compensated handsomely for this invaluable ecological service it is providing the rest of the world. It gets very little of it. There is another cruel irony here. Although Africa contributes only 3.8% to the total global greenhouse gas emissions it bears the worst effects of climate change. Studies indicate Africa will see a 20% drop in rainfall by 2030. Crop yields in Africa are projected to decline by 10% in the next thirty years. Wheat could disappear by 2080 and the production of maize, a staple food, will become scarce. If Africa must counter the negative consequences of climate change it needs at least US$12bn a year.[1] Beseeching the developed world for money is not yielding result. So where will the money come from? One potential answer could be carbon credits.

The Carbon Market

Carbon credit markets are trading exchanges where carbon credits are sold and bought. It works on a work on a ‘polluter pays’ principle. One carbon credit equals 1 tonne of carbon dioxide (tCO2) or an equivalent of another greenhouse gas certified under an eligible standard. Buying it has the effect of a polluter paying a price for releasing an equivalent amount of carbon dioxide or another harmful greenhouse gas into the atmosphere. For the seller it is a monetary compensation for cutting it. Once a credit is used to reduce emissions, it becomes an offset and is no longer tradable.[2]

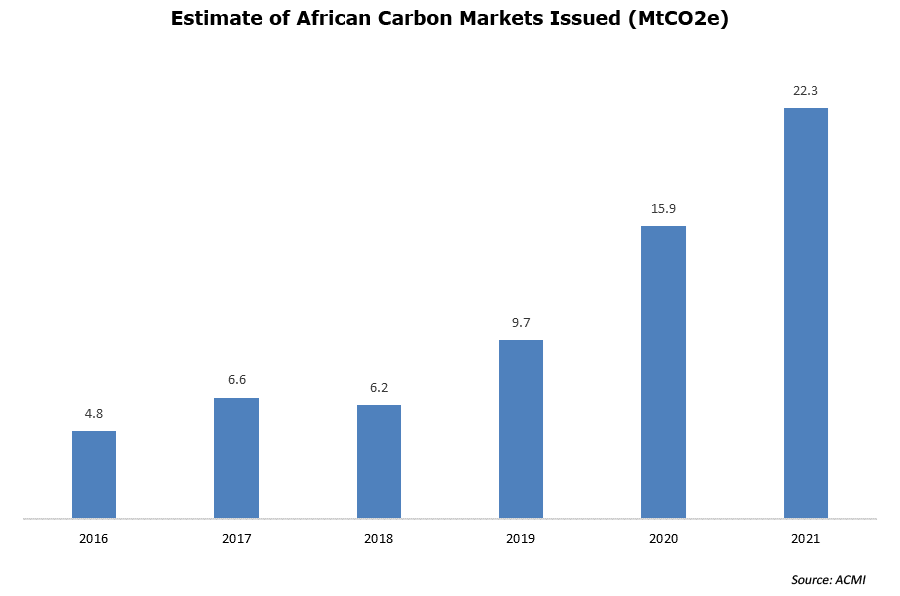

Carbon credits that come with corresponding adjustments mean that the emissions being offset is only counted once by the country that bought the credits, while the country that produced them would give up the right to use the credits to meet their own national targets. This is to avoid the double counting of underlying emissions reductions or removals when carbon credits are traded. As climate change accelerates the demand for carbon credits has exploded. For Africa, the carbon market presents a once in a lifetime opportunity to unlock finance in exchange for all the ecological service it has been providing. For now it accounts for only 13% of the global carbon credit market.[3] But through the Africa Carbon Markets Initiative (ACMI), the region aims to acquire the lion’s share – unlocking up to US$6bn by 2030 and more than US$100 bn by 2050 for climate adaptation projects such as reforestation and mangrove habitat protection. It also promises to add at least 30 million new jobs. The UN says the ACMI could produce 300 million credits a year by 2030 -- a 19-fold increase on current volumes. The UAE has already made a non-binding commitment to buy US$450m in carbon credits via this initiative. But the ACMI has been slammed as a thinly veiled ‘extension permit’ for fossil fuel dependant firms and countries to continue emitting carbon. They also fault ACMI for using a simplistic multiplier to project number of jobs assumed to be created.[4]

