Africa walks a tightrope

Economic implications of the Russian invasion of Ukraine

By Ronak Gopaldas

Russian President Vladimir Putin’s decision to invade Ukraine has thrown global markets into disarray and threatens to derail what was an already fragile post-Covid global economic recovery. Beyond the global geopolitical and humanitarian implications his actions also have some serious ramifications for the global economy.

Russian President Vladimir Putin’s decision to invade Ukraine has thrown global markets into disarray and threatens to derail what was an already fragile post-Covid global economic recovery. Beyond the global geopolitical and humanitarian implications his actions also have some serious ramifications for the global economy.

The question for Africa is whether policymakers can tactfully navigate this crisis and find a way out of an imbroglio that threatens to split the world once again in two opposing camps forcing both governments and investors to choose sides. To understand who the potential country and sectoral winners and losers could be, it is important to understand the transmission mechanisms of the immediate fallout across three key areas;

- Financial markets / economics

- Commodities

- Geopolitics

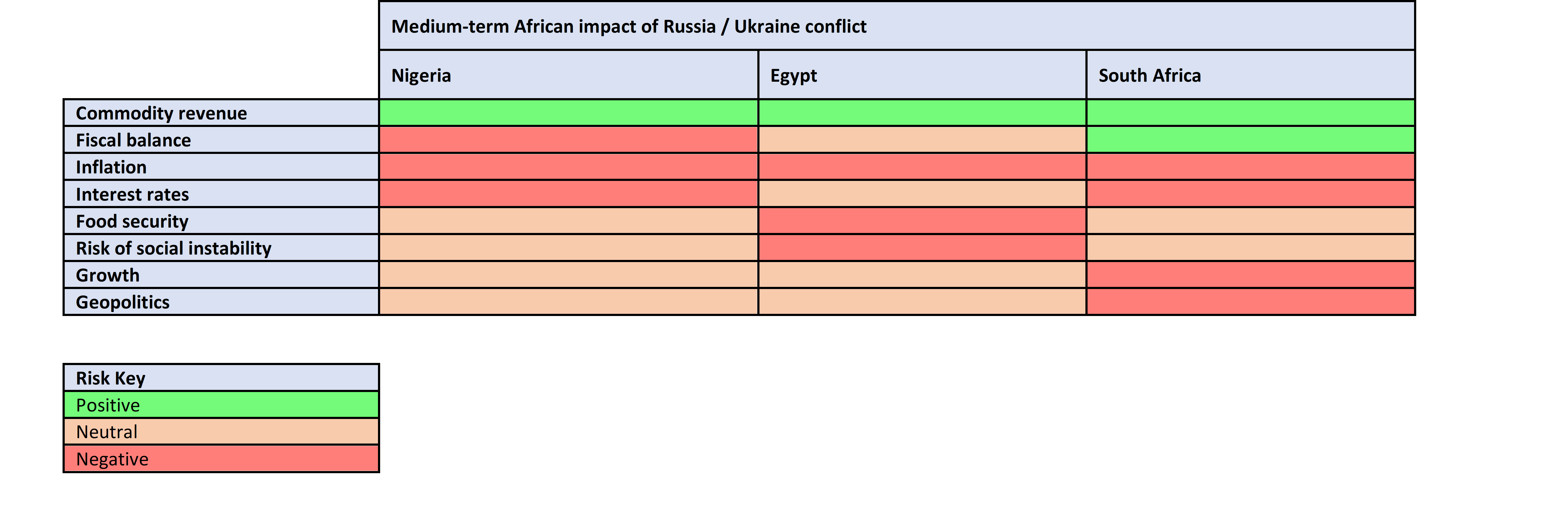

While the humanitarian and social costs will fall squarely on the citizens of Ukraine (rising death toll and displacements) and Russia (soaring inflation and interest rates, job losses, and economic isolation), the economic and political costs will be global. African countries stand to benefit enormously from surging commodity prices, but whether the windfall will be enough to stem the global currency, inflation and interest rate shocks will depend on their willingness to make bold political decisions. Being on the wrong side of the geostrategic calculus could have devastating long-term economic and political consequences. Nigeria, Egypt, and South Africa are in the spotlight.

The immediate aftermath

After months of growing tensions Russia launched what it termed a “special military operation”[1] on 24 Feb. It sent its forces into Ukraine under the pretence of ‘protecting Russian citizens from “genocide”. It also cited its unhappiness with the western security alliance - NATO’s eastward expansion in Europe.

The almost universally condemned invasion, which seemingly has very little support even in Russia[2], saw the immediate imposition of severe sanctions against the country, most notably by the United States, Europe, and NATO allies. Russia was effectively shut out of global markets overnight, isolated physically (the barring of Russian planes from international airspace[3]), economically (suspension of international trade in goods and services[4]) and financially (Visa, Mastercard and American Express ceased operations in Russia[5]and many Russian banks have been banned from SWIFT[6]).

Western powers (NATO, US, UK) are reluctant to be drawn into the war for fear of triggering a nuclear standoff with Russia, which has the largest nuclear arsenal of any country. Russia has already placed its nuclear capabilities on high alert.[7] Instead, the sanctions are ostensibly designed to wreak an enormous economic, social and (it is hoped) political toll on Russia, with the hope that internal dissent will ultimately remove President Vladimir Putin from power. But sanctions are a slow poison, and as Syria and Venezuela have demonstrated, there is no guarantee it will work.

Russian authorities know the playbook, and in response to growing domestic protests against their country’s military action, have begun clamping down on citizens, blocking social media sites, Facebook and Twitter[8], and implementing a raft of new laws aimed at quelling dissent and controlling the narrative.

