Programme Overview

The MSc in Financial Engineering programme at Nanyang Business School is available on a full-time and part-time basis. The full-time curriculum will be taught in three trimesters over one year, the part-time programme will require 6 trimesters

over two years.

Each trimester is divided into two mini-terms of seven weeks each, with two recesses, one in December-January, and another in April-May (exact dates to be confirmed).

During the course of the programme,

you will be required to complete:

- 20 core courses (including the seminar series FN6816 Seminar in Special Topics)

- Four elective courses

TRIMESTER I (Jul - Nov) | |

|---|---|

Mini Term 1 (Jul - Sep) | Mini Term 2 (Sep - Nov) |

TRIMESTER II (Nov - Mar) | |

|---|---|

Mini Term 3 (Nov - Dec) | Mini Term 4 (Jan - Mar) |

TRIMESTER III (Mar - Jun) | |

|---|---|

Mini Term 5 (Mar - Apr) | Mini Term 6 (May - Jun) |

Carnegie Mellon University (CMU) Term

You will also have the opportunity to attend a Carnegie Mellon University (CMU) term, optional for both full-time and part-time students. The CMU term takes place during the final seven weeks of Mini Term 6 at CMU in the US (subject

to US visa approval, if applicable).

Students who opt out of the CMU term will complete the remaining courses at Nanyang Technological University (NTU) to fulfil graduation requirements. On the successful completion

of CMU term, you will be awarded a Certificate in Computational Finance by CMU.

Class Hours

Courses are held on campus at NTU. Each course consists of 21 hours of instruction, through six weeks of 3.5-hour classes. Examinations will be held in the 7th week.

To cater for working professionals taking the course, classes for

full-time and part-time students are conducted in the evenings on weekdays and on selected Saturday mornings or afternoons.

On average, full-time students take four to five classes a week, while part-time

students take two to three classes.

Period Of Candidature

| Minimum Candidature | |

|---|---|

| Full-Time | 12 months (3 trimester or 6 mini terms) |

| Part-Time | 24 months (6 trimesters or 12 mini terms) |

| Maximum Candidature | |

|---|---|

| Full-Time | 24 months (6 trimesters or 12 mini terms) |

| Part-Time | 48 months (12 trimesters or 24 mini terms) |

Exemptions

You may apply for exemptions of up to a maximum of three core courses, subject to approval. The period of application will be advised by the MFE Office

Programme Calendar

Module Information

Financial, Mathematics & Statistics

- Calculus & Linear Algebra

- Stochastic Modelling in Asset Pricing

- Stochastic Calculus for Finance

- Probability & Statistics

- Linear Financial Models

- Financial Time Series Analysis

- Numerical Methods for Financial Instrument Pricing(E)

- Simulation Methods (CMU)

- Advanced Statistical Modelling (E)

- Optimization in Finance (E)

Finance

- Corporate Finance

- Asset Pricing Theory

- Bond Portfolio Management

- Equity Portfolio Management

- Derivative Securities

- Interest Rate Derivatives

- Financial Risk Management

- Advanced Risk Management (CMU)

- Studies in Financial Engineering (CMU)

- Term Structure: Theory & Practice (CMU)

- Monetary Economics (E)

- Financial Accounting (E)

- Exotic Options & Structured Products (E)

- Credit Risk - Measurement & Management (E)

- Seminars on Special Topics

- Advanced Topic in FE Studies (E) - Quantitative Management of Bond Portfolio

- Trading Analytics and Processes (E)

Computing

- Object Oriented Programming I

- Object Oriented Programming II

- Financial Computing (CMU)

- Financial Engineering Project (CMU)

- Programming Web Applications in Finance (E)

- Artificial Intelligence Techniques in Finance (E)

All Core Modules and Electives might be subject to changes.

Financial Mathematics & Statistics

This course covers mathematical tools and concepts for solving problems in financial engineering. It will also help to satisfy some of the prerequisites for subsequent courses in financial mathematics and quantitative analyses of financial data. Topics covered include matrix algebra, Euclidean vector spaces, linear transformations, vector differential calculus, multiple integration, and difference and differential equations.