That notwithstanding, a clear and a growing need for voluntary carbon markets exists. Research by Ecosystem Marketplace Market shows the market grew to US$ 2bn in 2021, quadrupling in market value from 2020.[5] McKinsey estimates this demand could be worth about US$ 150 bn by 2030.[6] Although Africa is currently producing only a small fraction relative to its total maximum annual potential, this is set to expand rapidly.

Voluntary Vs Compliance

There are two types of carbon markets – one, which is asset-backed and the other that is compliance based. The asset-backed carbon credit market is also called voluntary market and is currently estimated to be worth US$2bn but growing fast. The compliance carbon market works when the government sets a cap on carbon emissions and entities buy and sell the excess credit through an exchange. It is also commonly known as a ‘cap-and-trade’ scheme. The price of carbon is set by the market in both instances. The difference is that in the case of the voluntary market credit is created first and demand follows, while in a compliance-based market the demand is created first and credit is created later. Advocates consider carbon pricing to be the most effective policy tool that can mitigate climate change. A carbon price can send appropriate signals to encourage changes in energy consumption, provide market incentives for the adoption of energy-efficient technologies, and stimulate growth in green industries. By putting a price on externalities, carbon pricing can help shift financing from polluters to the protectors of the environment. Market mechanism is also a powerful signal for the world to rid its addiction on fossil fuel and make the hard but necessary transition to clean energy.

| Voluntary carbon market | Compliance carbon market |

| Asset Based. (Reforestation projects; Mangrove Protection Projects) | Not asset linked. A cap on carbon is set and then companies need to buy the excess carbon |

| Create carbon credit first and find the buyer (off taker) later | Set the cap first and buy carbon credit later |

| US$2bn | US$1 trillion |

Can Singapore emerge as a carbon trading hub for Africa?

Singapore is a leading Asian financial hub that has ambitions to become an international carbon credit trading centre. In June 2023, it launched the Climate Impact X (CIX), a global carbon exchange and marketplace to facilitate the trade in carbon credits. The exchange, which is focusing on the trading of offsets from nature-based climate projects initially, has successfully facilitated the trade of over 12000 tons of carbon credit through a standardised contract which bundled 11 forest conservation projects, including a Kenyan one under the UN Redd+ scheme. Each standardised contract, which is called CNX, is worth a 1000 carbon credits. By launching CIX and guaranteeing ‘high integrity’ carbon credits, Singapore aims to tap the US$2 billion a year voluntary carbon market and restore investor confidence that has been spooked by allegations of ‘green washing’ and lack of standards in the certification of carbon credits. Climate activists have accused corporations of using carbon offset schemes to delay making the transition to clean fuel. Until recently, the voluntary carbon market was showing promising growth as more listed companies came under shareholder pressure to adopt net zero policies. But as criticism grew louder companies began to back out. The number of credits used by companies fell 6% in the first half of 2023, the first dip in seven years. Energy giant Shell is the latest to scrap plans to buy carbon credit offsets.[7]

Despite such setbacks, Singapore is moving fast to outflank competition in the carbon market. Singapore-based ACX, a carbon credit trading platform, and the Nairobi International Finance Centre (NIFC) are soon to start Kenya's first carbon offset exchange. 25% of all carbon trading activity in Africa today occurs in Kenya.[8] By hosting the African Voluntary Carbon Credits Market Forum, the Victoria Falls Stock Exchange of Zimbabwe has also shown its intention to become a prominent hub for carbon credit trading. Singapore, however, believes it is better positioned to emerge as a carbon services hub than many others given its global reputation as a trusted and highly developed financial centre and technocratic administration. It sees US$1.8 billion- US$ 5.6 billion worth of new economic opportunities being created over the next 30 years. At US$20 per metric ton, the average price of carbon credit is woefully low. According to the World Bank reckons less than 5% of emissions are priced at or above the level that would be required, by 2030, for temperature increases to be limited to 2°C above pre-industrial levels. But as the world moves towards a carbon neutral future the price is expected to increase. That could spark demand for a range of high value services that Singapore already provides as well as new ones for which it is gearing up.

