African business bullish on single market even as trade challenges remain

Standard Bank survey says lack of foreign exchange is a key impediment to intra-Africa trade

African businesses are optimistic about the African Continental Free Trade Area (AfCFTA), even as they find trading across borders a challenge. This according to a Standard Bank study that surveyed 2636 small businesses across 10 African countries.

African businesses are optimistic about the African Continental Free Trade Area (AfCFTA), even as they find trading across borders a challenge. This according to a Standard Bank study that surveyed 2636 small businesses across 10 African countries.

The AfCFTA, officially launched in January 2021, aims to consolidate a market of over 1.4bn individuals and double intra-African trade, from about 14% of total exports to over 30% in just a few years. The Africa Trade Barometer (ATB) shows that most small firms believe the single market will yield benefit. This free trade area also presents foreign investors with a significantly larger market than when viewing African nations individually. Although trade under AfCFTA is yet to take off awareness about it has increased. The ATB shows that 44% of small African businesses are now aware of the agreement – up from 18% in September 2022.

While intra-African trade remains modest at the macro level, businesses surveyed reported that on average 71% of their exports go to other African nations. According to Standard Bank this is because many of the businesses it surveyed are small and tend to export mainly to nearby countries.

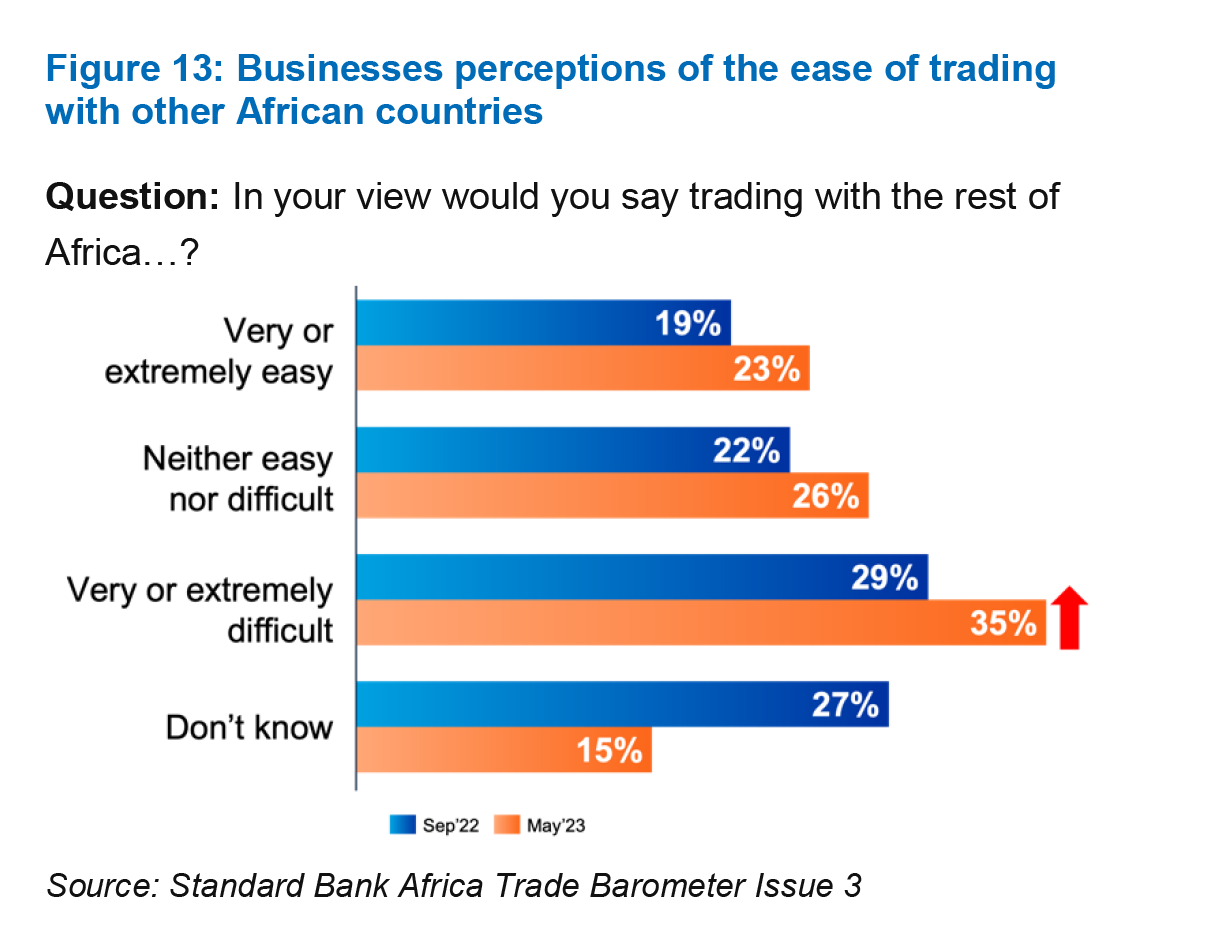

The proportion of companies that find trade with other African nations to be either very challenging or extremely so has risen to 35%, up from 29% in the previous year. This negative shift in perception is attributed to intricate business regulations, steep import-export tariffs, and inadequate road infrastructure. With fewer tariff and non-tariff impediments, much of the intra-African commerce takes place within established regional trading blocs such as the East African Community (EAC), Southern African Development Community (SADC), and the Economic Community of West African States (ECOWAS).

One of the top impediments to intra-African trade is the access to foreign currency, especially US dollars. 75% of respondents cited a shortage of foreign currency as a major barrier. The shortage has become worse as most African currencies have declined in value, domestic economies have been hit by inflation and US federal interest rates have climbed causing debt distress for many African economies and putting pressure on foreign exchange. The survey shows that despite challenging macroeconomic conditions – African business confidence is generally positive. Most traders surveyed expect the scale of their foreign trade activity to increase in the coming years.