Financial markets in turmoil

On news of the invasion, the Russian rouble fell more than 30% against most major currencies (figure 1) while the stock market fell by a third[9], wiping out more than US$189bn in value. Some Russian stocks and exchange traded funds listed in London and New York lost up to 90% before being suspended.[10]

In response, Russia’s central bank more than doubled interest rates just four days later from 9.5% to 20% to try and stem the exchange rate losses.[11]Russian companies were also instructed to sell 80% of their foreign currency revenue to shore up reserves.[12] Almost hourly, news emerged of global corporations announcing they were suspending operations in Russia or exiting the country entirely (figure 2).

One of the biggest announcements came from the energy major BP, which said it would relinquish its nearly 20% stake in Russia’s state-owned energy conglomerate, Rosneft worth an estimated US$14bn.[13] Shell, ExxonMobil, and many others will also make sizeable write-downs[14] as they are unlikely to recover their investments.[15] Such exits by oil majors and other corporates have happened in Russia before, but in an age where corporate reputations are sacrosanct, many may not return. At least, not until the country is under new management.

Compounding matters, Russia’s sovereign credit rating was cut to junk (sub investment grade) by rating agencies Moody’s, S&P and Fitch, and markets started to price in the inevitability of a default.[16] The Russian government and its state-owned firms owe something like US$150bn to foreign investors. Most of this is to be paid in either dollars or euros. But sanctions imposed after Russia's invasion of Ukraine mean it has lost access to a large proportion of its US$630bn in foreign currency reserves. It made payments of US$117m on two dollar-denominated bonds, albeit a day late. At the time of submitting concerns that Russia could default on its debt repayment remained, although the direct impact that will have on the global economy is expected to be limited but the fallout on Russia itself could be serious. International lenders and investors are almost certain to take heavy losses the longer the conflict continues.

Interest rates were already set to rise globally, triggered by the US Fed signalling a rising rate trajectory to quell record inflation after an extended period of ultralow monetary accommodation. Globally, central banks are in a quandary. The natural impulse is to raise the benchmark rate but to do so would only cut growth and further depress the economic outlook. Record low rates and unparalleled fiscal stimulus are part of what got us here. Policy options are limited, and the more likely outcome is for gradual, well communicated, and incremental rate hikes.

This is the best-case scenario for many African countries who were already in a weak fiscal position or full-blown debt distress. Their economies were forced to increase spending to offset the worst of Covid’s impacts among the poor and purchase vaccines, much of it funded by IMF or World Bank loans. Rolling back social relief will be politically unpalatable but a gradual US hiking cycle will provide some breathing room. The prospect of stagflation (high inflation, weak economic growth) looms large in Africa.

Commodities go on a tear

As emerging market currencies, equities, and bonds plunged commodity prices soared (figure 3). Russia is one of the world’s leading producers of oil, natural gas, coal[17], aluminum, nickel, platinum, gold, and wheat.[18] It supplies 10% of global oil and 40% of Europe’s gas. Ukraine is the ‘breadbasket’ of Europe, and the fifth largest exporter of wheat globally, accounting for 7% of global production.[19] Together, Russia and Ukraine account for a nearly a third of global wheat exports[20] and a fifth of corn exports.[21] The conflict has sent soft commodity prices to near all-time highs and the prospect of food insecurity must not be overlooked – 45% of Africa’s total wheat imports come from Russia and Ukraine.[22] In 2020, African countries bought up to US$5bn worth of wheat from the two warring sides.

On metals, gold prices topped US$2,000 a fine ounce and is holding steady at these levels, with some analysts expecting the price to push to US$2,150/oz as the conflict escalates[23] (figure 4). Platinum group metal, palladium - 40% of which is produced by Russia, rose nearly 10% to US$3,263.[24]

On metals, gold prices topped US$2,000 a fine ounce and is holding steady at these levels, with some analysts expecting the price to push to US$2,150/oz as the conflict escalates[23] (figure 4). Platinum group metal, palladium - 40% of which is produced by Russia, rose nearly 10% to US$3,263.[24]

It was the perfect commodity price storm in what was an already frothy market. Brent crude oil jumped to almost US$140 per barrel[25] as the US imposed a Russian oil ban. Not only has Russia been shut out of most export markets, but logistics and supply chain challenges have still not recovered from the impact of Covid, and despite record prices, additional supply chain challenges stemming from Russian isolation could significantly delay getting goods to buyers, impacting supplier cashflow.

It was the perfect commodity price storm in what was an already frothy market. Brent crude oil jumped to almost US$140 per barrel[25] as the US imposed a Russian oil ban. Not only has Russia been shut out of most export markets, but logistics and supply chain challenges have still not recovered from the impact of Covid, and despite record prices, additional supply chain challenges stemming from Russian isolation could significantly delay getting goods to buyers, impacting supplier cashflow.

Geopolitical realignment

The West’s relationship with Vladimir Putin has long been strained, but it now appears irrevocably broken. NATO countries have effectively severed all ties with Russia and multinationals have been pressured to do the same. The country is not entirely on its own, however.