This course covers the mathematical foundations of multi-period asset pricing. Topics include probability measure spaces, arbitrage pricing, risk-neutral martingale measures, martingale representation, Radon-Nikodym theorem and state-price density, Markov property, Brownian motion, Cox-Ross-Rubinstein binomial model, and semi-continuous models.

This course extends the concepts covered in the Stochastic Modelling in Asset Pricing module to the continuous state-space, continuous time scenario. Ito's integral and stochastic differential equations, Girsanov's theorem, and martingale representation will be covered in the context of the Black-Scholes option pricing model. This course also extends the Black-Scholes option pricing model to multi-asset models, change of numeraire and a selection of the following topics: exotic options, stochastic volatility models, and interest rate term structure (Vasicek, CIR, HJM).

This course covers the essential concepts and methods in probability theory and statistical inference, using statistical computer software and real-life data. Topics include conditional probability, Bayes' Theorem, probability distributions, moment generating functions, sampling distributions, estimation methods, common estimators, hypothesis testing, common test statistics, and statistical computing software, mainly S-Pius.

This course covers both underlying theory and practical techniques of linear statistical models. It also develops essential skills of using computer software to apply regression analysis to real-life financial problems. Topics include simple and multiple linear models, model selection, residual analysis, diagnostics, detection of multi-collinearity, non-standard conditions, and common transformations. Principal components and factor analysis are also introduced.

This course covers the data analytic aspects related to financial time series. Topics include univariate ARIMA modelling, forecasting, seasonality, model identification and diagnostics, and GARCH model and its applications in volatility estimation. Recent advancements in modelling financial time series including non-stationary time series with unit root, vector autoregressive models, and nonlinear processes will also be discussed. This course will emphasize hands-on applications using computer software and real-life financial data.

The first course aim is to give you a basic overview of the numerical methods that are used in finance. The first half of the mini-term will be spent on acquiring background knowledge (numerical methods to solve algebraic equations, numerical differentiation, and integration, ordinary differential equations); the other half will be spent on numeric methods for option pricing (solving the Black-Scholes equation numerically and Monte Carlo methods). The second course aim is to give you a taste of real work of a C++ developer.

This course initially presents standard topics in simulation including random variable generation, variance reduction methods and statistical analysis of simulation output. The course then addresses the use of Monte Carlo simulation in solving applied problems on derivative pricing discussed in the current finance literature. The technical topics addressed include importance sampling, martingale control variables, stratification, and the estimation of the “Greeks.” Application areas include the pricing of American options, pricing interest rate dependent claims, and credit risk.

This course builds upon the materials covered in Linear Financial Models and Financial Time Series Analysis. It introduces advanced statistical techniques and illustrates their applications in econometrics and finance. Major topics will include factor analysis, principal component analysis, nonlinear regression analysis, nonparametric estimation, and multiple time series analysis. Computer software will be used to apply these techniques to real-life financial data. Other topics of current interest will also be covered as time permits.

This course covers mathematical optimization and its applications to finance. The course quickly discusses deterministic optimization and spends time on exploring stochastic and robust optimization. Applications to finance include asset-liability management, risk management, and multi-period portfolio selection with transaction costs.

Finance

This course covers the essential elements of the corporate financial management process. Its objective is to inculcate an understanding of the various functions of the financial manager and show how these functions relate to the overall valuation of the firm. Major topics include cost of capital, real options, capital structure determination, dividend policy, corporate risk management, and corporate governance. Case studies are used to familiarize the students with applications of various tools and concepts discussed in the class.

This course develops the consumption-based asset-pricing model and lays the foundations for the understanding of special pricing models such as CAPM, ICAPM, and APT. Topics include expected utility analysis, mean-variance analysis, consumption-based asset pricing models, asset prices in equilibrium, estimation and evaluation of asset pricing models, and the use of stochastic discount factor.