One of the top impediments to intra-African trade is the access to foreign currency, especially US dollars. 75% of respondents cited a shortage of foreign currency as a major barrier. The shortage has become worse as most African currencies have declined in value, domestic economies have been hit by inflation and US federal interest rates have climbed causing debt distress for many African economies and putting pressure on foreign exchange. The survey shows that despite challenging macroeconomic conditions – African business confidence is generally positive. Most traders surveyed expect the scale of their foreign trade activity to increase in the coming years.

The AfCFTA has responded to this issue by initiating the Pan African Payment and Settlement System (PAPSS), designed to enable instant cross-border payments in local African currencies. It serves as a centralised platform linking central banks, commercial banks, and various financial institutions across the continent. Launched in January 2022 by Afreximbank in collaboration with the AfCFTA Secretariat, following a successful pilot phase among West African Monetary Zone countries, many see PAPSS as a potential game changer. By enabling African currencies to be directly convertible within the continent, PAPSS eliminates the need to rely on intermediary currencies such as the dollar, euro, or pound. Transactions involving these external currencies often lead to significant time delays and additional conversion costs. In fact, currency conversions rack up as much as US$5bn in annual expenses for Africa. Since its inception, PAPSS has onboarded over 40 commercial banks and nine central banks.

The AfCFTA has responded to this issue by initiating the Pan African Payment and Settlement System (PAPSS), designed to enable instant cross-border payments in local African currencies. It serves as a centralised platform linking central banks, commercial banks, and various financial institutions across the continent. Launched in January 2022 by Afreximbank in collaboration with the AfCFTA Secretariat, following a successful pilot phase among West African Monetary Zone countries, many see PAPSS as a potential game changer. By enabling African currencies to be directly convertible within the continent, PAPSS eliminates the need to rely on intermediary currencies such as the dollar, euro, or pound. Transactions involving these external currencies often lead to significant time delays and additional conversion costs. In fact, currency conversions rack up as much as US$5bn in annual expenses for Africa. Since its inception, PAPSS has onboarded over 40 commercial banks and nine central banks.