At the UN General Assembly draft resolution vote to demand a withdrawal of Russian forces from Ukraine, five of the 180 voting countries sided with Russia. They were the usual pariahs, Belarus, North Korea, Eritrea, Russia itself and Syria. More telling for Africa, however, were those countries that abstained from voting: Algeria, Angola, Burundi, Central African Republic, China, Congo, Madagascar, Mali, Mozambique, Namibia, Senegal, South Africa (who offered to mediate talks), South Sudan, Sudan, Uganda, Tanzania, and Zimbabwe. Just as telling were the countries that were not present for the vote – Burkina Faso, Equatorial Guinea, Eswatini, Ethiopia, Guinea, Guinea Bissau, Morocco, and Togo. Half of African countries at the United Nations Security Council failed to condemn Russia’s invasion of the Ukraine. Nigeria and Egypt sided with the West, while South Africa failed to denounce Russia.

Several African countries and their leaders are still beholden to Russia, at the very least ideologically, but also financially, through patronage, or through arms, mercenaries, disinformation (bots / cyber-attacks) and political protection.[26]

For its part, the African Union (AU) strongly denounced Russia’s provocation urging an immediate end to the bombing. It was also angered by reports of African citizens in the Ukraine being discriminated against in the rush to flee the war-torn country.[27] Kenyan ambassador to the UN, Martin Kimani, was more forthright in expressing his country’s unhappiness and the implications for sovereignty everywhere. It is clear from the varying reactions that Africa is hardly united in its view. This disunity may allow Russia to maintain its ties with Africa as it seeks to circumvent global trade sanctions. While Moscow could exercise some leverage when it comes to diplomacy but when on the economic front it may find itself powerless. Russia represents just 3% of Africa’s international trade, and it barely accounts for 1% of the total FDI received by the continent.[28]

Deciphering the voting patterns is tricky as abstention or absence is not necessarily tacit support. It also does not necessarily speak to the relationship these countries have with Russia, although many do have strong ties. Instead, it can be interpreted as an unwillingness to upset China (which abstained), a country that does have close ties to Russia and who African countries would be keen not to upset given the scale of Chinese trade and investment with the continent. Herein lies another predicament for African states - which side to choose in the conflict? The Russia / Ukraine conflict is already reshaping geopolitical allegiances and shifting trading patterns. African countries must be nimble and strategic in positioning themselves to take advantage of a realignment in the global order.

As witnessed by the global response to Africa’s pleas for vaccine access during Covid, the continent is hardly at the front of the queue when it comes to international support in times of turmoil. What little development aid the continent did receive may be compromised as Western donors redirect their aid money and attention to Ukraine.

Africa does have some leverage. It is an important alternative provider of several of the commodities Russia exported and can step in to replace sudden stops of Russian oil and gas. The continent must leverage this strategic advantage wherever possible.

The impact on Africa

For African countries, whatever the position of their government on the invasion, the economic and financial shocks are inescapable.

- Financial markets

Sentiment toward small, open, emerging market economies in Africa soured on news of the war. They were already out of favour in light of US Federal Reserve monetary tightening. Currencies like the Rand were hit and stock market indices broadly fell as investors worked through the impact on earnings, particularly on tickers exposed to Russia and Eastern Europe (Naspers owns Russia’s VK, a Putin aligned media house[29]). Conversely, mining and oil stocks surged. The divergent movements in asset classes is interrelated.

High commodity prices bode well for government revenue in commodity exporting countries. It will give them more room to service sovereign debt. That the initial movement in African bond yields was muted[30] indicates uncertainty over real yield compression on higher inflation. Sovereign bonds from several African issuers, however, went on to rally as investors see junk rated African debt as a safer bet than Russian bonds. It’s one of the few upsides for Africa in the unfolding conflict. Commodities are another but are a double-edged sword. Africa’s natural resources endowment has been a primary driver of its growth, but a lack of value-added production means that African countries have to import the final products of the commodities they export at far higher prices. Moreover, this explosive rise in commodity prices could stymie diversification efforts and make countries complacent.

- Commodities

Africa is set to suffer an inflationary double blow, not just on far higher oil and food prices, but also on weaker exchange rates. There will be some offset for oil and grain exporters who will benefit from a weaker currency and higher prices, but for the ordinary African in import dominated economies, the inflationary pressure and supply constraints pose a real danger to food security. The interest rate trajectory should steepen, and the primary concern is for the real economy.

