Botswana halts diamond mining

Weak demand hits the diamond-driven economy

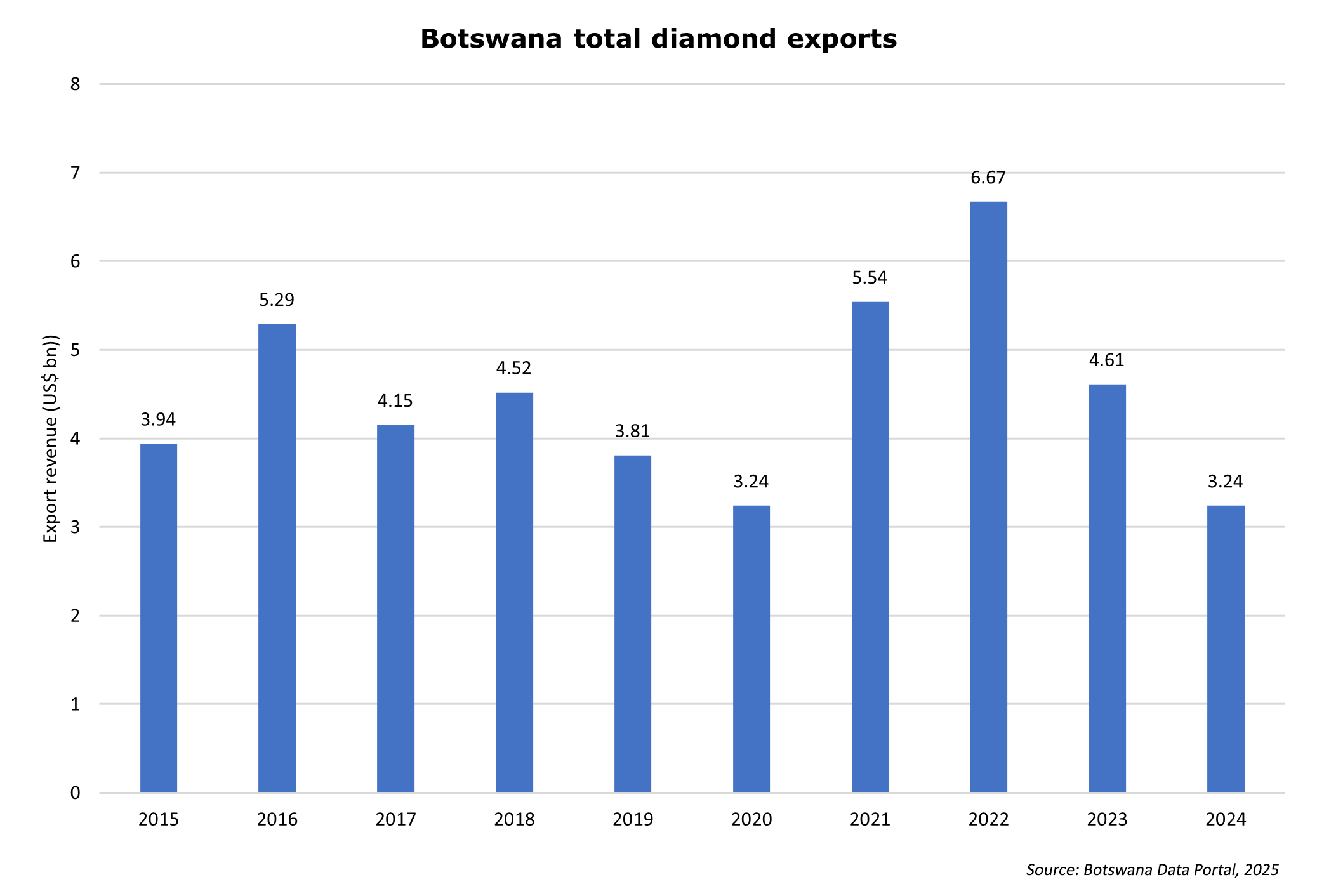

Debswana Diamond Company, the mining firm jointly owned by the Botswana government and De Beers of South Africa has halted operations as the global slump in diamond demand drags on. Diamonds account for about 30% of Botswana’s government revenue and 75% of its foreign currency earnings. The downturn has already taken a toll on the economy, which contracted by 3% in 2024. The International Monetary Fund (IMF) expects a further reduction of 0.4% this year.