This course covers concepts and techniques for managing fixed income portfolios. Topics include institutional features of bond markets, measurement of risk and return of bond portfolios, and application of these concepts to bond portfolio management. The course will include simulated trading exercises and a portfolio management exercise using real-time data over the period of the course.

While soundly anchored within the bounds of modern portfolio and asset pricing theories, this course aims to provide an in-depth but practical understanding of the equity management process, from stock, industry and market evaluation through to portfolio selection techniques and the on-going management functions and evaluation. The use of derivative products in this process is also considered. Project work will include the simulated management of a US equity fund using real-time market and company data, plus announcements.

This course covers the use and pricing of derivatives- from the basic features of forwards and options to dynamic trading and hedging strategies. Important quantitative techniques and arguments are developed. The course also emphasises economic intuition and understanding, providing practical insights through class projects.

This course covers:

- the various exchange-traded and over-the-counter interest rate derivative products

- the estimation of parameters of the interest rate models using historical data

- computer programming to compute the values of the derivatives

- hedging interest rate risk using interest rate derivatives

- financial engineered interest rate derivatives.

This course gives a broad overview of the financial risk management field, from the perspective of both a risk management department and of a trading desk manager, with an emphasis on the role of financial mathematics and modelling in quantifying risk. Specific techniques for measuring and managing the risk of trading and investment positions will be discussed. You will learn to develop risk sensitivity reports and use them to explain income, design static and dynamic hedges, and measure value-at-risk and stress tests.

This course has two objectives:

- to learn the modern or proactive approach to risk management by studying a sequence of structured solutions to financial problems

- to become acquainted with the conceptual building blocks underlying structured solutions.

Solutions will involve futures and swaps and you will apply theory to design and implement personal trading

This course focuses on the use of financial engineering and derivative securities in solving practical business problems. You will work through business cases and give in-class simulated sales pitches to hypothetical clients. The cases highlight the design, valuation and hedging of structured products. In addition, we will look at real options and at derivative pricing with exotic "underlyings" such as energy, weather, and credit.

This is an advanced course on fixed income pricing theory and practice. The course will present popular continuous-time spot rate evolution and term structure models such as the Hull & White and the Heath-Jarrow-Morton models. These valuation techniques will then be applied to solve practical financial engineering problems relating to structuring and risk management. The highlight of the course is a series of in-class case presentations in which student teams will function as derivative structuring groups. Each team will design and price an exotic structured security and then give a sales pitch to a hypothetical client.

Monetary transmission in an open economy. Dynamic balance of payment adjustment, international capital mobility and systemic consequences. Exchange rate regimes. Relative effectiveness of monetary and fiscal policies. Causal nexus of money, output and prices. Institutional aspects of monetary policy making in major economies.

The objective of this course is to provide a sound understanding of the various items in published financial statements. After the course, participants are expected to be able to analyse and understand financial statements with greater depth.

This course covers the applications and the associated risks of financial options that have non-standard features, and the use of financial instruments to restructure an existing financial profile into one having more desirable properties. This is an application oriented course that makes use of case studies to illustrate key concepts. Pre-requisites: basic knowledge of the operations of key financial markets, and derivative products like standard options, swaps, futures and forward contracts.

The course will cover measurement and management of credit risk as well as the valuation of credit derivatives in addition to the valuation of securities associated with default risk. The course will cover both theoretical models and their applications. The topics include structural valuation models, reduced form valuation models, recovery models, credit rating models, default correlation models, copula-based default correlation models, credit swaps and collateralized debt obligations etc. The course will also involve implementation of the models using Visual Basic or C++.

This course is offered as a series of the ongoing MFE Speaker Series where industry specialists are invited as guest speakers for seminars to share their knowledge, expertise and experience on FE topics. It aims to give you the opportunity to learn from industry experts on the current/prevailing market conditions and how the theoretical directly impacts reality. The first-hand industry experiences of the speakers also offer a glimpse of what the industry is like and what to expect, so that you are better prepared for the industry.