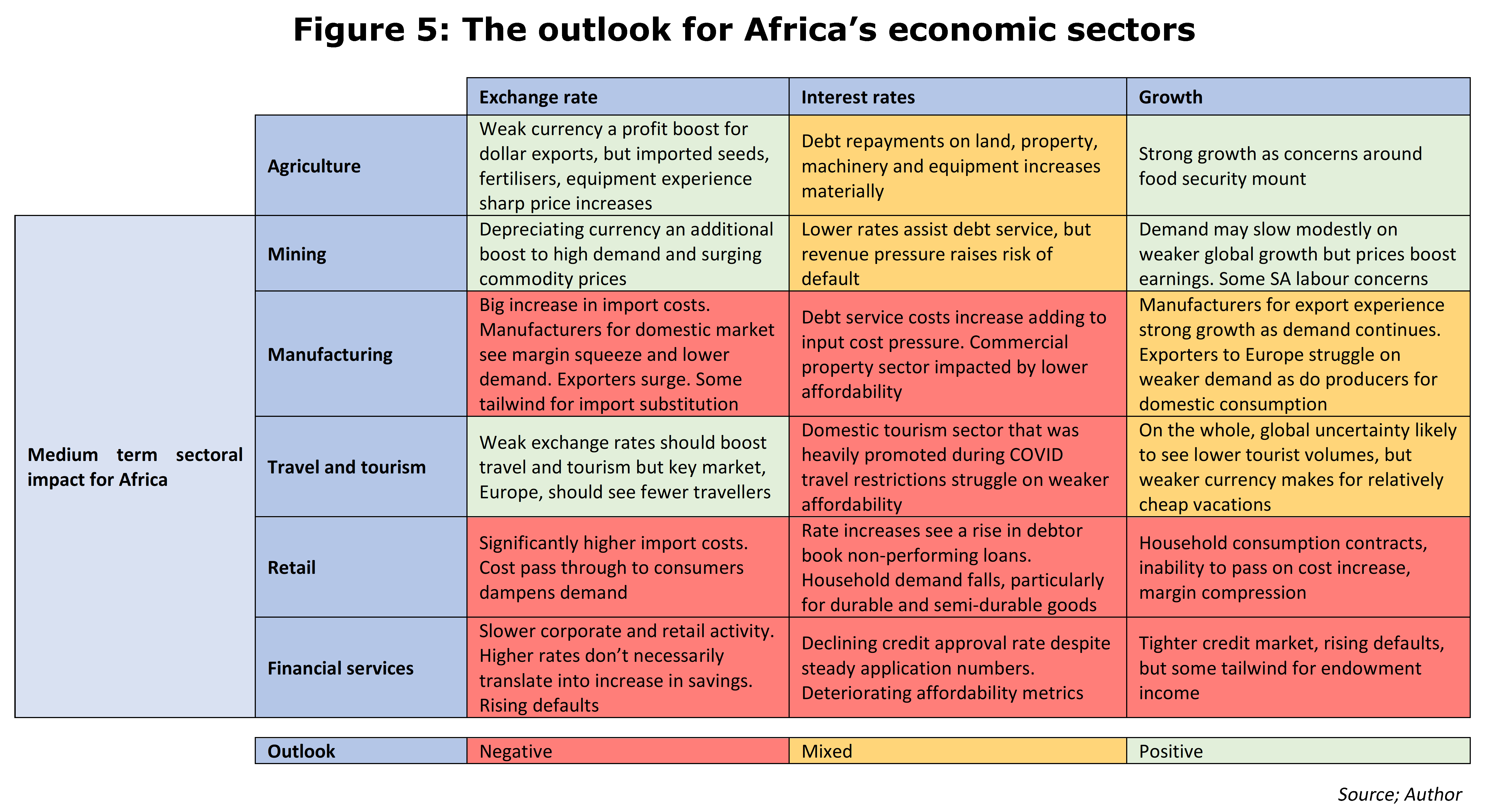

- The real economy

Primary sectors - agriculture and mining account for a significant proportion of the labour market and contributor to the gross domestic product (GDP) of Africa. Yet the commodity dividend may not bring in lasting returns. Few are sufficiently equipped with enough refining, manufacturing, and beneficiation capabilities to take advantage of higher commodity prices for stable and sustainable growth. Extraordinary extractive wealth and lack of diversified downstream value adding capability has meant that Africa has long been vulnerable to repeated cycles of booms and bust. The windfall from this crisis may not trickle down either.

For all their mineral wealth, countries like Nigeria, Egypt, and South Africa are consumption driven economies, dependent on strong household balance sheets and income statements, both of which will weaken as higher interest rates, fuel, and food prices eat into disposable income. Utilities, manufacturing, retail, and wholesale trade are all likely to bear the brunt of higher input costs and the increased cost of funding. Passing these costs on to the end user only erodes demand and drags on company earnings, hiring and profitability. Banks are likely to see slower business activity, an increase in non-performing loans, and weaker credit demand / affordability. International trade too will decline. Imports will wane on weaker demand, while slower growth among Africa’s biggest trading partners, Europe, the US, and China are likely to curb export growth.

Much of the oil and mining tax windfall will be offset by weaker revenue growth from the tertiary sector (retail trade, financial services). On a net basis then, the upshot of higher commodity prices is overstated for Africa. As an example, Russia is a large exporter of fertilisers to Africa, which will drive up the cost of grain production and reduce the benefit of soft commodity price increases. Instead, Africa may find itself mired in a stagflation outcome, where economic growth is stagnant, but inflation continues to accelerate. The predicament here is that a traditional policy response, hiking rates to head off inflation, serves only to further depress growth.

Nigeria

Despite the global turmoil Nigeria’s equity market was relatively unchanged on news of the Russian invasion, closing flat on the day. Traders may have been taking time to process the possible implications for the economy or at the very least, publicly traded oil players on the Nigerian stock exchange. While the Nigerian All Share Index continues to hold up well, buoyed by oil stocks, the impact on the broader economy is decidedly less positive.

For oil producing African states like Nigeria, Angola, Algeria, and Egypt, the higher oil price, a function of supply squeeze worries as Russia is shut out of global markets, will mean greater returns (figure 6).

A sharp rise in exports and foreign exchange income, much improved terms of trade and tax revenue and an improvement in the current account balance should theoretically stem the flight of capital.[31] Nigeria, however, lacking the capacity to refine much of its oil production, is also Africa’s largest importer of refined oil products.[32] In 2020, Nigeria’s petroleum imports (US$43.46bn) were, in fact, higher than crude exports (US$27.73bn).[33]

A sharp rise in exports and foreign exchange income, much improved terms of trade and tax revenue and an improvement in the current account balance should theoretically stem the flight of capital.[31] Nigeria, however, lacking the capacity to refine much of its oil production, is also Africa’s largest importer of refined oil products.[32] In 2020, Nigeria’s petroleum imports (US$43.46bn) were, in fact, higher than crude exports (US$27.73bn).[33]

Nigeria also produces less than 5% of its annual wheat requirement and is the world’s sixth biggest wheat importer[34], importing mostly from the US, Canada, Russia, and Ukraine.[35] The government has resorted to imposing food import bans and subsidies to farmers in an effort to encourage domestic wheat production but with little success.[36] This leaves the country very exposed to wheat price spike and the pass-through to inflation.