The decline of the global diamond market since mid-2023 has led Debswana to reduce its output by 27% in 2024, lowering production to about 18m carats. This year, it plans to trim output to 15m carats. The company, which is responsible for roughly 90% of Botswana’s diamond sales, says the latest cutbacks will help reduce costs, particularly on fuel and electricity.

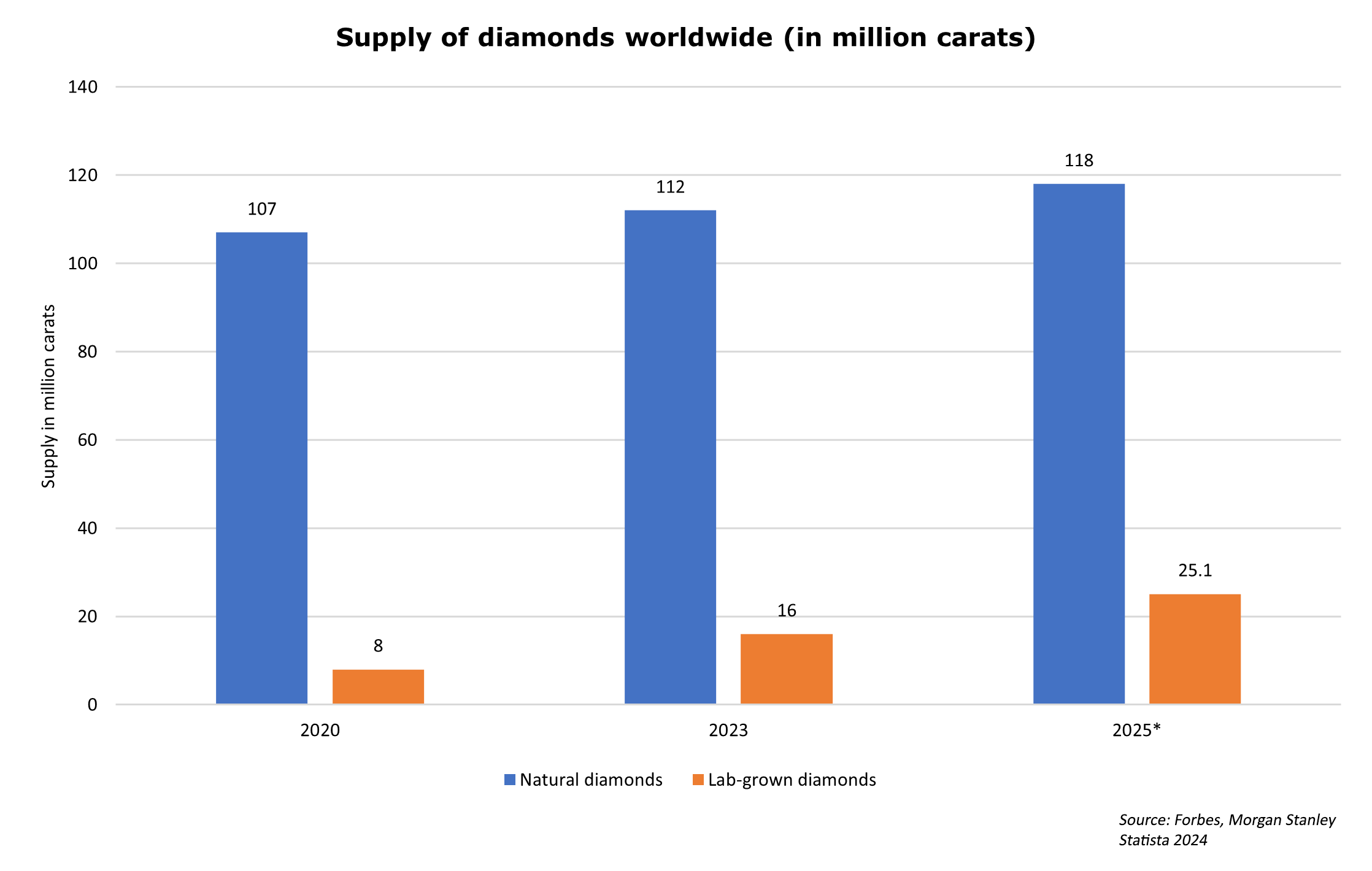

The global diamond industry is estimated to be worth well over US$100 billion. But several factors have led to the fall in global demand for natural diamonds. One of the most significant is the rise of lab-grown diamonds, which have become a strong competitor. The global market share by value of lab-grown gems rocketed from 3.5 per cent in 2018 to 18.5 per cent in 2023. Prices for synthetic stones have fallen sharply, making them far more accessible to consumers. Today, lab-grown diamonds make up 50% of the US engagement-ring market by volume.

This shift in consumer preferences has led to a buildup of unsold natural diamond stock, putting pressure on prices and weakening their image as a reliable store of value. At the same time, producers of synthetic diamonds have intensified their marketing efforts – promoting their products as sustainable alternatives and casting natural diamonds in a negative light, often linking them to conflict and environmental harm.

Economic challenges in China, a key growth market for diamonds in recent years, have also weighed on demand. Contributing further to the decline, the number of marriages in China fell by a fifth last year – the steepest drop on record – dampening appetite for bridal jewellery. Meanwhile, several brands made heavy purchases in 2022, concerned about potential supply disruptions following sanctions on Russian diamonds. This left them with unusually high inventory levels. The setback for the diamond industry has hit the Botswana economy. GDP shrank 3% in 2024 and analysts expect a further 0.4% decline this year. Adding to the strain, new US tariffs on Botswana diamonds have introduced fresh uncertainty to the sector.

In response, the Botswana government is planning cost-cutting measures such as downsizing the state vehicle fleet and restricting official travel. On the revenue side, it is stepping up tax enforcement and introducing a levy on digital transactions.