Price of carbon per ton

| Current | US$ | If all countries adopt compliance scheme by 2050 | US$ | If only those with existing scheme adopt compliance scheme by 2050 | US$ |

| Average | 20 | Regions with existing compliance schemes | 250 | Average | 20 |

| EU/US Average | 80-140 | Regions with no existing compliance schemes | 82 | ||

| Minimum floor price range required to keep global warming within the 2 Degree C limit, as provided under the Paris Agreement | 40-80 | ||||

| Minimum floor price range demanded by African leaders | 30-100 |

Source: Study of Singapore as a Carbon Services Hub, South Pole 2021; Bloomberg et al

The launch of CIX comes as Singapore allows its firms to international carbon credit to offset up to 5% of taxable emissions, in lieu of paying the carbon tax, which is set at US$4 per ton of carbon. But this will be raised to US$19 by 2025, and then US$34 in 2026 and beyond. The plan is for the carbon tax to reach between US$38 and US$60 per ton of carbon by 2030. Singapore aims to reach its net-zero emission target by 2050 and has shown a certain drive by achieving a reduction of over 32% per cent below its business-as-usual expectation in 2020. Its current emissions are a little over 52 million tonnes, which is expected to peak at over 65 million tonnes over the next seven years before tamping down.[9] The small island city-state which spans a little over 719km2 in size contributes only 0.1% to global emissions. Yet it has one of the biggest per capita carbon footprints in the world. 95% of its electricity comes from imported natural gas and it contributes 43% of the island’s GHG emissions. Singapore also hosts more than half of the data centres in Southeast Asia. These data centres consume inordinate amount of electricity. But unlike other Asian countries Singapore does not subsidise fossil fuel. The number of vehicles on the road have been kept in check through a strictly controlled quota system that makes car ownership in Singapore prohibitively expensive. It has pledged to reduce Emissions Intensity (EI) by 36% from 2005 baseline by 2030.

Where is the opportunity?

The clearest near-term opportunity for Singapore appears to be in the financing and trading of carbon credits. The carbon market in Africa now is entirely voluntary. But as some of the key African economies start to move towards compliance, Singapore can play a catalytic role in capacity building, particularly on carbon accounting, monitoring, reporting, verification, and governance for carbon crediting. It is, perhaps, with that vision in sight that Singapore has signed carbon credit agreements with African governments. In 2022, Singapore and Ghana concluded negotiations on the implementation of a carbon credit scheme that would be complaint with Article 6 of the Paris Agreement. Earlier this year, a Memoranda of Understanding (MOU) to work towards Implementation Agreements was also signed with Kenya. The National Environment Agency (NEA) of Singapore has signed MOUs with five established carbon credit programmes to ensure that the carbon credits issued by Singapore to offset taxable emissions are robustly validated and verified. These programmes include the Gold Standard, the Verified Carbon Standard by Verra, Global Carbon Council, American Carbon Registry, and the Architecture for REDD+ transactions. Singapore will soon launch an open source blockchain-based decentralised registry of carbon credits that would be open to the public with the aim of enhancing transparency and minimising the risk of double count.