This course covers market structure, transaction costs for trade execution, venues and processes required in institutional trades. In this course, you will be exposed to the issues relating to the execution of trades in trading venues and the processes that entails through the trade lifecycle. The course mainly takes the perspective of a sell-side and covers the constraints the sell-side faced in managing the transaction costs for the execution of trades. Particularly, you will learn about the types of transaction costs involved in the execution of trades, ways to quantify and manage these costs.

This course covers market structure, transaction costs for trade execution, venues and processes required in institutional trades. In this course, participants will be exposed to the issues relating to the execution of trades in trading venues and the processes that entails through the trade lifecycle. The course mainly takes the perspective of a sell-side and covers the constraints the sell-side faced in managing the transaction costs for the execution of trades. Particularly, participants will learn about the types of transaction costs involved in the execution of trades, ways to quantify and manage these costs.

Computing

Introduction to programming concepts, syntax, algorithms, data structure and programs design. Object-Oriented programming (OOP) concepts using C++, and the implementation of software based on OOP libraries. Object-oriented concepts such as classes, inheritance, polymorphism etc. Data representation, abstraction, and encapsulation in OOP. Dynamic data structures. Recursive programming techniques. Divide-and-conquer. Dynamic programming.

Common data structure and algorithmic design and analysis techniques. Searching and sorting. Implementations and applications of data types such as lists, trees and graphs, and algorithm complexity. Selection and application of appropriate data structures to meet the requirements of a given application. If time permits, more advanced concepts such as time and space complexities, problem reductions and NP-hardness will be covered.

The goal of the course is to refresh and expand your knowledge of several important topics of the Master Program, such as Object-Oriented programming with C++, theory of pricing and hedging of derivative securities, numerical analysis and stochastic calculus. The course is organized around a project of design and implementation of a powerful C++ library for pricing of derivative securities. You will learn important principles of implementation of financial models and master algorithms of evaluation of different types of derivative securities: European, American, standard, barrier and path dependent options on stocks and interest rates.

This course will focus on portfolio construction and product structuring. Specific applications will vary from year to year.

This course teaches how to build web-based applications for finance. You will learn how to create interactive reports and dashboard, interactive rich data visualization in browser. You will learn about how the internet works, and how to create a website with cloud computing infrastructure like Amazon Web Services. You will also study about the latest technology for internet, the cryptocurrency and payment system, Bitcoin and Blockchain. The course will advance your knowledge and skills towards building real-world application for the internet. Web-based application is easily accessible worldwide only with a browser and there are powerful libraries to display financial data in browser. This skill is of very high practical value because they can turn your knowledge to applications more quickly and prepare you for a career in finance. Spreadsheet running on desktop is not the working model for the future due to its “offline” nature and lack of tools; the now and future are all about web-based applications.

Theory and practice of artificial neural networks, fuzzy systems and evolutionary algorithms. Implementation of fuzzy systems. Neural network models. Implementation of supervised and unsupervised learning. Evolutionary search implementation issues (coding, operators, fitness/objective function). Hybridized systems. Applications in finance.

Curriculum

Preparatory Courses

Incoming MFE students are required to attend the Math preparatory course in June before course commencement. Optional preparatory courses in Finance and Programming are also available. No extra credits will be given for these courses.

- The Math preparatory course is compulsory for all incoming MFE students who are required to register, attend all classes as well as sit for the test at the end of the course.

- The Basic Finance and Financial Computing Preparatory course introduces participants to the basics of finance and applications. It provides an overview of finance, basic theory, terminology and Excel computing commonly used in finance.

- The Programming Preparatory Course will help you to get a head start in programming languages to prepare for the MFE course, as well as give you a glimpse of what financial industry practitioners do today.

The Mathematics Preparatory Course is compulsory for all incoming MFE students. It is designed to refresh your mathematical skills and know-how, and will help you to brush up on your mathematical knowledge. The course comprises six 4-hour sessions and there will be a test at the end of the course.