The country’s inflation rate stood at 15.6% y/y in January and food inflation remains above 17% y/y.[37] While the rate of price increases have been on a steady decline since early 2021 when inflation was closer to 20% y/y, the impact of a higher oil price, the government’s limited scope to carry further fuel subsidies and the looming impact of the wheat price surge suggest inflation will push markedly higher in the coming months, fanned by what many expect will be inevitable naira depreciation.[38] This will cut the central bank’s room to provide consumers with further interest rate relief – interest rates have been steadily declining since 2019. Instead, rates are likely to climb, squeezing disposable income and household consumption.[39]

Egypt

While Egypt produces less than a third of Nigeria’s oil output, the petroleum sector is still a significant contributor to the economy, rising more than 80% in 2021 and generating US$12.9bn in revenue.[40] The jump was due to a combination of new projects coming online as well as higher commodity prices. The elevated oil price is certain to be a strong tailwind for the economy as are higher gas prices – the 2015 discovery of Zohr offshore natural gas field is the largest in the Mediterranean. The country’s relatively close proximity to Europe makes it a compelling alternative to Russian gas and Egypt may over the coming years see a flurry of upstream oil and gas investment as countries look to diversify their supply streams.

For Egypt, the immediate concern stemming from the Russia-Ukraine conflict will be food security and for political stability. The country does not produce sufficient grain or oil seed crops, popular staples for many Egyptians, to meet domestic demand. The country is the world’s largest wheat importer and among the ten largest sunflower oil importers. 85% of Egypt’s wheat and 73% of its sunflower oil is sourced from Russia and Ukraine.[41] With these supplies now at risk, and with just four months of wheat reserves and five months of sunflower oil on hand, the government is scrambling to secure new suppliers.

The Egyptian government spends 2% (US$3.3bn) of its annual budget on providing five heavily subsidised loaves of bread per day to 88% of its total population and runs a similar subsidy for cooking oil.[42] The cost of maintaining these subsidies will place enormous strain on the exchequer, but cutting subsidies is not an option. When the Egyptian government tried this in 1977, it led to two days of deadly riots.[43] The “bread riots” as they became known, forced the then government to backtrack on their plan to reduce subsidies which have been in place ever since. More recently, in 2017, protests brought cities across Egypt to a halt after the government of President Abdel Fatah Al-Sisi cut the state-sponsored provision of bread to bakeries.

To be sure, Egypt is on a far sounder footing than it was in 1977. Its economy grew 9% in the last six months of 2021.[44] Inflation is relatively stable at 6% but could increase on rising oil and food prices if the government discontinues subsidies. The policy rate has fallen more than 10 percentage points since 2018 but this too will likely begin rising. Nevertheless, an inability to source wheat and cooking oil and maintain price stability could lead to social and political instability. It was only a little more than a decade ago that stagnant economic growth, rising unemployment and high food prices created conditions that led to a popular revolt resulting in the ouster of former President Hosni Mubarak. The Arab Spring, which began in Tunisia spread through North Africa toppling one regime after another.[45]

South Africa

Unlike Nigeria and Egypt, for whom rising oil prices will prove a tailwind, South Africa is not an oil producing country. Instead, a weakening currency and surging oil price means that the 29% rise in the price of a barrel of oil in the international market since 2021 (figure 7) costs almost 61% in local currency.

South Africa’s inflation trajectory was deteriorating prior to the Russian invasion of Ukraine and will be worsened by the market upheaval. Administered prices for electricity and water, a depreciating rand and rising food and oil prices meant that inflation was already set to surpass the South African Reserve Bank’s (SARB) upper target level of 6%. High levels of unemployment, weak wage growth and poor household demand, it was assumed, would keep inflation from straying too far from the upper limit and implied that the interest rate hiking cycle would be gradual. Those assumptions will have to be revised by economists as will the growth outlook. The SARB has twice raised interest rates by 25 basis points since the second half of 2021, but may want to get ahead of expected inflationary pressure by hiking by 50 basis points at the upcoming meetings. While this should cushion some of the exchange rate weakness, much of the inflation is exogenous, and rate hikes won’t have any material impact on inflation. Instead, hikes will drag on growth. There are positives, however.

While not rich in oil and gas, South Africa does have a developed commodity export sector - from gold, coal, iron ore, and platinum group metals, to maize, citrus, and other soft commodities. Corporate tax receipts from mining companies who reaped the dividends of higher commodity prices and a weak currency in 2021 generated US$12bn revenue more than projected in the previous fiscal year[46] and may well do so again in 2022.[47]

The country’s agricultural sector is also set to benefit, being relatively well diversified, albeit not entirely self-sufficient. South Africa is a net importer of wheat, producing between 50% and 70% of its annual consumption. The rest is imported from countries like Argentina, the US and Ukraine.[48] Like Nigeria and Egypt, South Africa will need to find alternative suppliers to make up the shortfall,[49] although the urgency is not as immediate. That said, South African consumers are heavily exposed to transport and fuel costs which make up a large part of household budgets.

Worryingly, there is again an anti-foreigner sentiment gaining momentum in South Africa[50] which is no stranger to xenophobia.[51] Just six months ago, a week of violent unrest and looting forced the government to deploy the military to stabilise hotspot areas. Rising food and transport costs in a country with high unemployment and little government support could conceivably lead to more social unrest.