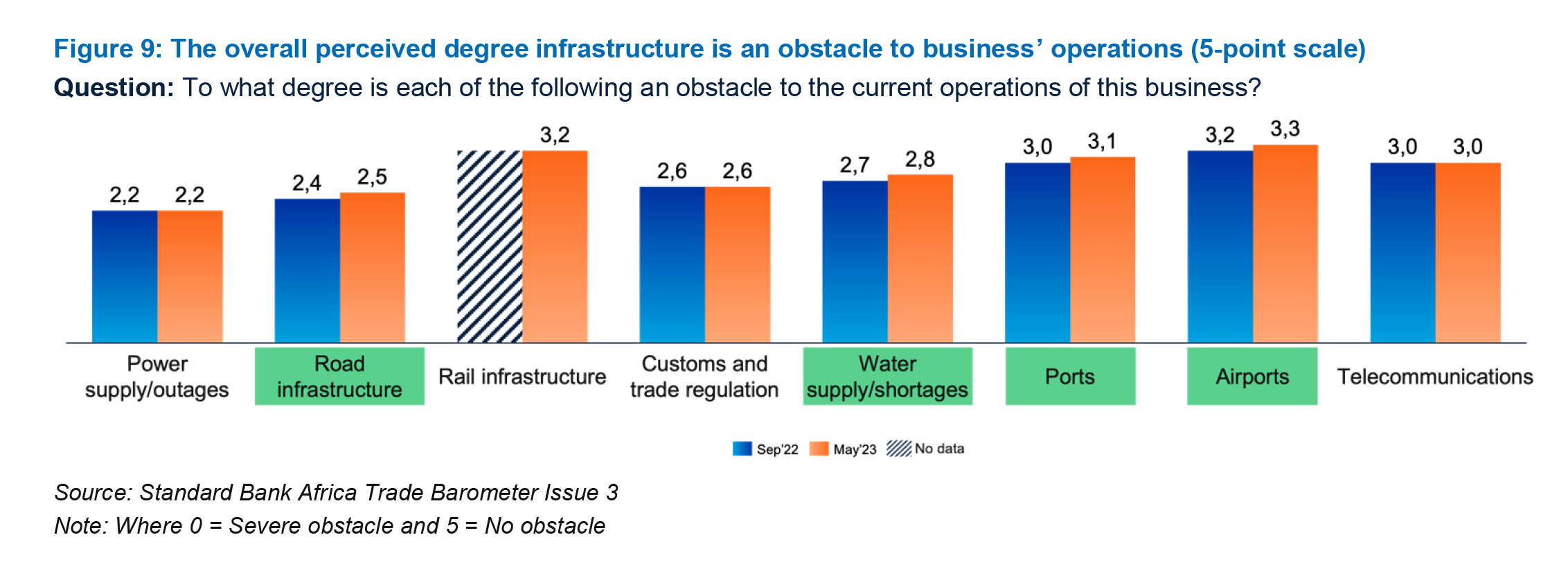

While many businesses find the quality of African transport and other infrastructure lacking, most of those surveyed feel positive about their own government's efforts in bolstering cross-border trade. Standard Bank believes this sentiment stems from the numerous infrastructure projects either underway or recently completed across the continent. Notable examples:

- Electricity: The African Development Bank's US$1.3bn investment in cross-border electricity connections in East Africa, alongside Nigeria's new Electricity Act, which encourages private investment into its power sector.

- Roads: Zambia's 327km road from Lusaka to Ndola, and the Mozambican government’s initiative, backed by the World Bank, to enhance 508km of key roads.

- Railways: Kenya, Uganda, and Tanzania are progressing with their standard gauge railway (SGR) projects, while Ghana is adding 1,898km to its existing 1,300km rail network. Additionally, Mozambique recently introduced a freight rail service connecting Maputo Port to three main trade hubs in Zimbabwe: Harare, Bulawayo, and Gweru.

In Africa, trade data tends to be heavily influenced by large corporations dealing mostly in high volume commodities. As a result, insights into the trade practices and attitudes of small businesses – which represent the largest share of all local businesses– is relatively underreported. The Standard Bank Africa Trade Barometer (SB ATB), which seeks the opinion of small business entities, is a noteworthy exception. The ATB index rankings is based on seven broad thematic categories of data: trade openness, access to finance, macroeconomic stability, infrastructure, foreign trade, governance and economy, and traders’ financial behaviour. Kenya, Mozambique, Namibia, and Nigeria improved in the overall Standard Bank ATB ranking, while Ghana, Tanzania and Uganda declined.

References

‘The African Continental Free Trade Area: A pipe dream or silver bullet?’, The Brenthurst Foundation, 25 May 2021

‘A false start for Africa’s free trade deal?’, Institute for Security Studies, 03 December 2021

‘Latest milestone for the African Continental Free Trade Area: The Pan-African Payment and Settlement System’, Carnegie Endowment for International Peace, 07 February 2022

‘AfCFTA: A new era for global business and investment in Africa’, World Economic Forum, 18 January 2023

Regional economic outlook: Sub-Saharan Africa’, International Monetary Fund, April 2023

‘Ecobank taps Africa Union’s PAPSS system for cross-border transfers’, TechCabal, 26 June 2023

‘OPINION | There's a dollar drought, but sub-Saharan Africa doesn't have to wilt’, News24, 02 July 2023

‘Africa Trade Barometer’, Standard Bank, September 2023

‘Network’, Pan-African Payment and Settlement System, Accessed 26 September 2023