Topics Taught Include:

| Topic 1: Basic Mathematics Sets, Real Number System, Surds and Logarithm, Simultaneous Equations, Functions, Polynomials |

| Topic 2: Matrix Algebra Basic Matrix Operations; Elementary Row Operations; Determinants; Matrix Inverses; Linear Equations; Eigenvalues and Eigenvectors |

| Topic 3: Vector Space Basic Vector Operations, Norms, Spanning Sets and Basis, Geometry of Vector Spaces, Gram-Schmidt Process |

| Topic 4: Differential Calculus Series and Sequences; Limits & Continuity; Derivatives (including Partial Derivatives); Product Rule and Chain Rule; Taylor Series |

| Topic 5: Optimization Unconstrained Optimization; Constrained Optimization |

| Topic 6: Integral Calculus Definite & Indefinite Integrals; Techniques of Integration; Special Functions; Laplace Transforms |

| Topic 7: Difference and Differential Equations Solving difference equations; First & Second Order Linear ODE; Solving ODEs using Laplace Transforms |

Recommended Text: Lee Hon Sing and Gerald Cheang, Introduction to Calculus and Matrix Algebra with Applications in Finance, Second Edition, 2007, McGraw-Hill

*Course content is subject to revision.

Instructor: Assistant Professor Tong Ping

This Basic Finance and Financial Computing Preparatory Course is an introductory finance sequence designed for candidates who plan to enter the Master of Science in Financial Engineering (MFE) at the Nanyang Business School. Topics covered include the role of a financial system, the principles & mathematics of the time value of money, modelling financial statements, valuing firms using discounted free cash flow, basic valuation of bonds & stocks, fundamentals of capital budgeting, investment decision rules, and risk assessment. You will also learn how to use EXCEL to solve a set of linear equations, run simulations, and implement scenario & sensitivity analyses.

The course comprises five 4-hour sessions. Classes will be conducted in a seminar style together with in-class exercises. Microsoft Excel will be the only computing tool used in class.

You will receive handout materials comprising of PowerPoint slides and Excel Templates.

After Taking This Course:

Students will be able to:

- explain basic principles and concepts of finance,

- determine future cash flow of real and financial investments,

- perform stand-alone risk assessment, and

- use Excel functions and commands to build formulas and design analytical models.

Topics taught include:

| Topic 1: What Is Finance and Why Study It? |

Topic 2: Financial Statements

|

Topic 3: Time Value of Money

|

Topic 4: Bond and Stock plus Preferred Stock

|

Topic 5: Project Investment Analysis

|

Topic 6: Cash Flow Estimation and Risk Analysis

|

Topic 7: Finance and The Financial System

|

Recommended Text: Zvi Bodie and Robert C. Merton, Finance, 1st Edition, (ISBN: 0-13-310897-X)

Instructor: Associate Professor Charlie Charoenwong

The Programming Preparatory Course is designed to give you a head start in financial modelling, data analysis, and coding. It will help you to prepare for the MFE course from a financial practitioner point of view.

This "crash" course will begin with showcasing real-world applications, walking you through essential syntax, and getting your mind and hands working together during the practical sessions.

The course comprises six 4-hour sessions and there will be a test at the end of the course.

Topics Taught Include:

| Topic 1: Excel/VBA Excel is a very handy tool to analyse data visually. We will enhance your basic skills from two aspects: more data analysis functions in spreadsheets and automation of tasks with VBA. |

| Topic 2: R To build a foundation in programming, we start from a language with lots of built-in statistics/plotting capabilities. Plus, we do it in RStudio IDE which assists our coding practices. We will complete an introduction and make R a good companion for your daily computing use. If you would like to go further, pick up the FE8828 elective for data analysis. |

| Topic 3: Python/C++ We will go further with general-purpose programming with Python and introduce you to important programming concepts of OOP and Functional programming. We will do more programming exercises with finance examples. After finishing this module, you are equipped to get some real tasks done for financial engineering. |

Instructor: Dr. Yang Ye finds pleasure in programming to find things out. The school’s quantitative risk lead for global commodities supply chain, he holds a B.Eng in Mechanical Engineering (Mechatronics), PhD in Biological Science (Computational and Structural Biology), and Energy Risk Profession (GARP).