Botswana has long aimed to diversify its economy beyond diamond mining, with mixed results. Over the years, successive administrations have channelled investment into sectors like tourism, financial services, and other mineral extraction, including copper.

The discovery of diamonds in early 1970s propelled Botswana from one the poorest countries in the world to one of the wealthiest in Africa. Diamond revenues were invested in infrastructure, education and healthcare. Excess surplus was channelled into a well-managed Sovereign Wealth Fund (SWF). The landlocked sparsely populated republic has long been widely regarded as a model of clean technocratic governance and has consistently ranked high in the global index of hard infrastructure, human capital and governance. By 2005 Botswana had achieved upper-middle-income status. But the recent slump in diamond revenues has forced the country to draw down its reserves The so-called Government Investment Account (GIA) has fallen by P14bn (US$1.05bn) dropping from P19.1bn (US$1.43bn) in July 2023 to P5.1bn (US$381m) as of March 2024 (the national currency is Pula). With finances under strain, there are concerns that the government may need to reduce spending on social benefits.

References

'Don’t panic, Serame urges amidst struggling fiscus', Mmegi, 16 August 2024

'Botswana in a tight position as lab diamonds sparkle a little brighter', Old Mutual Investment Group, 02 December 2024

‘Diamonds lose their sparkle as prices come crashing down’, The Guardian, 25 January 2025

'The 2024 diamond crisis: An industry at its breaking point', Rapaport, 13 February 2025

'The World Bank in Botswana', World Bank Group, 09 April 2025

'Botswana economy hit hard as diamond slump deepens', Mining.com, 30 April 2025

'Botswana's Debswana curbs diamond production as weak demand persists', Reuters, 06 June 2025

'Botswana's diamond giant slashes output as demand falls', BBC News, 06 Jun 2025

'Botswana Country Report 2024', BTI Transformation Index, Accessed on 12 June 2025

Lab-grown diamonds put natural gems under pressure, The Straits Times, 20 Feb 2024

International Merchandise Trade Statistics of Botswana - Botswana Data Portal, Statistics Botswana Data Portal, 23 Feb 2025

Lab-grown diamond industry | Statista, Statista, 23 Feb 2025

Diamond industry worldwide | Statista, Statista, 23 Feb 2025