More broadly, that the South African government chose not to condemn Russia’s invasion of Ukraine at the UN Security Council vote will not have gone unnoticed by western allies and could threaten trade relations with major Western partners. South Africa defended its position blaming instead the UN Security Council for its inability to discharge its responsibility to maintain peace and security.[52] It’s a curious stance. South African trade with Russia amounts to less than US$1bn whereas trade with NATO countries is in excess of US$75bn.[53] South Africa’s position is given more context when looking at how its fellow BRICS (Brazil, Russia, India and China) members voted. Of the four countries (excluding Russia), only Brazil voted for the resolution. Allegiance to the BRICS alliance is being tested, but at what cost, and how will it shape South Africa’s relations with the East and the West?

Winners and losers

Of the all the African states it is Algeria that stands most to gain from the Russo- Ukraine crisis. Its Medgaz pipeline exports up to 17 billion cubic feet of gas to Spain and will surpass this figure due to recent capacity enhancements.[54] Angola, Congo, Gabon and Equatorial Guinea, all significant oil exporters, could be other big winners of trade and investment. Conversely, oil importers like Kenya, eSwatini, Malawi, Namibia and other non-commodity exporting countries will suffer the inflationary shock without the cushion of higher export revenue. But the eventual winners and losers in Africa will only become apparent many years down the line. A great deal will depend on the outcome of the war. What can be gleaned, however, is that almost all countries in Africa will be negatively impacted by rising inflation sparked by higher commodity prices and weaker currencies.

Both Nigeria and Egypt will reap the benefits of higher oil and gas prices and rising demand as buyers of Russian oil and gas look to diversify supply sources. This benefit will be blunted almost entirely in Nigeria which imports most of its refined products, neutralising the positive effect on the fiscal balance and terms of trade. South Africa will experience a strong tailwind from gold, coal, platinum group metal and iron ore prices as it did in 2021 but will be partially offset by significantly higher crude oil costs.

All three countries will experience a material increase in inflation on the back of rising commodity prices, with Nigeria and South Africa having to respond more aggressively via interest rate increases. Egypt is unlikely to have to respond as forcefully given its better economic footing and currency reserves which will somewhat cushion the pound. Egypt’s food security concerns are the highest, however, due to the large subsidies passed on to citizens. The additional cost will have to be carried by the fiscus. Egypt is also the most likely to experience social instability due to rising prices, but in Nigeria much depends on the government’s ability to continue the fuel subsidy program.

South Africa’s growth trajectory is most at risk. Much of these risks emanate from internal structural weakness, lack of reforms, and labour market rigidities but will be exacerbated by higher inflation and rates and depressed domestic demand. South Africa’s geopolitical standing is also more precarious. It has chosen not to condemn Russia’s incursion outright. The risk to trade agreements with Western countries should not be ruled out.

Announcement of a ceasefire could ease the inflation and interest rate hike. But what is more likely is that the war will drag on for months. The longer the war drags on the worse the commodity market dislocations will become, ultimately forcing countries to shake their dependence on Russian oil and gas. That could see an acceleration of investment in the African upstream and refining sectors.[55]

It is important to watch how China responds[56] to the unfolding events.[57] Most likely It will remain neutral. Beijing has its own eyes on Taiwan and perhaps sees the outcome of the Russian military action as a test case for what it could expect were it to take similar measures. Moscow’s decision to invade Ukraine is already costing lives. In Russia itself inflation is set to soar. Economic isolation has begun to bite. The Russian banking system has been locked out of the international payment system; its stock market has been closed and citizens are finding it difficult to move money in and out of the country. Bank runs / collapses, foreign divestment[58], business insolvencies, surging unemployment, hyperinflation and a deep economic contraction are all already beginning to play out.[59]

Financial market and economic contagion has, and will continue to spread around the world. Its effect could be felt most acutely in Africa in the form of food shortages, social, and political instability. In a heightened risk-off environment such as this, investors must carefully weigh each permutation. As always, there are opportunities in crisis and African states should choose carefully and deliberately. As Russia is forced out of the global marketplace, Africa can fill the void. Watch that space.

References

[1] Vasovic, Natalia Zinets and Aleksandar. Missiles rain down around Ukraine. Reuters. [Online] February 25, 2022. https://www.reuters.com/world/europe/putin-orders-military-operations-ukraine-demands-kyiv-forces-surrender-2022-02-24/

[2] Dougherty, Jill. Russians struggle to understand Ukraine war: 'We didn't choose this'. CNN. [Online] March 3, 2022. https://edition.cnn.com/2022/03/03/europe/russia-reaction-war-ukraine-dougherty-intl-hnk/index.html

[3] Joe Sutton, Pete Muntean and Karla Cripps. As Russian planes face airspace bans, Canada investigates reported Aeroflot violation. CNN. [Online] February 28, 2022. https://edition.cnn.com/travel/article/russia-flight-ban-canada/index.html

[4] Goodman, Joshua. Global trade suffers as Russia continues attacks on Ukraine. PBS. [Online] March 4, 2022. https://www.pbs.org/newshour/economy/global-trade-suffers-as-russia-continues-attacks-on-ukraine

[7] Finnis, Alex. What are nuclear weapons? Definition explained, the countries with the most and how Russia compares to Nato. inews. [Online] March 4, 2022. https://inews.co.uk/news/world/what-are-nuclear-weapons-definition-explained-countries-most-russia-nato-uk-usa-1499035