Singapore could also play a role to support the voluntary adoption of mitigation targets by Asian and Western firms operating in Africa as they come under increased pressure to disclose their carbon footprint. It already has a small but growing carbon services industry, with at least 14 companies involved in carbon services. Such services span a wide range, although financial, financial intermediation and legal services are the key services that Singapore can offer Africa. Singapore is a commodity trading hub and could therefore emerge as a favourable location for agribusiness companies operating in Africa to seek carbon trading-related services. It is investing well over US$600 million in developing environmental technologies and clean energy solutions. Some of these low-carbon technologies being test-bedded in universities such as the Nanyang Technological University will not only help Singapore address its own climate challenges but may also be applicable in African cities such as Lagos, Nairobi, and Kigali. Singapore’s carbon tax and climate policies being implemented under the framework of the Singapore Green Plan could serve as templates for small but ambitious African states like Rwanda and Mauritius who are emerging as financial and technological hubs for the continent.

Conclusion

It is still too early to say if Singapore could indeed emerge as a preferred carbon trading hub for Africa. The competition from Africa itself is fierce. By hosting the African Voluntary Carbon Credits Market Forum, the Victoria Falls Stock Exchange of Zimbabwe has also shown its intention to become a prominent hub for carbon credit trading. The government Tanzania claims to have attracted over 20 companies that are set to invest over US$20bn in carbon offset projects across the country. It has already attracted more than US$1bn since Dar-es-Salaam adopted regulations and guidelines on carbon trading in 2022. According to the World Bank, there are now 73 carbon-pricing schemes across the world, covering 23% of global emissions. A carbon market launched by the Johannesburg Stock Exchange (JSE) has already drawn interest from major entities. JSE customers can now hold carbon credits and renewable energy certificates in local or global registries. Kenya plans to launch its own carbon market very soon. The two could very well collaborate to compete with Singapore. South Africa, after all is the biggest carbon emitter in Africa, while Kenya is a net positive renewable energy producer. They are both part of a pan-African initiative which could see the merger of their respective capital markets – potentially making much bigger and deeper than that of Singapore. The transition to net zero also brings opportunities for Africa. McKinsey has identified eight manufacturing opportunities that together could generate up to US$2bn in revenue a year in total and create 700,000 new jobs for Africa by 2030. This includes assembly of off-grid and microgrid solar systems, electric vehicles (EV) and bioethanol cookers. Capturing these opportunities will require structuring bankable projects, financing, and technical know-how. Done well, it could widen energy access, reduce air pollution, improve urban living, and create thousands of much needed jobs. A well-functioning carbon credit market that helps African firms generate high-quality high-value carbon credits could open a whole new avenue of finance. If Singapore succeeds in creating a vibrant one, it could one day become the most pivotal hinge that strengthens the partnership between Singapore and Africa.

*with additional inputs from Rufus Mwanyasi

References

[1] Nikkei Asia, Asia must help Africa escape worst impacts of climate change, Nov 2021

[2] UNDP Climate Promise, What are Carbon Markets and why are they important? May 18, 2022, https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important

[3] Bloomberg

[4] Climate Champions, Africa Carbon Markets Initiative launched to dramatically expand Africa’s participation in voluntary carbon market, 2022, https://climatechampions.unfccc.int/africa-carbon-markets-initiative/

[5] Ecosystem Marketplace, VCM reaches towards US$ 2 billion in 2021: New Market Analysis Published from Ecosystem Marketplace, 2022, https://www.ecosystemmarketplace.com/articles/the-art-of-integrity-state-of-the-voluntary-carbon-markets-q3-2022/

[6] Levy, C. Blaufelder, C, Mannion, P. and Pinner, D. A Blueprint for scaling voluntary carbon markets to meet the climate challenge, 2021, https://www.mckinsey.com/capabilities/sustainability/our-insights/a-blueprint-for-scaling-voluntary-carbon-markets-to-meet-the-climate-challenge

[7] Reuters, Carbon credit market confidence ebbs as big names retreat, Sep 2023

[8] The Straits Times, Singapore and Kenya sign three new deals, move investment treaty forward, May 2023

[9] The Straits Times, Singapore boosts UN climate targets, confirms net zero by 2050