Speaker Series Seminars

Our Speaker Series brings industry experts to life through engaging lectures, insightful talks, and interactive seminars. These sessions go beyond theory, bridging the gap between textbook knowledge and real-world applications in financial engineering.

Our speakers generously share their firsthand experiences, offering a sneak peek into industry culture and valuable insights for your future career. Armed with this insider knowledge, you’ll be well-prepared to hit the ground running as you

embark on your financial engineering journey.

Past Speaker Series Topics:

- Operational Risk Management Workshop

- Quantum Computing – Theory and Practice

- Financial Compliance – Theory and Practice

- Estimation and Testing of Asset Pricing Models

- State of the Art Indexing and Systematic Investing

Leading People Globally

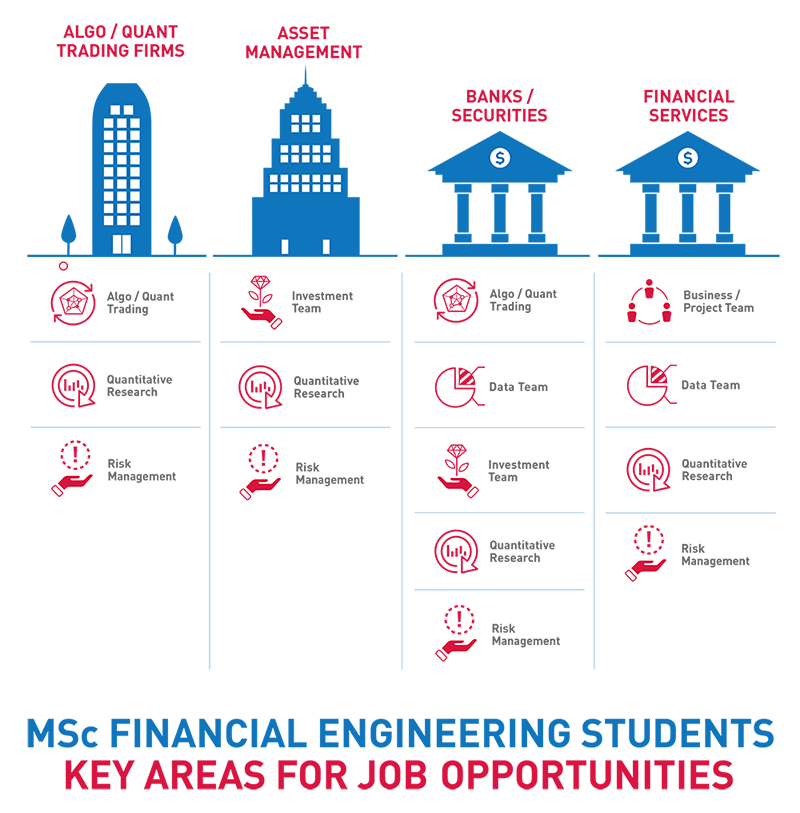

Our MSc Financial Engineering graduates at Nanyang Business School work primarily in the financial services industry. Many of them work in risk management, quantitative asset management, product structuring, quantitative trading, quantitative research, and financial information technology, as well as other areas in high-technology finance.

Here are the key job opportunities in Singapore which you can look forward to.

Carnegie Mellon University Segment

As a student in the MSc in Financial Engineering programme at Nanyang Business School, you will gain a distinctive edge in your financial engineering education and experience. Through our collaboration with Carnegie Mellon University (CMU), which has been ongoing since the programme’s inception in 1999, you have the option to spend your last mini term (for seven weeks) at CMU in the US.

CMU’s Tepper School of Business is one of the first business schools in the world to emphasize interdisciplinary thinking. It is the pioneer in introducing a master’s level programme, the Master of Science in Computational Finance, which integrates computer science, mathematics and finance.

If you opt for the CMU term (subject to the approval of US visa, if applicable), you will complete four courses at the Carnegie Mellon faculty. Upon completion of the courses, you will be awarded the Certificate in Computational Finance by CMU.