[8] Milmo, Dan. Russia blocks access to Facebook and Twitter. The Guardian. [Online] March 4, 2022. https://www.theguardian.com/world/2022/mar/04/russia-completely-blocks-access-to-facebook-and-twitter

[9] HYAGARAJU ADINARAYAN, SRINIVASAN SIVABALAN. The Russian stock market is experiencing the fifth worst crash in history. Fortune. [Online] February 24, 2022. https://fortune.com/2022/02/24/russia-stockmarket-crash/

[10] Ponciano, Jonathan. Russia Stocks Crash Even With Moscow Exchange Closed—Experts Call Market ‘Uninvestable’. Forbes. [Online] February 28, 2022. https://www.forbes.com/sites/jonathanponciano/2022/02/28/russia-stocks-crash-even-with-moscow-stock-exchange-closed-experts-call-market-uninvestable/?sh=1a04b64f5a9a

[11] Reuters. Russian central bank hikes rate to 20% in emergency move, tells firms to sell FX. Reuters. [Online] February 28, 2022. https://www.reuters.com/business/finance/russia-hikes-key-rate-20-tells-companies-sell-fx-2022-02-28/

[12] Troianovski, Anton. The ruble crashes, the stock market closes and Russia’s economy staggers under sanctions. New York Times. [Online] February 28, 2022. https://www.nytimes.com/2022/02/27/world/europe/ruble-russia-stock-market.html?

[13] Zhang, Yan Anthea. Shell, BP and ExxonMobil have done business in Russia for decades – here’s why they’re leaving now. The Conversation. [Online] March 3, 2022. https://theconversation.com/shell-bp-and-exxonmobil-have-done-business-in-russia-for-decades-heres-why-theyre-leaving-now-178269

[14] https://www.wsj.com/articles/companies-divesting-from-russia-are-facing-big-write-downs-11646303400

[16] Kelly, Andrew. S&P cuts Russia's rating to junk, Moody's issues junk warning. Reuters. [Online] February 26, 2022. https://www.reuters.com/markets/rates-bonds/moodys-puts-russia-ukraine-ratings-review-downgrade-2022-02-25/

[17] Neil Hume, Tom Wilson and Emiko Terazono. Commodity prices soar to highest level since 2008 over Russia supply fears. Financial Times. [Online] March 3, 2022. https://www.ft.com/content/5753f4dd-1e8e-4159-a4e4-d232e4ad50ed

[18] Reuters. Factbox: Commodity prices fly as sanctions disrupt Russian exports. Reuters. [Online] March 4, 2022. https://www.reuters.com/business/commodity-prices-fly-sanctions-disrupt-russian-exports-2022-03-04/

[19] Christina Lu, Robbie Gramer, and Anisa Pezeshki. Forget Oil. Putin’s War Is Wrecking the Wheat Market. Foreign Policy. [Online] March 2, 2022. https://foreignpolicy.com/2022/03/02/russia-war-wheat-economy-food-security/

[20] ITV. Wheat prices rocket amid Ukraine war - will loaves of bread in the UK cost more? ITV. [Online] March 5, 2022. https://www.itv.com/news/2022-03-04/wheat-prices-rocket-amid-ukraine-war-will-loaves-of-bread-in-the-uk-cost-more

[21] Thomson Reuters. Wheat prices hit 14-year highs after Russian invasion of Ukraine. CBC. [Online] March 4, 2022. https://www.cbc.ca/news/business/russia-ukraine-invasion-impact-wheat-prices-1.6373522

[23] Golubova, Anna. Gold price to hit $2,150 as Russia escalates war in Ukraine. Kitco. [Online] March 5, 2022. https://www.kitco.com/news/2022-03-05/Gold-price-to-hit-2-150-as-Russia-escalates-war-in-Ukraine.html

[24] Sistla, Asha. Gold crosses $2,000 mark, palladium at record high on Ukraine crisis. Reuters. [Online] March 7, 2022. https://www.reuters.com/markets/europe/palladium-scales-record-high-gold-hits-2000-russia-ukraine-war-2022-03-07/

[25] Tan, Huileng. Oil surges 10% to $130 a barrel on intensifying fears of a supply crunch. Business insider. [Online] March 7, 2022. https://www.businessinsider.co.za/money-and-markets/oil-surges-130-dollars-a-barrel-russia-crude-ban-fears-2022-3

[27] African Union. Statement of the African Union on the reported ill treatment of Africans trying to leave Ukraine. African Union. [Online] February 28, 2022. https://au.int/en/pressreleases/20220228/statement-ill-treatment-africans-trying-leave-ukraine

[28] Kedem, Shoshana. How will the Russia-Ukraine War Affect Africa. African Business. [Online] March 3, 2022

[31] Afolabi, Adesola. How will the Russia-Ukraine crisis impact Nigeria’s financial markets? Stears Business. [Online] March 2, 2022. https://www.stearsng.com/premium/article/how-will-the-russia-ukraine-crisis-impact-nigerias-financial-markets

[32] Bala-Gbogbo, Elisha. Africa’s biggest crude producer remains stuck on imported fuels. World Oil. [Online] October 21, 2019. https://www.worldoil.com/news/2019/10/21/africa-s-biggest-crude-producer-remains-stuck-on-imported-fuels

[33] Nigeria’s petroleum imports exceeded exports by $43.56bn –OPEC. Nigeria’s petroleum imports exceeded exports by $43.56bn –OPEC. Hellenic Shipping News. [Online] October 4, 2021. https://www.hellenicshippingnews.com/nigerias-petroleum-imports-exceeded-exports-by-43-56bn-opec/

[35] Vanguard. CBN intervenes in wheat production, multiplies 13,000MT seeds. Vanguard. [Online] October 30, 2021. https://www.vanguardngr.com/2021/10/cbn-intervenes-in-wheat-production-multiplies-13000mt-seeds/

[36] Falayi, Kunle. Why Nigeria has restricted food imports. BBC. [Online] August 17, 2019. https://www.bbc.com/news/world-africa-49367968

[37] Trading Economics. Nigeria Inflation Rate. Trading Economics. [Online] February 2022. https://tradingeconomics.com/nigeria/inflation-cpi

[38] Lucas, Muyiwa. Russia-Ukraine war poses double risks for Nigeria’s economy. The Nation Online. [Online] February 28, 2022. https://thenationonlineng.net/russia-ukraine-war-poses-double-risks-for-nigerias-economy/

[39] Aziz, Wasilat. CPPE: How Russia’s invasion of Ukraine will affect Nigerian economy. The Cable. [Online] March 1, 2022. https://www.thecable.ng/cppe-how-russias-invasion-of-ukraine-will-affect-nigerian-economy

[40] Reuters. Egypt's 2021 petroleum exports revenue up 84.3% to $12.9 bln -minister. Reuters. [Online] February 2, 2022. https://www.reuters.com/article/egypt-petroleum-exports-idUSS8N2SK06R

[41] Tanchum, Michaël. Home The Russia-Ukraine War has Turned Egypt's Food Crisis into an Existential Threat to the Economy The Russia-Ukraine War has Turned Egypt's Food Crisis into an Existential Threat to the Economy. MEI. [Online] March 4, 2022. https://www.mei.edu/publications/russia-ukraine-war-has-turned-egypts-food-crisis-existential-threat-economy

[42] Christina Lu, Robbie Gramer, and Anisa Pezeshki. Forget Oil. Putin’s War Is Wrecking the Wheat Market. Foreign Policy. [Online] March 2, 2022. https://foreignpolicy.com/2022/03/02/russia-war-wheat-economy-food-security/

[44] Safty, Sarah El. Egypt's private sector wheat imports surge as state buyer tightens purchases. Reuters. [Online] February 10, 2022. https://www.reuters.com/article/egypt-wheat-idUSL8N2UJ4CE

[45] Poole, James. Record grains: wheat spikes to 14-year high on deepening supply fears. News24. [Online] March 4, 2022. https://www.news24.com/fin24/economy/world/record-grains-wheat-spikes-to-14-year-high-on-deepening-supply-fears-20220304

[46] Ensor, Linda. Treasury estimates windfall tax this year at R120bn. Business Day. [Online] November 11, 2021. https://www.businesslive.co.za/bd/economy/2021-11-11-treasury-estimates-windfall-tax-this-year-at-r120bn/

[47] Phillipas, George. Russian-Ukrainian war might be the boon SA has been waiting for. Business Day. [Online] February 27, 2022. https://www.businesslive.co.za/bd/opinion/2022-02-27-george-philipas-russian-ukrainian-war-might-be-the-boon-sa-has-been-waiting-for/

[49] Sihlobo, Wandile. How Russia-Ukraine conflict could influence Africa’s food supplies. The Conversation. [Online] February 24, 2022. https://theconversation.com/how-russia-ukraine-conflict-could-influence-africas-food-supplies-177843

[50] Isilow, Hassan. South African politicians play up anti-foreigner sentiments to win votes. AA. [Online] October 26, 2021. https://www.aa.com.tr/en/africa/south-african-politicians-play-up-anti-foreigner-sentiments-to-win-votes/2403115

[51] Prinsloo, John Bowker and Loni. Government sues Huawei for employing too many foreign nationals. Business Day. [Online] February 11, 2022. https://www.businesslive.co.za/bloomberg/news/2022-02-11-government-sues-huawei-for-employing-too-many-foreign-nationals/

[52] McCain, Nicole. President Cyril Ramaphosa defends SA's decision to abstain from UN vote on Russian invasion. News24. [Online] March 7, 2022. https://www.news24.com/news24/southafrica/news/president-cyril-ramaphosa-defends-sas-decision-to-abstain-from-un-vote-on-russian-invasion-20220307

[55] Dapo-Thomas, Opeoluwa. Russia-Ukraine crisis: Lessons Nigeria can learn. Naira Metrics. [Online] February 25, 2022. https://nairametrics.com/2022/02/25/russia-ukraine-crisis-lessons-nigeria-can-learn/

[56] Gunia, Amy. Sanctions on Russia Could Drive Moscow Closer to Beijing and Change the Global Financial System. Time. [Online] March 4, 2022. https://time.com/6154189/russia-swift-china-usd-rmb-finance-trade/?utm_source=twitter

[57] AFP. Ukraine war tests China's 'no limits' bond with Russia. News24. [Online] March 6, 2022. https://www.news24.com/news24/world/news/ukraine-war-tests-chinas-no-limits-bond-with-russia-20220306

[58] Maurer, Mark. Companies Divesting From Russia Are Facing Big Write-Downs. The Wall Street Journal. [Online] March 3, 2022. https://www.wsj.com/articles/companies-divesting-from-russia-are-facing-big-write-downs-11646303400

[59] Hotten, Russel. Ukraine conflict: Russia doubles interest rate after rouble slumps. BBC. [Online] March 1, 2022. https://www.bbc.com/news/business-60550992

.tmb-listing.jpg?Culture=en&sfvrsn=8636ce67_1)